bongobaz

-

Posts

401 -

Joined

-

Last visited

Content Type

Profiles

Forums

Post article

CAGMag

Blogs

Keywords

Posts posted by bongobaz

-

-

Wonder if anyone can help us out

We had our house on the market with your move for 13 weeks

we then called then up and asked if we were ok to take off market as we had no interest

they then sent us an invoice for £300 fees for taking off the market!

yet still after 3 weeks there sign is still outside advertising for them!

is there any way round this for us?

have we to pay there fee?

cant we charge them for free advertising on our property still??

any help or advice would be great

thanks in advance

-

do i need to reply to them or just leave it now then?

thanks for your help

-

-

-

-

no not on benifits only was on them for a few months years ago and dont think will need them again

thanks

-

do i just send them a letter saying i knowing about it and quote the 6 year rule?

-

Hi wondered if anyone can shed light on this for me.

Had a leeter friday last week from an old council i used to live at asking foof overpayments for housing benifits going back from 11/4/2005 to 16/5/2005 for £150

Do i have to pay this or does the 6 year rule come into it for a debt?

I was on benifits around that time but this is the 1st i have heard of any over payments and have moved address twice since then and then letter comes out of blue?

Thanks

-

Couple of points:

!. "overallowed HB" (ouch, dreadful grammar) - I take this to mean an overpayment of Housing Benefit.

Were you on Housing Benefit at the time?

2. Have you had any of their so-called previous requests?

3. How do they know that you are in fact the debtor? Addressing a letter like this to "Dear Sir/Madam" flags up warning bells to my mind.

As TC says, let them return it to the council - do NOT, under any circumstances call b & s.

Lastly, you should remove the ref no. showing in the letter as it is an identifier - do you recognise it by the way?

Regards.

i did go onto housing bernift for a few months while out of work.

not had any other letters apart from this and am sure i made all old payments

-

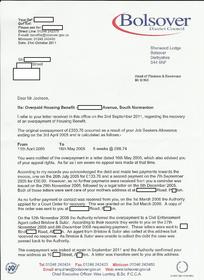

Had the letter below come through and was looking for some help.

I moved from one council to my current council over three years ago.

At my old council I got a CCJ for payment but am sure i paid it all off.

Been with my current council now for over three years and this letter below come through.

Can they chase you after 3 yrs?

any help???

thanks

EDIT Can you please re post the letter with the identifying data removed saintly

-

Try This

I DO NOT ACKNOWLEDGE ANY DEBT TO YOURSELVES.

Dear XXXXX

Account no: XXXXXXX

You have contacted me regarding the account with the above reference number, which you claim is owed by myself.

I would point out that I have no knowledge of any such debt being owed to (insert company name).

I am familiar with the Office of Fair Trading Debt Collection Guidance which states that it unfair to send demands for payment to an individual when it is uncertain that they are the debtor in question.

I would also point out that the OFT say under the Guidance that it is unfair to pursue third parties for payment when they are not liable. In not ceasing collection activity whilst investigating a reasonably queried or disputed debt you are using deceptive/and or unfair methods.

Furthermore ignoring and/or disregarding claims that debts have been settled or are disputed and continuing to make unjustified demands for payment amounts to physical/psychological harassment.

I would ask that no further contact be made concerning the above account unless you can provide evidence as to my liability for the debt in question.

I now require all further correspondence from your company to be made in writing only.

Please note you may also consider this letter as a statutory notice under section 10 of the Data Protection Act to cease processing any data in relation to this account with immediate effect.

This means you must remove all information regarding this account from your own internal records and from my records with any credit reference agencies.

Should you refuse to comply, you must within 21 days of the initial request to stop processing my details or provide me with a detailed breakdown of your reasoning behind continuing to process my data.

It is not sufficient to simply state that you have a ‘legal right’. You must outline your reasoning in this matter and state upon which legislation this reasoning depends.

I reserve the right to report your actions to any such regulatory authorities as I see fit including but not limited to Trading Standards, the Office of Fair Trading, the Information Commissioners Office, The Financial Ombudsman Service and my MP .

DONT SIGN IT, send it recorded and sit and wait to see what they do.

Hope this helps

Thanks for that!!

Shall i send this to Wescot and Fredericksons too??

-

A debt is deemed to be statute barred if there has been no acknowledgement of the debt in writing, or payment made against the debt for a period of 6 years.

If you are sure that 6 years has passed without acknowledgement nor payment being made, then send the statute barred letter from the template library,

if you are not 100% confident, then send them the "prove it" letter, either way be very careful of Carter, they will initiate court action at the drop of a hat, however, they also have a habit of merely seeking to claim their fees in court which effectively splits the claim, something which is entirely illegal and will result in their claim being struck out.

In the case of there not being a six year gap making them prove it, places the account in dispute and they are then obliged by statute to follow certain procedures. ignoring the debt will more than likely see Carter assuming there is no defence and going for a judgement by default.

Either way write to these bloodsuckers and start the ball rolling.

Don't speak to anyone on the telephone, no matter what they say or insist on, refuse to answer their security questions and insist that all communications are made in writing, keep proof of postings and copies of all correspondence

Hope this helps

WHICH IS THE PROVE IT LETTER???

is it the CCA request??

im almost sure i have had no contact for over 6 years but would rather make sure first.

-

Can anyone help me with this one.

I had a derbt with Vodafone well over 8 yrs ago.

I was getting chased from a company called Wescot and didnt reply.

I have not heard anything for the last 3 yrs then about a year ago they started chasing again sending letters which i have ignored.

I have then received a letter from Frederickson International and have ignored that.

I now have had a letter from Bryan Carters chasing the same old debt.

Thing is I am paying Bryan Carters for an old Capital One debt.

Can anyone advise me where i stand with this old debt.

I am 99% sure i have not contacted or responded to any of there letters regarding this for well over 6 yrs.

Any help please?

Do i send the letter M??

Thanks

-

MCOL site is still down so I've emailed my Ackowledgement of Service to them.

-

the issue date is 22 may 2008 i have until tues to fill in the form

poc are :-

1. the defendant entered a credit card personal load aggrement regulated by the consumer credit act 1974 with egg banking plc. the defendant failed to make payments. egg assigned the debt to credit solutions ltd.

2. the defendant acknowledged the debt by making payments to credit solutions. the defendant stopped paying. the remainder of the debt is outstanding.

3. credit solutions assigned the debt to the claimant and sent notice of assignment to the defendant. the claimant sent a letter before action on 19/6/07.

4. the defendant has not made any payment. the balance remains outstanding.

and the claimant claims the sum of £2690.20 and the interest under section 69 of the county courts act 1984 at the rate of 8% a year from 27.2.01 to 30.04.08 of £1545.21 and also interest at the same rate up to the date of judgement or eariler at a daily rate of £0.59

total ammount claimed £4235.41!!!

HELPP!!!!

-

I had a credit card with egg and the debt was sold to Credit Solutions.

I asked for my statements and did a CCA request.

I got me statements but the CCA request came as a blured photocopy with no deed of asignment

I also notice Credit Solutions had added £500 charges to the debt.

I disputed this with them and sent the LBA then i also sent a letter in feb 07 stating the debt was in dispute and they had failed to send me a correct CCA or deed of asignment.

I sent the below letter in june 07 and have heard nothing since

"

I am writing with reference to your letter dated 25th May 2007.

I would refer you to my previous letters dated 23rd February 2007, 16th January 2007 and 2nd January 2007. I have enclosed copies.

Please be aware that I am disputing the charges applied to the above account as unfair under the Unfair Contract Terms and Regulations and the common law.

Any claim issued by yourselves will result in a counter claim for these charges.

I am also still awaiting the correct documentation from my original Consumer Credit Act 1974 request from 14th July 2006, which you defaulted on. Copies enclosed.

Therefore I require answers to my previous correspondences within the next 14 days or I will start a claim against you for the full amount plus interest, plus my costs, without further notice."

I have now come back from holiday and have a MCOL form Credit solutions and my defence has to be in for Tues next week!!

Can some one please help me in how to word my defence?

Can the do this is there is charges on the account and they have not porvided a correct CCA?

Pls help some one???

-

-

has anyone managed to make a claim and win where statements where missing??

-

i sent a prelim on 19th sept and received a reply saying £12 is not a penalty blah blah blah! usual reply i think.

also it says " there is no evidence these charges have been applied to the account"

due to statements they can not supply i put in estimated charges on the statements missing

am i ok to proceed with lba next?

how will i stand as there are no statements for the months im claiming charges for. i have a letter from ge money saying they can not find these statements

-

ive not taken any new insurance out. its off road garaged and not being used for a year or so while i carry out repairs to it.

is there anything else i can do??

thanks for the reply

-

received a letter stating car insurance was due from isurance finance company saying they will automatically renew insurance unless i contacted them and cancelled it.

i wrote a letter and sent form to cancel the insurance and direct debit explaining i was not renewing insurance.

aprrox 3 months later found out they had taken 2 payments so contacted bank and stopped the direct debits.

now insurance company threatening court action for rest whole of the insurance money saying they never received the form/letter from me cancelling policy!

is it legal for them to renew without my authority?

is there anything i can do??

please help

-

im not sure if there is any charges on these missing statements but am thinking if i claim for 3 per statement how will i stand?

if it goes to court and there are no statements is it for me to prove these charges or them??

-

anyone any help on this???

shall i send a prelim asking for , say 3 charges per statement missing??

-

i have sent a dpa to burtons for staements. have recieved statements with a cover letter saying 16 statements are missing.

i then sent the dpa follow up asking for the missing statements and have recieved a letter saying due to system problems they cant supply these statements.

looking for advice as to where to go from here?

do i send a prelim asking for charges that i think were applied on the missing statements??

Estate agent trying to charge £300 for house not sold

in General Consumer Issues

Posted

we cant find what we signed but when we phoned them to ask if we were ok to take off we presumed there would be noe fee as they didnt tell us