Spamalot

Registered UsersChange your profile picture

-

Posts

1,786 -

Joined

-

Last visited

-

Days Won

1

Content Type

Profiles

Forums

Post article

CAGMag

Blogs

Keywords

Everything posted by Spamalot

-

Thank you Andy, *Update* I finally received a hearing date for this claim at the tail end of last week. Within a few days I also received an email from Lowells containing a 'Notice of Discontinuance' So, Happy days! Once I have received confirmation from the court the shredder will be out, as will the bonfire. I just want to say a huge thank you for the guidance I have received over the last 12-13 years, especially Andyorch for being there since my first claim back in 2009, and to dx100k for his patience this time around. I have won some and lost some, but all in all I have come up smelling of roses thanks to CAG and their team and saved myself 10's of thousands of pounds. I'll never be rich but at least I am no longer in debt This claim marks the final chapter in the " Book of bad debts by Spam" So WooHoo! FREE AT LAST!!!

-

Thank you Andyorch, that's extremely helpful. The default they are saying that's not needed, according to them was served in 2008, the alleged loan was for 7 years taken out in 2005, so they are contradicting themselves left right and centre. Despite the fact that I have made a huge faux pas in engaging with Lowell with regards to mediation, it has actually given me a heads up in to how they were going to attempt to ambush me. I've informed the court and the mediation service that I won't be partaking and I shall sit here quietly waiting for the next move. Spam

-

Hi all, I filled in the allocation questionnaire, sent it to Lowell and the court agreeing to mediation. Lowells response was to send me a Tomlin Order. I contacted Lowell to inform them that I would not be signing their Tomlin order and advised them I had only agreed to mediation in the hopes that they would provide some documents. I then received another email basically trying to bully me into admitting I had this alleged account/loan. I decided that mediation was no longer a good idea and have cancelled it and elected to go for a hearing. At least the Judge will see what trash they have provided me with as 'evidence'. One thing Lowell has said is that they do not need a default notice as the alleged loan is now past its fixed term.... is this correct or is this another dirty tactic? I always thought one was needed to legally enforce a debt. Perhaps those in the know can advise me. Thanks in advance.... Happy days, Spam

-

Thank you both. My defence was as vague as their Claim. 1. I am the defendant in this claim and litigant in person. All allegations made by the claimant are denied. 2. The defendant does not recognise the alleged agreement xxxxxxxxxxx as mentioned in the particulars of claim therefore it is denied that any such agreement exists. 3. The defendant has requested copies of the alleged agreement under Data Subject Access Request, Consumer Credit act 1974 s.77/8 and Civil Procedure Rules 31.4 but to date the claimant has failed to provide a copy of this document. 4.The defendant has also requested copies of the default and termination notice for the alleged account xxxxxxxxx as required to legally enforce the alleged debt, but again the claimant has failed to provide either. 5. In addition the defendant has requested copies of statements for the alleged account xxxxxxx showing the amount of monies allegedly owed to the claimant. To Date these have not been provided. 6. The defendants view is that this claim is vexatious and an abuse of process as the claimant has failed to provide any documentation to support their claim and respectfully requests that the said claim be struck out. As an aside, I noticed that the 'statement' they did provide had a different figure on it to what they are claiming, so I will hopefully be able to flesh out quite a bit in my skeleton argument. Spam

-

I Submitted my defence last weekend,. In short, denying all allegations and requesting that the claim be struck out as claimant has no documents to support their claim and have failed to provide any evidence whatsoever that any monies are owed to them by me and I considered it an abuse of process. I have now received their directions questionnaire where they are championing 'Mediation over the telephone' Should I agree to mediation once I receive the questionnaire from the court bearing in mind the dispute is about the existence of the alleged account and the lack of documents to prove it exists/ existed? All I can say in mediation is that I've never heard of the account...... Do Lowell have to provide documents to the mediator? Thanks in advance for any advice offered and sorry if the answers can be found elsewhere, but I'm not sure where to look Spam

-

Apparently Copies of Default, Enforcement, Termination and Assignment notices are not saved by Customer name so Halifax are unable to provide copies under a DSAR. I have contacted the DSAR team today because the only glossary of terms missing relates to recoveries, therefore I'm having difficulty completely understanding some of the terminology. With regards to the potential write off of the loan in 2015 there is an entry on the repayment sheet listed under WRO , Bad Debt account transfer and the balance is set to 0 On an accompanying sheet there is an entry, among others that says ' Set recoveries write off' There are no other mentions of the account being written off before the sale to Lowell in 2019. These entries are on the same day in Feb 2016. Without the glossary I can't be sure what the 'WRO' stands for so I'm hoping that they will send me the list I've asked for...... although the phone call asking for it was like pulling teeth... Spam

-

I think the 17 December just relates to my SAR request and when it was processed by them. The account was sold to Lowell in December 2019 under the account number I don't recognise apparently. I'm sure I saw something about the account being written off on one of the Westcott screenshots, but I need to go back and find it again.

-

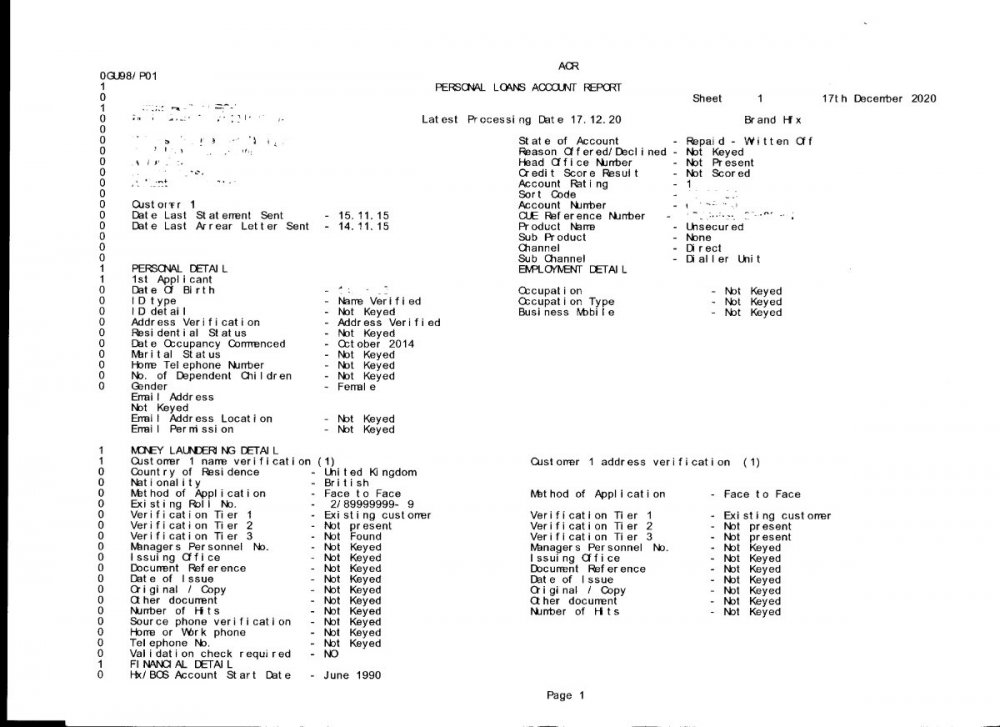

It was set to zero in 2015, and that’s when it ‘switched’ account numbers. It says on the loan report ‘state of account is repaid - written off’ As far as I can make out, the original loan account ceased to exist in 2015. Again, happy to stand corrected as there is so much stuff in the SAR and it’s incredibly confusing!

-

Mystery solved! The original loan was written off in November 2015, ( last arrears notice and statement dated around then all sent to my correct address) the Halifax then wrote to me at an old address in February 2016 (the one where I lived when the loan was taken out) and informed me that the debt was being transferred to Westcott because a suitable repayment plan hadn't been arranged..... this is despite my regular monthly payments to them...... shady tactics!.... In this letter (only seen because of SAR) it quoted another number as the account number..... this I have now discovered is my customer ID with the Halifax. I never paid Wescot, who managed to write to me at my correct address too, because they used my 'customer ID as the account number, and I'd never received the letter from the Halifax. because I had continued to pay the Halifax by standing order for a debt they'd written off and the loan account no longer existed, they transferred the repayments to the account that they eventually sold to Lowell. the upshot is, the loan account I originally had, according to the Halifax is fully paid.... in fact overpaid due to their less than transparent actions. Apologies if I have confused everyone, but I know what I mean! Spam.... with a headache...

-

What they have sent is the application form for the original consolidation loan taken out in March 2005. It does have my signature. After it was defaulted, I paid regular arranged instalments on that loan to the Halifax until I changed bank accounts and failed to set up a standing order with my new bank. Although not particularly affordable, I probably would have paid Lowell’s if the assignment had been for the account number I recognised but I genuinely had no clue what the account number they had been assigned was so I ignored them. As I also hadn’t had any statements for a couple of years I couldn’t say for sure that the amount assigned was right either. So all the stuff provided relates to a loan I had with the Halifax, but none of it has the account number assigned to Lowell’s on it. The default screen grab just says that a default notice was sent out in March 2008, quoting the account number that Is on the loan agreement. The Halifax confirmed to Lowell that they don’t have a copy of the original in their records. ( this information came from the SAR I sent to Lowell and was also mentioned in the SAR from the Halifax.) Should things go pear shaped for me, I’ve discovered through the SAR that a bunch of unlawful charges were added to the loan before it was defaulted so I’ll see if there’s anything I can do about those .

-

Andy.... I have been through my SAR and none of my ex account numbers tally with it. I have however found a sheet referring to that account number, and I would definitely say that it is a 'receiving account' because as I have been repaying my loan instalments the balance in that account has increased by that amount. So if I've read it correctly, the Halifax have sold the account that I have been making my repayments into and not the actual debt. Again, I could be totally wrong, but I can find no other reference to that account. I guess it will all come out in the wash when it reaches court. I also know from the SAR that there is no default notice on the system, so if one magically appears I can challenge its authenticity. I've yet to find a copy of the assignment, but I shall keep on looking. dx.... definitely interesting!

-

Thanks dx. I have sent off the CPR 31.14 request. Whilst going through my papers I believe I have discovered what the mix up is. Back in the day, when Blair Oliver and Scott were 'collecting' the bank account number they were asking for repayments to go into is exactly the same as that which has been assigned to Lowell. This might seem a stupid question, but does that mean the Halifax have assigned their own bank account? I'm assuming that If I'm paying into it to pay off a loan it wouldn't belong to me..... Happy to stand corrected if anyone out there knows how mechanics of these things work. Anyhoo, I have received my SAR from the Halifax today and can't find anything so far in relation to that bank account number other than it's been sold, but I've got a lot of papers to sort through, so watch this space..... Spam

-

Thanks Andy, I've uploaded the docs they sent as a result of PAPDC notice request and SAR. There is another sheet of 'statement' but I don't think it adds anything to the mix. On all the documents provided the account number format is x/xxxxxxxx-x the account number they have been assigned and are claiming for is a bank account number format xxxxxx xxxxxxxx I'll crack on with the 31.14 asap Lowell_docs.pdf

-

Name of the Claimant ? Lowell Portfolio Ltd Date of issue – 27.Jan 2021 Particulars of Claim What is the claim for – the reason they have issued the claim? 1) Defendant entered into an agreement for a Halifax (Unsecured Loan) account under reference XXXXXXXXXXXXXX (the agreement) 2) The defendant failed to maintain the required payment and the service was terminated 3) The agreement was later assigned to the Claimant on xx/xx/xx and notice given to the defendant. 4)Despite repeated requests for payment the sum of 2,600 remains due and outstanding And the claimant claims a) the said sum of 2,600 b) costs What is the total value of the claim? 2,800 Have you received prior notice of a claim being issued pursuant to paragraph 3 of the PAPDC (Pre Action Protocol) ? yes Have you changed your address since the time at which the debt referred to in the claim was allegedly incurred? Yes Did you inform the claimant of your change of address? Halifax were notified of my change of address Is the claim for - a Bank Account (Overdraft) or credit card or loan or catalogue or mobile phone account? Unsecured personal loan When did you enter into the original agreement before or after April 2007 ? Before Do you recall how you entered into the agreement...On line /In branch/By post ? in branch Is the debt showing on your credit reference files (Experian/Equifax /Etc...) ? NO ..... account they are quoting never has been, the account number not assigned dropped off a couple of years ago. Has the claim been issued by the original creditor or was the account assigned and it is the Debt purchaser who has issued the claim. Assigned to debt purchaser Were you aware the account had been assigned – did you receive a Notice of Assignment? I received a notice of assignment of an account number I don't recognise Did you receive a Default Notice from the original creditor? Not for the account number assigned Have you been receiving statutory notices headed “Notice of Sums in Arrears” or " Notice of Arrears "– at least once a year ? No, not for the account number assigned, up until November 2015 for Halifax Loan Why did you cease payments? I have never paid anything to the account number assigned.... The loan that I did have with the Halifax I had an arrangement with and failed to transfer the standing order when I changed bank accounts... Then life got in the way and I forgot What was the date of your last payment? I believe it was May 2018, but not certain as bank account is now closed. Was there a dispute with the original creditor that remains unresolved? No Did you communicate any financial problems to the original creditor and make any attempt to enter into a debt management plan? Yes What you need to do now. Answer the questions above If you have not already done so – send a CCA request to the claimant for a copy of your agreement (If Applicable)

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.