armitage188

Registered UsersChange your profile picture

-

Posts

24 -

Joined

-

Last visited

Reputation

1 Neutral-

2 LLoyds defaults - can i get them removed from credit file?

armitage188 replied to armitage188's topic in Lloyds Bank

Yes, I can prove it. But what I came here to query was how can I get the defaults removed. Do the answers to those questions actually get me any closer to having the defaults removed from my account? -

2 LLoyds defaults - can i get them removed from credit file?

armitage188 replied to armitage188's topic in Lloyds Bank

Defaults happened in 2012. But I don't see how that helps? -

2 LLoyds defaults - can i get them removed from credit file?

armitage188 replied to armitage188's topic in Lloyds Bank

I have all online statements, yes. -

2 LLoyds defaults - can i get them removed from credit file?

armitage188 replied to armitage188's topic in Lloyds Bank

I looked through other threads with the same situation and all were advised to do the Section 78 request. I followed that. It was a template that I got from CAG which tells the lender that I didn't receive a notification of a default being put on the account. I don't see anything that I 'needed to do' in post 6. I'm unaware of when the default occurred . The dates on my credit file are certainly not when it would have occurred (they're much later). For clarities sake, here's the template I mentioned (obviously, I amended for my details): [Template removed - what does it say about NOT posting our templates in the open forum??? So something else you didn't read properly - DX] -

2 LLoyds defaults - can i get them removed from credit file?

armitage188 replied to armitage188's topic in Lloyds Bank

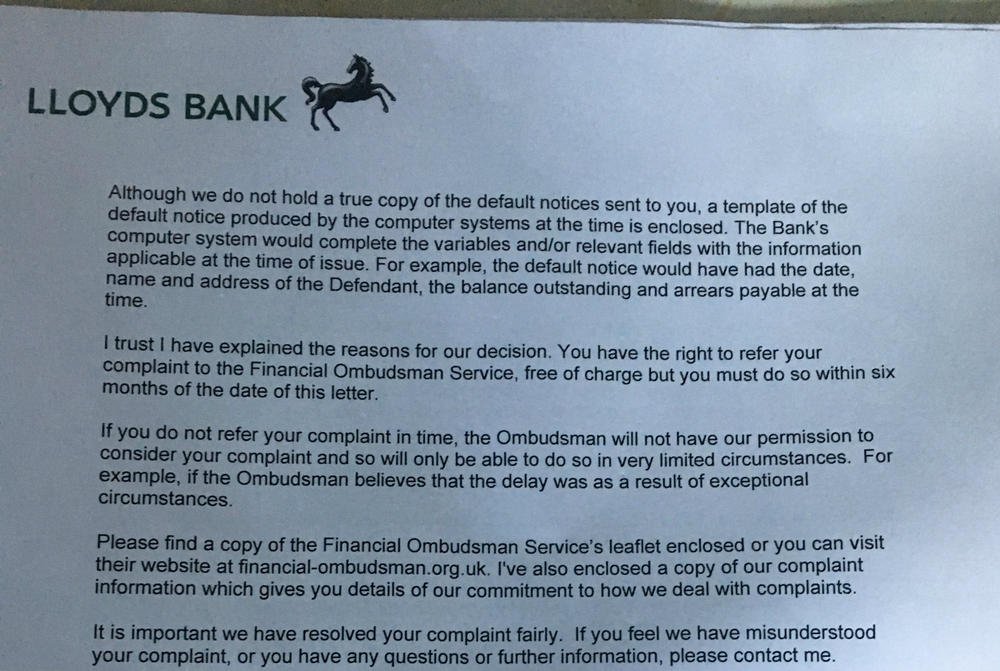

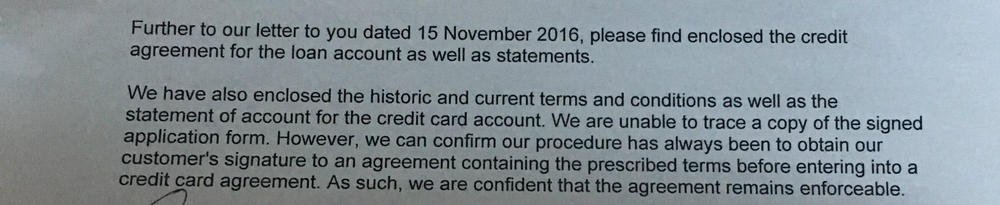

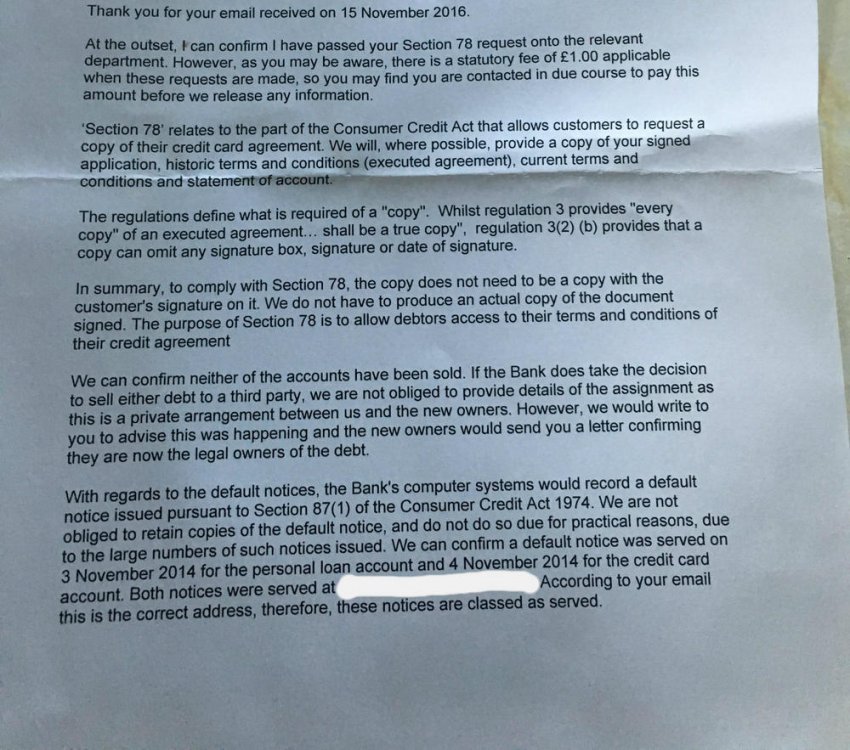

As a follow up to this, I'm posting the letters I received from Lloyds after doing the Section 78 request I was advised to do. What do you make of the wording of these? It seems really dodgy to me - like they know they don't have a leg to stand on and they're just trying to brush it under the carpet. Any advice? Next steps? -

2 LLoyds defaults - can i get them removed from credit file?

armitage188 replied to armitage188's topic in Lloyds Bank

Type of accounts: one is a loan, the other a credit card. I was stuck in the cycle of using a loan to pay off a credit card after being made unemployed years ago! I know it'll be tough, but I'll keep on fighting it to get them removed. I'm annoyed that 6 years is such an arbitrary figure. Why not 2 years, 3 years or 4 years!? I'd be fine then. I know we all have to pay for our mistakes in some form, but I do find it infuriating that they put a 6 year sentence on this kind of thing. You're punished for years after living through a really tough time (being made redundant, struggling financially, etc). 2 years seems like a fair punishment for this kind of thing, but to stop me being on a JOINT mortgage application when I'm now running a very successful business and financially very well off, I think that's really wrong. -

I have 2 defaults on my account (by from Lloyds). I've paid off the debt on both completely about 6 months ago. I know that paying the debt doesn't remove the default notice on credit file. Obviously, I'd like to get rid of the default notices on my credit file ASAP, as they're causing me issues in a joint mortgage application with my partner. We're having to just do it in her name now, which is frustrating as means we can't count my income towards it. I've read lots of accounts of people removing defaults. Can you give me some idea about removing the defaults and my best course of action to get this sorted ASAP. Some details: - I'm sure they've listed the default dates wrong. Bringing them forwards, which is obviously detrimental to me as well. At the very least, they should be back-dated to the date when the default actually took place. But ideally, I'd like them expunged. - the debts are both paid off. - debts were sold on to other organisations (other than Lloyds). So to summarise: can you give advice on default notice removal, please? Any links to resources would be much appreciated. Kind regards,

-

You mean the lump sum to pay everything off? I haven't paid that yet, but the DMC were offering me an average of 30% savings across the 3 creditors on the debt I still owe. The DLC one has an address, yes. The two Lloyds ones haven't sold the debt. They're two departments of Lloyds and I don't have specific addresses for them. They're just listed as generic Lloyds HQs.

- 40 replies

-

- account

- acknowledge

- (and 15 more)

-

What I've been saying throughout this thread is I don't know who to send the CCA requests to. Because: a) they keep getting sold to different people. b) I can't find a list of addresses for the debt departments of the creditors. Also, what's the best case scenario with a CCA request?

- 40 replies

-

- account

- acknowledge

- (and 15 more)

-

It was mentioned in this thread earlier that I could "demand the pot of gold back" from the DMC. What does that mean? The trouble with doing that is right now all the interest payments are frozen. I imagine that would cease to be the case if I broke the contract with the DMC.

- 40 replies

-

- account

- acknowledge

- (and 15 more)

-

No, all the three debts are with the DMC. Yes, the one getting re-sold a lot is the one currently with DLC, which is the business loan. Is that significant? Who do I send the CCA requests to? What addresses at Lloyds? Thanks.

- 40 replies

-

- account

- acknowledge

- (and 15 more)

-

https://www.moneymt.co.uk They used to be Debt Advice Unit. Those were the figures I gave above. That's what I currently owe. There's two Lloyds ones totally around £3000, and the DLC one of around £4000. The DLC was originally a Lloyds business loan. The two Lloyds ones were a credit card and a (non business) loan.

- 40 replies

-

- account

- acknowledge

- (and 15 more)

-

The DMC is Money Management Team. The debts are (with rounded figures): Lloyds - £3000 DLC - £4000 Well calls and letters ceased when the DMC took over, so yes. Also, all my interest and charges have been frozen, which is more than I could do as an individual trying to contact these creditors. Also, what do you mean by "demand the pot of gold back?" How would I go about doing that? How do I know where to send these things, though? Is there a list of addresses to send CCA requests somewhere? The one debt that keeps on getting resold makes it difficult to know who to send it to. The Lloyds ones are confusing as there are so many departments. This is what I do. And it's one of the reasons everything takes so long. They give me the runaround through letters they take weeks to reply to. Did that. No responses at all.

- 40 replies

-

- account

- acknowledge

- (and 15 more)

-

Thanks for the message, Jedicris. I tried to do it myself, but was just given the runaround for months and months. One of the debts kept getting sold onto other people. Then I wouldn't hear back from them for ages and I'd get a letter saying it had been sold, etc. They just made it very hard for me to speak to them and pay it off. Is that actually true? They claim to have a negotiation team that know how the companies work, how best to contact them, etc. It's also in their best interest to get the most savings, as they earn more money for themselves with their % fees. So far, they managed to actually get settlement figures back in around 1 week. I wasn't able to get that in over 6 months! So they must be doing something right. Yeah, that was just an example. Thanks.

- 40 replies

-

- account

- acknowledge

- (and 15 more)

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.