cruzhughes

Registered UsersChange your profile picture

-

Posts

1,281 -

Joined

-

Last visited

Content Type

Profiles

Forums

Post article

CAGMag

Blogs

Keywords

Everything posted by cruzhughes

-

Shall I add this in You should be investigating my claims inside or outside of 6 years. Not continuously using delaying tactics by not responding to any letters I have sent to you in the past 2 years in a timely manner or answering questions relating the issues surrounding this bogus debt And maybe this 39 months have passed since January 2016, which equates to £ 4,167.15 With the PPI refund of £8,163.29 (inc. interest), the account is currently in credit by the amount of £ 3,996.14. This is the equivalent of just over 37 monthly payments, based on the above. This factor was also agreed by District Judge in a previous hearing. And shouldn’t the 12 year rule apply in this circumstance Cos loan was changed from CCA to MCD?? it’s now classed as a mortgage not a secured loan. Maybe there’s something I can put in to do with this Am I right in thinking about the limitations being 12 years

-

I have started drafting a letter can you advise on this please Dear Sir or Madam, Thank you for your letter dated 28th March. It is noted you have totally disregarded my letters dated 8th November and 26th January and have failed to answer the questions put to you. My letter on 8th November asked for following information in regards to the outstanding balance • How you’ve reached this figure • Payment schedule • Monthly repayment • Months remaining • End date of loan Until you can provide some clarity on the above then my dispute remains ongoing, and had been added to by my letters of complaint in respect of unlawful fees and charges making up a chunk of the account balance. I once again outline my own position in respect of the current balance, the unlawful penalty fees being applied and the correct monthly repayment obligations going forward. The current balance, before deducting unlawful fees and interest: • Balance when you purchased the debt was: £ 26,152.32 • Minus PPI Refund + interest adjustment: £ 8,163.29 • Minus mis-sold PPI remaining within the current loan balance: £2,002.24 • New balance: £15,986.79 In your recent letter, dated 28th March you refer to the monthly repayments being £231.49. However, this figure is wrong as it includes interest and a payment for PPI for both of which need deducting. Therefore the repayments, calculated as £26,152.32 split over 212 remaining months from January 2016, equals £123.36 - minus £17.51 PPI, equals £105.85 per month. PPI was refunded up to December 2016, with the award made in January 2017. This is paid back to the account balance as follows: 12 x £17.51 / 212 = £1.00 per month to add on. £106.85 is the rightful monthly payment from January 2016 onwards. 39 months have passed since January 2016, which equates to £ 4,167.15 With the PPI refund of £8,163.29 (inc. interest), the account is currently in credit by the amount of £ 3996.14 This is the equivalent of just over 37 monthly payments, based on the above. After these 37 months is up which will be Feb 2022 the 1st payment of £ 106.85 becomes due. Or Balance when you purchased the debt was: £ 26,152.32 Minus PPI Refund + interest adjustment: £ 8,163.29 Minus mis-sold PPI remaining within the current loan balance: £2,002.24 New balance: £15,986.79 divided by 176 months (Jan 19 to Aug 33) = £ 90.83 a month You have been made very aware that my account balance is the result of a series of rewrites, originating with loan no 624851 which commenced in October 2001 Also Loan 2320257 which commenced in Oct 2006 was secured by a legal charge on my property, which was registered at the same time and remains in place. To complete the picture, the other loan numbers are: Loan 51 - commenced 11/10/2001 Loan 69 - commenced 10/03/2003 Loan 78 - commenced 31/03/2005 Loan 16 - commenced 14/07/2005 Loan 57 - commenced 31/10/2006 Loan 03 - commenced 03/04/2007 Loan 61 - commenced 05/10/2007 Loan 84 - commenced 30/08/2008 The conduct of Welcome Finance is what has incurred any balance in the last loan. The result being an ongoing Unfair Relationship and the unjust enrichment on their behalf. You have access to the historical transaction activity that has created the current account balance, which means that you can verify that there has been many fees and charges applied (and their respective amounts), which currently make up part of the balance. All of which need to be deducted from the loan balance. In view of the above, when you respond to this letter and when all historical fees and charges are corrected and the above factors agreed on. I will pay the amount due if any for 29th December to you immediately, followed by regular payments of the same on 29th of each month thereafter. Despite the fact that my serious dispute with Welcome Finance, and subsequently with yourselves as the assignee, remains ongoing. Any charges you take it upon yourselves to apply will be recognised by me, as they have no basis in law. Note that, historically, it has been possible to overpay each month, with the excess allocated as a positive arrears balance that could be used to satisfy future minimum repayments when due. I reserve the right to utilise this option in the future too, and may do so from time to time. As for the time limits regarding the complaint I am am not out of time as this complaint started with Welcome Finance after receiving a Subject Access Request In 2016 and as they sold the debt to you in September 2016 mid complaint and this remains ongoing with yourselves. You should be investigating my claims inside or outside of 6 years. I am requesting you remove the charge, write the bogus debt off or give this debt back to the original owners. My evidence regarding the resultant balance has been clearly submitted many times. I trust this provides you with a clear outline of my position. If you require further clarity on anything, do not hesitate to write to me and request it. I look forward to hearing from you in 14 days.

-

The Fos couldn’t help me with prime so nothings open. They couldn’t investigate the ir for the same reasons they couldn’t with welcome. prime we’re out of jurisdiction they could only investigate your complaint about Prime Credit should be about the charges added to your account as a result of their debt collecting activities. If you look at the letter I sent you dated 26/1 you’ll see how much they haven’t answered Surely though as I didn’t become aware of all this till 2016. Then isn’t that within the 6 year rule? As you well we’ll know we’ve been battling since 2016 I received the SAR from welcome. Then they sold this debt on. im looking for a bit of guidance as to what to say and what to do next. This amount wouldnt be outstanding if welcome hadn’t done what they done and there defo wouldn’t have been the last loan of 28 grand as welcome rewrote that and added more Ppi extended the term and no money changed hands. It it was a straight rewrite of the balance remaining of the 2007 loan.

-

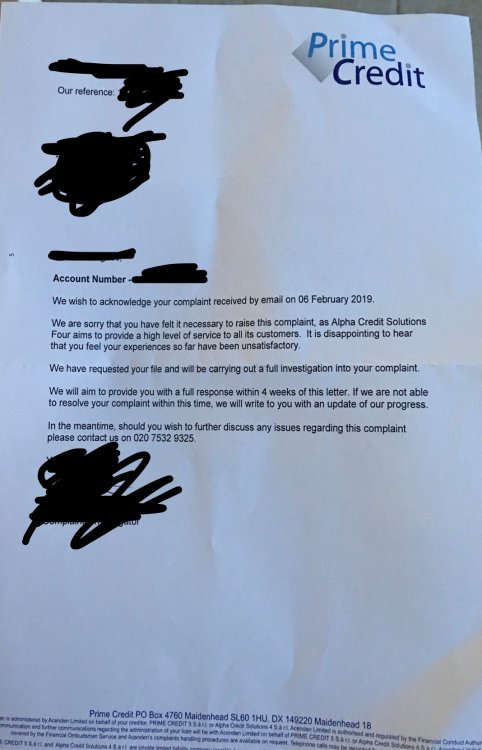

Do I reply to this letter. All my questions to them in last letter remain unanswered. Thats things like how long they say is left on loan. The fact that the payments are wrong ect. Fos was welcome then prime. What next. It’s just dragging on and on now. And things aren’t getting any further resolved. still not paid them a penny

-

Here we go... laughing at this what next now?? Still unable to upload will email you it now. It’s saying I’m allowed to upload 3.42mb file is only 1.4mb and it still won’t upload 2019-03-28 prime complaint response.pdf

-

It’s now over 6 weeks after receiving letter that stated I would have a final response or be updated in 4 weeks Surprise surprise not heard a pip

-

From Brighton after me sending this Thanks for the reply, The claimant holds no documents either. I have been everywhere to try and track this information down. As I stands I have a charge on my property which could cause problems if I wanted to remortgage or sell. But no one holds and proof. Is there any further advice you could give about removal of this charge please Dear Sir, Thank you for your email, we believe that the land registry may hold documents relating to this case as it may be registered with them when the final charging order is made. We suggest you contact them for more information. Kind Regards, The land registry don’t unfortunately. After I had applied for official copies they then updated the register to state this this back in 2016. Dear Sir, Unfortunately we are unable to provide any further documents to what the land registry have provided due to the file being destroyed. Kind Regards, Still no closer

-

Reply from Brighton Dear Sir, Thank you for your email, unfortunately as previously stated due to the nature of the case being very old we no longer have the file and it was before our electronic records began. We suggest you contact the claimant who may have retained some documents regarding the case. Kind Regards, Im banging my head against a brick wall

-

Good morning, Thank you for your email. Please note your case has been transferred to the County Court at BRIGHTON. As we no longer hold this case at the County Court Business Centre, I am unable to take any action or provide any updates in relation to this claim and you will need to forward your email to the relevant Court to be processed. is it me or am I just going around in circles?? 2016 I got in touch with Brighton and they said I need to get in touch with my local court. Which I did..

-

I’ve rang the court a few times no luck getting through. I am waiting for an email response any day now. this is just crazy! You think link would have applied to the court for proof not tell me too.. seeing as they think they are owed the money

-

What’s interesting is they say account was defaulted 1999. But charge wasn’t placed till 2006. i wonder what happened to the 6 year rule?? Link_4th_March_.pdf

-

Received this from link Lloyds must have forwarded my letter direct to them. Whats your thoughts?? Doesn’t seem to me like they have any proof?? I still cannot upload ant attachments so will email you

-

Look at last paragraph on first page... worded very different to everyother ive received from them...

-

I have used 116.36 MB of your 48.83 MB attachment limit. ill leave that in the site teams hands. Have sent letter to you dx.

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.