zebra1950

Registered UsersChange your profile picture

-

Posts

17 -

Joined

-

Last visited

Reputation

1 Neutral-

Hi All Just had a phone call this morning from Age UK who have been acting on my behalf to sort out the tax refund error and they have given me the very excellent news that the HMRC have written the overpayment off, and I will get confirmation in due course, this is the best Xmas present one could wish for, I can't thank or praise Age UK enough in the speed in which way they acted, I don't yet know what reasons the HMRC gave to them but it doesn't matter as its a weight lifted off my shoulders, also I would like to thank everyone on these forums for their support and advice. Have A Wonderful Christmas Folks Regards Zebra1950

-

Hi Hightail Yes I get what your saying, re-: the marriage allowance and I have sent all my papers off to Age UK who are going to go over all the calculations and let me know where, and if the errors show up, I can't honestly answer the question about whether or not I am owed a repayment from another source. Zebra

-

Hi I applied by phone and I am not blaming the people on the forums about the negativity, the blame rests entirely on the HMRC as they had all the relevant documents after I applied by phone. Zebra

-

Hi Reading all these negative postings, it looks very much like I am going to have to pay it back even though the HMRC made the error in the first place. Zebra :mad2:

-

Hi Honeybee, This wasnt the same allowance as my wife and I were both born in 1950, this particular allowance came out last year and I was genuinely led to believe that this was backdated for all the time we have been married. Kind Regards Zebra

-

Hi ericsbrother, Firstly I am not trying to "impress" either you or the taxman with the gobbley gook wording, and yes I do know what state pension and occupational pension I receive, its just when this marriage persons allowance came into affect last year and I applied, then that, is where the confusion arose from. What I am saying is the HMRC had all the relevant documents regarding my tax affairs, they are the ones who made the error but I have spoken to them over the phone and they are sort of only half admitting the mistake, I have now passed all the information onto AGE UK who are looking into this matter for me, and I have informed the HMRC that I am putting this into dispute, my own personal annual income from both sources are approximately £11.250.00. Zebra

-

Hi All I rang the tax office yesterday and they are looking into it and will get someone to call me back one day this week, I have just noticed on their P800 (Understanding Your P800 Tax Calculation Form) where it states that in some cases they will agree not to take tax from the customer if they have not used all the information supplied and that the HMRC did not act on information which caused their mistake, but then they go on to say, ( within 12 months), therefore giving them a timescale to rectify their miscalculations, so they are covering themselves, very crafty move. Zebra

-

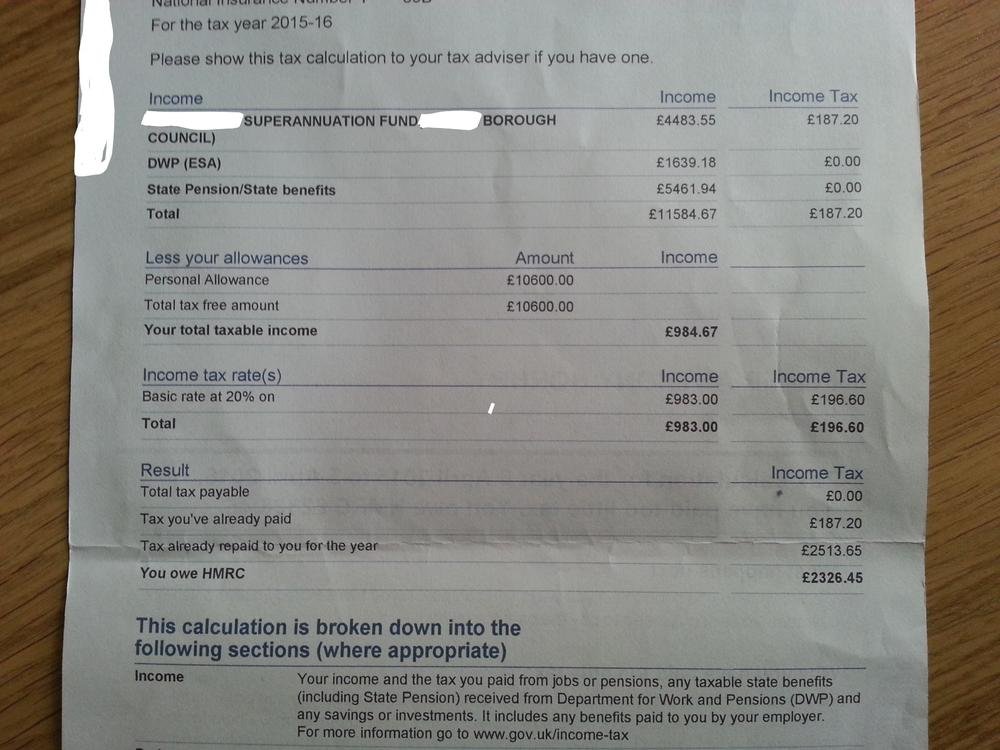

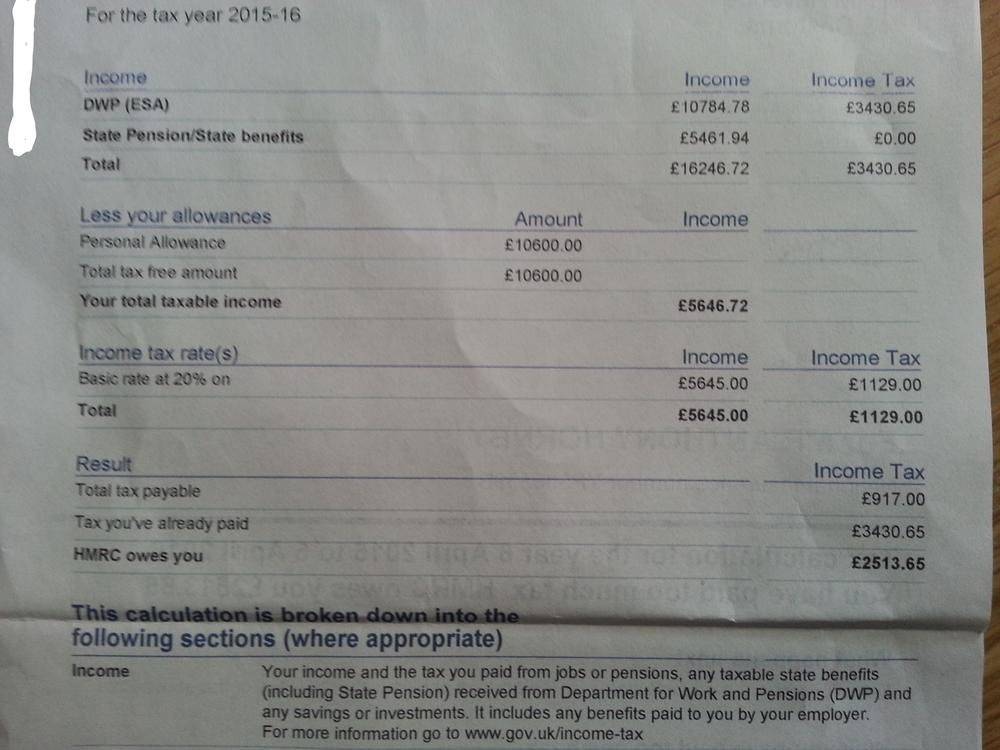

Hi ericsbrother, Thanks for your input on this, I don't know how they arrived at these figures as I would not have received £10k in ESA, it looks like they have mixed up part of my superannuation with this benefit, but its still vague to me, and yes my wifes income is less than £9k per annum, it has really got me bemused on how they work their figures out. Regards Zebra

-

Hi Again Grumpy I've been given this debate some thought, this is definite negligence on their part and whichever employee of theirs dealt with this mis-calculation, then they should be responsible for paying this back from their salary instead of landing me in debt, because my son manages a licensed social club and if one of his employees or in fact himself, accidently gives too much change, then they are responsible for paying that money back to the till. Zebra

-

Hi Rainbow Thank you so much for your support, I really appreciate this. Regards Zebra

-

Hi Grumpy I disagree with your comment to some degree as I had applied for the married mans allowance, so I genuinely thought that this had been backdated for all the years I have been married so it was a genuine mistake on my part, but they, the (HMRC) are supposed to be the brains when it comes to tax calculations as they had all the relevant paperwork regarding my tax affairs, but I suppose you're right and I will have to pay it back but I will have a good go at disputing it. Zebra

-

I am going to ring them first thing tomorrow morning and strongly dispute this, as it is THEIR mistake not mine.

-

Hi Again Renegade I forgot to mention that I think that the confusion lies with me having two separate tax codes, one for my State Pension and the other for my Occupational Pension and those guys at the HMRC are well aware of this, but I think its baffling them as well, but it was they who sanctioned these codes in the first place, I've had more hassle from them since I retired than when I was working. zebra

-

Hi Renegade, I have just taken a couple of photos of the two tax notifications that the HMRC has sent me, the one from May 2016 showing that they owed me over £2500 and the one from November 2016 wheras I now owe them over £2300, but its all gobbldee gook to me, wonder if you or anyone on the forums can make any sense of it. Regards zebra

-

Hi Honeybee I will try to sort out the paperwork and do what you suggest, also could I ask one more thing, if I am unsuccesful and have to pay it back whats the longest time they will allow, eg, would I be able to pay it back over 3-5 years

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.