NisCAPE

Registered UsersChange your profile picture

-

Posts

18 -

Joined

-

Last visited

Content Type

Profiles

Forums

Post article

CAGMag

Blogs

Keywords

Everything posted by NisCAPE

-

******************UPDATE****************************** Apologies for the late responce. But I have good news! My case was heard in court the by a district Judge. Initially, the judge was reluctant to "set aside" the judgement, as he felt that although I hadn't received the correspondence it wasn't a total defence to the traffic matter. What swayed his mind was the Impactive effect the CCJ was having on my career and he felt it wasn't proportionate (Rightly so!). Judge ordered CCJ to be "set aside" provided I make full immediate payment of £165 within 14 days! Job done ! Appreciate all your advice !

-

I'd appreciate that! Re: The default removal, I'll have to keep my eye on my credit file! I shall update this thread accordingly. I am going to try Dx's method (maybe in vain I know), to remove this blemish of a default from black horse, (even though they've sold the debt off). I shall update you with my results! Fingers crossed!' "Nothing ventured, nothing gained". Appreciate your help guys!

-

Appreciate your replies Dx and Martin ! To answer your questions, The Loan is a joint loan, but secured on the property (property now sold, negative equity). My Ex filed for bankruptcy, leaving myself with the debt (amongst many others). As the OC obviously only had myself to turn to for the money. Its obviously caused havoc with my credit rating. I remember reading a thread on this site by DX on how to remove defaults, crazily enough, had a responce TSB stating they've removed my default ! Bit of good news there i suppose !

-

Ouch ! I'm unsure of what to do?! It's having adverse affect on my employment.

-

Requesting removal of the Default. Thing is I've been through a separation, changed addresses, etc etc, cant remember ever receiving a default notice !

-

Many thanks for your reply The original debt was with Black Horse Finance. Should i start again, but with Black Horse Finanace? Direction would be greatly received. Thanks again.

-

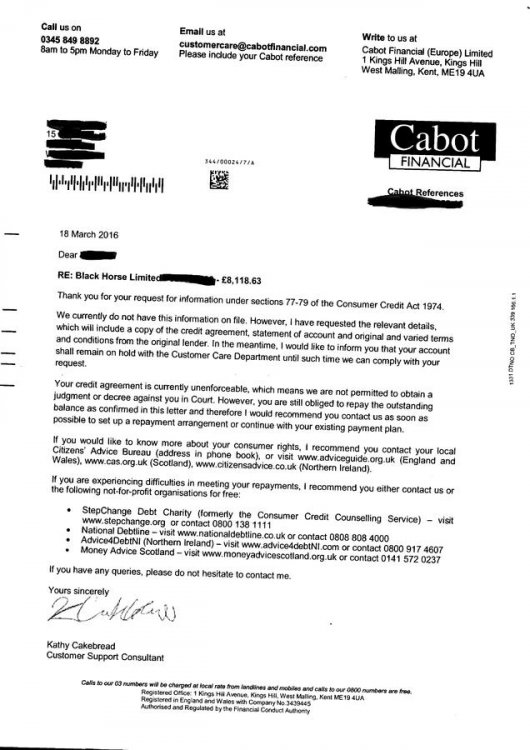

Hi There, I'm looking to remove a deault from Cabot, who are the current owners of the debt. I've sent in the CCA request as requested. But received the following letter attached below, in excess of a month from my request. What should my next step be? Write to them again? It appears they're using staling tactics. Many thanks for your advice!

-

Cheers Andy, Sound Advice, I'm not sure whether there was anything further i could have done in predicament. I'm going to run the gauntlet, and risk the £155. Regardless of the outcome, as it stands i have a horrible mark on my record for another 5 years, part of which i feel, is totally unfair, and where I've not had the chance to fit in the wheel of the justice system by having my say. Justice has not been served in this instance i shall be fighting this.....!!!

-

Hi there again, I've just chased this CCJ, it turns out it's a CCJ imposed by a company called PARKING EYE....!!! I told them I was totally oblivious to this penalty notice and have never received any paperwork in regards to this. 2 reasons, i) I moved address, ii) i sold the car They said they the only way to resolve this is by TOMLIN ORDER...?! I pay the sum of £165 in full, and they produce this in court and there you have it, one CCJ removed. I'm skeptical about this, and just think they're trying to fleece money out of me. Am i right in thinking this...?!! appreciate your help on this one ...

-

Hi CitizenB, Many thanks for your response. I've just carried out a search, and unfortunately trustonline have the same details that are on my credit file. This is, amount of monies owing, case reference number, thats your lot....! So I'm still non the wiser. Whats my next step...?!!! Contact court, I'm not willing to pay the sum of £165 at the moment , because i frankly don't know what i'm owing £165 to and to whom....? Any further suggestions...?!

-

Morning all, To my shock and horror, I've just realized I've been issued a CCJ from September 2013. (£165) I have no recollection of who, what or why this CCJ has appeared on my file. My initial gut reaction (prior to visiting this site) was to send an email to where the judgement has been held (Northampton County Court). I await a reply. What would you suggest are my next steps in tackling this, as i feel hard done by, as i haven't had a chance to fight or defend myself, for what ever reason the CCJ has been placed. Many thanks in anticipation of your pearls of wisdom.

-

Hi There, As you can see this is my first post, i think the forum is fantastic...!!! Now, my issue is regarding Black Horse. My ex-wife and i had a secured loan (to the house which was solely in my wife's name) with them from 2005. Cutting a long story short, we were unable to pay this loan, because we were both made redundant subsequently fell into arrears. In the interim i broke up with my then wife and we've been separated for the last 4 years living apart. Unfortunately for my ex-wife at the time, she had to also sell her house. To my understanding my ex-wife had been in an arrangement with Black Horse making token payments to them. I have only by chance taken a look at my credit file and noticed that Black Horse have placed a default on my credit file in February 2013. The account is still shown as OPEN on my credit file. It gets worse, there are TWO DEFAULTS for the same amount of monies owing (£8k) One by Black Horse and another by a company called Marlin Finance Services. It appears that Marlin Finance inherited the debt from Black Horse. I have written to the CRA's and have requested that my name is dissociated from my ex-wife. Now my questions are as follows:- 1) Is it possible to have two defaults at one time...?! 2) I've never received a default notice or even a warning, can this still be enforced...?! 3) Even though both entries on my credit file are showing my account as still OPEN, could i still have these removed...?!!! 4) What would you consider are the best steps to proceed with this matter...?! Many Thanks for your help.....Looking forward to your replies.

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.