Kirkstaller

Registered UsersChange your profile picture

-

Posts

24 -

Joined

-

Last visited

Content Type

Profiles

Forums

Post article

CAGMag

Blogs

Keywords

Everything posted by Kirkstaller

-

Cabot Financial / Mortimer claim form - Fashion World

Kirkstaller replied to Kirkstaller's topic in Financial Legal Issues

Cheers mate. From other threads it looks like they might still try to get us to pay the alleged debt, needless to say we won't be. -

Cabot Financial / Mortimer claim form - Fashion World

Kirkstaller replied to Kirkstaller's topic in Financial Legal Issues

My wife called the court yesterday to ask if the claim has been stayed (nothing back from Cabot or Mortimer in response to our requests). The confirmed over the phone that it had. My wife asked if they would be confirming this to her in writing and they said no - this seems odd to me, is this standard practice? Would you recommend any further action now the claim has been stayed? I know this is not 'the end' of the matter - although it's good news for now and a spot of luck after messing up the defence. What happens if they don't supply the requested paperwork? Thanks again. -

Cabot Financial / Mortimer claim form - Fashion World

Kirkstaller replied to Kirkstaller's topic in Financial Legal Issues

Thanks for your advice, I think we will do as you suggest. We've only fought one claim before and that was in 2014 (not through MCOL), so my wife thought she had to fill in the box before the system would accept AoS. Needless to say, it won't happen again! We went on to win that claim in court. What do we do about the postal order Cabot are claiming we didn't enclose? Should we respond to their correspondence and send another PO? Mortimer have acknowledged the CPR 31.14 but have not responded with the requested information. We're hoping they are unable to locate it (as I've seen in other threads). We never received a default notice so I'd be interested to see what they come back with. I'll let you know how we get on. Until then, I'm reading up. -

Cabot Financial / Mortimer claim form - Fashion World

Kirkstaller replied to Kirkstaller's topic in Financial Legal Issues

Her advice was to submit an application notice. Can I ask what your idea is? Thanks -

Cabot Financial / Mortimer claim form - Fashion World

Kirkstaller replied to Kirkstaller's topic in Financial Legal Issues

Is the only way forward to submit an application notice? Or do we have to continue with defence she submitted? -

Cabot Financial / Mortimer claim form - Fashion World

Kirkstaller replied to Kirkstaller's topic in Financial Legal Issues

Hi They havent come back with a full answer yet but advised to email MCOL informing them of the error and with the correct defense failing that might be an application notice Thanks -

Cabot Financial / Mortimer claim form - Fashion World

Kirkstaller replied to Kirkstaller's topic in Financial Legal Issues

Thanks. Is amending the statement of case the best way forward now? I don't imagine the defence we've filed will be of any use. What happens if Cabot can't produce a copy of the agreement and default notice? What a mess this now is. -

Cabot Financial / Mortimer claim form - Fashion World

Kirkstaller replied to Kirkstaller's topic in Financial Legal Issues

We received the letter on post #7. We thought it was merely an acknowledgement of our position. My wife has been onto her lawyer friend this night, who has signposted us to a route which might allow us to amend our defence. We are emailing the defence tonight. It doesn't look great but the facts remain the same. Thanks for your help. I'll keep you updated. -

Cabot Financial / Mortimer claim form - Fashion World

Kirkstaller replied to Kirkstaller's topic in Financial Legal Issues

I've logged into MCOL using her Gateway ID to lodge the defence. At the foot of the page it says 'Response History', under which it says the Latest Document is 'Defence'. When I click on the claim number and 'View Defence' it takes me to the single paragraph my wife wrote when she was acknowledging the claim and saying we were going to defend it. The document status is 'Issued'. There is no option to edit/add to this. Have I got this wrong? My wife says she had to put something in the defence box when acknowledging the claim and defending it. -

Cabot Financial / Mortimer claim form - Fashion World

Kirkstaller replied to Kirkstaller's topic in Financial Legal Issues

I've royally messed up. And I could cry. When acknowledging the service and saying we are defending the claim, my wife has written her own defence - a single paragraph saying: I believe that I cleared the balance with Fashion World and as I did not receive any statements from them I was not aware of any outstanding balance due What the heck do I do now. Is it possible to amend the defence? Can we put something in more formidable later on? -

Cabot Financial / Mortimer claim form - Fashion World

Kirkstaller replied to Kirkstaller's topic in Financial Legal Issues

As in - keep para 3 unchanged? Do I resubmit the CCA request? Respond to Cabot's letter? Thanks -

Cabot Financial / Mortimer claim form - Fashion World

Kirkstaller replied to Kirkstaller's topic in Financial Legal Issues

Thanks. One final thing - what do I do about the CCA request I've potentially ballsed up (and will resend)? How do I address this in para 3? Thanks a lot -

Cabot Financial / Mortimer claim form - Fashion World

Kirkstaller replied to Kirkstaller's topic in Financial Legal Issues

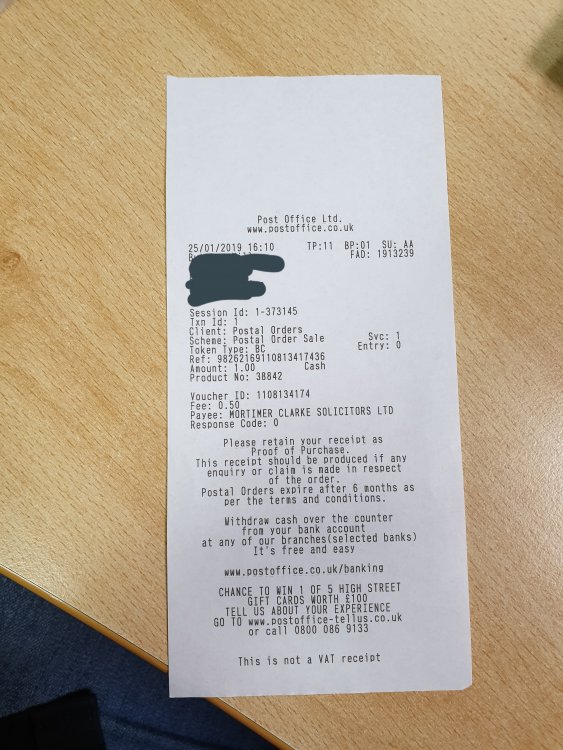

Hold the press - Cabot have now replied and said that I didn't include a postal order or cheque for £1 when I made the CCA request. I did send this but I think the Payee was the solicitors (receipt attached). What do I do now about paragraph 3? -

Cabot Financial / Mortimer claim form - Fashion World

Kirkstaller replied to Kirkstaller's topic in Financial Legal Issues

If they haven't submitted an account reference what should I do about the opening paragraph? From looking at other threads I assume the particulars of claim is the standard opening of a defence? -

Cabot Financial / Mortimer claim form - Fashion World

Kirkstaller replied to Kirkstaller's topic in Financial Legal Issues

Cheers thanks you so much. I'll be submitting it through MCOL tonight. -

Cabot Financial / Mortimer claim form - Fashion World

Kirkstaller replied to Kirkstaller's topic in Financial Legal Issues

Not yet andy. -

Cabot Financial / Mortimer claim form - Fashion World

Kirkstaller replied to Kirkstaller's topic in Financial Legal Issues

This is my first draft: Particulars of claim: 1.The Claimant's Claim is for the sum of £688.36 being monies due from the Defendant to the Claimant under a home shopping agreement regulated by the consumer credit Act 1974 between the Defendant and JD Williams Ltd Re Fashion World under account reference xxxxxxxxx and assigned to the Claimant on DD /mm/yyyy notice of which has been given to the Defendant. Not sure what to put here as they haven't quoted an account number 2. The Defendant failed to maintain the minimum payments due and the Agreement was terminated. Defence: The Defendant contends that the particulars of claim are vague and generic in nature. The Defendant accordingly sets out its case below and relies on CPR r 16.5 (3) in relation to any particular allegation to which a specific response has not been made. 1. Paragraph 1 is noted. I have had an agreement in the past with JD Williams Ltd Re Fashion World Ltd but the particulars of claim do not specify which account the claim refers to. Furthermore which is denied, I am unaware of any legal assignment or Notice of Assignment allegedly served from the original creditor nor the Claimant. 2. Paragraph 2 is noted but not admitted. The Claimant would not be aware of any alleged breach or in a position to plead such fact as an assignee as the defendant did not enter into any agreement with the Claimant and is therefore put to strict proof to verify the alleged statement of its particulars. Furthermore, which is denied, I am unaware of any Default Notice allegedly served. 3. On 25/01/2019 I requested information pertaining to this claim by way of a CPR 31.14 request and a Section 78 request. The Claimant acknowledged the CPR on 30/01/2019 but has since failed to provide the requested information. How should I address the CCA request? 4. It is therefore denied with regards to the Defendant owing any monies to the Claimant, the Claimant has failed to provide any evidence of assignment/balance/breach requested by CPR 31.14, therefore the Claimant is put to strict proof to: (a) show how the Defendant has entered into an agreement; and (b) show how the Defendant has reached the amount claimed for; and © Show and evidence any breach and service of a default Notice which it refers to in their particulars; (d) show how the Claimant has the legal right, either under statute or equity to issue a claim; 5. As per Civil Procedure Rule 16.5(4), it is expected that the Claimant prove the allegation that the money is owed. 6. On the alternative, if the Claimant is an assignee of a debt, it is denied that the Claimant has the right to lay a claim due to contraventions of Section 136 of the Law of Property Act and Section 82A of the consumer credit Act 1974. 7. By reasons of the facts and matters set out above, it is denied that the Claimant is entitled to the relief claimed or any relief. -

Cabot Financial / Mortimer claim form - Fashion World

Kirkstaller replied to Kirkstaller's topic in Financial Legal Issues

I'm drafting it now. Mixed my dates up - thank you for bringing this to my attention. -

Cabot Financial / Mortimer claim form - Fashion World

Kirkstaller replied to Kirkstaller's topic in Financial Legal Issues

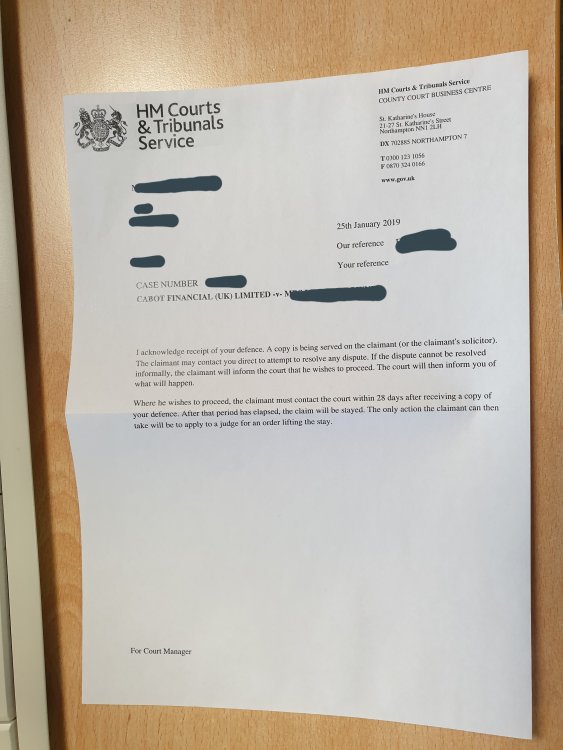

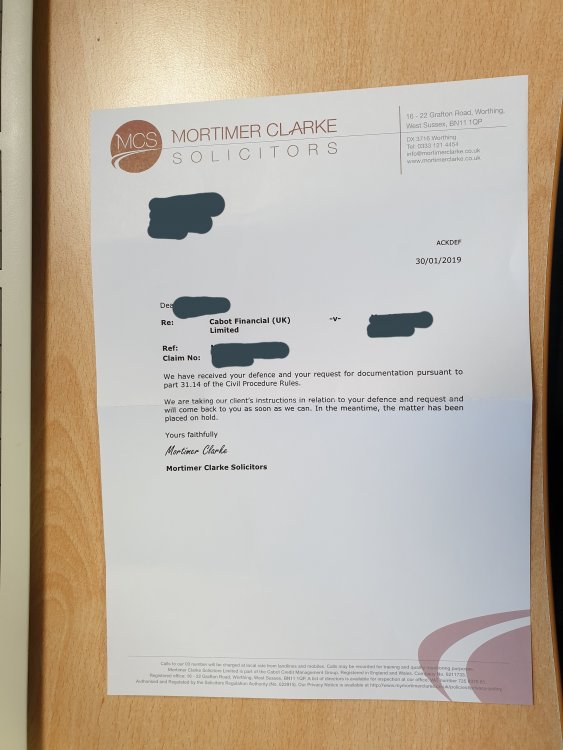

OK, latest update is here. On 25/01/19, I sent the CCA request to Cabot and the CPR 31:14 to Mortimer Clarke. HMCTS also acknowledged that we had chosen to defend the claim (attached). On 30/01/19, Mortimer Clarke sent the attached response to the CPR 31:14. My questions 1. We haven't received anything back from Cabot yet in response to the CCA request; when is the deadline? What impact would any non-compliance have on the claim? 2. When Mortimer Clarke say that the matter has been 'placed on hold', what do they mean? What could happen next? 3. What do we need to do next? Do we need to write and submit our reasons for defending the claim? Thanks for your help -

Cabot Financial / Mortimer claim form - Fashion World

Kirkstaller replied to Kirkstaller's topic in Financial Legal Issues

Thanks. They're going out today. -

Cabot Financial / Mortimer claim form - Fashion World

Kirkstaller replied to Kirkstaller's topic in Financial Legal Issues

Many thanks. With the CPR 31:14, which documents do I request? Just the ones explicitly mentioned in the Particulars of Claim? For example, there is no default notice referenced, nor is a Termination Notice (although it does say that the Agreement was terminated)? -

Hi all My wife recently received a County Court Claim Form which we have decided to dispute in full. I've completed the details below. I would be really grateful for your help with next steps. From reading other threads it seems my next move should be to send a CCA request to the Claimant and a CPR 31:14 request to the legals reps. Is this correct? Thanks --- Name of the Claimant: Cabot Financial (UK) Limited Date of issue: 09 Jan 2019 - Defence form submitted online on 24 Jan 2019 What is the claim for: By an agreement between JD Williams Ltd Re Fashion World & the Defendant dated 11/10/2015 ('the Agreement') JD Williams Ltd Re Fashion World agreed to issue the Defendant with a credit account. The Defendant failed to make the minimum payments Due & the Agreement was terminated. The Agreement was assigned to the Claimant. THE CLAIMANT THEREFORE CLAIMS 1. 688.36 2. Costs Have you received prior notice of a claim being issued pursuant to paragraph 3 of the PAPDC (Pre Action Protocol)? No Have you changed your address since the time at which the debt referred to in the claim was allegedly incurred? No Did you inform the claimant of your change of address? N/A What is the total value of the claim? £688.36 amount claimed + £60.00 court fee + £70.00 legal representative's costs = £818.36 Is the claim for: Catalogue When did you enter into the original agreement before or after April 2007? After Is the debt showing on your credit reference files (Experian/Equifax /Etc...)? ***Wife is checking - will update*** Has the claim been issued by the original creditor or was the account assigned and it is the Debt purchaser who has issued the claim Unsure Were you aware the account had been assigned – did you receive a Notice of Assignment? No Did you receive a Default Notice from the original creditor? No Have you been receiving statutory notices headed “Notice of Default sums” – at least once a year? No Why did you cease payments? Account was settled What was the date of your last payment? Unsure Was there a dispute with the original creditor that remains unresolved? No Did you communicate any financial problems to the original creditor and make any attempt to enter into a debt management plan? No, as N/A

-

Black Horse HP - Consumer Credit Act 1974

Kirkstaller replied to Kirkstaller's topic in Vehicle retailers and manufacturers

Got it sorted, thanks guys Just needed to pay closer attention ot the contract! -

First time poster in need of advice! In October 2008 I bought I Ford Fiesta from my local Ford dealer. I decided to finance the car over 5 years through the dealer (with Black Horse) as this was a much quicker process than applying for a personal loan from one of the banks. The APR wasn't too bad and the car would be with me within 5 days. When I read the agreement, I realised that it was in fact a Hire-Purchase Agreement (HP) and NOT a personal loan. The dealer explained that I could return the vehicle to BH after half of the finance had been repaid. I agreed to this as I liked the idea of having the opportunity to wash my hands of it in a couple of years. A few weeks ago me and my wife discovered that baby no. 2 is on his way and that we would need a bigger car to ferry them around in. I reached for the finance agreement so that I could work out when I would be able to Volutarily Terminate and return the car back to BH. The agreement clearly states at the top of the page, "Hire Purchase Agreement regulated by The Consumer Credit Act 1974". However, further down the page it states, "You have no right to cancel this agreement under The Consumer Credit Act 1974". Am I reading this right? If it is indeed a regulated HP agreement then surely BH can't not accept a Volutary Termination? The rest of the contract pertains to a HP agreement (can't change reg without permission, take outside of EU without permission, numerous references to HP) so it's not just a typo at the head of the page. I'm due to have paid half the outstanding credit by March 2011. Is it worth ringing BH now to establish the precise terms of the contract or are they obliged to accept the car under the CCA? Any help much appreciated

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

- Create New...