Snowyandfudge

Registered UsersChange your profile picture

-

Posts

51 -

Joined

-

Last visited

Content Type

Profiles

Forums

Post article

CAGMag

Blogs

Keywords

Everything posted by Snowyandfudge

-

Shop Direct Interest- can I claim this back?

Snowyandfudge replied to Snowyandfudge's topic in Mail order catalogues

Thanks for the advice. I think court action maybe needed- how would I go about this? Many thanks -

Hi everyone I have recently claimed back £300 pounds worth of charges from Shop Direct. My claim included interest at 39%. Howver, they state they won't be refunding interest back on these charges which nearly amounts to £280. This is my remaining balance. They defaulted me last year for £347- can I get this Default removed and claim the interest back? Thanks everyone

-

Many thanks. For all it is worth have now lodged complaints with the OFT and the ICO. Vanquis were aware of this dispute every month until they registered the default- which is I believe against the ICO technical guidance on unresolved disputes. Their DCA breached so many guidelines that Vanquis did admit their representaives had not handled this complaint as they would have liked.

- 83 replies

-

- debt collection agencies

- impact

-

(and 1 more)

Tagged with:

-

Yes, will ask. Am thinking of adding the section on unresolved disputes in the techincal guidance in my letter to the data controller attached with evidence. What do people think?

- 83 replies

-

- debt collection agencies

- impact

-

(and 1 more)

Tagged with:

-

Not sure, was receiving statements, so why online too?

- 83 replies

-

- debt collection agencies

- impact

-

(and 1 more)

Tagged with:

-

Thanks. Only receiving interest off the sums applied since May 2011. Do you think, I would have a good case for the default being removed- as if I settle for their refund balance would now be £190? What is evanquis- this is showing on the statements.?

- 83 replies

-

- debt collection agencies

- impact

-

(and 1 more)

Tagged with:

-

Thanks. Yes, have agreed all charges to be refunded.It's the issue of interest, we are confused with. Vanquis state the following: Interest was never charged on the penalty fees applied to xxxxx account prior to May 2011. As interest was not charged, no refund of interest is due on those fees. However, there was purchase interest on the statements, would the penalty fees not have had interest applied? timeline of events.doc

- 83 replies

-

- debt collection agencies

- impact

-

(and 1 more)

Tagged with:

-

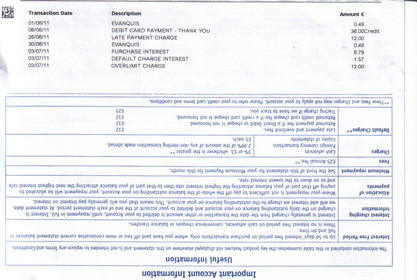

Full page print.pdfPlease find attached a pdf.

- 83 replies

-

- debt collection agencies

- impact

-

(and 1 more)

Tagged with:

-

Thanks again. Have uploaded July 2011 statement. Before May 2011 only purchase interest was added. We received postal statements but also noticed evanquis- not sure what this is, it also appears on 1st May 2012 statement. Even though passed onto DCA in Feb.

- 83 replies

-

- debt collection agencies

- impact

-

(and 1 more)

Tagged with:

-

Thank you so much was about to address letter to the office in London- so much appreciated. Have checked statements and no interest was applied since March 2012 as Vanquis stated .Not sure how to work out interest on statements between Dec 2010 and May 2011 which is when they state no default interest was applied, ( which he is correct- I have checked statements) but purchase interest at 2.840% (34.07 annual) is applied during this period. Also, after May 2011 default interest and purchase interest are both applied. Would appreciate any advice please over this interest ! Does it help my complaint that Vanquis actually called these penalty fees?

- 83 replies

-

- debt collection agencies

- impact

-

(and 1 more)

Tagged with:

-

Thank you so much BRIGADIER2JCS I did not expect this so soon after what happened to you Daughter- thank you so much. Will it help that the complaint manager actually called these penalty fees in his last email when previously was calling these default charges? I also found out from 1st Credit yesterday that they went back to Vanquis on the 1st March after we disputed the balance made up of these charges. Vanquis then replied to 1st Credit on the 20th March saying the balance is correct and that to continuing collecting. Was instructed then to start offering discounts upto their maxi level ie 50% The account was then sent back to Vanquis on the 24th May 2012 as they had been unable to collect payment due to the dispute over the balance. On 31st May 2012, the same date as the DEFAULT was registered, we received letters from C.A.R.S introducing themeselves and asking for the FULL BALANCE. On the 6th August 2012 we re- contacted VANQUIS who said they were placing our complaint on hold and stop collection from C.A.R.S. C.A.R.S state that the account was only placed on hold on the 13th August 2012. Emailed CEO and within a week, Vanquis wrote to us, stating they would refund charges. The interest is somthing though that we are still disputing. When home today, I plan to look for the statements, that we do have to see if interest was applied from DEC 2010 to MAY 2011. I will post the letter tomorrow lunchtime- does any one know where the Data Controller will be located at Vanquis- as found two addresses? Thanks. Thanks everyone so far for your advice- greatly appreciated.

- 83 replies

-

- debt collection agencies

- impact

-

(and 1 more)

Tagged with:

-

Thanks so much Brigadier2JCS thanks for the advice, sorry to hear about your Daughters burglary. Received a further email. Interest was never charged on the penalty fees applied to xxxxxxxxx account prior to May 2011. As interest was not charged, no refund of interest is due on those fees. Finally admits these are penalty fees! In order to obtain a SAR, xxxxxxxx would need to write to each organisation requesting one and enclosing a £10 statutory fee. There is a 40 day maximum statutory period for response. As previously advised, other than you advising the DCAs that the account was in dispute, we have been able to find no evidence to support that the request for default fees to be refunded was ever made to us. We repeatedly placed this account on hold- mentioning these default sums. Sent letters. DCA sent discount letters as mentioned above. As previously advised, I will reimburse the cost of providing the original Orange documents. If these are not provided I will, reluctantly, decide on my proposed resolution without this information.We don't have orginals- we use ebilling.

- 83 replies

-

- debt collection agencies

- impact

-

(and 1 more)

Tagged with:

-

Thank you for the great advice as usual.How would I find the number/address please for the data controller for Vanquis? What do you advise regarding the phone bill we emailed Vanquis. The format is still the same, even if we have to post. .He states without this call he would be unable to decide to remove the default.

- 83 replies

-

- debt collection agencies

- impact

-

(and 1 more)

Tagged with:

-

Thanks. Don't have them all, but will upload what I do have. ( think I should full SAR them). What I don't understand, is what he is saying regarding the format of the bill we sent him - it will still be the same if I post this to him, what will be the diffference ?

- 83 replies

-

- debt collection agencies

- impact

-

(and 1 more)

Tagged with:

-

Hi everyone- just received this update from Vanquis: Dear xxxxxxxxxxxxxxxxxxxxxxxxxx Thank you for providing an interest calculator. As previously advised to you, interest was only charged on this account until February 2012. It would appear that your calculator is calculating interest until the current date - this is therefore incorrect. In addition, we have only charged interest on default fees that were applied since May 2011. Therefore any charges prior to this date are not eligible. I confirm that upon receipt of a SAR we would supply screen shots containing a summary of calls made to/from us. It would not include calls to/from third parties acting on our behalf (we do not hold this data so any request for it would need to be made to them). It would include a copy of the default notice but not the credit agreement (this would be provided in response to a request under S78 of the Consumer Credit act). I have been informed that the document supplied by you does not conform to the format previously seen by our telephony department. Combined with the fact that we cannot trace the call it is believed that the matter can only be progressed further by our telephony partners by providing the original documentation to them. They will then contact Orange in order to attempt to resolve the matter. Any advice please on what to do next- greatly appreciated.

- 83 replies

-

- debt collection agencies

- impact

-

(and 1 more)

Tagged with:

-

lol thanks both dx and Citizenb! Although we provided him with an email-with the same info we would post, why would the postal one be any different to tracing - something does not add up! Vanquis state they have a good relationship with the moblie operators. If they can't trace it, why make us go through hoops when he has listened to the calls from the DCA and clearly hear a dispute is going on. Furthermore, those charges make the default amount now invalid. Furthermore, f I formally requested a full SAR does this need to include a credit agreement, default notice and log of calls they made/transcripts in addition to the statments etc. If they can't trace the call- this is stalling the complaint. They have listened to a few DCA calls but not all. The DCA knew there was a default for at least 6 months prior to the regsitered default date of 31st May. 2012 ( still don't understand the relevance of the 31st) their incoming calls/notes would show we discussed this with them, in addiion to the letters we sent. Why the DCA did not go back to Vanquis when the complaint was placed on hold every 14 days- is something that baffles me! They have tried to cut us short of settlement by over £140 and over the phone he skirted over the issue of our agrreement request - something is not adding up here. Our balance should now stand at £70 and not the incorrect £547 they are recording! Any advice on what to do next would be greatly appreciated-as I envisage another stalling tactic next week .

- 83 replies

-

- debt collection agencies

- impact

-

(and 1 more)

Tagged with:

-

Thanks dx. Emailed the SOC across- which the Manager said he would look into. Briefly, phoned me to ask if I can send documents- they can't trace call but going to investigate with the moblie operator. He did mentioned briefly, that his representatives had not handled the account as he would expect ( I am assuming he means his DCA) asked if I had lodged with the OFT and will make a decision within a day if he can get call listened too. If not, he will have to be forced to make decision on what he has found out so far- which he would rather not too. Did mention that distress and inconvenience would be factored into his decision. What would you advise next, do I need to contact Orange to verify their documents they emailed- I just feel as though they are now stalling, Mentioned going for a joint mortgage soon and he did sound emphatic.

- 83 replies

-

- debt collection agencies

- impact

-

(and 1 more)

Tagged with:

-

Thanks dx. .Yes, the default figure of £547.10 includes £476.61 of charges so would technically make this invalid.Yes, they have charged overlimit charges going right back to Dec 2010.

- 83 replies

-

- debt collection agencies

- impact

-

(and 1 more)

Tagged with:

-

Thanks dx I am going to send them this today via email ( always receive a read receipt) can't believe they were wanting to refund only £30.32 interest when the interest should be £152.61:x This now makes the balance £70.49 instead of £547.10! Would they have to remove the default now?

- 83 replies

-

- debt collection agencies

- impact

-

(and 1 more)

Tagged with:

-

Thank for the good advice as usual Citizenb. There has been various breaches as discussed above- would the fact that this was in dispute prior to being recorded in May 2012 and the incorrect balance recorded ( as the charges have been refunded) be a strong case for removal. Like, I said I too am confused after sending an ebill via email why we need to send a copy via royal mail. We have sent logs/bills of all the calls we made to the DCA advising of a dispute, which was then followed up in writing, but they are not asking for a hard copy of those? If I have correctly used the spreadsheet, the balance should now stand at just over £70.

- 83 replies

-

- debt collection agencies

- impact

-

(and 1 more)

Tagged with:

-

Vanquis SOC.doc Have attached the SOC, thanks.

- 83 replies

-

- debt collection agencies

- impact

-

(and 1 more)

Tagged with:

-

Thanks-Citzenb- much appreaciated. How would I go about finding out when it was posted? The untraceable call will be the key factor in whether the default is removed. No mention of these breaches and now, if I have calculated the interest correctly- they were refunded the incorrect interest amount. What would you advise next.

- 83 replies

-

- debt collection agencies

- impact

-

(and 1 more)

Tagged with:

-

Ok, just done this now using the spreadsheet and the interest rate of 34.07 . This spreadsheet shows an increase of £476.61 with interest of £152.61 on charges of £324 doe sthis look about right? This would make the remaining balance £70.49. They have been reporting £547.10 on cra as the default amount. Any advice on what to do next, please? Thanks.

- 83 replies

-

- debt collection agencies

- impact

-

(and 1 more)

Tagged with:

-

Thank you Mike770- will do this now.

- 83 replies

-

- debt collection agencies

- impact

-

(and 1 more)

Tagged with:

-

Hi dx my claim is not for PPI can I still use this spreadsheet? Thanks Any advice please on what do next?

- 83 replies

-

- debt collection agencies

- impact

-

(and 1 more)

Tagged with:

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.