george96

Registered UsersChange your profile picture

-

Posts

39 -

Joined

-

Last visited

Content Type

Profiles

Forums

Post article

CAGMag

Blogs

Keywords

Everything posted by george96

-

Balance on Paragon loan - all fees and charges.

george96 replied to george96's topic in Mortgages and Secured Loans

It's Parogon. The charges add up to more than the remaining balance, should I ask for a cheque for the remainder? -

Anyone else had issues with this firm? Prior to Dec 12 I would receive emails from Newcall Primus telecom notifying me of my bill for phone/broadband. The DD would be taken 2 weeks later. Something changed in December and the "Primus" name was dropped. I no longer get email alerts to view my bill before the DD is taken. Also they have started taking the DD on the 1st of the month instead of the 14th. And now they have taken the March payment on 27th Feb. Which means they have taken 2 direct debits in Feb. Also, I have been charged for going over my broadband limit. They did not alert me to the fact that usage had exceeded my limit. Previously I would get a warning pop-up telling me I was near the limit. This has now stopped and I can't see anywhere in my user account where I can request this service.

-

I'm writing to Paragon where I have a secured loan. Can I ask for a default notice fee of £50 to be refunded?

-

I SAR'ed Paragon and they only sent me copies of the statements of the account (which I already have). They go on to say that... "whether certain information must be disclosed depends on whether it is 'personal data' and how it is stored" They then go on to claim that other information is not held digitally but on paper or microfiche; this information does not fall within the ambit of section 7 of the DPA. Can they really think that people will believe that they don't hold information on individuals' accounts digitally. Everytime I speak to them they access previous communication, whether by letter or telephone, from a computer database. What's the best way to pursue this?

-

Mysterious. Demand for ghost CC debt to be repaid.

george96 replied to george96's topic in Debt Collection Agencies

I've now received a letter from Red threatening all sorts of action. Should I write to them explaining that I have no knowledge of the account number they allege I owe money to, or should I acknowledge receipt of the non-compliant CCA for Morgan Stanley but ask for a CCA for the BC account from which the copy statements have been sent? Or should I just ignore them? -

Mysterious. Demand for ghost CC debt to be repaid.

george96 replied to george96's topic in Debt Collection Agencies

Bazooka Boo It's the "original Barclaycard account" 16 digit number. And, no I didn't sign a new agreement for BC. -

Mysterious. Demand for ghost CC debt to be repaid.

george96 replied to george96's topic in Debt Collection Agencies

The two sets of statements they sent me were for a Morgan Stanley card, which then morphed into a Barclaycard after the takeover; I recognise both of these. But the Barclaycard referred to in the demand letter has a completely different number. -

I've been having correspondence with Lowell about a Barclaycard debt. They sent me a letter demanding payment quoting a Barclaycard account number which I know nothing about. I wrote to them saying I didn't recognise the debt and they, in return, sent me statements from two separate credit cards - neither of which had the Barclaycard account number originally quoted (and which they are still quoting)! They've also sent a CCA for a Morgan Stanley CC (which I think is unenforceable for lots of reasons). What should I do? Should I again write that I don't recognise the Barclaycard account which they are quoting or write that the CCA is unenforceable. Or both? Funny innit?

-

@npowerhelp Charged for visit by npower

george96 posted a topic in Utilities - Gas, Electricity, Water

NPower have charged me for a visit to my house by one of their agents, apparently for a chat . It wasn't arranged and I wasn't informed that they were coming. Can they do this? -

I have paid one pcn direct to the council via the council's website. The other pcn is being disputed - I've sent a statuary declaration (out of time) to the court. So there is no council debt; only bailiff charges. They have charged 2 x £11.20 letter fee and 2 x £28.00 for the first visit plus £160.00 "attendance charges".

-

Vicki202 Fantastic news. I didn't realise how corrupt bailiffs were until I recently had dealings with them (and read a few threads on here). The abuse of power and, more seriously, the thuggish behaviour of some is staggering. They prey on people who are vulnerable, scared, desperate and ignorant of the law. They misrepresent their powers and fraudulently charge for the work they (supposedly) do. Websites like this would not exist if banks, dca's and bailiffs did not try to profit (unfairly and unlawfully) from the misfortune of others. WELL DONE ONCE AGAIN. DON'T LET THE B*ASTARDS GET AWAY WITH IT!

-

Bazooka Boo I already have. dx I initially sent a basic hardship letter taken from the templates off this site. Then I sent a letter offering £20.00 with the balance to be refunded. When Lloyds stonewalled me I simplly sent this: Lloyds TSB Charlton Place SP10 1RE 11th May 2011 Your ref: xxxxxxxx Acc no. xxxxxxxx Dear Mr. Stephen, Thank you for your reply dated 3rd May 2011, to my letter of complaint regarding the excessive charges levied by you on my current account. I have been reviewing the bank’s conduct across all of my Lloyds accounts – both past and present – and have decided to submit a Subject Access Request under the Data Protection Act 1998. This will be sent to the Data Controller at Lloyds TSB and will cover all of the six Lloyds accounts which I hold or have held. So whilst your suggestion to contact the FOS is welcomed, at the moment it’s a little premature. Yours sincerely. xxxxxx lloyds SAR notification.doc

-

After a couple of letter to and fro (hardship plea, good customer etc.) , I received a letter from Lloyds stating they would NOT refund any of the charges and that I should take it up with the Banking ombudsman. I wrote back saying that I would now be requesting a SAR for the 4 accounts I held in the past including a personal loan account with PPI. A week later they refunded the charges!!!! Still going ahead with the SAR.

-

Right. One last attempt to get some response. Please. (do my posts suggest I'm an infiltrator or bailiff spy or something?) The baillif expects me to pay the full amount on Wed 8th June approx £320.00. He doesn't know that I've paid the pcn direct to the council. As there is now no penalty charge, what can he do? Can he still try to seize goods/vehicle for bailiff costs only. Anyone got any advice/idea how I should handle this? I'm beginning to feel that you're all avoiding me!

-

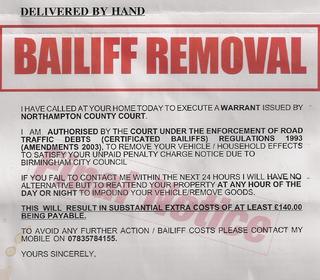

Hi dx I have read all of the stickies and followed all of the links - which is probably why I'm a bit unsure of the charges bailiffs can make. 1st visit they can charge £28.00 for debts of £100 or less. Or 28% of debts of £100 to £200. + VAT So that would be £93.44 + £28.00 = £121.44 + VAT @20% = £145.73 Is this correct? What else can they reasonably charge for? If he visits again but does not clamp the car (I don't have it here) or gain access can he charge again? This is the letter he left with me.

-

I had a visit from a bailiff from Equita yesterday. I did not let him in or discuss anything; I simple took a letter from him which he was about to post. I later phoned him and offered to pay in instalments. He then informed me that the total amount was £320. When i asked how this was calculated he just stated thet the additional charges were for "bailiff costs". I asked him to give me a breakdown of these costs but he refused. I previously had a PCN letter from Equita stating that I owed £93.44 including the £11.20 statutory fees. So where do costs of £226.56 come from? What should the costs be? I've read numerous threads on here but am still a little confused as to what charges can and can't be included.

-

I'm in a very similar situation. Had a visit from a bailiff who posted a letter informing me that I had 24 hours to contact him or he would re-attend to impound vehicle/remove goods. This is for PCN. The total charge is £93.44 including the statutory fees of £11.20. When I called the bailiff he informed me that I had to pay £320. When I asked how he'd arrived at that figure and, how that was broken down he simply said "bailiff charges" and wouldn't elaborate. How can they possibly take £230 for the 1st visit? Is this right?

-

Thanks for the replies. I have opened another bank account.

-

I have an account with LLoyds with NO overdraft facility. Throughout the history of the account, if any transaction would take me overdrawn lloyds would refuse the transaction and charge me £20.00 for the returned DD or standing order. It only happened twice in 3 years. Fair enough, I should have been more on-the-ball. Over the new year bank holiday a DD took me £27.00 OD which Lloyds allowed to go through. By the time I learned of this, 4 days had passed before I was able to transfer funds into the account. Now Lloyds have charged me £5 for the use of an unauthorised overdraft and £10 per day whilst I was overdrawn. What can I do?

-

I have a mortgage with NR with an additional unsecured loan attached to it. I make 1 payment to northern rock which covers both debts. For the last 8 months I have been unemployed and the dep't for work and pensions have been paying the majority of the interest on the mortgage. I have been making up as much as I can afford each month but inevitably have fallen 1 month in arrears. I have just been informed by NR that they have defaulted me on the unsecured loan as I am 4 months in arrears. The next step is legal action. For the last 5 months NR have been using the additional money I pay each month to keep the mortgage only 1 month in arrears and have not been apportioning any of the payment to the unsecured loan. They have now said that it was my responsibility to inform them how I wanted the additional money split between the mortgage and unsecured loan. This is the 1st time NR has told me I could do this. All of the additional payments have been made by debit card over the phone and at no time did anyone at NR ask me how I wanted the payment split. Is there anything I can do? Especially with the default.

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.