JHGlover

Registered UsersChange your profile picture

-

Posts

27 -

Joined

-

Last visited

Content Type

Profiles

Forums

Post article

CAGMag

Blogs

Keywords

Everything posted by JHGlover

-

If anyone does find a decent solicitor who deals with this type of law, and are good, let me no........... why the up front fees

-

why is it wyen you write something something changes, i have just been informed by my parent that he has contacted Swift to explain his loosing his job, it would seem he has missed his last payment and swift will be sending him a letter to put down his expenditure etc: is there any advice out the on how to complete this or will Swift be favourable, and rip him off aggain by lowering his payments and extending the loan and of course adding more interest ??

-

Currently no fight but am preparing for one, my parents have not as yet defaulted, but sure as eggs is eggs they will not be able to continue to keep up the repayments, i have advised they send for SAR which we are waiting for, once we get this information we can start to look at any details that will be required to to for unfair or unenforcable CA, it will be interesting to find out what details are sent, certainlay as the interest rate seems to be increasing whenever Swift feel the urge, so will be looking to claim back the PPI, and any other outragous fees, like broker fees, we have also asked for the original CA, be intyeresting to see if they send an original or, one thats been changed to fit with Swifts usual tactics. but we do have the original to compare with, is there any documentation i should be looking for in the SAR that swift may feel like omiting ?? also should they have recieved statements from swift about how their account stands??

-

Hello you all, qestion, can a claim still be made on PPI if a claim has been paid during the 3 year term, but would it still be claimable, if the term was only for 3 years but payments are being collected for the 15 year term of the loan.

-

I am hoping this will all come to light when.if we recieve the documents from the SAR ferom what i can gather no letters have been recieved pertaining to this.

-

I have the Agreement number, but have been informed that the payments have been £545.00 for the first 36 months however on the CA its states he should have been paying £515.95 for the first 36 months , i have been informed it has been reduced to £512.00 for the next 144 months but on the CA it states it should be 485.72, i have asked parent to check his bamk statements to see what he has been paying for the last 3 years, surely there is some discrepency here

-

I am checking with my parents if they have recieved any otherecorrespondence from Swift with relation to an account number, however as i have stated there is no account number on the credit agreement, , and sorry didnt read the letter fully, to notice the CA info

-

Thanks sparkie, but as i stated there is no account number, also is there a letter for requesting the a copy of the original credit agreement and if so is there a fee

-

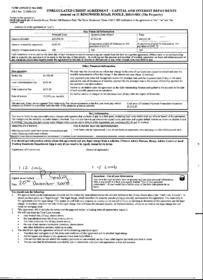

I was just about to do a SAR letter, but i cant seem to find any indication of an agreement number, the only indication of numbers is the top left of the form that i posted earlier, that says FORM UNRCAP [1 Nov 2005] [V8.5 Rev 7 ] 20061215 the latter numbers look like a date to me. but no indication of agreement number, anyone have any idea how i would correspond with them, secondly i would like to get a copy of the CA from Swift just to see if they have a copy, i think there is a letter and a fee to pay for this i believe can some one please enlighten me, thanks

-

I contacted the FOS today and was advised they couldnt investigate my issue due to the fact that the loan was prior to April 2007, they said i would need to contact OFT, which i subsequently found out dont deal with individual cases, they then directed me to consumer direct, who were helpful to a point and advised they would get trading standards to contact me, i also approached some of the online solicitors who stated they wouldnt take the case due to the loan being unregulated, being prior to April 2007 & also because it was a secured loan, so this company that act like loan sharks seem to be able to get away with taking away a house from pensioners with no recourse, comments please

-

Sparkie, excuse my ignorance, but how would i find a public access barrister

-

Thanks sparkie can you or anyone else recomend a good barrister that i can contact to look into this case.

-

Sparki were you refering to my post In my opinion this agreement is unenforceable, for so many reasons I cant count, It is impossible to understant the manner in which payments have been calculated.....it is without doubt a multiple agreement partly regulated by the CCA 1974...therefore the interest rate on the PPI should be shown an an APR in any event and it is not.......if the PPI is taken out of the amount of credit by the misselling it would affect the whole agreement and would in my view be declared void. My Advice Get genuine good legal advice off a good consumer law lawyer sparkie

-

this PDF should work Scan0002.pdf

-

-

how can i upload the copy of the loan agreement to this site, minus personal data of course....

-

-

Thanks Sparkie i will do that, however i no the PPI company as Sterling Ins Goup Ltd, how would i find out who the broker was, i will need to ask my stepfather, i suppose the biggets question is would the CA be enforcable,

-

dear all I have been looking through all the pages on this forum, i am asking for advice on a loan secured on my parents house. this is with swift, the loan we for 35k with PPI of 5.212.20, this loan period was for over 15 years, an unregulated credit agreement, taken out on 1/12/2006, details of the loan amount 35k monthly payments £452.29 over 180 months PPI 5,212.20 36 payments of 63.36 144 payments of 33.13, i have added the figures and the dont seem to add up. Total 36 payments 0f £515.95 then 144 payments of £485.72 I believe this has been increased due to applying higher interest rates. Fees payable Broker fee £1,500 Load admin fee £595.00 Title ind fee £135.00 Interest rate 12.25 pa variable The reason i post this is because the loan was sold to a 60 & 66 year old, who have no chance of fulfiling the payments over the next 12years and know my mother is 69 and my step father 63, they have kept up their payments however know due to hardship and no job, the ppi is soon to be cancelled and therefore will not cover any isues that may arise due to age, i appreciate that my parents were stupid to take the loan out in the first place and i have certainly told them, however that said the situation is becoming fruitless, i have looked at other options which includes providing some financial support, however there is a limit, i have looked at the form on page 1 of this thread and the CA form is the same. i would very much appreciate and advice, as it would seem whatever action happens they are going to loose their house under the current circumstances. i ca PM the credit agreement if someone wants to have a look

-

Curry's basically said they arnt going to do anythin until i prove there is a fault, and exactly what the fault is.

-

TV has now gone into an independant TV repairers to get an evaluation on the fault.

-

So if there is no EU Law, why did Tesco's cave in, and why all the publicity, including writings in papers, like the Daily Mail & the Guardian.

-

well i went to currys today, the store were very helpful, and one of the assistants even stated that if it was up to her then she would replace it, however to the nitty gritty, i spoke to the manager and advised regards to the repair or replacement, regards to the EU, the above post however knowledgable is incorrect as i have done alot or research on this issue, i had a long conversation with the manager of the store who then said they would take the TV in and have it inspected and or repaired, who promtly dissapeared afetr delegating to an assistant, so when the assistant spoke to the Curry's tech guy they said the total opposite that the wouldnt even inspect it yet repair it, so that was that, they couldnt repair so the next step was replace, however the assistant and the duty manager this time spoke to their head office, and i then had a conversation with their customer service guy, basically they havnt got a clue regards to the law, because if they did they would no i had done my research on this subject. so i was advised to again get it inspected, however i then asked if the TV was faulty within the 1 yr manufaturers garauntee would we be here disusing the issue to which he replied no, so with regards to the EU law that states that consumer items have a 2 year garauntee then tehere should be no issue, but i think that the shop assistants and even the managers and it would also see so do the customer service team havnt a clue, so to cut a long story short i have advised that i will be taking Curry's to the small claims court, i will be doing this for my own piece of mind and for the experience, but i will keep this post updated at every turn.

-

Out of Warranty TV advice please!

JHGlover replied to FerretloverUK's topic in General Consumer Issues

http://www.consumeractiongroup.co.uk/forum/general-consumer-issues/210085-expired-warrant-currys-tv.html#post2300997 -

Didnt get to Currys today, but will be there first thing in the morning, funny enough my cooker packed up yeterday as well, so we went of to buy a replacement, bought from Comet, whilst there asked him about the warranty issue with Currys. and what he would do, basically his answer was, As with all stores they have to honour the EU 2 year garauntee, however they wont, the only way i will win is if i take Currys to court, however Curry's just think they can fob you off and that will be the end of it, and with the majority people that is usually the case as they cant be bothered to chase, when i asked the shop assistant what he does, he replied "I buy the extended warranty" this is the shop assistant, so anyway i will be visiting Currys tomorrow morning with the TV and asking them for a repair or replacement, to at least give them the oppotunity to resolve the issue, if not, i am determined to take them to the small claims court, watch this space.

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.