Fullyskinted

-

Posts

481 -

Joined

-

Last visited

Content Type

Profiles

Forums

Post article

CAGMag

Blogs

Keywords

Posts posted by Fullyskinted

-

-

Well, I bottled it. A few months back now I caved and settled out of court. Ironic, as I settled for a lot more (to me) than I could have way back when they first started offering settlements which would have been done before any red marks would have been put on my Credit file!

I was getting really stressed and worried I might lose my house etc. So I bit the bullet and called them to discuss a settlement.

I still saved myself a few£k but I now have a VERY dented credit file as a result.

Funnily enough, it just reminded me where all my money had gone this year!

Still got the issue with the PPI on this card going on. The FOS have been 'dealing' with it for over 3 years now.... But that's another story.

THanks for all your help and advice over the years.

FS

-

Hi, I instructed a PPI Claims Specialist to claim back my PPI for me for a loan I took out years ago.

Have today received a letter which states that despite several attempts with GE Money (the actual lender), they are refusing to uphold the complaint and are stating that Loan Line were responsible for the sale of the PPI.

The letter then goes on to state that as Loan Line were not regulated by the FSA at the time of the application they are unable to forward the complaint to the FOS.

WHAT

THE

HELL?

Not impressed, Ive since tried doing my own research for Loan Line contact details etc and I cant find any! From memory, the loan was taken out with loanline.co.uk but I cant find any websites that seem to be the same company.

Has anyone had similar dealings with Loanline / GE Money?

How is it that someone can sell credit and not be regulated?

Any help/advice greatly appreciated.

Thanks. FS

-

Well, just printing off the letter and List of Docs...

Ill upload my List later. Here's the letter Ive sent them:

MBNA Europe Bank Ltd Vs F Skinted

Please find enclosed my List of Documents

I can confirm a copy of the same has been filed at Court.

I can also confirm that I have recived your List of Documents dated 22/12/09

Can I take this opportunity to request fully legible copies of the following:

Credit Agreement 14/3/98

Terms and Conditions (from 14/3/98)

Default Notice

Notice of Termination

Could you also provide me with copies of all correspondence sent to myself from MBNA from October 2006 to verify my records.

Also, I would like copies of all documentation sent to me by "Global Vantedge" and "Debt Clear Recoveries and Investigations Ltd". Again, to verify my records.

Could you also provide me with the Deed / Notice of Assignment for both of these companies.

Regards,

FS

-

Im not sure I follow you. Had a look at CPR Part 1 and, err, not sure what youre getting at.

-

If this thread should be put into the Legal Issues then please feel free to do so mods. Thanks

-

OK, bit of an update. I submitted my defence in the timescales. See below:

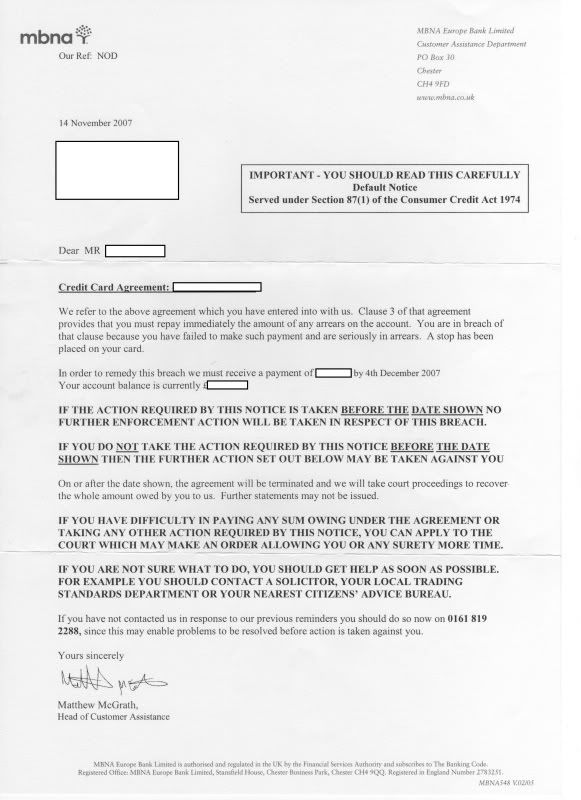

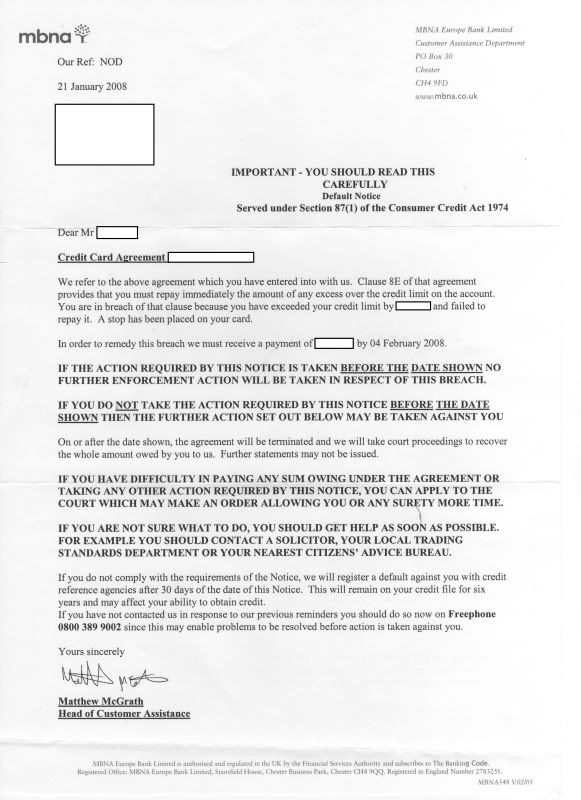

Going through the paperwork, I also found TWO DNs! See below:

One for the arrears in Nov 2007 and one in Jan 2008 for the excess over limit (the limit was breached as they were charging me out of order fees and interest!)

The first one (to me at least) seems to be in order but Im not so sure on the 2nd one. The dates are way too tight, not even 14 days from conception!

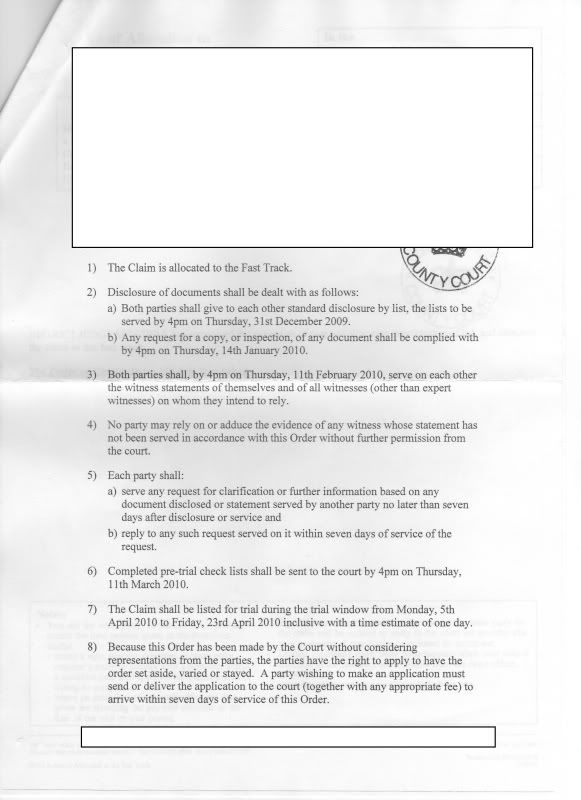

Also, I now have instructions as per the attached Order: See below.

OK, my defence:

Defence

1. I, Fully Skinted, of ESSEX am the defendant in this action and make the following statement as my defence to the claim made by MBNA Europe Bank - the claimant. This all follows from a request for information that the defendant submitted in writing dated 2nd January 2007. A copy of the text body of the letter is attached, along with the claimaints apparent 'suitable' response which was recieved 16th May 2007 (along with a letter dated 9th May 2007).

2. Except where otherwise mentioned in this defence, I neither admit nor deny any allegation made in the claimants Particulars of Claim and put the claimant to strict proof thereof.

3. The Defendant is embarrassed in pleading to the Particulars of Claim as it stands at present, inter alia: -

4. The claimants' particulars of claims disclose no legal cause of action and they are embarrassing to the defendant as the claimant's statement of case is insufficiently particularised and does not comply or even attempt to comply with CPR part 16. In this regard I wish to draw the courts attention to the following matters and the contents of CPR Part 16;

a) The Particulars of Claim are vague and insufficient and do not disclose an adequate statement of facts relating to or proceeding the alleged cause of action. No particulars are offered in relation to the nature of the written agreement referred to, the method the claimant calculated any outstanding sums due, or any default notices issued or any other matters necessary to substantiate the claimant's claim.

b) A copy of the purported written agreement that the claimant cites in the Particulars of Claim, and which appears to form the basis upon which these proceedings have been brought, has not been served attached to the claim form.

c) A copy of any evidence of both the scope and nature of any default, and proof of any amount outstanding on the alleged accounts, has not been served attached to the claim form.

d) The claimant did not send a Letter Before Action as required under the Pre-Action Protocols.

CPR Part 16:

"7.3

Where a claim is based upon a written agreement:

(1)a copy of the contract or documents constituting the agreement should be attached to or served with the particulars of claim and the original(s) should be available at the hearing, and

(2)any general conditions of sale incorporated in the contract should also be attached (but where the contract is or the documents constituting the agreement are bulky this practice direction is complied with by attaching or serving only the relevant parts of the contract or documents)."

5. Notwithstanding matters pleaded, it is denied that the Claimant has established a cause of action or that the claimant has a valid claim against the defendant.

Consequently, it is proving difficult to plead to the particulars as matters stand.

The relevant Act of Parliament in this Case

6. Firstly I will address the issue of which Act is relevant in this case, in case it is suggested that the claim falls under the Consumer Credit Act 2006, it is drawn to the courts attention that schedule 3, s11 of the Consumer Credit Act 2006 prevents s15 repealing s127 (3) of the 1974 Act for agreements made before s15 came into effect. Since the agreement would have commenced prior to the inception of the Consumer Credit Act 2006, section 15 of the 2006 Act has no effect and the Consumer Credit Act 1974 is the relevant act in this case.

7. For the avoidance of any doubt I include the relevant section of the 2006 Consumer Credit Act (Except taken from Consumer Credit Act 2006 (c. 14) - Statute Law Database

11 The repeal by this Act of-

(a)the words "(subject to subsections (3) and (4))" in subsection (1) of section 127 of the 1974 Act,

(b)subsections (3) to (5) of that section, and

©the words "or 127(3)" in subsection (3) of section 185 of that Act, has no effect in relation to improperly-executed agreements made before the commencement of section 15 of this Act.

8. Therefore the Consumer Credit Act 2006 is not retrospective in its application and has no effect upon this agreement and the Consumer Credit Act 1974 is the act which this agreement is regulated by

The Request for Disclosure

9. I will shortly be requesting the disclosure of information pursuant to the CPR 31.14A), which is vital to this case from the claimant.

10. Until I have received any such documentation requested, it is difficult to fully compose this defence without disclosure of the information requested, especially as I am a Litigant in Person.

11. The courts attention is drawn to the fact that the without disclosure of the requested documentation pursuant to the Civil Procedure Rules I have not yet had the opportunity to asses if any documentation which the claimant claims to be relying upon to bring this action even contains the prescribed terms required in Consumer Credit (Agreements) Regulations 1983 (SI 1983/1553) which was amended by Consumer Credit (Agreements) (Amendment) Regulations 2004 (SI2004/1482). The prescribed terms referred to are contained in schedule 6 column 2 of the Consumer Credit (Agreements) Regulations 1983 (SI 1983/1553) and are inter alia: - A term stating the credit limit or the manner in which it will be determined or that there is no credit limit, A term stating the rate of any interest on the credit to be provided under the agreement and A term stating how the debtor is to discharge his obligations under the agreement to make the repayments, which may be expressed by reference to a combination of any of the following--

1. Number of repayments;

2. Amount of repayments;

3. Frequency and timing of repayments;

4. Dates of repayments;

5. The manner in which any of the above may be determined; or in any other way, and any power of the creditor to vary what is payable

12. The courts attention is drawn to the fact that where an agreement does not have the prescribed terms as stated in point 14 it is not compliant with section 60(1) Consumer Credit Act 1974 and therefore not enforceable by s127 (3). The courts attention is also drawn to the authority of the House of Lords in Wilson-v- FCT [2003] All ER (D) 187 (Jul) which confirms that where a document does not contain the required terms under the consumer credit act 1974 and the Consumer Credit (Agreements) Regulations 1983 (SI 1983/1553) and Consumer Credit (Agreements) (Amendment) Regulations 2004 (SI2004/1482) the agreement cannot be enforced

13. It is submitted that if the credit agreement supplied falls foul of the Consumer Credit (Agreements) Regulations 1983 (SI 1983/1553) in so far that the prescribed terms are not contained within the agreement then the court is precluded from enforcing the agreement. The prescribed terms must be with the agreement for it to be compliant with section 60(1) Consumer Credit Act 1974. In addition there is case law from the Court of Appeal which confirms the Prescribed terms must be contained within the body of the agreement and not in a separate document

13. I refer to the judgment of TUCKEY LJ in the case of Wilson and another v Hurstanger Ltd [2007] EWCA Civ 299

"[11] Schedule 1 to the 1983 Regulations sets out the "information to be contained in documents embodying regulated consumer credit agreements". Some of this information mirrors the terms prescribed by Sch 6, but some does not. Contrasting the provisions of the two schedules the Judge said:

"33 In my judgment the objective of Schedule 6 is to ensure that, as an inflexible condition of enforceability, certain basic minimum terms are included which the parties (with the benefit of legal advice if necessary) and/or the court can identify within the four corners of the agreement. Those minimum provisions combined with the requirement under s 61 that all the terms should be in a single document, and backed up by the provisions of section 127(3), ensure that these core terms are expressly set out in the agreement itself: they cannot be orally agreed; they cannot be found in another document; they cannot be implied; and above all they cannot be in the slightest mis-stated. As a matter of policy, the lender is denied any room for manoeuvre in respect of them. On the other hand, they are basic provisions, and the only question for the court is whether they are, on a true construction, included in the agreement. More detailed requirements, which are designed to ensure that the debtor is made aware, so far as possible, of specified information (including information contained in the minimum terms) are to be found in Schedule 1."

14. If the agreement does not contain these terms in the prescribed manner it does not comply with section 60(1) CCA 1974, the consequences of which means it is improperly executed and only enforceable by court order

15. Notwithstanding points 12 and 13, any such agreements must be signed in the prescribed manner by both debtor and creditor. If such a document is not signed by the debtor the document cannot be enforced by way of section 127(3) Consumer Credit Act 1974

16. The claimant is therefore put to strict proof that such a compliant document exists

17. Should the issue arise where the claimant seeks to rely upon the fact that they can show that the defendant has had benefit of the monies and therefore the defendant is liable, I refer to and draw the courts attention to the judgment of Sir Andrew Morritt in the case of Wilson v First County Trust Ltd - [2001] 3 All ER 229, [2001] EWCA Civ 633 in the Court of Appeal

at para 26

"In effect, the creditor--by failing to ensure that he obtained a document signed by the debtor which contained all the prescribed terms--must (in the light of the provisions in ss 65(1) and 127(3) of the 1974 Act) be taken to have made a voluntary disposition, or gift, of the loan moneys to the debtor. The creditor had chosen to part with the moneys in circumstances in which it was never entitled to have them repaid;"

The Need for a Default notice

18. It is neither admitted nor denied that any Default Notice in the prescribed format was ever received and the Defendant puts the Claimant to strict proof that said document in the prescribed format was delivered to the defendant.

19. Notwithstanding point 18, I put the claimant to strict proof that any default notice sent to me was valid. I note that to be valid, a default notice needs to be accurate in terms of both the scope and nature of breach and include an accurate figure required to remedy any such breach. The prescribed format for such document is laid down in Consumer Credit (Enforcement, Default and Termination Notices) Regulations 1983 (SI 1983/1561) and Amendment regulations the Consumer Credit (Enforcement, Default and Termination Notices) (Amendment) Regulations 2004 (SI 2004/3237)

20. Failure of a default notice to be accurate not only invalidates the default notice (Woodchester Lease Management Services Ltd v Swain and Co - [2001] GCCR 2255) but is a unlawful rescission of contract which would not only prevent the court enforcing any alleged debt, but would also give rise to a potential counterclaim for damages where damage occurs to my credit rating (Kpohraror v Woolwich Building Society - [1996] 4 All ER 119)

Conclusion

21. The Defendant denies that there has been any failure to make payment in accordance with the alleged contract. The Claimant has failed to produce a copy of a credit agreement in the requisite timescale/at all, and in the absence of such an agreement, which conforms to sections 60 and 61 of the Consumer Credit Act 1974, the Defendant avers that no agreement has ever existed for there to have been any failure to make said payment.

22. Without Disclosure of the relevant requested documentation I am unable to assess if I am indeed liable to the claimant, nor am I able to assess if the alleged agreement is properly executed, contain the required prescribed terms, or correct figures to make such an agreement enforceable by virtue of s127 Consumer Credit Act 1974

23. In view of the matters pleaded above, I respectfully request that the court gives consideration to whether the claimant's statement of case should be struck out as disclosing no reasonable grounds for bringing the claim, and/or that it fails to comply with CPR Part 16.

24. Alternatively, I respectfully request a stay in proceedings until such time as the claimant complies with the requests outlined in paragraph 9 above or until the court orders its compliance with the same. I will then be in a position to file a fully particularised defence and counterclaim and will seek the courts permission to amend my statement of case accordingly.

To be honest, I havent sent in a CPR and I didnt expect to get a response like what I have so soon!

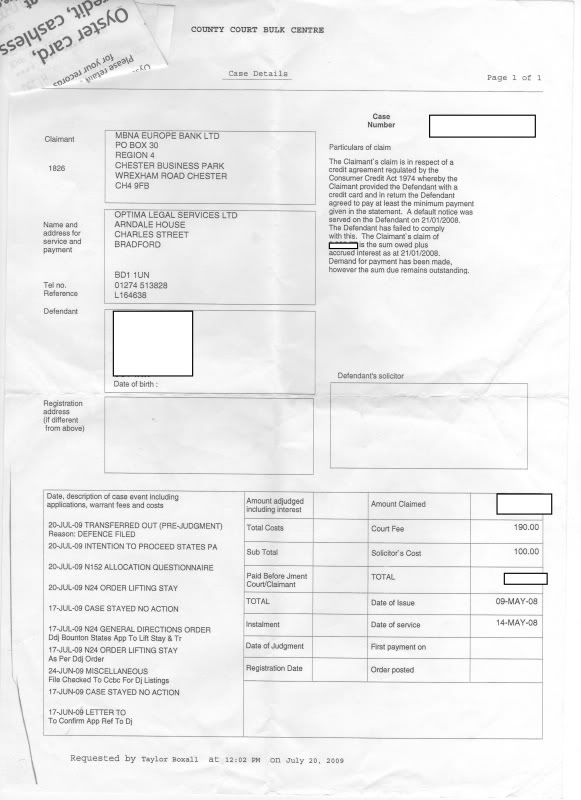

Here is their POC:

Please note the date that the date stated on the POC is 21/1/08. Thats the date of the DN for the excess on the account.?!?!? THoughts?

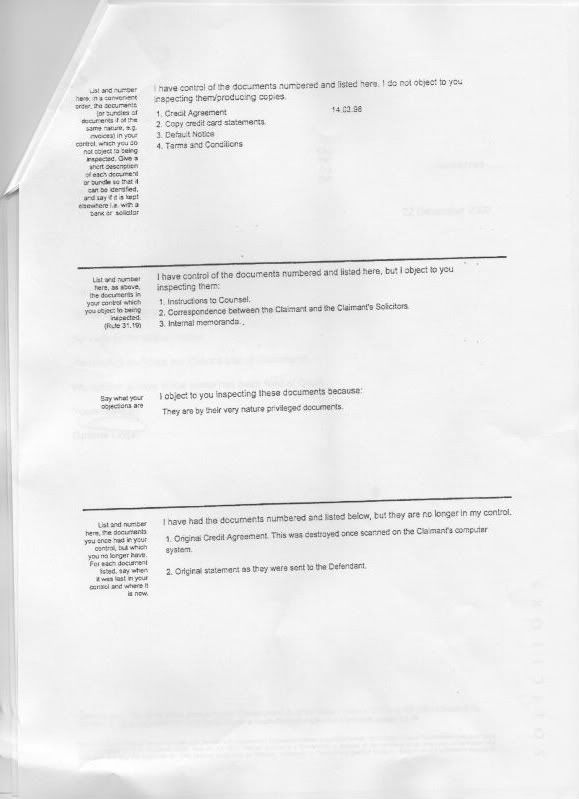

THeir Std Dis List of Docs: PLEASE NOTE: They actually state that the original agreement was destroyed!!! ( Im guessing they mean the application form?!?!?!)

The Order:

The two DNs:

-

Hi Amber, if you look at the initial post on this thread, this was the first thing I did way back in Jan 2007. They didnt send me anything other than past statements though, so Ill send another one I think.

GOnna piece together a CPR request too, once I work out which is the most relevant

ALso found the paperwork I was missing today. But thinking about requesting a copy of all correspondence from 2006 when this all started. Making sure I have a copy of everything for my case file/reference. Amongst some of the paperwork are claims to owning the debt by at least one, maybe TWO DCAs! BUt nothing was ever send to me about this assignment! Good job I put on the defence about the possibility of submitting an ammended defence!

-

Well, just did an all nighter and got a defence together. Think Ill post up later on as Im about to drop it off at the court and then come home and go to bed!

Bit surprised I didnt have any comments between this post and the last one tbh, but there you go. I havent been posting as much as some of the similarly started threads, so I guess thats why. I ended up using a couple of defences off of here and making them fit. Lets hope it works out OK.

Also wrote a letter to go on my file outlining some of the history about how this came about and why I started with the CCA request in the first place.

-

Im liking that there ^^^^ Meldrew! Might use that myself! You had any comebacks? I gotta put a defence in tomorrow with the court!

-

Hey guys. Just had some interesting conversations with National Debtline. They also have some interesting letters on their site too.

OK, I got a copy of the POC sent to me by the court. It reads:

The claimants claim is in respect of a credit agreement regulated by the CCA 1974 whereby the Claimant provided the Defendant with a CC and in return the Defendant agreed to pay at least the minimum payment given in the statement. A default notice was served on the Defendant on 21-1-08. The defendant has failed to cpmply with this. The claimants claim of £XXXX.XX is the sum owed plus accrued interest as at 21-1-08. Demand for payment has been made, however the sum due remains outstanding.The guys ar national debtline said I could ideally do with the Data Protection Search thingy (I forget now) - it takes up to 40 days and the creditor have to issue you with everything they have against your account/name. UNfortunatley, I havent done this, so Ill have to base my defence on the basis of unenforcement. He said its a pretty black and white case. So Im feeling slightly upbeat about it.

Do you guys think I should put in the Data Protection request thingy with MBNA? I havent corresponded with them for ages!

Also, what does a defense look like? I need to get it in by mid week next week! Gonna speak to CAB aswell today. Hopefully they have some local guys that I can go see about it and setting up a defence team.

Thoughts?

-

Who would that come from? MBNA or Optima?

-

Got to go to work now, so Ill try and do it there later on.

Particulars of CLaim I got a copy of last week, Im not sure if I have a copy of the defence submitted, but it was done as a last min thing...

-

You'll need to bite the bullet and get professional representation to fight this, as the prospect of losing are now quite high without full knowledge of the situation.

That my thinking too. But who?

-

I think I need some professional help now. I cant believe its gone to court.

See my thread...

http://www.consumeractiongroup.co.uk/forum/mbna/97485-mbna-cca-received-5-a.html

I thought the judge would either throw it out, or let it go to court and Id get my chance to make the solicitors from Optima stupid (theyre still sending me letters asking why Im refusing to pay the debt!)

So, who do I use? I havent got as much time as I used to have to go trawling through this forum but I cant afford to lose the lump sum that they'll be wanting (over £7k now with fees/interest/costs) and they still keep bashing my credit file. Is there NO way to get this thrown out, or is it that the judge has a hard on for peeps like me trying to make the CC bang to rights?

Im really down over this now. Just what I need just before christmas and with a possible redundancy at work looming in the new year...

Any help or pointers would be greatly appreiciated. Thanks in advance

-

Nice. Good work!

Ive just had a letter from the courts saying my defence has been struck out and I need to respond with a defence complying with CPR Sec 16 and 22? WTF are they?

My CCA req goes all the way back to Jan 2006 and then it took them over 5 mths to respond with a shoddy A4 copy which isnt fully legible, no T&Cs or the rear of the 'agreement' so Im looking for some help too.

Reading this has inspired me

-

OK, Now Im REALLY worried. Got a letter last week form the Judge. The defence has been struck out" because it discloses no grounds of defence of the claim".

I now need to file and serve a fully detailed defence in proper form and which complies with CPR Parts 14 and 22 by 4pm Wed 2/12

If I dont submit this in compliance, I get debarred drom defending and the claimant will be at liberty to enter ofr judgement for claim and costs etc.

I have just missed the timescales to have this order stayed or set aside aswell (only just noticed that bit!)

I think I need some serious legal advice. Ive had my PC repaired, so can get at all my old files etc now (once i hook it back up) but the main thing is that this isnt making me feel too good about christmas etc, esp as I also have a redundancy looming

So, WTF are CPR (I looked and it looked terribly complicated).

I have just spoken to a 'financial resolution' type place to see what they say. They cant help me, but they are in agreement that once the acct goes into dispute, no action can be taken , no monies requested and no credit file repercussions are allowed either. THE FSA STILL havent rung me back form months ago and Im REALLY REALLY annoyed about the whole thing now tbh.

-

I basically have totally lost track of this, moved rooms about and now cant find anything! Incl all my paperwork on the case!

I had to put the AQ in, asked for a stay again (for time!)

THe FOS paperwork went in in Jun 07. And apparently they had 'dealt' with it by Jun 08. Ive asked them for copies of the correspondence as I dont recall any of it reflecting the 'case closed'

Youre right in the bit about even with the FOS decision, I can still take them to court, but a) it wouldnt look so good and b) the court can still make the debt payable - even if it isnt enforceable.

-

Well, I got it in by 4. Thats the main thing. Probably fcuked it up, but What the hell. I can follow it up like you say...

-

Thanks all. Ive finally found the AQ, which is a start!

-

Indeed it is! The AQ was due in on the 10th Aug apparently (oops) so the extension is until 4pm today.

Yes, I do need a copy of the POC.

Apprently the FOS (as I called them today) ruled it was all OK for MBNA to rip me a new A hole in June 08. But I dont recall any correspondence to reflect that... they just told me today. THey said they would open the archive and find out what went on. Apprently they didnt hear form me with any dispute over the outcome, so case closed.

-

This is the one of my problems. My desktop PC has died, I cant find ANY of the paperwork from 2 years ago and I cant find the POC!

I think Im screwed.

I made the offer, just to try to get it gone. ANd looking that some of the offers being banded about this morning, I think my offer is more than enough!

Ive looked thro all my old posts etc. They have broken sooooooo many rules/.regs, but WTF am I to do when the FOS ruled it was case closed and I didnt have a leg to stand on?!?!

-

Yes, sorry - its here

http://www.consumeractiongroup.co.uk/forum/mbna/97485-mbna-cca-received-5-a.html

-

I am today responding to a 'General Form of Order or Judgement'

And if you look at my thread, yours looks awesome quality in comparison! I didnt even get the T&Cs!!!

Still not sure where to go. Ive just rang their solicitor and made an offer, as Im sstill not sure how it would pan out if it did go to court!

-

See my thread. Same as what happened to me... TWO YEARS AGO!

Miss sold PPI by Loan Line/GE Miney. But cant find any details?

in Payment Protection Insurance (PPI)

Posted

OK, spoken to both the claims company and GE. Loanline no longer trading. GREAT!

Second. Was Loanline any other organisation? i.e. RBS under another trading name?

Third. As the loan was taken out prior to 15th Jan 2005 it cannot be dealt with under the FSA compensations (or whatever) that it might have been because LL are not longer trading...

The claims company are saying thats the end of it, cant help, no go, etc etc.

However, you've just made me realise something. If Loanline are no longer trading, and the acct was still running, then they would still be making me pay each month and Id still be paying the PPI each month, so surely GE cant get away with that?