gazab41

-

Posts

224 -

Joined

-

Last visited

Content Type

Profiles

Forums

Post article

CAGMag

Blogs

Keywords

Posts posted by gazab41

-

-

I haven't had relationship breakdown and no work so had problems in my head, getting sorted mind would just like to get rid of allience and liecester/ Santander once and for all

-

Ok guys advise needed again on this

received a few letters at my previous address from Moorcroft re Santander who took over allience and liecester

last one threatened a visit to the property owned by girlfriend,

of which I moved out of last year when we had a blip in our relationship.

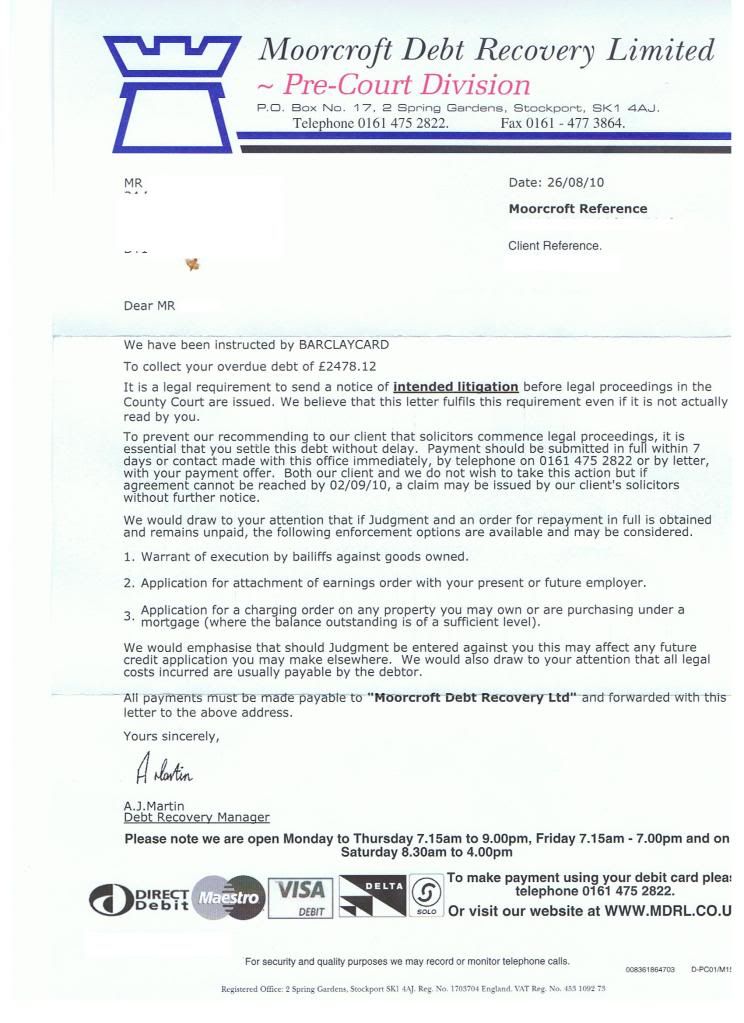

Today I recived the following letter.

At new address

It reads thus

Dear Mr

We are agents of Santander(uk) plc

Their records show that the above account has an outstanding balance.

They have therefore asked us to contact the account holder to discus the account and we have been provided this address by a credit reference agency

that supply us with address links based on information they hold.

Please contact us to confirm the position and so that we can make appropriate arrangement

However if you believe that you are not the person responsible for the account it is important that you contact us immediately either by telephone or letter.

Thank you for your cooperation in this mater.

The only thing on letter is a 12 digit morcroft ref followed by in brackets one letter a dash followed by 2 letters and 3 numbers.

If you look back to 2010 Santander sent stat of account showing I owed nothing

payment protection was also applied on this account which I was miss sold

thanks

if some one could advise be great full thanks.

-

ok all this has now gone from lowells to Fredricksons.

Letter reads as this

DO NOT IGNORE

IMMEDIATE PAYMENT REQUIRED

We have been instructed by Lowell Financial Limited who have passed this account for collection of the outstanding balance. As we have been appointed as their agent you should now make contact with us and not lowell Financial Limited. We are athorised to contact you to secure repayment of the debt.

You have failed to pay the balance of £2502.19 which remains outstanding despite previous repeated requests for payment. Our client now requires payment in full to avoid further action.

You must contact us imediatley on 0845 3136625 to discus the mater further.

Payment should be made to fredricksons etc

thing is card number is again incorrect as again states barclay card and this was a msdw card with a flawed cca any advice please re letter to send these thanks

-

oh last time i paid anything towards was 2009 the figure was always going down previously... but has gone up for whatever reason never sent any arrears notices either!

-

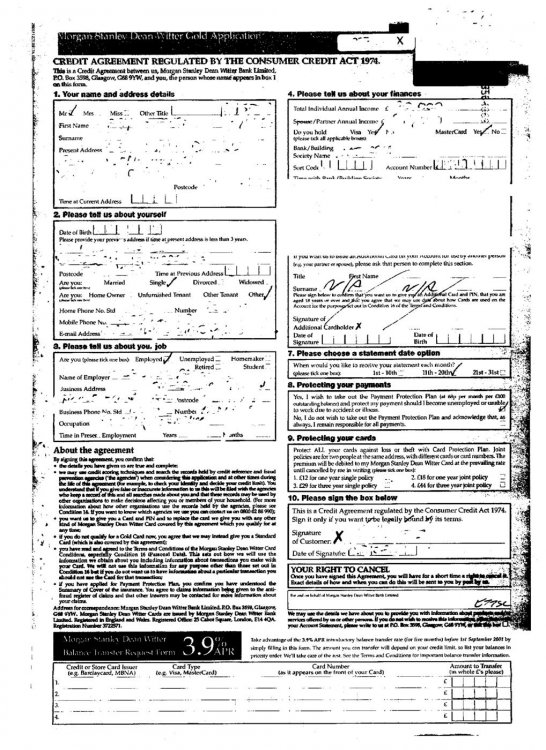

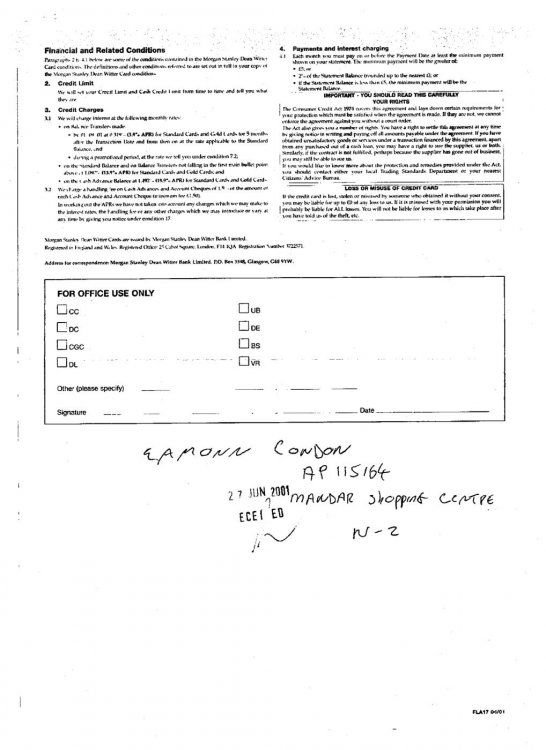

yes signiture on it but it is an application for msdw gold card which was not what i had done in shopping centre nothing else ever sent to me. except a card not even terms and conditions..... this is an application form with bits missing

-

-

ok I recived the following from Lowells, first was some copy statments from the days barclaycard took over morgan stanley account, I have now recived a 2 page application form which to me looks like a fantastic cut and paste job, followed by a demand from lowells to pay up. help needed please..

http://www.consumeractiongroup.co.uk/forum/asset.php?fid=30779&uid=244572&d=1336574567

-

ok Prove it letter sent and in reply dated 15 th of March I recive the following

Dear SirThank you for your recent correspondence, the contents of which are noted

We can confirm that the balance relates to a barclaycard account opened on 29th June 2001 with an account number of 5301************ and a card id of 5301************ the last payment recived was a £1.00 on * September 2009.

We understand that you have no knowledge of this debt and are unclear how it accrued.

In order to provide you with furthur details with regards to the outstanding balance, we have contacted Barclaycard to request information. We have placed your account on hold in the meantime.

Thank you for your Patience.

Ok this Account was Opened as Morgan stanley then Migrated in 2008 to Barclaycard from morgan stanley the card ID number they quote is indeed the number barclaycard gave to morgan stanley card which was last used in 2003 and the orig amount of credit was £2800 and I certainly paid at least most of it back before Barclaycard took it over as had payment plan intrest frozen etc. both numbers quoted relate to barclaycard cards, so am very confused £1.00 payment i belive relates to payment for CCA which still has not been recived.

Any help would be gratefull on this.

-

ok still have not sent prove it letter, i have had allsorts of offers from lowells including free christmas gifts worth about 250-300 pounds if i contact them today i recived an aledged statment of account.

this gives a lowell ref number.

A credit agrement date of 29/june 2001

a card number starting 5301 this is a barclaycard number

anyway card number wrong and the MSDW migrated to barclay card in 08

I will now send prove it letter idiots

-

Hi have recived another Demand from Lowells who now owe the debt apparently, still no cca and the amount has gone up again.

the thing with this the card number again quoted is nothing to do with me is there a letter from earlier i can post them thanks:evil:

-

ok all advice needed had letter from lowells own account now notice of assignement sent etc.

however there are a number of issues still no CCA, Amount gone up again and they have got the account number wrong out 0f 16 digits only first 5 match and another 6 appear in the account number but in the wrong place. just wonder what next move is thanks

-

HI all just want some advice, Im working as a supply teacher and last monday was involved with Accident at work. whilst teaching class a whiteboard about 10ft by 4ft crashed down from wall hitting me across right shoulder, was looked at by school first aidder and reported in accident book with a request for local council heath and saftey team to look into it, was told no problem if i went and had it checked out local hospital that afternoon.

There caretaker also spoke to me and i belive jokingly said you are not going to sue us. on monday evening it had started to swell up, I had very little sleep and by tuesday morning was very painfal to use right arm. I phoned school left answer machine message explain I would need first lessons covered as

not sure how long would be in hospital, left my mobile number and said i would keep them updated, I then let my agency know what had happened preivious day.

Agency contacted me back stating for me just to get to school as soon as I could. got to hospital which is local to home address about 9am and had to wait till about 10.15 am to be seen. I let the school know this they also stated thanks get in as soon as you can.

I was sent for xrays etc and about 11am was told no breaks only soft tissue damage take pain killers and anti inflamatorys for next week and do excersises to restrenthen arm.

I phoned school again and let them know i would be there asap rely on train etc which takes arround 1.5 hrs to get there.

I arrived arround 12.45 which is towards end of lesson 3 . on a tuesday i teach lesson 1 and 2 morning and lesson 4 in the afternoon.

I then submited timesheet for full 5 days which was rejected stating no arrival till 1pmish, asking for resubmission am guessing 4.5 is what they want me to put down,

need to contact agency on monday re this would it be worth making a claim for injery thanksany advice gratefully recived.

ps whiteboard had hit 1 teacher before and just missed another cartakers have just rehung it thanks in same way

-

thanks for looking here are answers to questions.

1. no answer from FOS

2. was addvised against need to sar companies as they stat no CCA HELD will now if need to, and do i send one to hfc and another to marbles(avimore finance Halifax)

3. should i send cca request to capquest or wait.

4 have recontacted oft this morning about harrasment and have been given email to respond too, told they are building file on capquest thanks all

-

-

ok herew is full update and an SOS for Letter to send to Capquest.

ok account was on hold until following letter arrived which included copies of letter from post 9 and 10

http://img192.imageshack.us/i/capquestlettergmarch201.jpg/

then I recive the following

http://img683.imageshack.us/i/21stapr.jpg/

followed by the next threat taking me to court LBA

http://img19.imageshack.us/i/13thmaymarbles.jpg/

and today i receive a notification of statatory demand need a letter to counter with as the copy of letter sent from marbles is older than my last corespondence from them thanks

-

ok on sat I recived a letter from MKRR in relation to this card

i will post below the wording of this letter.

04/05/2011 our ref (letter followed by 4 numbers)

Dear Mr

I am writing to you regarding your outstanding balance, with the objective of finding a solution to resolve this debt.

ignoring this letter will only result in making this situation worse and we strongly recomend you contact us upon recipt of this letter.

we are in a position to offer a payment arrangment to resolve the problem if you contact us straight away, alternatively you can make payment at any postoffice or paypoint using the bar code to the right.

if you ignore this you will leave us no option but to continue our collections activity.

1. nowhere on this letter is any referance number that relates to any barclaycard account only this is there own ref number (3 letters followed by 7 numbers)

Today we got a phone call at 18.30 asking to speak to me I then asked them who they were and they stated they were MKRR part of barclaycard. I stated they had the wrong number and appoligised for ringing

Which letter that I have previously posted should I send these guys this account was unlawfully terminated, No terms and conditions nothing recived for Sar and i know ppi was applied at one time where do i go now.

-

ok I recived a letter from Barclaycard on weds 20th april stating account had been assigned and transfered to MKDP LLP on 21st March.

states I owe them £3148.46 at this moment have recived nothing in way of CCA or Sar details and this goes back to Aug 2009 not even recived terms and conditions Advice please!

-

ok today after several months of account being on hold i recived the following letter.

-

hi all this Account transfered from Moorcroft to Westcot earlier this year.

I recived 2 letters from this DCA including final notice, followed by a letter from "nelson guest soliciters of sidcup"(sent from westcots hull address.

I then sent the 2 companies the following letter.

Dear Sirs

I am receipt of your letter, dated 11/03/11, which was received today, Westcot ref:

This account is in serious dispute with Barclaycard, the details of which are none

of your concern. You must however read the later paragraphs concerning home

visits and data protection.

TAKE URGENT NOTE:

I DO NOT

WISH TO RECEIVE ANY REPRESENTATIVE OF YOUR ORGANISATION, OR INDEED AN AGENT OR

REPRESENTATIVE EMPLOYED BY ANY ORGANISATION THAT YOU ISSUE INSTRUCTIONS TO.

There is only an implied license under English Common Law for people to be able to visit

me on the property where I resided without express permission; the postman and

people asking for directions etc (Armstrong v Sheppard and Short Ltd [1959] 2

Q.B. per Lord Evershed M.R.)

THEREFORE TAKE NOTE THAT I REVOKE LICENSE UNDER COMMON LAW FOR YOU, OR YOUR REPRESENTATIVES

TO VISIT ME AT THE PROPERTY WWHERE I RESIDE AND IF YOU DO SO, THEN YOU WILL BE

LIABLE FOR DAMAGES FOR A TORT OF TRESSPASS AND ACTION WILL BE TAKEN, INCLUDING

BUT NOT LIMITED TO , POLICE ATTENDANCE.

I also

caution you here that should you ignore my request on this point; the actions

of your representative(s) will happily be recorded by video recording equipment.

Accordingly I reserve the right to use any evidence of you or your

representatives’ ignoring this request in connection with any actions that I

choose to pursue, including media exposure.

Should it

be your intention to disregard my wishes, and break your obligations, please be

advised that the following rules also apply, as laid down by the OFT in respect

you, as a holder of a consumer credit license, are obliged to follow:

The

areas of the OFT guidance which applies to you in this instance are:

Debt

collection visits

2.12

Examples of unfair practices are:

a. not

making the purpose of any proposed visit clear, for example, merely stating

that collectors or field agents will call is not sufficient

f. visiting

or threatening to visit debtors without prior agreement when the debt is

deadlocked or disputed

Deceptive

and/or unfair methods

2.8

Examples of unfair practices are as follows:

k. not

ceasing collection activity whilst investigating a reasonably queried or disputed

debt.

Please note you may also consider this

letter as a statutory notice under section 10 of the Data Protection Act to

cease processing any data in relation to this account with immediate effect.

This means you must remove all information regarding this account from your own

internal records and from my records with any third parties and credit reference agencies.

Please confirm that you have complied

with my request under section 10 of the Data Protection Act.

If Westcot Credit Services Ltd or Yourselves process

or continue to process my information, then you will be complicit in the

current breaches under the Data protection act. I am sure that Westcot Credit

Services Ltd and Yorselves will be aware of the penalties and fines involved.

I do believe this makes my position clear and unambiguous

I then recieved the following letter dated 21st March 2011

[Dear Sir/MadamClient Rederence

Westcot Debt Number

Client Barclaycard

Balance £2502.19

Further to your recent communication.

When you signed the contract with our client, it was stated in your terms and conditions that your account may be passed to a third party to deal.

In view of the above we require you to contact or office to discuss repayment of this account.

Payment can be made by Debit Card/Credit Card (subject to acceptance) by calling the westcot Payment Hotline on 0844 824 1155 or pay online at _www.paywestcot.co.uk.

Alternatively telephone us to set up a direct debit or standing order. you can also use paypoint or by sending a cheque or postal order t/o the address below. please ensure your westcot debt number is quoted at all times

Just wonder what my reply should be still no CCA card was MSDW migrated to goldfish the back as morgan stanley then Barclaycard so I have never signed a contract with thier client at any rate any advise please... thanks

-

:mad2:Ok here is an update on the current saga . I will post all documents sent to me until October 2010. Nothing recived since.

2 letter sent in response of my letter of end of Aug

Uploaded with ImageShack.us

3 letter sent on 7th Oct 2010 litigation warning

4 letter sent on 23rd sept instalments

5. letter sent on 23rd sept discount offer

Uploaded with ImageShack.us

Today jan 14th we had a personal debt collector from Moorcroft arrive he did leave when my girlfriend asked him too he did not see me as was in the shed sorting out garden tools and when she threeten to call police he went. Moorcroft were sent letter in Aug about dispute no visits but just turning up is not on I dont even have intrest in property I just live there. please help with the next letter I could send still no cca.

I have not sent unlawful recinsion letter yet please help with the correct response thanks

-

ok this is the leter arrived yesterday from capquest and orig told by 1st credit it would go back to marbles.

what should i do next as no cca etc and belive i have paid most of orig amount off anyway confirmation from marbles no cca

thanks all

-

Ok today I have recived a letter from Apex Credit Management.

should i send them the same letter i sent moorcroft re serious dispute the amount i owe as gone up again now if its terminated etc it should not in my humble opinion.

-

have sent the following letter to moorcroft

1st September 2010

Dear Sir

I am receipt of your letter, dated 26/08/10, which was received today, your ref:).

This account is in serious dispute with Barclaycard, the details of which are none of your concern. You must however read the later paragraphs concerning home visits and data protection.

TAKE URGENT NOTE:

I DO NOT WISH TO RECEIVE ANY REPRESENTATIVE OF YOUR ORGANISATION, OR INDEED AN AGENT OR REPRESENTATIVE EMPLOYED BY ANY ORGANISATION THAT YOU ISSUE INSTRUCTIONS TO.

There is only an implied license under English Common Law for people to be able to visit me on the property where I resided without express permission; the postman and people asking for directions etc (Armstrong v Sheppard and Short Ltd [1959] 2 Q.B. per Lord Evershed M.R.)

THEREFORE TAKE NOTE THAT I REVOKE LICENSE UNDER COMMON LAW FOR YOU, OR YOUR REPRESENTATIVES TO VISIT ME AT THE PROPERTY WWHERE I RESIDE AND IF YOU DO SO, THEN YOU WILL BE LIABLE FOR DAMAGES FOR A TORT OF TRESSPASS AND ACTION WILL BE TAKEN, INCLUDING BUT NOT LIMITED TO , POLICE ATTENDANCE.

I also caution you here that should you ignore my request on this point; the actions of your representative(s) will happily be recorded by video recording equipment. Accordingly I reserve the right to use any evidence of you or your representatives’ ignoring this request in connection with any actions that I choose to pursue, including media exposure.

Should it be your intention to disregard my wishes, and break your obligations, please be advised that the following rules also apply, as laid down by the OFT in respect of debt collection, and that you, as a holder of a consumer credit license, are obliged to follow:

The areas of the OFT guidance which applies to you in this instance are:

Debt collection visits

2.12 Examples of unfair practices are:

a. not making the purpose of any proposed visit clear, for example, merely stating that collectors or field agents will call is not sufficient

f. visiting or threatening to visit debtors without prior agreement when the debt is deadlocked or disputed

Deceptive and/or unfair methods

2.8 Examples of unfair practices are as follows:

k. not ceasing collection activity whilst investigating a reasonably queried or disputed debt.

Please note you may also consider this letter as a statutory notice under section 10 of the Data Protection Act to cease processing any data in relation to this account with immediate effect. This means you must remove all information regarding this account from your own internal records and from my records with any third parties and [/url]credit reference agencies.

Please confirm that you have complied with my request under section 10 of the Data Protection Act.

If Moorcroft process or continue to process my information, then you will be complicit in the current breaches under the Data protection act. I am sure that Moorcroft Debt Recovery Ltd will be aware of the penalties and fines involved.

-

ok have not sent unlawful recinsion letter yet however have recived this letter from moorcroft.

should I send something back re dispute and then send Unlawful recinsion letter to Barclaycard any help please.

Gaza B v Alliance and Leicester

in Payment Protection Insurance (PPI)

Posted

this is a really strange one tbh, they have agreed a pay back of ppi.

But very strange there was in theory 3883.64 owing on account In 2009, this includes the 2146 pounds PPi single premium added at beginning of loan , they then calculated interest based on the 35.77 PPi payments I made over 36 months.

So total figure offer of 4093 net however they are then taking the full arrears amount off what giving me.

209 after tax which doesn’t make any sense as obviously redress is supposed to put in a position pre ppi.

The arrears figure without ppi would be 1737 approx, have a document showing 0.00 owing that is on the thread.

They sent transactional history showing these arrears written off for some reason in 2010.

Admitted they don’t have records either they have admitted this in writing .

I have calculated that purely the 35.77 payments plus stat interest would equate to a lot more then offer even if just gave me that minus the arrears which should be 2000 less.

Ps asked me to send income and expenditure so they can decide if to pay me redress and not use to pay arrears, fos want to take it on as odd not seen this before.

Thanks again

may also add if you look at my old post the figures they quote includes the original charge for ppi, so don’t understand how they can give me that back then take it off arrears which includes the ppi amount.

They state account written off in 2010 but as you see in other post they were still chasing in 2013.

Why would they ask me to send income and expenditure to see if they can pay me the lot.

Fos looking at taking it on as not putting me back in position I would of been in if the PPI could of been claimed in the first place when lost job years ago I would be in a better position and certainly would not have ended up with large overdraft with own bank any help appreciated even if draft income form thanks

They calculated payment of 4093 after tax removed

break down original ppi amount plus the interest on what I actually paid which is 35.77 x 36 months

orig ppi charge 2146

interest is 1999

approx figures

arrears listed 3883 which includes the 2146 ppi charge without that should be 1737 owed