RedEst

Registered UsersChange your profile picture

-

Posts

11 -

Joined

-

Last visited

Reputation

1 Neutral-

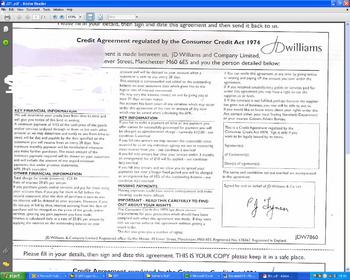

This is a copy of the letter i sent orginally: This account is in dispute. On 11/11/2009 I wrote to J D Williams requesting that J D Williams supply me a true copy of the executed credit agreement for this account. In response to this request I was supplied a mere application form which did not comply with the requirements of the Consumer Credit Act 1974. The document sent purporting to be a credit agreement does not contain any of the prescribed terms as required by section 60(1) Consumer Credit Act 1974. The Consumer Credit (Agreements) Regulations 1983 (SI 1983/1553) made under the authority of the “1974 Act” sets out what the prescribed terms are, I refer you to Schedule 6 Column 2 of SI 1983/1553 for the definition of what is required. Suffice to say none of the terms are present in the document Since this document does not contain the required prescribed terms it is rendered unenforceable by s127 (3) consumer Credit Act 1974, which states 127(3) The court shall not make an enforcement order under section 65(1) if section 61(1)(a)(signing of agreements) was not complied with unless a document (whether or not in the prescribed form and complying with regulations under section 60(1)) itself containing all the prescribed terms of the agreement was signed by the debtor or hirer (whether or not in the prescribed manner). This situation is backed by case law from the Lords of Appeal in Ordinary (House of Lords) the highest court in the land. Your attention is drawn to the authority of the House of Lords in Wilson-v- FCT [2003] All ER (D) 187 (Jul) which confirms that where a document does not contain the required terms under the Consumer Credit Act 1974 the agreement cannot be enforced. In addition should you continue to pursue me for this debt you will be in breach of the OFT guidelines, I draw your attention to the Office of Fair Trading’s guidance on debt collection. The OFT guidance which was issued July 2003 (updated December 2006) relating to debt collections and what the OFT considers unfair, I have enclosed an excerpt from page 5 of the guidance which states 2.6 Examples of unfair practices are as follows: h. Ignoring and/or disregarding claims that debts have been settled or are disputed and continuing to make unjustified demands for payment I require you to produce a compliant copy of my credit agreement to confirm I am liable to you or any organisation, which you represent for this alleged debt, if you cannot do so I require written clarification that this is the case. Should you ignore this request I will report you to the Office of Fair Trading to consider your suitability to hold a credit licence in addition to a complaint to Trading Standards, as you will be in breach of the Administration of Justice Act 1970 section 40 Since the agreement is unenforceable and the default notice is non compliant, it would be in everyone’s interest to consider the matter closed and for your client to write the debt off. I suggest you give serious consideration to this as any attempt of litigation will be vigorously defended and I will counter claim for all quantifiable damages I respectfully request a response to this letter in 14 days I trust this out lines the situation

-

I'm having trouble with JD Williams Solicitors now - they say they have not received the account in dispute letter - in my haste i did not send it recorded - they have taken my account off stop - shall i send the letter again - this time recorded? Esther

-

It is a bit scary when they speak like that - im so glad i found this forum

-

Ok thanks UF When i opened it i was a bit stunned - didnt expect to get anything like that Esther

-

OK - these are my uploaded letters from thw JD Williams solicitor Any help would be greatly appreciated Thanks JD 15.01.2010 A.pdf JD 15.01.2010 B.pdf

-

Ok i cant upload the letters from work - will try again from home later Or - dont know if i can email them to someone who might be able to help ?? Esther

-

Hi All I've finally had another response - this time from their solicitor. Have attached files again. Please can you advise what i should do now Thanks in advance Esther

-

Hi Guys I have deleted personal information from my replies and have attached them now. Hope they are ok Thanks Again for your help. Esther:) JD2.pdf

-

Hi I have received replies to this letter Have attached files - what should i do now? I also received a list of transactions made on my account - do you need to see those? Thanks again for your help on this Esther jd1.pdf jd6.pdf jd5.pdf

-

Hi - and thansk for the quick response. I think I''ve had it about 2 1/2 - 3 years now. I opened it on the internet.

-

Hi I am new to this site and really need some help. I had a JD Williams catalogue account which has been passed to Reliable Collections. My situation is that over the past few months i have been fighting a custody battle with my ex paying huge solicitors fees and in my own error admittidly have ignored this account. I owe them £758.07 and really can only afford to pay them £20 a month until i get my finances sorted. I am scared to call them as i dont have any excuse for this and now i have a letter saying a debt collector will call at my home. Please can someone help me - this is the last thing i need right now - when i call them what do i say??? thanks,

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.