kellemeek

-

Posts

17 -

Joined

-

Last visited

Content Type

Profiles

Forums

Post article

CAGMag

Blogs

Keywords

Posts posted by kellemeek

-

-

yeah its 4 blue pages long. I have sent the section off asking for another 14 days because i want to defend the claim.

Could i not just write up a defence to the court and attach the letters recieved from Next to the blue court papers or is it better to get the n244 forms?

-

and will i have to attend the court because its about 150 miles away from my home town and i am due to have a baby in the next 3 weeks.

-

Hi there,

Is this the form?

Do i send this off to the courts with photocopies of the letters next sent me and also the court fee? Or do i send the form off with the fee?

Im stuck as to what to do.

-

I will try too yes, i dont know a great deal about computers as you can tell. But please be patient with me and i will try and do my best.

-

Hello there,

I have resized the last one

Hope you can read it.

-

Please treat this letter as my request made under CPR 31.14 for the disclosure and the production of a verified and legible copy of [each of the following / the] document(s) mentioned in your Particulars of Claim:

1 the agreement. You will appreciate that in an ordinary case and by reason of the provisions of CPR PD 16 para 7.3, where a claim is based upon a written agreement, a copy of the contract or documents constituting the agreement should be attached to or served with the particulars of claim and the original(s) should be available at the hearing. Further, that any general conditions incorporated in the contract should also be attached.

2 the assignment*

3 the default notice*

4 the termination notice*

5 [any other documents mentioned in the Particulars of Claim]*

I sent the request under CPR 31.14 requesting the agreement in addtion to the other docs you need to defend your case as said to do so by one of the board members on here.

The letters i recieved where

1.

2.

3.

I will get the last one resized when i figure how to do it.

-

And yes they sent the debt to moorcroft. Who said they wanted £110 a month or they would be taking me to court.

-

I really cant remember if a default notice was issued. I have checked all my letters and cant seem to find one.

A few questions

1. If they have issued a default notice is the debt enforceable in court even though there is no signed credit agreement?

2. If they have issued a default notice is there anyway i can request a copy of it?

-

I dont think one was served, does this matter to the courts?

-

Hi there,

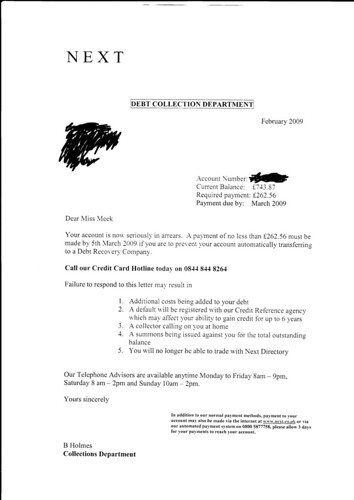

I sent a cpr request last week and next have sent me a letter back saying :

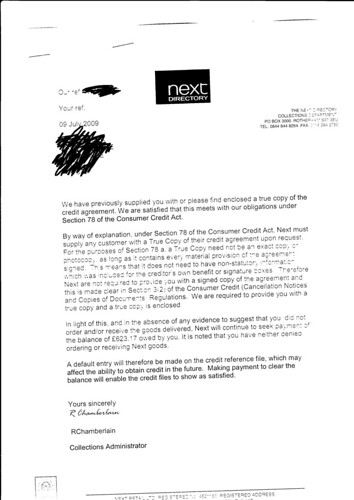

We have previously supplied you with or please find enclosed a true copy of the credit agreement. We are satisfied that this meets with our obligations under section 78 of the consumer credit act.

By way of explaination, under section 78 of the consumer credit act, Next must supply any customer with a true copy of their credit agreement upon request.

For the purposes of section 78a , a true copy need not been an exact copy or photocopy, as long as it contains every material provision of the agreement signed. This means that it does not need to have non-statutory information which was included for the creditors own benefit or signiture boxes. Therefore next are not required to provide you with a signed copy of the agreement and this is made clear in section 3(2) of the consumber credit (cancellation notices and copies of documents) regulations, We are required to provide you with a true copy and a true copy is enclosed.

In light of this, and in the absence of any evidence to suguuest that you did not order and/or recieve good delivered, next will continue to seek payment of the the balance of £623.17 owed by you. It is noted that you have niether denied ordering or recieving goods.

A default entry will therefore be made on the credit reference file, which may affect the ability to obtain credit in the future.

Right thats the letter and they also enclosed a copy of the credit agreement which has not been signed anywhere.

Im stuck now because i dont know if the above is true and i cant provide this information to the courts.

If anyone has any advice

Kelle

-

And sorry for all the bad spelling mistakes. My little girl thought it was a good idea to throw my glasses in the park pond.

-

It says BALANCE UNDER AN AGREEMENT REGULATED BY THE CONSUMER CREDIT ACT 1974 MADE BETWEEN THE DEFENDANT AND THE CLAIMANT OR ITS PREDECESSOR IN TITLE ABD OUTSTANDING AT THIS DATE THE DEFENDTANT REMAINS LIABLE FOR MAKING REPAYMENTS UNDER THE AGREEMENT UNTUL THE OUTSTANDING DEBT IS REPAID IN FULL.

the claiment is next directory ltd and the solicitors are MLS in stockport.

-

Hi there

Its from Northampton ccbc abd has a claim number on it, Its four pages long and i have to put all my income details on it and what i spend on food and bills etc.

The offer of repayment is underneath this part and asked if i can pay the amount admitted by a certain time or says i can pay by monthly instalments and asks for how much i can afford.

-

For background info:

When did you start the account with Next?

Is the amount they are claiming more than £5000?

Have you ever had any charges added to the account eg. late payment, over limit? If so, have you ever reclaimed them?

Did they ever issue you with a default notice?

I opened it in 2006 i think but i am not sure. The total is for £670, and yes late payment charges have been issued onto the account and i have never reclaimed them before.

I think they have issued a default notice in the past.

The debt was taken over by moorcroft and they said they would only accept £120 a month, i explained that i couldnt afford this so she said i should wait a week for the blue papers to come through.

I have been reading alot but i really dont understand it i am ready to have a baby in 4 weeks and the stress is really getting to me now :?

Should i just offer a repayment rather then apply for a cca because it looks really hard to go down this route.

Kels

-

Hi there,

I have been sent a blue paper from court saying next directory are taking me to court because i fell behind with my repayments.

It says on the form: offer of repayment but i am scared that they wont take £40 a month for a £600 debt. If the court refuses to accept this repayment a month does that mean baliffs can come into my home and take everything?

I have also been reading about cca and dont know if i could request one from next directory? Does anyone know if that is possible?

And if i can then should i put on the form i am defending it at the moment?

I dont know what to do

Its my own fault for not keeping up on repayments really.

Its my own fault for not keeping up on repayments really.If anyone has any advice

Kind regards

Kelle

-

Hi there,

I currently have accounts for littlewoods, additions and empire stores that have been passed to NDR because i was missing payments on them all. NDR set up payment plans for them all at around £40 each a month, i agreed other the phone that i would have to pay it if thats all they were willing to take everymonth, But i am really finding it hard to find the £120 a month because i currently have other debts, not major ones but enough to find it hard to pay what ndr are asking.

They are phoning me all the time no matter what time of day, 8pm sometimes, i dread answering the phone to them now , they said £36 a month will be added to the account and it will be passed to a debt collection agency who will call on my door if i dont pay them.

I wish i never opened the accounts and do understand this is all my fault but it is starting to effect my sleep now and i really need to stop turning the phone off and do something about it.

I opened the littlewoods account in 2006 and have requested a cca but its been 2 weeks now and i have recieved nothing from them.

But the other two accounts where opened after april 2007 so i know that the debt for these would be enforceable in court. I want to know if i can offer to pay them smaller amounts each month, i dont want to not pay because the debt is mine but they are asking too much for me at the moment and default charge after another keeps getting added and it becomes more and more each month.

If anyone can offer some advice because ndr dont seem to want to know.

Thanks in advance

Kelly

Next directory taking me to court

in Financial Legal Issues

Posted

I have rang a free legal advice centre in Hull and they said i can pop in sometime tomorrow to discuss it with them, I dont have a clue as to what to do so i hope maybe they can help me with it.