Showing results for tags 'agreement'.

-

Today I received a white county courtclaim form from northampton for the MBNA Credit card 2008 – now with PRA GROUP - £2723 – defaulted 2012. On 12th Nov PRA Group wrote to me in response to my returned PAP form where I stated I dispute the debt because I need more documents or information Specifically I wrote: I need a copy of (1) the Default Notice, (2) the Notice of Assignment, (3) a complete set of statements detailing exactly how the debt has accrued detailing: (a) All Transactions, (b) Any additional charges, be them by the original creditor or you PRA Group (UK) Limited, the debt purchaser or any predecessor, © Details of all contractual interest added by whom and on what date, (d) List of ALL Payments made toward the Agreement. The PRA group letter on the 12th said, that in response to my query (PAP form) please find enclosed copy of statement of account from MBNA and a copy of the credit agreement (was an online application 2008) plus statements from the MBNA credit card (virgin). The letter goes on to say that they will put the account on hold for 30 days until 12th December to allow sufficient time to receive the letter and contact them. Today I received the county court claim form. I don't know what to do now? Please advise. Should I try to a negotiate an offer with PRA or will I have to pay in full somehow! I don't want a CCJ registered.

-

I will be concise as this is not a confessional, if helpers need more information I will respond promptly. I am 67 years old and have seven creditors, one with CCJ. I followed the advice of CAG and offered what I could, a token £5 a month to each. These payments were set up and have run without apparent fault for about seven years. Since doing this I was evicted from my home of sixteen years (the reluctant CCJ with a very patient landlord) and had no valid postal address for some time. In 2013 I had to move to Germany for family reasons. My only income is my state pension and a very, very small private pension. In short, absolutely no spare cash as the pension has to cover room rent and everything else. My assets fit into two suitcases and have no value My sister who is in the UK received a letter from Robinson Way addressed to me. She has told them to remove her address from my file as I do not and never have lived at that address. They have agreed to do this. They are talking as if this were a recent matter, insisting on the establishment of a repayment plan. Obviously I have nothing to offer them and their threats of legal action are not particularly concerning. When the CCJ was issued the judge noted that the matter would not be pursued unless there were substantial assets, which is oddly reassuring now. I intend to contact RW by email so that everything is recorded but before I do I wanted to gather any advice from you good folks. Incidental to this, I do not know what my credit record looks like now. I have lost my CRA access details and it seems not to be possible to open a new subscription from Germany. Finally, (because it is stupidly embarrassing) I have noticed an error in Robinson Way's payments. When I agreed to the monthly payment I established a standing order which is still running. I periodically check that all payments are going out as they should. What I did not notice was that RW established a direct debit, with the same reference number in addition to the standing order. So they have been receiving and taking twice the payment I agreed and this seems to have been going on for the whole period.

- 27 replies

-

- agreement

- repayments

-

(and 3 more)

Tagged with:

-

Hello I wonder if you can advise me. My son has had a loan from Money barn. He picked the car up and its been one problem after another with the car. He has phoned moneybarn to tell them, and they say they have opened a case but he should take it up with the garage. It is 14 days on Wednesday so does he still have time to cancel the loan and if he does should he send an email as well as phone them, he wouldnt have time to send a letter would he? Thank you for any help you can give.

-

Hi Everybody, Not sure this is the correct place for this but as I bought the item from Curry's I thought it was the best place. I am after some advice regarding a washer/dryer that is protected by a 12 month Mastercare support agreement. The washer dryer is 8 years old but we have always been protected by Mastercare and they have always fixed the problem throughout the years. However a few weeks ago we had a the common problem of the dryer not getting hot and requested an engineer to come out and clean the condenser. If this was an easy job I would have done it myself, but it is buried at the bottom of the washer dryer and we have been told not to do the job ourself. Anyway, he found a piece of plastic in the pump and claimed this was the problem. We asked him to clean the condenser and he said "no". We were not surprised when the dryer was exactly the same and on the first wash after he left the drum started making a loud noise so we reported both faults. On the second visit (12th November) he said we can still use the washer but we need a new drum. He also ordered a new condenser and said there is no need to clean the condenser as a new one is coming. The day after he ordered the drum and condenser I got a text saying they were out of stock and we would be contacted when they come in. I have used the washer a few times but it is getting nosier and nosier and it really is not washing clothes very well. I rang today for am update and they said there is no expected date for the drum, so i asked if they can send an engineer to fix the condenser, and this is where i need advice... She told me I can not have an engineer because I have already had two visits with the same problem. Despite explaining that neither of them actually bothered to empty the condenser, she was adamant that no visit can be booked and I need to speak to my home insurance company and ask them to fix the problem. I have never heard this rubbish before and doubt it is true but she would not budge. The new condenser is also out of stock and I will have to wait for it to arrive. I am basically without a washer or a dryer, no engineer can be booked and they have no date of when the machine will be fixed. The agreement says "For the life of your support agreement we will carry out as many repairs as your product needs" it makes no mention of two visits only. I can not find on the warranty an explanation of how long they have to fix the problems which is already becoming an inconvenience. Does anybody know what a reasonable time to fix the problems is? I have been offered another 12 month agreement which is due to start next month but do not know if I should take out the cover. I hope I explained my problem properly Kind Regards Jimbo

- 5 replies

-

- agreement

- mastercare

-

(and 1 more)

Tagged with:

-

Hi, I am posting this as I require some urgent advice regarding a minor and an agreement. I am 17 years old and I got onto an online car auction and won. The vehicle is for £7,900 + VAT + 20% commission + vat, therefore the total plaice is around £11,300. However I don’t have the money to buy the car and I did not think that I will win the auction. I contacted the auctioneer about this and they said that in there terms and condition (which I agreed to over email) they clearly state the following: 1) if a buyer wants to cancel they must pay the 20% commission+ vat. Which works out at £1580+ Vat 2) it is a trade sale so consumer right do not apply 3) there is a 2% interest each day for late payment 4) if an under 18 bids in a vehicle the parent or legal guardian is liable to pay. 5) is payment is not received within the allotted time they will use legal action. 6) If the reserve price is not met the seller may still sell the vehicle to the highest bidder. I need to cancel the bid as I have not got the money to purchase the vehicle but I don’t even have the enough money to pay for the cancellation charge. The auctioneer have got a copy of my driving licence and are saying that I have till 5pm otherwise they will go to court and most likely I will get a CCJ in my name which will be for the full amount of approx £11,300 plus 2% interest each day. I would like to know if they will still be able to take me to court even if I am under the age of 18 and classed as a minor, and I did not think this would happen. My parents are not aware of the situation and even they do not have that hind of money. Adobe is greatly appreciated. Thanks Thanks in advance.

-

Hello all, I'm in the process of renting a flat through an established letting agent and they are taking a long time to send the tenancy agreement. I have signed a contact with the agency and made the initial payment for the first months rent 15 days ago, and should be moving in soon. Whats the course of action to take to ensure i get something in writing asap, as txt messages and phone calls do not work, it's always "will be with you soon".

-

Hi all I am new the CAG i would just like to see if anyone could help or give me the best advice on bankruptcy on a personal agreement my partner and i are directors of a LTD company The LTD company had a debt with a supplier (not sure if i can post their name ) the debt was 11938.71 in March this year they sent us a statutory demand / winding up petition which we did not want to happen as thats our monthly income so if they wound the company up me and my partner would have no income to pay the debt off we agreed with their solicitors a payment plan of £500 per month ( under the understanding the winding up petition would still be in place but on hold if we fail to make our payments ) and they would look into it in 6 months time to see if we can pay more off the debt we paid them on time each month and stuck to our word then at the beginning of July the winding up petition went active again we called to see the reason why as we stuck to our word and never missed a payment their reply was they want their money sooner rather than later we have sold the LTD company on but because me and my partner signed a Personal Agreement they are coming after us personally (also the personal agreement does not have my correct D.O.B ) i had a gentleman come out to my house trying to serve me with a bankruptcy petition he has been twice and posted a letter saying he will arrive on such a day at such a time to serve me with the petition he came but i never answered to him he has been out in total of 4 times am not sure whats the best thing to do do i take the petition off him or not ? i am willing to set up a payment plan instead of going bankrupt just do not want the same to happen where i pay them a few months then they try to make me bankrupt again can anyone help please

- 35 replies

-

- agreement

- bankruptcy

-

(and 1 more)

Tagged with:

-

Hi all, I have no idea if the reconstituted agreement I have received from Link Financial is enforceable. It is a £6k debt with Barclaycard. Please can somebody advise me how to upload this for somebody to check if it is enforceable? Thanks,

-

Hi fellow caggers, looking a bit of advice for my partner She opened a Halifax Rewards account in 2002 with her Ex husband They separated in 2011 and there was an OD on the account He sub sequentially left all the debt to her, he managed to remove himself from the account by paying a small amount, I will say he was a Halifax employee. The last payment into the account was feb 13 by my partner and the account was defaulted on her credit report in Dec 13 It was sold onto Hoist and is being managed by Wescot, we have not acknowledged the debt and sent them a prove it in January which they still havent complied with and the account is on hold My partner never received a termination notice and we have sub sequentially SAR'd Halifax and received a mountain of paperwork today. I can upload any thing that you need to see Looking through it there is no reference to a termination notice and have noticed from an initial balance of ~£300 the debt stands at ~£800 which is all charges Can she challenge Halifax to remove the default? Also can she reclaim the charges under BCOBS?

-

Hi, hope someone can advise me on this. My letting agent is telling me that at the end of my current contract, they want me to sign a 12 month contract otherwise I will have to leave. I looked on my tenancy agreement and it states the following TWELVE MONTHS beginning 6th july 2017. If the tenant does not leave at the end of the fixed term, the tenancy will continue, still subject to the terms and conditions set out in this agreement, from month to month from the end of the fixed term until either the tenant gives notice that he wishes to end the agreement as set out in clauses 6 and 7 below or the landlord serves on the tenant a notice under section 21 of the housing act 1988, or a new form of agreement is entered into, or this agreement is ended by consent or court order" clause 6 and 7 talk about giving the landlord 1 months notice before I want to leave. Am I within my rights to ask to stay on a monthly rolling contract based on the above? Thanks

-

HMRC calls on online marketplaces to sign agreement tackling VAT fraud READ MORE HERE: https://www.gov.uk/government/news/hmrc-calls-on-online-marketplaces-to-sign-agreement-tackling-vat-fraud

-

Hi there I am guessing this is a common problem. Around 2 years ago, I received a threat from Cabrot regarding an £8k credit card from Halifax taken out in 2000 (I think - may have been 2001). I followed instructions and sent them a letter requesting a copy of the CCA and got the usual BS saying they couldn't find the file but I am still liable for the debt, the last I heard from them was August 2016. Anyhow, out of the blue. Yesterday, I received a letter from our beloved friends stating they had found said documents and they believe these were enforceable to obtain a CCJ. There is no signature on the forms and the page numbers do not correspond properly with corresponding numbers either missing or duplicated (I have copies attached with details blanked out - I can only upload 5 but have another 5 or 6). Additionally, there is no credit limit either, just a note to say that it will be determined and could vary. They do however, have my name & address on the top of the form. Based on this would it be enforceable and accordingly, how should I reply? I had hoped this had been put to bed but sadly not and I'm hoping I am not screwed. Thanks in anticipation. KR

-

Hi all, ive had a credit agreement back from IDEM servicing re my mbna credit card, please can you take a look over it please, thanks in advance Scan mbna.pdf

-

I had a loan via satsuma loans (provident financial ltd) I started to find unaffordable. I did the right thing and rather than paying late I contacted them being honest and setup a payment agreement, which I have stuck to 100% and not missed a single payment since it was setup in may 2017. Despite this and the fact ive made major strides to improve my debt handling and credit record over the last 12 months its still had something dragging it down and ive just found out that its provident financial ltd. The record for them on my credit file is still showing as per the original loan agreement which I haven't been paying for almost 12 months now however this is no longer valid as the new payment agreement I had with them superseded this original agreement which explains why I haven't been making payments towards it. I have requested via experian and noodle that satsuma update this record to reflect the new agreement but they have refused to do so. My question is, is this legal? I dont see how when ive setup a payment agreement with a company's approval that the original payment agreement is still valid as surely you cannot have 2 payment agreements with 1 company for 1 loan.. ...the payment agreement I setup surely supersedes the original one? and I dont see how its fair that im being penalised for late payments on a loan agreement I no longer have any agreement to pay. this whole thing has utterly tanked my credit file despite the fact ive worked really hard over the last year to sort myself out and until I find someway to correct it it will keep on tanking my credit file. So just wondering what my options are here? Is there anyway I can force satsuma to update my file to show the new agreement rather then the out of date invalid one? Can I get some advice please?

-

Good afternoon I currently have an ongoing complaint which has recently progressed to a complaint being made to the financial-ombudsman. I recently received some letters from bright house regarding a late payment fee which say's on all 3 letters that the date of Agreement being 21-11-2017. Is this the actual day they claim the agreement/contract was made? As One of the items is a Television id took an agreement on in november 2014 and should of been paid of by now but which they claim over £1000 is owing on When challenged about this i stated that we had items 2-3 years after that and told them they would of not allowed us more items if we that far in arrears at which he said he only knows what was written on his pda (called to our home)

-

Background 4 years service continuous, rocky employment. Currently working my notice period due to evident constructive dismissal. Despite a grievance being submitted with my resignation no investigation has been commenced and a meeting was held where i was offered a PILON payment to leave that day. How do I approach a settlement agreement proposal with the employer it's an evident breakdown and It will save a lengthy tribunal process

-

Hi A DCA that I have been making regular monthly payments to are unable to show me a signed credit agreement. Does this mean the debt agency are unable to come after me for any more payments? I am thinking of offering a f&f to get rid of them. PLease advise. Many thanks

-

Hi everyone. I was wondering if I might get a few pointers in regard to a tenancy agreement that we had with a previous landlord. Three months into the agreement the landlord started texting daily asking for the rent. he was quite abusive in these texts, swearing and threatening to call at the property to get the keys unless payment was made immediately. The payment from housing benefits had been adjusted and we were waiting for it to be sorted. He has now actually had the backrent that was due. We were a bit concerned for our safety if I'm honest and told him via text and a recorded delivery letter that we were giving him notice. He texted back that yes unless we paid him by the weekend in full he was coming to get the keys and we could leave. We left the property but have now started receiving texts from him saying we owe the remainder of the agreement. Is this true. After doing some reading surely he would have accepted our "surrender" of the property when he stated he would come and get the keys if we could not pay in full b the following weekend? Many thanks

-

Think I might be fighting a losing battle with this one but I'm coming to the end of my contract and checked my phone bill just to see what I pay out. Dont normally check the details I just pay it as I trusted that it was correct Really shocked to see throughout my contract i've been paying insurance which I never agreed to. Contacted Vodafone who said tough as I should have checked the phone bill. They also said I took the insurance out in store. I know I didnt take out this insurance and my query is can anything be done to get a refund? Surely they must have a signed copy of the agreement. Then secondly didnt like the attitude of saying if you dont check your bill then tough. What they're saying they can charge what they want and if you dont notice it then tough Any advice would be appreciated Thanks

-

Hi everyone. just a quick question. i defaulted payments in march this year. They claimed to me that they Terminated the Hire Purchase agreement in May 17. since then i have had calls and emails to contact them regarding payment. This morning a letter arrived of NOTICE OF SUMS OF ARREARS. from what i can gather from google this is sent out because the hire purchase agreement is still active. They have not sent any debt recovery letters but just always send letters under the HP agreement. Is it right they are still sending letters out when the HP agreement is terminated?? Many Thanks

-

Hi everyone, My Daughter has got herself in a pickle - she is going to uni and against our advice re-signed her tenancy agreement that doesn't start till June 2018 my wife was the guarantor but she has not signed and my daughter has not paid any deposit yet. she has now fallen out with the others that she is sharing with currently and does not want to continue staying there next year after the current agreement expires in June 2018. She has been in touch with the letting agents who have told her that there is no way out since she signed unless she finds someone herself to take her place. she only did this due to the amount of emails they kept sending and they were using scare tactics to tell her that if they don't sign some one else will take the property. This and the Uni workload was stressing her so she signed it and now regrets that. is there any way out of it now as Guarantor hasn't signed and no deposit paid ? thanks for your help in advance alix2

-

Hi Everyone, Mt friend has asked me for some advice, I used to post of here in the past but as I am a little out of touch I thought it best to ask you guys. He has a small business in the event industry and now the season is over in the next 4 months he is going to struggle to pay 2 agreements he has. The first is a Finance Lease agreement and the second is a Hire Agreement (where you keep the goods at the end for one further payment. The first one , the Finance Lease is with Armada Investments for approx 1K a month and the second the Hire Agreement with 1pm ltd for £500 a month. Both agreements are guaranteed by him and his business partner as partners , not Ltd. They were 3 year contracts and only have until March 2018 until they are finished. He has already asked if he can take a payment holiday but been refused, they have only offered to take two payment a month instead of one- which doesnt really help the situation. So , my question is , can they default after one missed payment? Which is what they threatened last month when he was late. Or how many payments can he fall behind without being defaulted or goods taken back. Thanks guys in advance for your advice.

-

Hi all, I've now received a copy of my agreement /statement from Arrow after 10 months of CCA request arrow are going to contact a third party to manage the account (letter uploaded). IF Enforceable what could I expect next? With my other account Capital One I make a payment every month and not heard a thing Thanks for any advise

-

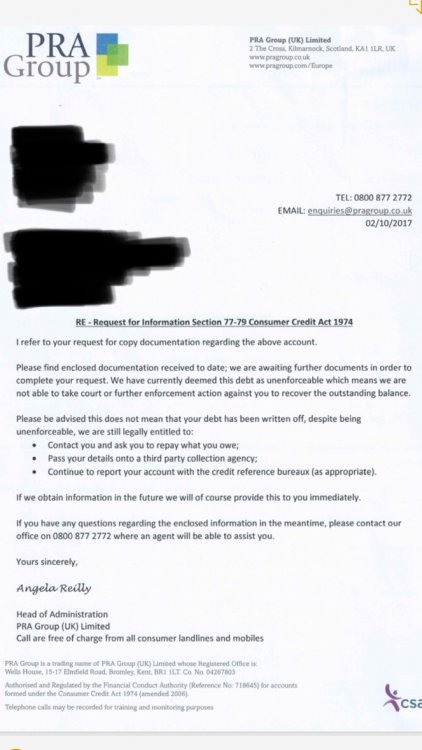

Hi there, My wife and I have unfortunately gotten ourselves into around £20,000 of debt. I recently wrote to the agencies sending out letters using the template to ask for the signed credit agreement. We have received this back from PRA GROUP. Could someone possibly give us some advice on what we need to do next Thank you Here

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.