SunshineandRain

Registered UsersChange your profile picture

-

Posts

15 -

Joined

-

Last visited

-

Anna1s1 started following SunshineandRain

-

Has anyone had any experience of making a complaint to a financial authority about this firm? It is so surprising that they are still in operation, still selling insurance and still apparently using all kinds of tricks and methods to get out of or delay paying claims. I notice that this thread goes back some years and the same complaints are still being made about this firm. Recently found a review website with about 400 or more bad reviews at this Pet Insurance. Only a very few reviews were good. Some people had been paying their insurance for their animals for years with no pay out when they claimed after years of not making any claims. Sadly, this information got to me too late to avoid signing up for the product over a year ago for 2 pets! They still appear on the comparison websites as though they were OK. I have been waiting on a claim payout from pet-insurance.co.uk, the first pet insurance claim I've ever made, for some months. Unfortunately, I only found out about the reputation of this firm when the receptionist at the Vet Surgery told me today that they always ask up front for payment when people are insured with this firm! Now I have to make a second claim for a small operation unrelated to the first claim but for a larger sum. I am very worried that they will never pay out as it is a huge amount for me to pay. Apparently they have numerous delay tactics. Mine include so far: Sending an email reply to my claim asking for more information so that I had to go back to the vet again to ask them to send the information. Also the email was sent to my email address with only the name of the sender in the subject box. No mention of 'Pet Insurance'. Consequently it was overlooked. A letter was sent to me weeks later and so on and on...... As advised on this thread I will carefully record all these tactics and keep all correspondence, so would be very interested to hear from anyone who has complained to a financial monitoring authority.

-

Hello Slick132:) Thank you for your reply. Have been searching through all the paperwork and stuff kept in the loft but can't find anything to tell me what was changed at the bank. I do remember going to the bank and the loan being remade though. I will try now to learn how to start a new thread for PPI and claim back some bank charges if it is not too late to do that. Thinking about the years of distress Barclays have put me through, I am gathering everything together to make a complaint about them to OFT. We were good customers until we hit difficulties. Barclays have no 'real' procedures to help people who are struggling to pay. They treat everyone who can't pay as criminals, using threat and scare tactics and then passing or selling on personal and private information to Debt Collecting Agents. At the same time they spend millions on advertising campaigns to presents themselves as 'the good guys'. I would be grateful for any advice about how to go about making this complaint. Many thanks for your continuing interest and support:) Sunshine&Rain

-

First National/GE Money

SunshineandRain replied to bigcolin66's topic in Mortgages and Secured Loans

Hello atom02 GE Money sent me their version of an 'agreement'. From this document it appears that the loan was even worse than I first thought. The interest comes to much more than I wrote in my post. Also there were omissions from the 'agreement'. We were sold this loan under pressure and I think the nature of the loan was misrepresented. I think the way the loan is constructed may be seen as unclear. A friend has a similar type of loan with another loan company but taken out at about the same time. She paid and paid regularly for years, then when she rang up to check, they explained that she still owed more than she had originally borrowed. She had not understood the undertaking at all and was probably pretty desperate when she took it out. (I know sometimes there was no heating or lighting in her home at that time). I am gathering all the paperwork together. (Not an easy task), in order to write to OFT etc with a letter of complaint. At the moment I don't know how to word or send a complaint but I will ask forum members for advice when I've got it all together. Do you remember what the circumstances were when you took out the loan? How much selling pressure was going on? I would not have taken the loan had I understood how much I was going to have to pay back to complete it. I think there may be a great many people who did not understand the conditions of this type of loan. Much good luck with your battle S&R -

Hello Slick132 There are no signatures on the document/'agreement' sent to me as posted above, not my signature nor any from a Barclays person. I originally made the application by filling in a form on the internet when a loan was offered to me, automatically, through my internet bank account. The application was accepted online by submitting the form, then I was asked to call at the bank to complete the loan. I probably did tick the PPI box as I believed that I would have more chance of getting the loan if I accepted PPI and was pretty desparate :(to pay bills and payments. The loan just bought some time but the debts continued to spiral. When I visited the bank I think I can remember the loan being 'remade' and landing up with more than had originally been offered but I not certain of that. I haven't started a PPI thread yet but I will do. Many thanks for your continued help. Regards:) S&R

-

Hello Slick132 Thanks for your reply.:) There are no signatures on the agreement, mine or anyone from Barclays. I cannot think of any reason why I was mis-sold the PPI as I originally opted for it believing that I would stand more chance of getting a loan if I accepted it. Only thing is that somehow I had no idea that it would be that much money when I took out the loan. At that time I was not in a position to turn the loan down, even so, had I realised or checked the actual amount I would probably have not taken the loan. I have just received a letter from Debt Managers and another from Russel & Aitken. The one from Debt Managers says that Barclays are unable to provide the documentation I asked for in my CCA request and therefore they will return my account to Barclays and they will not be pursuing the matter further. The R & A letter says that the account is closed and referred back to Barclays. At first I was relieved by this but on thinking about it I think that Barclays may 'sell' the account details on to another Debt Collection Agency. I would be interested to know if you think they will, or if you think it is really closed. I would be interested to know if anyone else has had a similar experience with these DCAs and solicitors and if their debts were then sold on again. Many thanks for helping and supporting me through this awful situation. Regards S&R

-

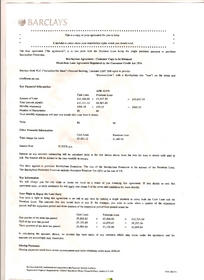

Slick132 Hello, thanks for the help. Here are the documents from Photobucket. Regards SandR:) Russell Aitken letter: Debt Managers Ltd letter: Barclayloan Agreement: Barclayloan Agreement: Barclayloan Agreement:

-

Hello Slick132 Sorry for delay in posting the agreement sent to me by Barclays at the request of Debt Managers Ltd, this was due to difficulties with scanning. The agreement is unsigned, by me or by any Barclays employee. The loan was applied for online but I was called in to the bank and the loan was completely remade. I had paid off a lot more than I remembered but with PPI and high interest rate there is still a huge amount to pay. Today I received a threatening letter from Russel & Aitken Solicitors and this is terrible, to be threatened with 'Court Action' and 'potential extra costs'. I have included this lovely item in the posted documents. Last week I sent a formal letter to Debt Managers putting the loan in Dispute because the copy of the agreement was not a true copy. Please advise me whether I should have blanked out the amounts before posting the documents. Please can you let me know if scanned documents can be read. Regards SandR

-

Hi Slick132 Many thanks for your help in creating a new thread for me. I am attempting to scan the agreement sent. I've got it all ready. The agreement was sent by Barclays at my CCA request in August, but it was not anymore than a copy which anyone could have made, so I wrote putting the loan in dispute. Having sorted the paperwork, the demands that Debt Managers are making bare no resemblence to the original loan. I think they may have added there own 'costs' or 'extras'. The loan was originally applied for over the internet but I remembered going to the bank and the amount being changed in the bank. There is a huge sum added on for Payment Protection. When I took out this loan I was quite desperate to help with other payments. Basically servicing loans with other loans. I was not aware of how much the original loan would grow and how much I would have paid after so many payments. I was able to keep up the payments for about two years and had paid about £6000.00. My husband entered an IVA agreement and we could not include some debts that were in my name because we would not have been able to meet the payment requirements. The debts that were left out in my name, I have been hounded for ever since, with constant phone calls and threats to turn up on my doorstep. The advice and letters I've got from this forum has helped me to deal with the problems as they arise. We had struggled to pay off ever spiralling debts for about ten years so I wish I had found the Consumer Forum earlier. It now makes me so angry when I think of all the people who don't have computers and don't find advice and help. When I look at the record of what we were paying, the interest rates, PPI, and 'extras' are outrageous. Again thanks for your help. Now to attempt the scanning process. SandR

-

Can anyone help with a similar problem re Barclays - Debt Managers Ltd? Have a similar problem with Barclays sending me an unsigned copy of a loan agreement that looks like a computer printout. This is dated June 2005. Can anyone help with advice as to whether it enforceable since it is dated before June 2007. This loan was taken out over the internet. I originally sent a CCA some months ago and received this printout/copy. I wrote a few weeks ago requesting the CCA again. Barclays denied having received my first CCA request despite the fact that it was recorded and delivered and they replied to it and sent the printout/copy! I have a letter saying they have no record of my original request, therefore they are going to ignore my second request and the failure to provide an agreement that I sent. This has bought them time to pass my personal details on to another Debt Collection agency, Debt Managers Limited, who are threatening me with the Count Court at Rotherham. Although I have written to Barclays continually over about two years since getting into problems repaying the loan, I have never had a sensible word from them or any of their offshoots or debt collectors. Just more and more threats on more and more computer generated letters. Reading the posts on the Forum has helped me not to panic and shown me what a bunch of predators are out there searching through data for anyone who is in an unfortuanate financial situation. Does the Data Protection Act work at all?

-

First National/GE Money

SunshineandRain replied to bigcolin66's topic in Mortgages and Secured Loans

My debt with First National/GE Money is unsecured. The debt collectors harassing me by telephone and in writing are Link Financial. I have sent a letter of complaint to Link and received a 'complaints form' from them today. I don't know how it will affect any official complaint I make if I fill in Link's complaints form . -

First National/GE Money

SunshineandRain replied to bigcolin66's topic in Mortgages and Secured Loans

Hello, also seeking information about First National/GE Money. We took out a loan in 2002 for about £6200 with add-ons to about another £800, dutifully paid the monthly payment of approx £122 until we encountered difficulties and had to stop payments. We did not realise what kind of loan this was. When the payments had to be stopped over £8000 had been repaid. If the loan had been paid until it ended, (120 months), we would have repaid more than £14600.00! That is a massive amount of interest! In 2008 my partner began an IVA agreement and this loan was included. Unfortunately the agreement was signed by both of us. Now, although my partner is paying 25% back to GE Money, they are harassing me for nearly £6000.00 and have passed on this originally very questionable loan to a company of even more questionable debt collectors. I would be very interested to know if any other Forum members have had similar experiences with First National/GE Money. I intend to report them but don't know how to go about that. Regards to all on Forum -

Debt Managers LTD and Barclaycard. Help needed!

SunshineandRain replied to sequenci's topic in Debt Collection Agencies

Thanks for the information PGH7447. -

Debt Managers LTD and Barclaycard. Help needed!

SunshineandRain replied to sequenci's topic in Debt Collection Agencies

Thanks for all the information of this thread. After long months of trying to communicate sensibly with Barclaycard, (and having details passed from one dubious debt collecting agency to another), I have received a very offensive demanding letter from Debt Managers Limited, 12 Hope Street, Edinburgh. When I sent a reply by recorded post, the receipt said that the letter went to Davidson Chalmers, LLP. When I put Davidson Chalmers into a search engine I found a website for one of the partners of this firm who appeared to be involved in property deals. His website makes no mention of involvement in Debt Collecting. Has anyone else noticed this on receipts for recorded delivery letters to Debt Managers Ltd, Hope Street? Does anyone know what LLP means? -

All new posters this is **important**

SunshineandRain replied to alanalana's topic in Payment Protection Insurance (PPI)

Thanks alanalana. -

All new posters this is **important**

SunshineandRain replied to alanalana's topic in Payment Protection Insurance (PPI)

Hello. Please can you direct me to the place to begin a new thread. This is my first post. I have been reading threads on this website for some time and would like say that it has sustained and informed me through months and months of harassment and intimidation from various debt collecting agencies. This forum has helped me to cope but this is still ongoing so I would like to ask for advice.

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.