mahharg

Registered UsersChange your profile picture

-

Posts

265 -

Joined

-

Last visited

Content Type

Profiles

Forums

Post article

CAGMag

Blogs

Keywords

Everything posted by mahharg

-

yeah you did and at the time it was only thinking about maybe getting a mortgage. Now it's about to become a reallity. Maybe I didn't have to pay it off, however I got a great settlement figure and there were no extra charges on there in fact the account had been interest free for all but 1 year. At least there would be no phishing demands in the future, at least i hope. This is the first time in 20 years that I'm debt free and it feels bloody good.

-

If that's the case DX100 and London1971, I will relax a bit. London1971 my default dropped off in June 2019. It's still anoying these DCA's think they're a law amongst themselves. This site has taught me so much in the past and I'm so confident in dealing with these people. Hopefully never ever again. I miss the old bank charges reclaim back in the day lol

-

From Clear score https://www.clearscore.com/learn/credit-score-and-report/understanding-credit-checks-hard-searches-and-soft-searches Hard searches (also known as hard checks or credit application checks) A hard search is when a lender takes a full look at your credit report (and score). This type of credit check leaves a mark on your credit report, so whenever prospective lenders look at your credit report they can see you applied for credit (and whether you were accepted). Most hard searches stay on your report for 12 months (though a debt collection is visible for a period of 2 years). Even the Ombudsman said that they're allowed to do this. Frustrating when you can't get the required assistance from them. I'm looking to get a mortgage in the next few months and I don't want this to affect me. My file is spotless but for these 2 "dirty trick" entries.

-

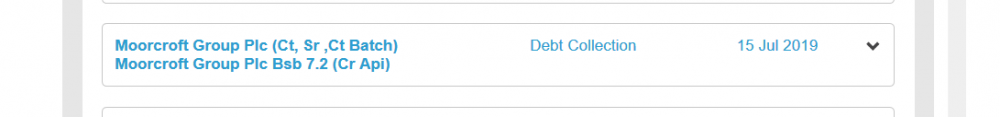

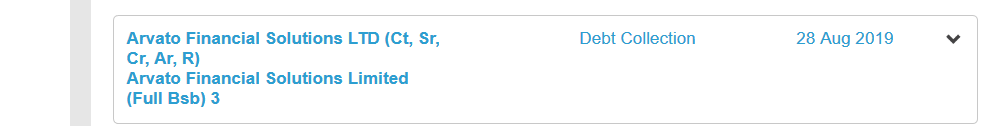

Hi I posted regarding this debt before, however I'm hoping for a bit of direction. My 2 Barclays defaults dropped off my file in June 2019. All monies owed have been settled as of July 2019 One directly with Barclays and another via avarto DCA. Just before the defaults dropped off 1 of the loans were "assigned" to moorcroft, then Avarto. As mentioned all sorted and settled with letter stating nothing owed and account closed. The issue I have is that both DCA's posted "Debt collection" searches on my credit file dated July 2019. As mentioned the defaults regarding these accounts dropped off in June 2019 (6 years after default). Transunion have these searches as a hard search. I believe these type of searches remain on file for 2 years. I've diputed these searches with Transunion, the DCA's and even the Ombudsman. I stated that after 6 years of a default, no traces relating to the defaulted account should be visible. All 3 stated that searches are permitted by anybody at anytime. I understand that soft searches can be carried out by almost anybody, however I disagree with this because this is a hard/debt collection search which has an impact on my file. I'm banging my head against the wall. Can anybody point me to the actual law that mentions about this. I've looked at the cca but can't find the specific section about this. Also who else could I complain to and how. I've checked the FCA but they don't appear to take personal complaints. If I wanted to go to court, I would need to refer to the law that is in my favour. Thanks guys

-

Hi I've got confirmation from Barclays that I should contact Arvato DCA for any full and final settlement relating to my account. I have now got a letter from Arvato stating; It then goes on to give details of how to pay. Is that enough or should I insist that Arvato send another letter confirming the remaing balance will not be passed to anyone else to pursue. This f & f would be the best thing that could ever happen to me. I would finally be debt free for the first time in over £25 years. I don't want to pass up this chance

-

Isn't the letter of assignment enough?

-

Really? I was advised by barclays to speak to Arvato regarding a f&f settlement. If I get the correct written confirmation from them, I would have thought that would be enough.

-

I've spoken (yeah I know I shouldn't). But I only confirm things when I have it in writing only. I have 2 loans with Barclays and 1 with Arvato (assigned by barclays) Arvato agreed to 50% settlement. A letter is being sent out to me confirming full and final settlement and that it won't be passed on to anyone else after I pay. Barclays have been offered 50%, now I'm waiting for decision. This is exactly what I would have wanted and tbh, just as I thought, DCA's seem a lot easier to get a settlement figure. If I hadn't spoken to them, I would never have known that they would accept 50% settlement. I know the advise on here is everything in writing. This is true for proof and confirmation however I see nothing wrong with speaking beforehand, as long as things are agreed only in principle until it what was agreed is supplied in writing. This is just my opinion.

-

Barclays wrote off OD debt, now saying I still owe

mahharg replied to mahharg's topic in Barclays Bank

Complaints manager has now confirmed that the account is classed as satisfied as per 2016 letter and I won't be persued for the remaining. I will be getting a final response letter stating that . -

Barclays wrote off OD debt, now saying I still owe

mahharg replied to mahharg's topic in Barclays Bank

A quick query. Do banks have to send periodic statements? I ask because if the written of letter was issued in error, I'm wondering if the bank have broken any rules because I've had no statement for 3 years (since the letter) I also question why I have not been chased regarding the outstanding? I honestly believe it wasn't issued in error at all. -

Barclays wrote off OD debt, now saying I still owe

mahharg replied to mahharg's topic in Barclays Bank

Just to claify a few points before I rush off to work. All 3 were sent to internal collections. The letter regarding the owed overdraft from the closed defaulted bank account came out of the blue in 2016. No attempt to recover the money was ever attempted since the letter Only due to a phone call regarding the loans that I was told there was an outstanding balance (no interest added just the balance as off 2016). complaint informed me the letter was sent in error and the balance is still owed....apparently. (verbally) I will be waiting for a final written response before going to the ombudsman. Thanks guys have a nice day -

Barclays wrote off OD debt, now saying I still owe

mahharg replied to mahharg's topic in Barclays Bank

The account was closed down in around 2013. I had 2 loans and this overdraft that I was struggling with. So all 3 were sent to collections. All 3 were defaulted and have now cleared off my files. I just think I'll let my complaint run it's course then guard it to the ombudsman. See what they think. I think what you say is right. The errors appear to come from collections. Even the complaints team can't appear to overrule them. -

Thanks DX. Good to know about last comment. I would never pay full and final without written confirmation stating it won't be assigned or sold to anyone else. Read to many cases on here.

-

Barclays wrote off OD debt, now saying I still owe

mahharg replied to mahharg's topic in Barclays Bank

That's what I'm thinking especially when they were kind enough to show the balance as zero. But as you mentioned, let's see what others think. Thanks Slick -

Barclays wrote off OD debt, now saying I still owe

mahharg replied to mahharg's topic in Barclays Bank

Thanks slick123 That letter is going nowhere. I don't bank with Barclays anymore and I did say that I don't want to talk about it on the phone. It's the "I can decide what to do next" comment that makes me think they are aware that if I didn't pay it, they couldn't do much about it. I just need to know with the letter, could I legally not pay it? Barclays have admitted it's their error in sending it in the 1st place. I haven't paid a penny in over 3 years. -

hi dx100uk Long time no chat lol. I'm not afraid of talking to tDCA'S, they don't worry me. I was just putting them straight. i actually find it quite satisfying when they realise that I'm no push over. Barclays aren't stopping me....yet. Just wondering if after looking at my income/expenditure (required before settlement figure is considered apparently) they can say I'm paying too much in child maintenance if it went to court. I'd rather pay for my children's future than them.. mucked me about too many times in the past. I understand that to get a mortgage you have to declare any outstanding debts. Even though they're not on credit file.

-

Hi all I am on a payment arrangement with barclays for 2 outstanding loans. Everything was going along fine until my default dropped off after 6 years. (current outstanding £13000 - paying £180 a month). This has left my credit file squeaky clean for the first time in about 15 years. Suddenly the bank decided to assign one of the loans to a DCA (Moorcroft then Arvato) and keep one in house. I wasn't happy and complained stating that they are simply making things difficult and I will not be dealing with different companies. I was informed that they were calling the loan back from Moorcroft, then instantly it was assigned to Arvato. I phoned Arvato explaining that I have an ongoing complaint and won't be communicating with anybody until the complaint has been exhausted. They were very understanding and said they would send it back to Barclays. I've spoken to complaints and informed them that my father is offering up to £6000 to clear the debt, so I can clear the debt and use my right to buy my council flat thus someting for my children (don't live with me) when they are older. Complaints said they can't decide on this and it is up to recoveries team. I stated that I need to do something to help my children's future and if a settlement figure can't be reached, I would up the child maintenance payments so that some could be put in a child ISA account for them to give them a head start in life. I pointed out that there would be hardly anything left. The question I'm asking is, can they stop me paying extra child maintenance for this purpose or am I entitled to pay what I like? It's not my children's fault that I got myself in this situation and with the price of property and low wages, I feel obligated to help them. thank you for reading

-

Hi all Just a quick one for those in the know. Back in 2015, I was on a payment arrangement for a bank account overdraft. The account was closed and I was paying something like £20 per month on a payment arrangement. Out of the blue in 2016 I got a letter from Barclays collections stating: Account number ******** Outstanding Balance £0:00 Dear me Your debt is now considered satisfied and can confirm that no further action will be taken against you. Any standing orders or direct debits you have set up in favour of this account should be cancelled. yours sincerley your collections and recoveries team My balance at the time was over £1000, so I was very happy with the letter. Anyway long story short, I had to phone barclays regarding a diiferent loan that I'm on a payment arrangement and the recoveries team are saying that I owe the money on the bank overdraft account. I complained to the complaints team. I was informed that the letter that I received in 2016 was issued in error and I still owe the money. I was further advised that it was up to me how I approach this. What do you suggest, should I pay or should I abide by the letter issued in 2016? Thanks guys

-

Hi Genie9373 I've just had a debt from barclays passed to Moorcroft "to collect on their behalf". My default dropped off my file last month. what Unclebulgaria67 says is correct in that the debt can't be put back on your credit file. I'll be following this thread with interest. I wish your brother good luck.

-

Sixt claiming damage that was already there

mahharg replied to mahharg's topic in General Motoring Issues

One thing that does concern me and I suppose a lot of others think about is that although I feel very strongly about this and believe that I would rightly win in county court, what could the cost implications be if I were to lose? I am thinking court cost of £35 or whatever it is plus maybe their solicitor fees which I hope would not be too much. Not forgetting the claim itself plus 8% interest. All in all I would hope it wouldn't cost too much more simply because I want to dispute the claim. This could put a lot of people off. -

Sixt claiming damage that was already there

mahharg replied to mahharg's topic in General Motoring Issues

I only signed 3 things. A computerized device on the counter of the office, The reciept stating that I agree to terms and conditions plus the pda computer that the employee who checked the car with me had. I did not sign or see any paperwork "Pre rental checklist", yet my signature is on this paperwork. They hasve obviously transfered one of the signatures onto the paperwork. I don't know if they are allowed to do this. I would think not. -

Sixt claiming damage that was already there

mahharg replied to mahharg's topic in General Motoring Issues

Yes I did take a photo after I had recieved the invoice for the repair. Wish I did before I took the car but hindsight is great. When you say report the alledge forgery. Do you think that I should go to a police station to report it asap or should I wait to see what they decide on their course of action if any first? -

Sixt claiming damage that was already there

mahharg replied to mahharg's topic in General Motoring Issues

Thank you for your response Bankfodder. They don't appear to have my card details stored on their system and they certainly haven't taken anything. My deposit was refunded almost straight away. I didn't think of the fact that they noted the exterior as clean on return could also mean no damage. This is something that I take on board. My main issues with them is their inconsistency, which to me appears very unproffesional. Also the forged signature. -

Hi all I need some advice on an issue that I have with Sixt. I will put in all events to hopefully give the full picture. 15th Feb hired a car at my local Sixt car hire office for 24 hours. No excess waiver taken On checking the car with the employee I noticed some scratches on the front reg plate and bumper. I was told that these slight scratches did not count as damage. I signed the employees pda computer and was given the keys. No paperwork except the reciept that I signed in the office prior to going to collect the car. I did not have a camera to use at the time. The car was due back by 11am on 16th Feb 2017. As per agreement I parked the car outside the office at around half midnight on the 16th Feb and dropped the key in the 24 hour dropbox. I checked online and noted that the car was checked back in at 7.07hrs. I understand that I am responsible for any damage until it is checked in. I had to go to the office later that morning to resolve a separate fuel issue. The employee who checked the car in, informed me that he had to drive the car to the petrol station to put more fuel in. He was speaking very candidly with me. No mention of anything wrong with the check in. 5 days later I get an email stating that the car has new damage and I am liable. Upon investigation, I find out that the damage being refered to is the same scratches that were there already. After multiple emails back and forth. I have denied all liability. My reasons are as follows: 1) The damage was already there. I informed the employee before taking the car. As per terms and conditions. 2) The photograph taken by Sixt was taken later on that day, after the car had been moved. Even though the damage was there, any new damage claimed could have been caused after the car was checked in. The car was parked in a way that a picture could have easily been taken where I left it. Why wasn't it? 3) Lack of consistency of the employees. The state of the car on check out was described as slightly soiled interior and exterior. On check in the state was described as clean. This could be the exact situation with the scratches. One person says it's ok, the next say it's not. This is obviously what has happenned. 4) I've been sent 2 different invoice amounts, 354 and 360 pounds. On one of the invoices it details labour charges and specific time spent on the repair. When I checked the car after the invoices were produced, the repair has not even been carried out. 5) In one of my emails I suggested that Sixt give customers a sheet of paper that shows a diagram of the car and any damage no matter how minor. This would avoid any confusement in the future. To my amazment one of these sheets was emailed to me with my signature on it. I have never seen this sheet let alone signed it. I feel that this could be classed a fraud. 6) The pictures of the car that Sixt produced showed extra markings that seem to have been added for the picture. I'm not sure if these were markings to point to the scratches or simply to make it look worse. These markings are not there now. All in all I feel that they are trying it on with me. I have invited them to take me to court. I recieved another email today stating that as we are getting nowhere, they have no option other than to refer the case to their legal department, unless "we can come to an agreed settlement" . I feel very suspicious about this. If they are adament that I am liable, why would they want to reduce the charge? You opinions and advice would be very welcome. Do you think I should let them take me to court?

-

Satsuma loans and compliment

mahharg replied to obiter dictum's topic in Provident and associated companies.

When I told them that I had only a bank account with a Cash card and that I couldn't make card payments, they gave me their account number. I used my Satsuma number as reference (8000000******). Account number 20577081 Sort code 20-11-81. Of course they like your card details because they then have more control over your payment.- 8 replies

-

- compliment

- loans

-

(and 1 more)

Tagged with:

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

- Create New...