-

Posts

380 -

Joined

-

Last visited

Content Type

Profiles

Forums

Post article

CAGMag

Blogs

Keywords

Everything posted by finaldj

-

Thanks for opening the thread. It's been a while since I updated this. So just a catch up. I had a number of debts some are still outstanding and just gone into default and handed over to LCS who as been trying to contact me. PRA group has 2 debts and had them since last year although they have only been emailing me they decided to start writing to me. The 2.5k debt I'm just getting emails at the moment. The capital one debt they threatend litigation in writing so I shot off a CCA request last week and they've come back with some information. A copy of the original agreement which has my first address on where I lived in 2010 and a list of statements dating back to 2010 - 2015 ending in 2015 when I got into debt with the card. They have given me 10 days to respond so at this stage should I offer a form of affordable month payments? The total debt is £1100

-

I understand about protecting the work force but her work said she needed to send proof in by forwarding the text message onto them showing she was tested and what the result was. They also asked if I or anyone in the house was tested and what our results were for "track and trace" purposes. Now I wasn't tested anyway but I work for the NHS my ward manager wasn't bothered about me being tested and my wife came back negative after 24 hours anyway. I understand her work needing to inform those she's worked with that she's getting tested and they then have the option to have a test themselves which in theory they should have done. I just don't understand why they need to know my results if there is any it's not even relevent to them? It would be upto me to tell my ward manager and between me and my company? I'm not fussed in the sense I just told my wife to let them know I didn't get tested but how far do you go with Covid19 that even an employer you don't work for needs to know my business? This isn't just aimed at me this is a general question of how far do you go if for example I was round a mates house they got the "virus symptoms" they let there employer know and get tested and tell their boss the results the boss then says what was your mates results. Who has access to what information?

-

Thanks for the links I have just had a quick look but they only seem to refer to an employer you work for rather than say me getting a covid test and my employer wanting to know anyone else in the house what their test results were. It might sound daft that she just has to let them know I didn't get it done or negative results so they know. But she has let them know her test result was negative and it should end there. I don't see why her work place should need to know what my results or anyone else for that matter that doesn't work for them?

-

My 6 year old wasn't well the other day had 1 episode of being sick and a mild temperature of 37.5c. Wife let work know who told her its company policy for her to go get a Covid swab. which she did and got the results back as negative 24hours later. We know what is was it was the pizza she had then night before didn't agree with her and her temp was back down to 36.4 not long after. Now her employer is asking what the rest of the house olds Covid swabs were? I never bothered getting tested not that I needed to as I knew it wasn't Covid with her and being sick 9 hours before hand isn't going to show Covid results in that instance. But I work for the NHS and had a Antibody test this week that came back positive anyway as had C19 about 2 months ago. The point being that her work said they need to know for track and trace. So whether I had the test or not I don't see why they would need to know my results? As she came back negative anyway that should be enough. I just feel that surley an employer I don't even know or work for has to know my medical record?

-

Looking for some advice, Me and the wife bought a car last year in April and I remember the dealer saying he would get the V5 sent off filled a slip out in the top right corner Skip till now the car is getting scrapped and just realised a new V5 never came through the post. It's been about 10 months. What should we do at this point ring the DVLA up and explain we never got one through the post or fill out a V62?. I've read about people getting fined but who is at fault her the dealer for not sending it off or us?

-

some Ebuyer items in order faulty - supplier dragging their heels

finaldj replied to finaldj's topic in Online Stores

Wish I had read the truspilot reviews first before he used ebuyer they are pretty bad at refunds to the point people have had to do a charge back on the card. No this is over 36 months with interest about £840 altogether. But he's using the TV set it up on the first day it came and was just assuming Ebuyer forgot to send the board and the first email back from them was they will look into it and get it sorted. Even to the point of offering another alternative board then took ages to sort that out just to say no. so the 14 days have already passed. I've never seen a situation like this where they have had to refund back to a finance company so not sure how it all works but can't do anything with Klarna atm because Ebuyer as messing about with the refund so as far as Klarna know there is no problems with the order. I'll as him to email them again see what they say as it's shut now for the weekend. Then take it further from there -

some Ebuyer items in order faulty - supplier dragging their heels

finaldj replied to finaldj's topic in Online Stores

He wants to keep some of the order. Half of the order was a tv so the pc parts only came to around £320. He has a CPU and Ram just no motheboard to go with it and it's a Ryzen build so wanted a board that was Ryzen ready rather than getting a board that wouldn't work without a bios update. So he hung onto the parts he has while they were sorting it thinking it wouldn't be an issue but then it's turned into a bit of a hassle because it takes days for them sometimes to email back. He tried to call them but everytime he said there is like an hour wait on the phone and the other day when he tried to call after being on hold 45mins they answered then hung up putting him back in another 30 min wait and he gave up. I think the issue now is he's keeping the parts he has which Ebuyer can refund Klarna the bits he doesn't have and that will adjust the payment terms (Looking at the Klarna site T&C) It's just waiting for Ebuyer to issue the refund which they seem to be messing around but in saying that I'm not sure what time frame they are allowed before you can start getting funny with them over it. I've read 30 days but this is on refunds of returned goods this is money they already have that needs to be returned to the finance company for goods not yet paid for which is £100. -

My stepson took out credit with Klarna finance to the tune of £700 on the 3rd February One of the parts ordered was a motherboard to go with some other pc parts that got delivered on the 10th February minus the motherboard. He emailed ebuyer to be told a load of crap. there was an error on the system for that board and for some reason couldn't order another one so offered a refund. He argued that finance had already been agreed and £700 was paid to them so in effect they had the money for the board and it was saying that 10+ was available on their site. After a couple of days and 7 enotes and a complaint on trust pilot it turns out they can't order a new board on the same account if one has already been ordered and failed it has to be refunded or paid for by another payment method. they offered a refund or another board same price or cheaper but not the same one. he found one cheaper and asked for that - to be told he can't have it as it's coming from the same wharehouse. they wanted their technical team to advise on another board direct from they're shop but he said they don't have any that are 100% compatabile with what he bought to go with it. he asked for a refund last thursday 13th February and chased this up on Monday 17th to be told it has been passed onto the refunds team and she will chase this up and will let him know when it's done. Its friday 22nd now and still no news of a refund going back to Klarna and since all this they've been sending emails and even an invoice from ebuyer the other day for the full amount of the payment terms. first payment comes out 18th March but Klarna said any issues with finance issues are dealt direct with Ebuyer. How long do you think he should wait that would be considered unreasonable for a refund?

-

My father in law went for power of attorney June 2019. This was because my mother in law has Vascular Dementia. I'm not sure how he got a signiture to be honest as she was already 2 years into a diagnosis and although she was somewhat with it I don't think she would have been in the know when it came to doing her signature as she would often drift in and out of reality and talk nonsense. However this was witnessed in a Solicitors who charged him about £1300. I have often had to help him out with getting bills, sky and other stuff sorted he's not so good at 77 in dealing with stuff like this while he hasn't gone into much detail about this I'm a bit concerend that it's taking so long reports on the internet suggest it should be done in 8-10 weeks he only told me he'd done this in January this year and the solicitors have said to him about 6 weeks ago it's still all going ahead. I'm just wondering if it should have taken this long? I haven't got involved yet but wondering if I should on his behalf.

-

I really need some help with debts & Stepchange

finaldj replied to finaldj's topic in Debt management and Debt self-help

Dear Customer Your tracking number: ****** Post Code:****** DX is a specialist delivery company appointed for the safe delivery of your order. Your parcel is scheduled for delivery to you by 08 Jan 2020 between 8am and 6pm. Your parcel will be delivered to: *********************** What if I am not in? Do not worry, if we are not able to deliver your package, we will leave a calling card or contact you via email to advise you of the options available to you for the safe delivery of your item. Alternatively, you can visit us at www.dxdelivery.com/redelivery to rearrange. Many Thanks DX Customer Services I thought it was a [problem] email so went direct to their site and put the details in from the email and it comes up a delivery for tomorrow. I havent ordered anything and not expecting anything either so not going to bother accepting it. What I don't want to do is sign for something then a DCA checks online to check for delivery and lifts a copy of my proof signiture and tags it onto some fake Creditor letter or something I know cabot weren't happy about the CCA request for that 11k by how the letter was worded compared to the other one from them. Where ever or whatever it is can go back and the sender can then contact me if it's something else. -

I really need some help with debts & Stepchange

finaldj replied to finaldj's topic in Debt management and Debt self-help

The only forms I filled out were CCA requests do they count as the same thing? -

I really need some help with debts & Stepchange

finaldj replied to finaldj's topic in Debt management and Debt self-help

Just a short update, Cabot have sent me a letter about 3 weeks ago to say the 11k debt was also unenforceable. They did say they were still looking into it and I should make every effort to pay them. They also had the £2400 debt which was also unenforceable. Intrum - They had a £1200 debt which is was unenforceable but did say they were taking 7 more weeks to gather the information they needed. So we'll see on that one This brings my total debt down from £28k to £13.4k PRA group as you said above have only sent emails to me so ignored them. Link financial do write to me sometimes but the last letter said they had taken a debt on from "Blank" so they forgot to put who it was so have left them for now and heard nothing. Argos, They have passed the debt onto Moorcroft but they are working on their behalf so left it at the moment. I did get an Email today from a company called DX to say a parcel was getting delivered tomorrow 8-6 and the tracking on their site which I checked externally to make sure it wasn't fake email comes up true. I haven't ordered anything so this is probably a debt collection agency getting me to sign for something so will probably just ignore the door and let it get sent back to the sender. -

I really need some help with debts & Stepchange

finaldj replied to finaldj's topic in Debt management and Debt self-help

Because it was suggested on here at one point. I got 1 letter from Cabot yesterday out of the 2 I sent stating the £2400 debt was unenforceable. I've still to hear about the 11k debt that they haven't written to me about yet. Intrum want about 7 weeks to gather the information. PRA group have around 2 of the debts but they never write to me only emails asking me to setup an account with them for the 2 debts they have. -

I really need some help with debts & Stepchange

finaldj replied to finaldj's topic in Debt management and Debt self-help

Just to update this thread. I've been paying littlewoods/Very £1 token payments for the last few months despite them saying they couldn't accept any payments because my incoming and outgoings didn't allow me to make a payment I still get letters/calls and emails from them. Argos - no payments have been made so far I've attempted to contact them via letter as they don't have any way of payment other than Debit card which they keep a copy of on your file and there is no account numbers on any letters to setup a bacs/SO payment as they want me to fill out my bank details via an online form so won't provide theirs to me. They've asked for an expenditure form which I sent back but they've not replied to that only last month defaulting my account and wanting full payment. They haven't passed the account onto a DCA yet. Link financial had the bank of scotland account but I haven't heard from them for months until the other day they wrote to me saying they had taken over an account of mine but missed it off the letter which account it was so I've left them for now as it was blank on the bit after it says the account we have is.... Cabot - they have 2 debts at the moment one for around 2.5k the other 11k however I wrote to them with CCA requests mid November and haven't heard from them yet. However they have stopped with letters and call since then. The only letters I have got from them recently were discounts to get the debts paid off early but nothing in anyway I could afford. Intrum - I sent a CCA request off to them at the same time as Cabot. They have my tesco account for £1,200. I got 2 letters from them today. the first letters is for 65% off the debt if paid in the next 2 weeks. the other letter says they are aware I have raised a dispute on the account. They are going to try and contact the original creditor and it may take several weeks to get this information They have suspended my account for the time being. They are asking for :- Details of what the dispute relates to Copies of any letters from the original creditor relating to the dispute Copies of any letters to the original creditor. Should I just ignore them? -

I really need some help with debts & Stepchange

finaldj replied to finaldj's topic in Debt management and Debt self-help

Just to update this post. Argos - wont accept any payments till I have filled out an income and out goings form should I do this? I was advised on here not to as it was none of their business? Littlewoods/Very account - this is an update from yesterday - they have totally ignored 2 letters sent to them now with an offer of £10 a month token payments £5 for each account. they sent me a text message for on open chat so I replied to this. I explained the letters sent and they have ignored them so far and I said they had a number of different address so can they send me the best one to contact them on incase I didn't get the right one. The text conversation went on regarding this letter and they again asked me to fill out and incoming out goings form on a link they provided which was very basic. It asked for "rent amount, heating, any child support I pay and council tax" the rest they said they didn't need to know as there was an industry standard they followed on what I should have left. Based on what I earned and what I filled in they said I had more going out than I had coming in I explained that after I had paid everything out not inc them at the min I was left with around £220 a month which about £100 was for food leaving me with about £120 left to get through the month on anything like bread and milk needed through the week so I was able to offer them £10. they refused to take anything and refered me to stepchange saying they are a responsible lender and stepchange will best advise me. I said I tried stepchange it didn't work for me and the only thing they can do for me now is suggest I go bankrupt that was the only option offered to me. So I said what about £1 a month token payments then till my wife at least finds a job which should be soon so my income should improve I can make better payments. They didn't want to know so I said well you are sending me threatening letters and phone calls asking for payments well above what I can afford but at the same time refusing any payment from me. His only suggestion was to place my accounts on default and eventually sell them onto a 3 party debt company and they might take up the payments. They have placed my account on a 30 day hold and suggested I contact stepchange in that time and let them know the reference number and will only deal with them. They have refused to talk further about my account at this point. -

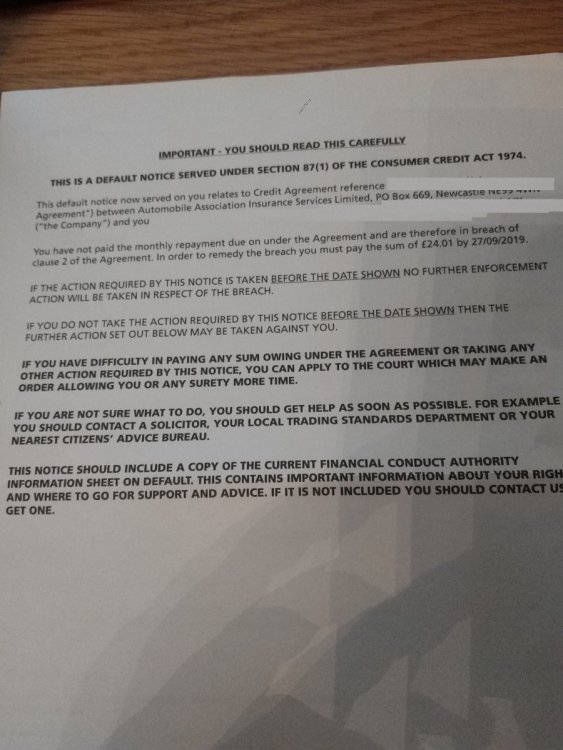

We have just switched house insurance from AA to another company ending our current contract with them on the 24th August. Wife called them on the 22nd to let them know we wont be going back with them and stopped the DD. However we got a letter on the 27th August to say a DD had been missed for £12.01 which they tried to collect on the 23rd and a further £12 missed payment charge. My wife said it's probably a cross over from the insurance thinking we were going with them on the 24th she said if she gets another letter she'll call them. the letter goes on to say (This letter is notice under section 86E and relates to a default notice this does not take into account of default sums which we have already told you about in another default sum notice, whether or not those sums remain unpaid) However today we did get another letter from AA saying they had issued a default notice for £24.01. The letter goes on to say if a payment is not made by 20/09/19 they will recover the amount of £23.68 from her debit card which she has authorised them to use to collect overdue amounts. Checking my wifes bank today she did in fact miss a £12.01 payment which was the last one to AA on the 23rd, She did think the last payment had come out in July so fair enough we can pay that. But it's just gone 2 weeks today can they issue a default that quick looking at the first letter on the 27th they appear to be saying they already issued a default notice before the 27th August letter. even the payment amounts don't add up. She is going to call them tomorrow or day after to sort it as it will be paid but not happy with the default notice after just 2 weeks.

-

I really need some help with debts & Stepchange

finaldj replied to finaldj's topic in Debt management and Debt self-help

From one of the letters Cabot sent me they are the owners of the Zopa loans debt for 11k left owing so I will CCA them The natwest account appears to be owned by Cabot but is managed by westcot so do I CCA Cabot? Intrum have the tesco debt and bought it from them in 2018 so will CCA them I will setup payment plans for the others. Is it just a letter for a CCA request or is there a small payment needed as well? -

I really need some help with debts & Stepchange

finaldj replied to finaldj's topic in Debt management and Debt self-help

Just an update to this thread. Likely Loans have taken my offer of £5 a month payment for 6 months to be reviewed in 6 months time. Argos have refused an offer of £5 a month instead they want me to fill out a financial assessment form so that they can then discuss what payments to make? Very/Littlewoods have so far not responded to the letter I sent which was the same date as Argos however I do have account details to setup payments for a standing order so should I do this or wait for a response back first? Westcot have now taken on the debt for HBOS from link financial (which says working on behalf of HBOS) Westcot have also taken a debt on for £2,407 it doesn't say what its for just that they are working on behalf of Cabot ( i assume its the Natwest debt) Intrum have taken on the Tesco Debt and Cabot have taken on the 11k Zopa loans debt Other than likely loans responding to me and me setting up a payment to them I haven't done anything with the other debts yet (other than writing to argos and Very/littlewoods, likey loans) I'm off work Wednesday so want to clear everything up so I know where I am I'm confused between who a DCA is and who the others are and who I should ignore and who I shouldn't? and should I do a CCA request if they work on behalf of? Cabot Intrum Westcot PRA group (they just call they haven't sent any letters out yet) Ok I just found out that Cabot bought westcot in 2017. -

I really need some help with debts & Stepchange

finaldj replied to finaldj's topic in Debt management and Debt self-help

Hi, Yes in the letter template from the site here I offered a £5 a month SO payment and asked for them to send their details so a payment plan could be setup until such a time as my situation improves. However the emails and text they send keep directing me onto their website where I can either pay by card or setup another DD with them. The DD is done through their own webform by me giving them my bank details to setup a DD there isn't an option with their details to setup a SO which is why I asked them to pass them onto me so I could set a plan up. they appear to have ignored the letter but keep sending me emails saying they can help me if in diffi culty etc and to give them a call

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

- Create New...