LSD374W

Registered UsersChange your profile picture

-

Posts

10 -

Joined

-

Last visited

Reputation

1 Neutral-

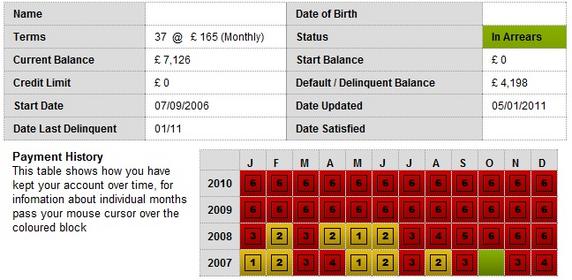

Hullo Caggers I'm ex BR and have been for a couple of years now. I'm very careful with my credit score and how its affected. However, I do need some advice. Every so often I check my credit score - Experian loves me - Equifax seems to hate me (Any reason for that?? ) The last time I checked my credit score on Equifax - it was 337. 3 Months later and It's dropped to 279 and there are a few strange things... I shall post a few screen shots in hope that one of you amazing folks can shed some light!! I have no extra credit taken out Same bank account No searches No OD No Bank charges I was BR 11/11/09 and Discharged 1 year later. My BR payments also stopped early. A loan from Lloyds TSB is making a massive impact on my score. It says I've defaulted by £3.5k and the wording in the warnings - seems to suggest that I still owe it - or at least thats what it seems to suggest to me and other lenders. The loan from Welcome was included in my bankruptcy - but shows as settled?? Can anyone offer some advice on this?? Thanks in Advance

-

Hello, Just looking for a few opinions really. Contract A was coming to an end - It had quite an easy number attached to it, so rather than lose the number, I asked that they port the number to a different account. Basically just swapping numbers about. I was told that I would receive a final bill - it would be roughly £30 - No big deal. I have 4 contracts with O2. I also have Home Phone and Broadband. So my payments are anywhere between £80 - £120per month. The number change and cancellation happened in October... Few months later, in January I received a call from Westcott finance. I'm coming out of Bankruptcy - so didnt bother getting in contact with them, thought it was a wrong number. I keep a hawk-like eye on my credit score reports and didnt have any accounts with issues or late payments. I then received a letter from Westcott Saying that I owed O2 an amount of £27 - which also included a fee from Westcott. There's no way Im funding that company.. Here's what happened next.. Never received any final bill Never received any emails to say it was overdue Never received any postal overdue bills Never received any calls to say it was overdue Customer service couldn’t find the account on 2 separate occasions. Was advised to call Westcott finance and find out what account number it was for. After many attempts, the account was found! Was advised to call back after 48hours after account had been found, to make payment. Called back - no record of even calling. Emailed O2 complaint review service on the 16th January – didn’t receive call back until the Thursday the 2nd of Feb. Was advised by CSA that she also couldn’t find the right account and that she would call back later that day. She never called back. I Called O2 on Wed 16th. No records of me making a complaint with O2. Given switchboard number to speak to complaints. Spoke to Sarah who seemed no further forward in investigating the complaint. She advised me that she had emailed me. She hadn’t. She advised she would call back. She also advised that I call |Westcott to chase this and sort it. Sarah called back and agreed that O2 had not emailed me regarding the outstanding payment, but advised that payment was valid. Advised that O2 could mark my credit file as a query, rather than restore it to its normal status of a cancelled paid up account. Was told that another system could confirm that 1!!! Text message was sent to my mobile in December. If this is the case – O2 would not restore my credit file at all. Advised Sarah that I wasn’t happy and I wanted to further escalate this. She advised 24hour call back. Still haven’t received a call - 4 days on! .... Here's the twist.... I'm an employee!

-

Hello Folks, I have just ordered my credit report from experian and equifax, and I'm a bit confused on how some information is recorded on my file. Experian is more of a concern. I was discharged from bankruptcy in November 2010, I bought my credit reports, everything seemed ok except for entry's from Welcome Finance... They seriously make me ill, and caused me so much bother, to the extent I had to change mobiles numbers and change jobs... Anyway, some files are showing as defaulted, but file updated for the period to ././.. Welcome finance are showing as 6payments or more late... No payments have been made for 3 years, and these were included in my bankruptcy order. Experian told me to send my discharge papers and they will update my file, equifax have told me to contact .... Welcome... NOOOOOOOOOOOOOOOOOOOOOOOO! I've send Equifax a copy of my discharge papers anyway. Has anyone had similar experiences, clearing up their credit files - post bankruptcy? I'm also not entirely sure on how to contact Welcome or what I should include in my letter... If anyone provide any useful information or previous threads, I'd be EXTREMELY grateful... I'm preparing for war. Thanks Millions

-

- banckruptcy

- equifax credit rating

-

(and 1 more)

Tagged with:

-

Hello, I was hoping someone could give me a little insight into something going on with my credit score, and how welcome finance are keeping records of my finances. I was made bankrupt just over a year ago. In fact my bankruptcy discharge was the 11.11.10. I've been keeping a close eye on my credit score and report and watched it steadily rise. The issue is, on my credit file, some accounts are showing settled, some show default (with a date) my welcome finance record is showing late by 6 payments (closer to 36) and updated every month!! Is this right? I'm trying to clear my past, start afresh and learn from my mistakes and I want to make sure this is reflected in my credit score! Any ideas?? Thanks

-

- bankruptcy

- credit file

-

(and 3 more)

Tagged with:

-

Have I broke the terms of Bankruptcy agreement!?

LSD374W replied to LSD374W's topic in Dealing with Debt in Scotland

Ray, Ida Thanks for the replies. It's really put my mind at rest. Ida, the examples from AIB were EXTREMELY useful. Thanks again for your quick and helpful posts. -

Hello, I was wondering if someone could answer my question. I was made bankrupt 11 months ago. Found it all easy and havent had any real issues ( aside glasgow city council ) 2 weeks ago, I had to take out a loan from Wonga, didnt even realise I would manage it! I paid it back, but I'm worried that I may be in breach of my bankruptcy terms?! I'm too scared to call AIB and ask. I'm sure that in my terms from the AIB I'm not allowed to have ANY credit, OR it wasn't allowed to be more than £500?

-

No Water Since New Year :(

LSD374W replied to LSD374W's topic in Residential and Commercial lettings/Freehold issues

Hello, Thanks so much for your help. I'm waiting for our family lawyers to get back to me - I would like a legal opinion - if nothing more than, to have some ammunition for when the letting agency contact me again. I will post my update later. Thank you so much. c -

No Water Since New Year :(

LSD374W replied to LSD374W's topic in Residential and Commercial lettings/Freehold issues

Hi and thanks for getting back to me. I've paid rent, but the situation remains the same. My agency have been telling me that they were waiting for an "update" regarding the repair. I called the plumbers, to establish why it was taking so long and what "update" The letting agency hadn't contacted the plumbers since last week!!! They were waiting for instruction from the landlord!! Called the agency and they bluffed, with excuses. Apparently my water should be back on today (THANK GOD) So fingers crossed. -

I currently have no running water in my apartment. I haven't had any since the 1st. Some of my neighbours haven't had any since Christmas eve, but the situation is becoming unbearable. I've had to vacate my house and move to my parents house, which is miles away from work. I have no place else to stay. I don't have a flush, I cant wash clothes, I cant shower, but my letting agency are being unhelpful to the point of obstructive. My letting agency are also the factors for the building. I called them in the morning and by early evening the water came back on, but had frozen a few hours later. I emailed them the following morning, called them all day (didnt answer) and they finally emailed me at 1658 on a Friday (they close at 5pm and dont open on a weekend) Actually becoming really upset and stressed out. Do I need to pay rent for the time I've not been able to live in the property? It's completely uninhabitable. If anyone could offer some answers or advice, I would be really grateful.

-

Hello, I'm in the process of declaring myself bankrupt. I had help from the Glasgow CAB team. I received a letter from the AIB today asking for a copy of my charge of payment from Welcome (grrrrrrr) Finance. I have since moved home and it seems the charge of payment has been lost. I have called Welcome ( call centre, not the office where I got the loan) and they told me that the only piece of info about my account, that they can send was a notice of default! I really need to get a copy asap, but Welcome, don't really want to help. Any suggestions ?? Thanks

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.