rhos123

-

Posts

456 -

Joined

-

Last visited

Content Type

Profiles

Forums

Post article

CAGMag

Blogs

Keywords

Posts posted by rhos123

-

-

Ok... just checking....

You'll need to write another to this bunch then, enclosing a copy of your last correspondence to Lloyds and anything they've written back to you agreeing to your proposals.

It would be far easier if they just talked to each other instead of trying to put frighterners on people....

hi, thanks for your reply, maybe a short simple letter to them would do?. dear sir/madam due to the lack of communcation by yourselfs and indeed your client i have indeed explained my current situation to yourselfs and indeed your client therefore i welcome the the courts judgement with regard to this matter!

-

How old is this loan?

If you've informed them of your circumstances by phone, it's been a time waste. If you've done it by letter without sending by rec. delivery, it's probably also been a time waste. By the tone of the letter, they're saying that you haven't communicated at all.... which would make a CCJ by default very easy for them at this stage.

Everything needs to be in writing and everything needs to be by rec. delivery.

hi, thanks for the reply, the loan was taken out jan 2007, i have indeed informed them by letter i allways send recorded delivery

-

Hi rhos

To the best of my knowledge SCM are Lloyds employees in the office next door.

http://www.bankactiongroup.com/forum/showthread.php?225605 post 15#

thanks rebel11, i thought so i have informed them of my current situation, so all the threats in their letter are indeed pointless

i have told them in writting that i am unemployed, i have no assets, etc, i send them a token payment each month and they cash the p/o. then they send this letter:jaw:

-

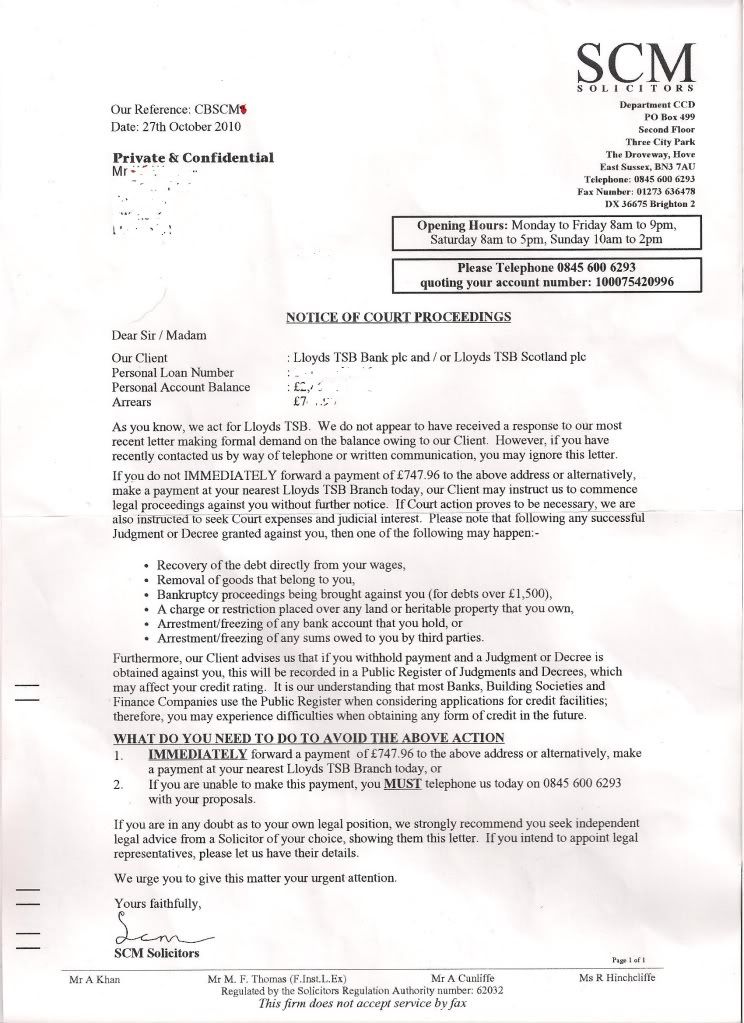

recived this from scm. any addvice most welcome.

-

I have recently had dealings with Go Debt. They wrote to me about a previous debt. I replied telling them that the debt was in dispute and had been for some time but they took no notice. I got fed up with the fact they would take notice of me so I informed them in writing that as they were in breach of debt collection guidelines I would charge them for my time in dealing with them. If they wrote to me after a certain date my charges would be £15 to read their letters and £15 to reply to their letters. Payment terms were 7 days from date of invoice with an admin fee of £50 if they did not pay within 7 days.

So far I have not received nothing except a letter from the Managing Director saying they would not pay my invoices so this week I have issued court papers for £320 plus costs. They have until 14 November to respond.

Looking forward to their response.

hi, ron can you post up the letter you have recived .

-

hi i recieved the same stuff from halifax and am going to send the letter of dispute, im still waiting for the true copy, all the best georghe

hi george i indeed belive they do not have the true copy, if they had it they would indeed send it:wink:

-

Thank you for your replies so far.

Do you think I should also ask for a copy of the deed of assignment ?

Does anybody know how you can tell whether the terms and conditions attached to the reconstructed credit agreement are correct for the time of inception?

hi, if you scan and post up the recon etc, remove all personal deatils ref numbers barcodes.. you should have recived a noa

-

Thanks Rebel 11 if i post up what they sent would some one take a look please thanks Maxedout

hi, please post the recon up remove all personal details, ref numbers or barcodes, as the trolls from the smelifax look in on these posts.

-

If you say so. Turning up like that wearing cargo pants, Republic gear. Skateboard out the back. Perhaps they felt the court needed a bit of a fashion lift.

INDEED , as it would only be a county court hearing the judge may indeed be wearing cargo pants.

-

Their pre-court division is on a level with a flying spaghetti monster. Doesn't exist. As to judges, red coats. Last one I saw wore perfectly ordinary every day clothing.

ah a judge with a red hoody , jeans , and a tie.

-

hi mr cartaphilus, i do not think that moorcroft own the debt , they only send a letter" pre" court division on behalf of the halifax.

i have hade lots of court papers berfoe from the judges that wear the red coat,

hi, you mention in your post to judges that wear THE RED COAT these are indeed judges in the crown court, now county court and crown court is indeed a diffrent matter!

-

Not sure if they will take notice of a formal letter because I received another letter from Lloyds Customer Services today saying this 2nd letter was their final word on the matter because I didn't raise any new concerns. The reason I didn't raise any new concerns by letter was because they told me someone would ring me about it which never happened..

This 2nd letter also said that if I responded to it, they would file it but may not reply: ie They are now blocking me from raising concerns about the way my complaint was handled.

The junior clerk at Customer Services who wrote this last letter silencing me does not understand the issues nor does she understand English Law which is maybe why she couldn't give me an adequate reply to my complaint.

I am going to write a Formal letter of complaint to the Customer Services and CC it to the Chairman of Lloyds, the Head of my Branch, Trading Standards, Watchdog, The Times etc and see if anyone answers...

I get so weary of this kind of corruption in the UK...

any update on this.

-

I've got 3 credit cards from when i was a student approx 10-12 years ago.

I stopped making repayments to all of them in Nov 2008

In July 2009 i sent them all CCA requests but havnt received anything valid back. I did get alot of threatening debt recovery letters - with the debt passing from one solicitor to another but for the last 6 months that seems to have quietened down from receiving them monthly to now every 4-6 months.

So basically its been 2 years since i last made any repayments and none of them have taken me to court which suggests to me they havnt got valid CCA's

Basically is there any way i can get these debts written off on a technicality of not have an enforceable CCA? I'm prepared to go to court if need be if theres a good chance i can get rid of these debts

I realise i can keep my head down for another 4 years and these debts will be written off but i'm 30 now and wont be able to get a mortgage and get on the housing ladder until i'm at least 36 which isnt ideal

Just wondering your thoughts on this?

Thank You

a debt is not written off, it may indeed become sat barred.

-

the £ 10 / p/o or cheque for the sar request is to lloyds . endorse your p/o or cheque to lloyds tsb bank.

-

The solicitor is Fairfax Solicitors in Leeds.

ok , phone the solicitor at fairfax in leeds and tell them to send you a letter! with reguard to this matter. post it up or type its contents on your thread should they reply.

-

Hope this has worked

[ATTACH]22651[/ATTACH]

hi thier letter says it all. when they find it they will send it. sit back and relax.

-

It's a culmination of things, DCA's have very little power, they never have but where things differ is that these days the individual is much more empowered

due to the internet and the advance of forums such as Consumeractiongroup, & moneysavingexpert , now the woman/man in the street can fight back and

use the legislation that was put in place to help protect them but who until these forums did not have a clue as to how to go about it or even if it was

achievable. Now they see others in the same predicament and they're able to exchange and arm themselves with information to help fight their corner

with a little more gusto. Almost every day on CAG a newbie comes to the board with almost exactly the same queries as those that are now cag

seasoned campaigners, it's a sort of deja vu feeling, so the DCA hasn't changed, they still churn out the same rubbish as what they did years ago, but

what has changed is the ability of the individual to be able to fight back....

Most debtors would like to pay their debts but it's gotten much harder to survive financially, something has to give and if it's a question of putting

food on a plate or ensuring a family has clothes on it's back or paying a DCA then the dca is going to lose everytime. (or at least they should)

There is nothing wrong with a dca wanting to collect money, debt is a way of life and whilst their is debt there will always be debt collectors, it's just

that the majority of them out there these days are nothing short of scavenging miscreants of the highest order who are only concerned as to their

own books rather than the plight of the average alleged debtor. CAG and other forums like it have helped stem the flow.....

how very true your words are, before i found the cag website i did indeed fear these **** dca/s , thier threats and horrible phone calls really upset me and my family, with thanks for the reading and help i have had on this forum i have indeed learnt to fight back!

-

Should i just ignore the litigation letter from cap quest,

you MAY indeed ignore the litigation letter from capquest. i think you will find that the capquest litigation letter is printed in their legal department THE NEAREST TOILET IN THEIR OFFICE!

-

Thanks for the reply, I really need to know an answer on this, it was an agreement signed at home and as far as I can remember I did not get a right to cancel notice as the money was in my account within 24 hours of me signing the agreement, I would really appreciate that only those that know for sure yes or no, respond as I have already posted this on here before and still have no clear answer on it, even though I really appreciate the help received on here it gets me nowhere if those that answer are not sure themselves, manythanks.

hi was this an internet application?

-

do not be worried about capquest, why send them a cca request and waste a £1, you are indeed on the dca merry go round.

-

Here we are

Nice email there to abuse

robbersway still sending free bog paper, use it as you choose to!

-

if they buy the debt then i presume its the hook line and sinker

-

Lowlifes are up for sale so they are obviously trying to shelve their cannon ball accounts before they get bought out, god I 'kin hate lowlifes...

ah it seems that thier gun powder is indeed running low!

-

I think it's becoming more and more clear that DCA's are buying debts on a "sale or return" basis. If they buy a debt they cannot collect on (account in dispute) they have the right to pass the account back to the original creditor.

Just my thinking of course

no doubt the o/c 's will soon be offering a bogof offer to these DCA's. more fool them!

Bryan Carter letter of cliam

in Lloyds Bank

Posted

thanks for that. i may indeed call thier bluff i do indeed have copies of all correspondence i know one thing it will not be ME looking stupid before the county court judge