Don Canard

Registered UsersChange your profile picture

-

Posts

19 -

Joined

-

Last visited

Reputation

1 Neutral-

I have just used my bank account debit card on that noddle site mentioned above and it worked. I found that I have a good credit rating, and as dx guessed there was no sign or mention of the money that First Credit were taking from me. I have indeed been diddled good style! I've been paying them back since 2004. Isn't telling outright lies to glean money from folk illegal? First Credit have taken a good couple of thousand pounds off me relating to that, and the cheeky b****rds wanted me to pay more before I went and died on them! Good god what type of world has this become.

-

I'll try to get one by post then. Excuse me for being a bit thick regarding this but what exactly would have happened had I done it six weeks ago? How would I have benefit from that I mean? I know I've a lot to come to learn regarding these financial goings on so I'm still unclear as to how it benefits me to have the report. What am I looking for and how would having the info earlier have helped? I suppose that's what I'm driving at. I need to know this stuff so that I can tell others without telling them wrong you see.

-

That's a shame what just happened there, I thought we all shared a common bond? Anyway, update. I received a letter from the DCA which informs me that they are unable to provide the paperwork I requested as the original creditor have failed to supply it. Therefore they say they are are 'closing their file'. having said that they then go on to say that I still owe them the (disputed amount) of money, and at any future time should they come into possession of the CCA I requested they will reopen the case. My thoughts on this are twofold. Firstly relief of course, as other forum members suspected I now feel they were simply leaching me of cash. My second concern is the mention of re-opening the file at some future date. Even if this can't or never will happen I don't feel it is right to allow them to hold onto it. The figure they originally purchased as 'debt' owed by me is incorrect, so no matter if they did reopen the file the figure would remain incorrect and in dispute. Is there any official way I can make this clear? I simply want to make sure that whatever unsatisfied debt they consider they own is not the incorrect figure that they are bandying around. I don't want to be held accountable for a sum I don't owe either now or at any future date.

-

Hey folks, can I remind you that I'm entrusting my next moves to your advice. There is always a different point of views wherever you might find yourself, but let's not fall out over them please. I'm not worried about debt avoidance, I've been paying these people for the last seven years or more, but I don't agree with the amount they claim (they bought?) is correct. Over the years I must have paid them far more than they purchased the debt for, so I think it's time to call it quits by whatever means. Please remember that these were the folks that were pushing me to pay more - only because they were afraid that I might die before I paid them! If you need to get angry, get angry at them - not each other. Thanks, Don.

-

I can't get a credit report if I wanted one. All these 'totally free' sites still want credit card details before they will continue with the report so that's where I'm stumped. I now aim to do nothing as priorityone says, but what are they cooking up in the meantime? It appears to me that they have just given themselves eight weeks in which to answer my complaint, with no mention of the CCA request at all. A lot can be fiddled in that time, if they were using me as a cash cow then maybe they now have time to cover that up? Anyway, I'll sit tight for now until I hear from them.

-

I tried to get a CRA report online but was asked for a credit card so I wasn't able to do it. If the alleged debt didn't show on a CRA what does that mean? Am I now free of it or have the DCA done something underhand or possibly illegal? And what do you think they will be thinking of doing about it?

-

The bit about the complaint was already written into the letter in the library so I left it in, but I'm more interested as to their reaction to the main contents of the letter. Where's my CCA for example or how do they propose to move forward? This complaints procedure letter just seems to be buying them more time that anything else.

-

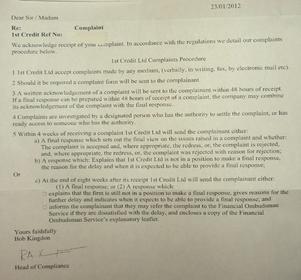

Hi folks, Well on the 18th of January I sent the account in dispute letter from the library as advised, and today I received my reply. Basically there is no mention whatsoever of the content of the letter regarding failing to supply a CCA, or what they intend to do about it. They only address the line at the very bottom of the account in dispute letter where it says; "You have 21 days from receiving this letter to contact me with your intentions to resolve this matter which is now a formal complaint". To this they have written back to say my complaint has been logged and will be looked into. I have posted the letter below. So what does that mean? What I wanted to know was what was their response to my disputing the debt, but they appear to have ignored that altogether.

-

Hi all, just an update on how things were going regarding First Credit and the CCA request I sent them. Well first of all I used the request template from this site, sent the one pound fee as a postal order made out as advised above, and then I waited. I posted the letter to them (1st class recorded) on the 27th December, which means the 12 days plus two have now elapsed but I've had no reply. What is my position now? Do I wait a little longer for their reply or is there perhaps a follow up letter that I should hit them with? I have already cancelled the Direct debit payment as it was due to go out on the 21st, I thought they might have answered me before now.

-

Thank you. I'm learning. I have just changed my telephone number so there should be no more harassment calls from them, it's all going to be done in writing/registered post from this point on. As I see it the first major obstacle is to check whether or not First Credit have legitimacy in collecting this debt, regardless of who they have reported it to. For me that simplifies matters. They have either to prove their entitlement to continue to fleece me, or I stop paying and have no need to concern myself further with their threats. I'm not trying to reclaim any money from them, I simply don't want to pay any more to them unless it is proved to be lawful. As the figure given/sold over to them by the bank is now in dispute I just wondered where that puts them regarding their ability to proceed? Furthermore, who do I take up the disputed figures with? If the bank has sold the debt, it has sold a debt that is over and above that which it should have been, and therefore (to my way of thinking) can't be collected. Also if the bank did sell the debt several years ago, would there be any point in speaking to the bank other than to request statements to varify the error?

-

Yes I take both points, thank you. Being new at this I will do it step by step, so the CCA request will go in first (today if possible) and let's hear what they have to say. I'll then do a CRA check once I've had their reply in order to varify their actions. They have always sent me annual statements showing the amounts I have paid and indicating the amount still left to pay, so it would be very interesting to find that they had omitted to inform the CRA about this. Anyway, like I say I'll go one step at a time as it's all still a learning experience for me.

-

Exactly. My understanding is that it's not statute barred because I have been paying it off in good faith all these years, thus keeping the debt 'alive'. What a fool they have taken me for! I've read so much about people trying to use loopholes to avoid paying their debts, but that isn't what I wanted to do. I did actually owe some of the money on the card but not all of it. Out of a sense of duty, and thinking that I was doing the right thing, I have attempted to repay what I believe I owed - only to become sucked into paying an amount I didn't owe and which will take the rest of my life to pay. If as seems likely, First Credit did buy my debt, then the repayments I have made to them over the past seven years or so have more than covered their outlay by a factor of two or three. I am slowly going from incredulity to anger over this. To think that those people are living off vulnerable individuals like myself, and abusing the tendency that is in us that makes us wish to honour our debts. I don't want to break the law of course, but I'll be damned if they get another penny from me without a fight. I have got the template from this site (many thanks to whoever provided it) and it will be posted just as soon as the post office returns to work. I will keep you all informed of what happens next. Do you know I'm going to go and sit down and have a drink of something quite strong now. I find it difficult to believe such parasites exist on the back of other peoples misery. Quite unbelievable, and a very sad indictment of our society. Thank you all for your contributions and advice.

-

Thank you for those replies priorityOne. I will send a CCA request to them asap. Is there a form for CCA's on this site, or perhaps an example of what I should write? So if I'm clear on this, I now send a CCA by registered mail. I wait thirty? or so days, and if they have not complied I can then stop the direct debit and write to inform them that the account is in dispute. If they do comply and send me some sort of credit agreement within the required time limit how will I know if it is enforceable or not? As you can see I have a lot to learn, but I'm really struggling to make ends meet now, and I'm embarrassed to say that I even thought of suicide the other day. But I refuse to be pushed into an early grave by people like this, to realise they have been proffiting from my misery is awful. The man on the phone seemed angry that I would be 82 before I had paid up, he didn't appear at all concerned at all that they would be leaching from me until I am 82 though. What bastards! (sorry).

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.