TheUnknownStuntman

Registered UsersChange your profile picture

-

Posts

49 -

Joined

-

Last visited

Reputation

1 NeutralRecent Profile Visitors

The recent visitors block is disabled and is not being shown to other users.

-

Good Afternoon Everyone, I hope everyone is safe and well. So quick update. I still pay £1 to Natwest but for the current account that was overdrawn. I guess I do this for peace of mind. I know the longer I pay this then the longer it would take to go to potentially Statued Barred. However Im not sure about it becuase its an overdraft that got added to the debt. The actual loan itself I stopped paying for. both was merged into one sum. I was paying £1 for the loan account and £1 for the current account that was in overdraft, both were standing orders that I pay direct to Natwest, if that makes sense I have heard nothing whatsoever for possibly 2 years. I noticed last month a hard search on my credit file from Intrum, Yesterday I recieved a letter from Intrum saying that Natwest no longer own the debt and that Intrum do, but Wescot (which I have heard nothing from) are still managing it so continue to pay them, which i dont. In my mind I am going to do nothing and just continue to pay natwest the £1 for current account. What do you think I should do ? Doc1.pdf

-

Lloyds Debt sold to cabot, now resolvecall

TheUnknownStuntman replied to TheUnknownStuntman's topic in Lloyds Bank

Thankyou. -

Lloyds Debt sold to cabot, now resolvecall

TheUnknownStuntman replied to TheUnknownStuntman's topic in Lloyds Bank

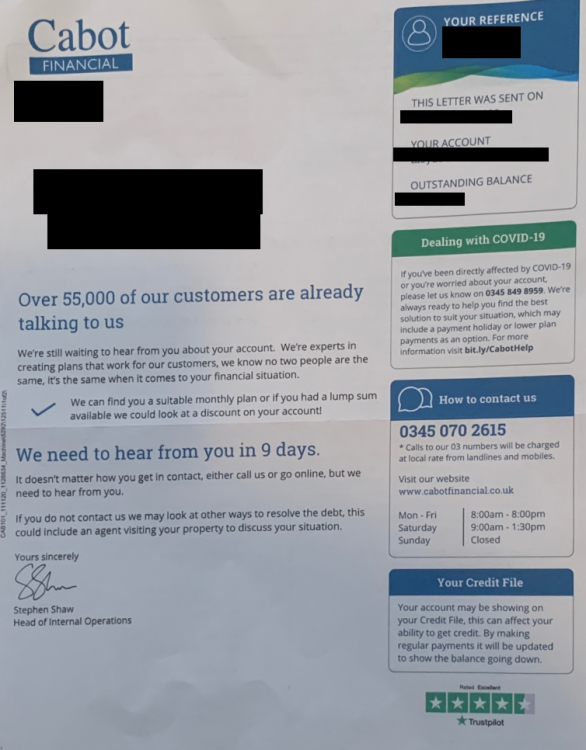

is it still safe to do so? will an agent come to my house? What happens after 9 days? Why has there efforts doubled so to speak and is there a way to stop them pestering so much. Thanks again for all your help and sorry for all the questions. I struggle with severe anxiety but this site has helped so much, Thankyou. -

Lloyds Debt sold to cabot, now resolvecall

TheUnknownStuntman replied to TheUnknownStuntman's topic in Lloyds Bank

Hello, We have never paid Cabot anything. Last payment was to lloyds before they sold the debt on. -

Lloyds Debt sold to cabot, now resolvecall

TheUnknownStuntman replied to TheUnknownStuntman's topic in Lloyds Bank

Good Afternoon everyone, hope you are all safe and well. So previously i had a topic called Lloyds Debt sold to Cabot, now Resolvecall. This debt has now gone back to Cabot and they are sending letters now every week and attempt to call my wife all the time on different numbers. We have been ignoring them but now we have a letter saying we have 9 days to get in contact otherwise an agent could knock on my door. I still have the original letter where Cabot have told us the debt is unenforceable and yet they still are harassing and lately even more so. Are we still OK to ignore these threats and they are trying to break the statute barred rule by making contact somehow? Any advice please as the wife is now worried. is there anything we can do to stop them harassing her? Thanks again guys for all your help. -

Good Morning Guys, Im hoping someone can help me. I am asking on behaf of another party. Couple joint own a home, the mortgage was halfed and now both sides have been paid. One side has decided they want to release equity but the other does not fully agree but has been asked to sign paperwork. The side that wants to release the equity has told the other side its only coming of thier side of the house. Is that a thing? How will that work if the house was to be sold as both parties have children. My question is how can the house sell and be equally shared if one of the owners has taken equity from the property. Im asking as one half is money minded and the other does not have a clue. you can guess who. Thanks

-

Lloyds Debt sold to cabot, now resolvecall

TheUnknownStuntman replied to TheUnknownStuntman's topic in Lloyds Bank

Thanks Guys, I thought pretty much its another powerless DCA but I double check on behalf of my wife as she suffers from bad anxiety so when a letter like this comes along I have to either try to intercept it or try to reassure her its nothing. I then show her your replies. Thanks again for your help. -

Lloyds Debt sold to cabot, now resolvecall

TheUnknownStuntman replied to TheUnknownStuntman's topic in Lloyds Bank

Thanks dx. I have read they these guys threaten with court action and send people to houses. I have the letter still from Cabot saying unable to find CCA. I was just checking whether its still safe to ignore letters now from Resolvecall, is it worth sending them a CCA ? Thanks dx. -

Lloyds Debt sold to cabot, now resolvecall

TheUnknownStuntman replied to TheUnknownStuntman's topic in Lloyds Bank

Hi Guys, Well looks like Cabot have given up and now passed the debt on to Resolvecall. I guess this is just another DCA. I am safe to ignore ? -

It was that long ago I carnt remember the exact details of why it went into a default. I think it was an overdraft which I was struggling to pay back. Natwest did write and say they have locked / closed the account and put into default, i think. At the time I had just lost my mum to a terminal illness which is why i got into trouble in the first place becuase I came out of work to look after her and Natwest did not want to help or listen.

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.