syproject

Registered UsersChange your profile picture

-

Posts

12 -

Joined

-

Last visited

-

-

thank you, I forgot all about my previous post

-

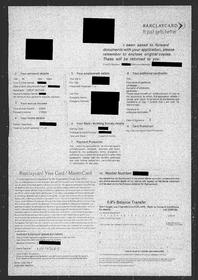

thanks guys i did set up a payment plan when they first called me because of the threats of baliffs would turn up to my house and court action. how ever i immediatly stop payment when i did not receive a cca back from them. i will speak with barclaycard later on today and find out when last payment would receieved. could i tell them to pass the debt back to barclaycard because the amount hfo is chasing is almost double to what was actually on the card? also i noticed on the cca that it shows protection for job loss and around the time i could not pay the debt i told barclaycard lost my job and they were un willing to help me. hmmm the ccs they emailed is here: ukbiometrics.co.uk/cca.jpg t&C's they emailed was: ukbiometrics.co.uk/t&ca.pdf - ukbiometrics.co.uk/t&c.pdf I can not make out much on them but should they not have sent me thru the post the copies? thanks again for all the help

-

i'll have a read of their posts, the only proof of duress i have is from the wife and work. thank you for the quick reply

-

I was wondering if anyone could offer me any advice. I have a company called HFO services is chasing me for an old barclaycard debt from 2003 They first contacted me in 2006 regarding this matter and I disputed it with them telling them I do not know of the debt that they are chasing. (unaware it was barclays, because the about was almost £1000 more than what they were asking for.) They threatened me with bailiffs and legal action so I agreed a payment plan (which was far too high) to stop legal action. They started pestering me multiple times a month and even Sundays for payment, I once paid twice in one week because of the threats. i still disputed this every time i spoke to them about the debt but paid to keep the baliffs away. I took advice from a friend I sent them a CCA request and sent a£1 so they could send me it. however they did not send me the signed CCA within 30 days so I stopped payment. I know they received it because I sent it recorded and they have said in phone calls there has been a £1 payment. They have recently contacted me again saying wanting payment for this debt or again the bailiffs will come in and I will be taken to court. I told them on the phone that I never received a CCA from them which they then became aggressive and starting making threats again. They told me on the phone “they were not legally obliged to provide a CCA” and if I did request another CCA they would just take me to court. I have now been emailed a cca but but my signature does not look right and it is very dark and hard to read. (also could i still go about seeing if the credit card agreement is legal?) Could any one advise the best method to take because I do not like the threating behaving, i would rather get a ccj and deal with the courts than speak to HFO again i have read about a 6 year sat barred for debt collection but may have failed this because i made payment due to the threats. Any help/advice would be appreciated. thank you

-

HFO Services have never mentioned Roxburghe in any letters, they even say over the phone that barclays sold them the debt, but barclays say they have sold it to Roxburghe Thanks for the reply DonkeyB, I will get on it.

-

i just found out barclays sold my acount to roxburghe http://www.roxburghe.com however HFO Services Claim they purchased the debt of Barclay card. is this right? can another company claim they are collecting for Barclaycard when they are collecting for Roxburghe? any help would be appriciated I also found out the oust standing debt barclays gave to Roxburghe was £2096 HFO are chasing 2750 plus charging interest everyday is this legal?

-

I Have just had a very rude man from hfo call at 8:30 this morning depanding me pay another one to stop the interest. I have already set up a payment plan with hfo and now they are demanding more money. They say they have never received my CCA Request even though I have proof of signature. I also found out that every one i have been deling with is in india! if I have done a cca request even if I have set up a payment plan. can I cancel everything till they give me what i have requested? also does any one have a default letter to report these idiots?

-

thanks S.B well they have defaulted on the CCA, will send a Subject access request before i stop paying

-

thanks so what information should I get from a cca? looks like I have gotten the letter muddled up.

-

thanks Shelbelle ! much appreciated

-

Hi all I have been reading through posts to try and help with my situation and read the best way to get help is to start your own thread. Right I got into trouble with Barclaycard who then sold the account to HFO Services. I have dealt with HFO for about 4 years, setting up payment plans and failed twice due to inexperience of debt management. I have now got it all my debts under control and paying HFO services monthly, however I have sent a CCA request to see what I actually signed up to. (I was 18, I am now 25.) I do acknowledge the debt and do want to pay all my debt off, however I want to see how much interest and charges they have put on to my account. they refuse to tell me such information and when I request them to send a balance they send a letter with just a figure of the amount I owe with no breakdown. I sent a CCA the 3rd February and I have still not received anything back from them. What should I do now? Do they legally have to supply me with this information? Thanks for any help any one can offer. simon

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.