uub

Registered UsersChange your profile picture

-

Posts

31 -

Joined

-

Last visited

Content Type

Profiles

Forums

Post article

CAGMag

Blogs

Keywords

Everything posted by uub

-

After looking back at documents that I still have I can see that the solicitors made a GDPR request to Hoist and Barclaycard and a CCA request to Hoist. Also I can see in both witness statements and defence statements that no admission was ever made to the sums claimed, I have attached these for reference. In fact the defence explicitly states the following. Defence.pdf Witness Statement.pdf

-

It was ignoring Hoist that led them to issuing small claims action in the first place. It was a credit card debt just over £5000, they are demanding payment of the original amount from Hoist before court fees/legal costs was added. There is absolutely no way I will pay it, I would rather instruct solicitors again than give a penny to these vultures, the whole thing has just got me in panic mode right now.

-

Hi there, I'm looking for some advice, I have spent years trying get myself sorted financially and off the credit doodoo list and now I have 0 defaults and a credit score over 900 and was recently accepted for a mortgage for the first time. I've received letters recently from Lowell regarding a debt that they have purchased from Hoist for in excess of £5000. Hoist issued a claim form in the county court and I engaged the services of a solicitor to deal with the case which ended with Hoist discontinuing the claim. I have communicated with Lowell advising them of the above and that I also consider the matter to be statute barred. Account opened 2015, defaulted 2016, court action and discontinuance in 2020. Lowell are claiming that the amount is not statute barred as I communicated by way of a 3rd party writing to Hoist requesting information ie the solicitors and also there was further acknowledgement by way of court fees. At no point have I ever acknowledged that I owe the amount in writing or otherwise and so obviously I disagree with their assessment of the situation. The whole thing is very stressful given that I am in the middle of purchasing a house. What is the best way of dealing with this?

-

Slight update from DCBL recently who have somewhat responded to the SAR. Looks like they don't hold much information or have simply not provided it and it also looks to be the case that they have issued the 'Letter before action' without the client actually transferring any evidence to them. Looks to be the case from the wording that they still intend to proceed. combined.pdf

-

Thanks for all the replies, all communication I have had with them is in the pdf and I have not revealed who was driving the vehicle. They have not provided me with clear pictures of the signage to see if it stated no parking and I have tried to get my own photos of it but it appears the area in question is now being ticketed by another parking firm and the original signage is gone. @FTMDave is it worth sending them another email on top of the response I have already given them? If so what should this say?

-

Apologies, I wasn't sure just how much identifying information to include, I've reuploaded with all dates and times as requested. The date of infringement: 07/12/17 Have you yet appealed to the parking company yet? No Have you received a Notice To Keeper? No, it went to a previous address however I have received the original via a SAR. What date is on it? 09/01/18 and 07/02/18 Did the NTK provide photographic evidence? Yes Did the NTK mention Schedule 4 of the Protection of Freedoms Act 2012 (PoFA)? Yes Who is the parking company? UKPC Where exactly was the vehicle parked? Progress Place, Liverpool, L1 6AF (it was an alleyway, not a carpark) DCBL-min.pdf

-

Hi all, I received a "Letter before Claim" letter recently from DCB Legal for £160 for a parking ticket issued by UKPC 4 years ago. From other posts on here I'm led to believe that there is a high certainty that this will lead to a court claim being issued. I've had to pay a solicitor twice previously to deal with county court claims that I had received in the past for consumer credit debt and I don't really want to go down this route again for such a low amount and would really appreciate some help from people here. I first emailed DCB Legal and stated that I have no recollection of the alleged PCN and let them know I have requested a SAR from UKPC as the merits of their claim are vague with no evidence being supplied from them and there is no breakdown to the amount of £160 that they are requesting. I ended the email stating that I need more time to resolve the matter. I then sent a SAR to both DCB and UKPC, UKPC responded a short time later with a zip file with a number of photos of the vehicle and signage (which is unreadable in the photos), 2 letters they sent demanding payment and what looks to be a reconstituted version of the original PCN. DCB Legal look to have added £60 on top of the original PCN. What would be the next step for me from here? Thanks in advance.

-

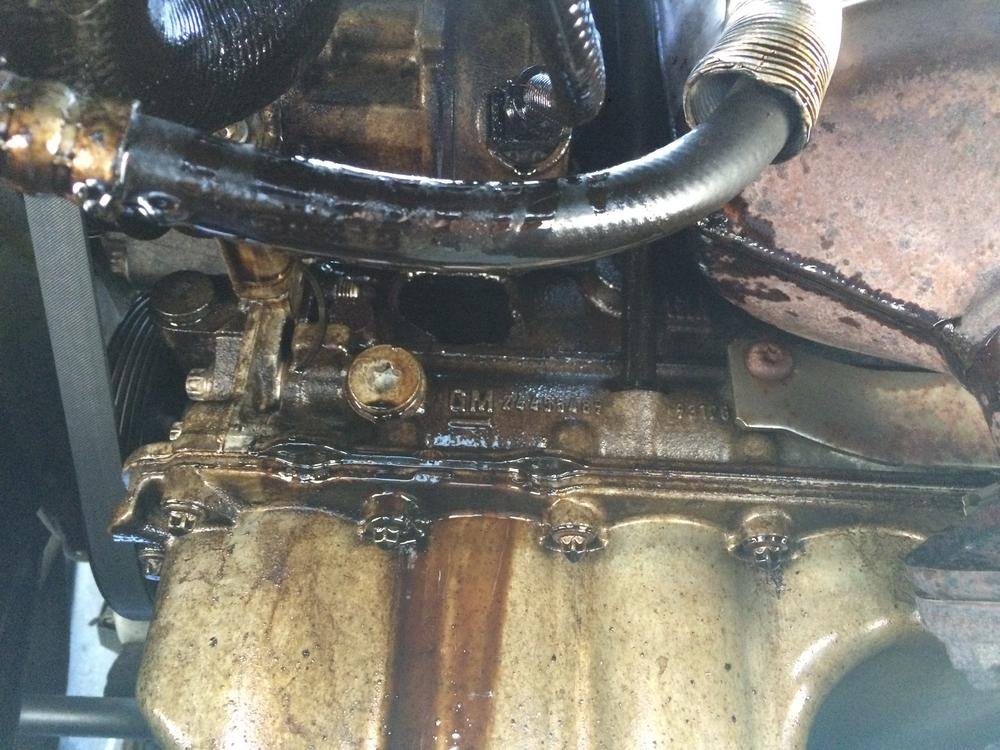

Thanks I intend to I have received a few nasty messages and threats from the dealer very recently since filing the papers, I've been accused of harassment, blackmail and abusing the car. I offered the garage to settle the matter previously by paying 50% of what it cost me to get it repaired as I wanted a quick, easy, amicable settlement to the whole issue as it had dragged on for so long when they refused this I said I would take the matter to court then hence their allegation. They are also claiming that their warranty does not cover neglect and abuse, I was travelling from London to Liverpool at a set speed on the motorway about an hour and a half into my journey when the engine popped, surely this and the fact I had only done 1000 miles since purchase would not be classed as abuse? I had problems with the car from day one with the wheels not being correctly balanced/tracked and then an oil leak 2 weeks after purchase. The dealer had no problems accepting responsibility initially, apologizing profusely, assuring me it would get sorted and also giving me use of a courtesy car until I purchased another vehicle.

-

I am taking the action against the dealer directly with his 'trading as' business name on the forms as he is not ltd registered. The repairs are nearly done on the car and I have a bunch of receipts totalling over £1000 now. On another note I received Notice of Issue Today.

-

3 copies of the small claims form was sent to the court yesterday attached along with receipts for the vehicle, a copy of the guarantee and a copy of the breakdown report. Brief details of the claims Amount claimed and the particulars

-

Well I didn't receive a response as expected, I have just finished filling in the forms to send to the small claims court, printing multiple copies along with evidence on which I intend to rely upon, I will be sending it off in the morning. Does anybody know how long it takes to receive a notice of allocation?

-

I do fully intend on taking it to court I have let it drag on for nearly 6 months already, I don't expect to get the full amount back and even then I don't expect any judgement to be paid immediately either, can anything be claimed compensation wise for the stress and inconvenience of it all? I already have pictures of the damage and the RAC report, I could get a local mechanic to do a small write up report for the court as well.

-

Thanks for this, it looks like exactly what I was looking for I will keep the thread updated on my progress for future reference for anybody in a similar situation, the dealer is still within the 14 days at present that I have given them. Is the letter I have sent them good enough to satisfy a court in regards to notice before action?

-

I bought a car last year for £3000, a month later a hole blew in the block and the engine was a complete write off as you can imagine, I was on the M6 and had been driving at a steady speed for over an hour when this happened. I had only driven the car for 1000 miles since buying it when this happened. The car was sold with a 6month / 3000mile warranty. I had the RAC tow the car to the garage I bought it from. The garage provided me with a courtesy car for 2 weeks until I had purchased another car and assured me they would honour the warranty and repair the car. Since this time the garage has still not repaired the car 6months on and I'm at my wits end with it now and have had enough, I have spoken to CAB in relation to it and they have advised me to send a letter before action to the dealer and take them to small claims court for breach of SOGA. The letter I had sent to the dealer is below. My question is what is the next step in relation to the small claims court, I understand I can do it online but I'm unsure what to put for the particulars for the claim, the claim amount and whether I can add compensation and interest to the claim. Any help would be appreciated.

-

Hi all, I received a claim form from the Northampton CCBC a couple of days ago, I have already filed an acknowledgement online with MCOL stating my intention to defend in full. Name of claimant: Lowell Portfolio I Ltd Date of issue: 22nd September 2015 What is the claim for: The claim is for £xxx.xx, the amount due under an agreement between the original creditor and the defendant to provide finance and / or services and / or goods. The debt was assigned to / purchased by Lowell Portfolio I Ltd, on 23/12/2011 and notice served pursuant to the law of property act 1925. Particulars RE- O2 (UK) Ltd A/C No xxxxxxxxxx, And the claimant claims £xxx.xx The claimant also claims statutory interest pursuant to S.69 of the county court act 1984 at a rate of 8% per annum from the date of assignment of the agreement to date but limited to a maximum of one year and a maximum of £1000 amounting to £58.18. Value of the claim: £xxx + court fee £60 + solicitor's costs £70 total: £xxx The claim was for an O2 mobile phone contract. Original account started: Unknown 2010 maybe? It is not the original creditor who has issued proceedings. I was unaware the debt had been assigned and did not receive notice of this, I have moved more than 5 times in the last 6 years. I can not remember receiving a default notice again this may possibly be due to the number of times I have moved. I have never received a statutory notice headed “Notice of Default sums” since the date of the default to my knowledge. I was unable to continue making payments with the original creditor due to financial difficulties I had at the time, mainly due to being made redundant. There was no dispute with the original creditor. I did not communicate my problems with the original creditor or enter any dmp. Since receiving this I have only acknowledged receipt of the claim form via MCOL online. Is the next step to send a CCA Request letter to the Lowell and a CPR request letter to their Bryan Carter?

-

Arrow Global ClaimForm Cap1 'debt' - Possibly statute barred

uub replied to uub's topic in Financial Legal Issues

How likely are they to apply for the removal of the stay? is there any time limit they have? -

Arrow Global ClaimForm Cap1 'debt' - Possibly statute barred

uub replied to uub's topic in Financial Legal Issues

I have phoned the court this morning and was told on the phone that the case was stayed yesterday as there had been no response by the applicant. Should I expect them to ask the court to reverse this and proceed? Would it be worth sending AG a SB letter now at this point to make sure I'm not further harassed on this matter? -

Arrow Global ClaimForm Cap1 'debt' - Possibly statute barred

uub replied to uub's topic in Financial Legal Issues

Just received this from Arrow this morning in response to my CCA request, they state they are awaiting to receive the documentation from the original creditor. This seems absolutely ludicrous that they would issue small claim proceedings for a debt they have apparently purchased and do not have a copy of the original CCA to back up their apparent vested commercial interest? -

Arrow Global ClaimForm Cap1 'debt' - Possibly statute barred

uub replied to uub's topic in Financial Legal Issues

I have submitted the defence via the mcol email this morning as the website wasn't working, I have just logged in and can see the following status "Your defence was received on 17/12/2014" I didn't receive any acknowledgement of them though which is nice. What happens next and the normal time frames for the next step? Edit Just phoned and spoke to MCOL he said they have 33 days technically to respond and if they don't the case automatically stays (not sure on the meaning of this?) Defence was received and accepted, confirmed. Guess I just have to wait now. -

Arrow Global ClaimForm Cap1 'debt' - Possibly statute barred

uub replied to uub's topic in Financial Legal Issues

I have just been preparing my defence as the date for filing is nearing closer, would some one be able to take a quick look and see if it is acceptable, thanks. -

Arrow Global ClaimForm Cap1 'debt' - Possibly statute barred

uub replied to uub's topic in Financial Legal Issues

Thanks for your reply, so if they both fail to respond/reply with the CCA/CPR, then the best course is to use a no paperwork/holding defence? what would be the likely outcome from that, I'm guessing they would ask for more time? would it not be best using both defences (statute barred & no paperwork)? -

Arrow Global ClaimForm Cap1 'debt' - Possibly statute barred

uub replied to uub's topic in Financial Legal Issues

I have attached both of the letters received in PDF format with identifying information removed.

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.