Flyyyte

Registered UsersChange your profile picture

-

Posts

56 -

Joined

-

Last visited

-

Days Won

1

Content Type

Profiles

Forums

Post article

CAGMag

Blogs

Keywords

Everything posted by Flyyyte

-

Advice required regarding Currys returns policy

Flyyyte replied to UKGez's topic in Currys/PCWorld/Dixons

Hopefully you've been able to get this sorted out. Can you update us because you're not the only one encountering problems with Currys returns. -

EuroCarParks "Notice to Keeper". Appeal it? Ignore it?

Flyyyte replied to Flyyyte's topic in Private Land Parking Enforcement

I've already expressed my gratitude to all those who responded to my OP. The advice received was invaluable in helping me determine which way to go, a decision which came down to whether or not I want to bother with Europarks or not. On due consideration, ignoring it seemed inadvisable; there is enough in this situation to infuriate, and even though my time is valuable, my self respect is actually more so. My wife and I have a familiarity with several different aspects of civil Law, though not this particular one (had such been the case, I would never have posted here.) As things stand however, I'll not be posting anything else on CAG unless by way of an update in the event of further developments, the sharing of which news would hopefully be of relevance / benefit to others. Meanwhile, elsewhere in Cumbria, it seems Euro Car parks is on a roll; our (so far minimal) research has turned up this gem, albeit the situation as described there has no resemblance to our own. Still worth a read though for anyone interested in how Euro Carparks is giving every appearance of trying to make its money out of finessing the definition (or trying to finesse the definition) of what is a parked vehicle and what is not: https://www.thewestmorlandgazette.co.uk/news/17703804.fury-over-car-park-operation-at-marks-and-spencer-store-in-kendal/ -

EuroCarParks "Notice to Keeper". Appeal it? Ignore it?

Flyyyte replied to Flyyyte's topic in Private Land Parking Enforcement

Sincere thanks, ericsbrother, for your post and apologies for this unintentionally belated reply. Your thoughtfulness is much appreciated. I've decided my time is worth too much for me to get into a dispute with this company at this ateg. I've appealed on the basis that their claim is without justification because they have chosen to withhold evidence essential to support of their allegation. I've also put that in writing and sent it as a pdf attachment to the online "appeal", seeing as how they deliberately omit to provide room online for any textual submission, but insist on having attachments" instead. Well, they now have mine. I take your point about their 'generic waffle'. My wife and I regularly shopa t M&S, Penrith, and until that last visit, its car park had been pay-and-stay, with a partial refund being made by the store according to how much you spent. The pay to stay machines had all gone by the time we made that last trip, so we took particular care to find the new notices with their tediously lengthy Terms & Conditions, and are absolutely certain that the free customer [parking limit was 2 hours -- hence, why we made damn sure we were in and out within that time. Euro Car parks is onto a nice little earner if it thinks it can get away with intimidating people into paying it whatever it demands because they live too far from the location to be able to check the Eurocar parks signage. If the company wishes to deny it's running a [problem], then it can tell me that in due course. Meantime, I want the DVLA to explain how come it is endorsing behaviour of this kind. I hadn't had time to redact the documentation but have done so now. It's attached herewith. Protection of Freedoms Schedule 4.pdf -

EuroCarParks "Notice to Keeper". Appeal it? Ignore it?

Flyyyte replied to Flyyyte's topic in Private Land Parking Enforcement

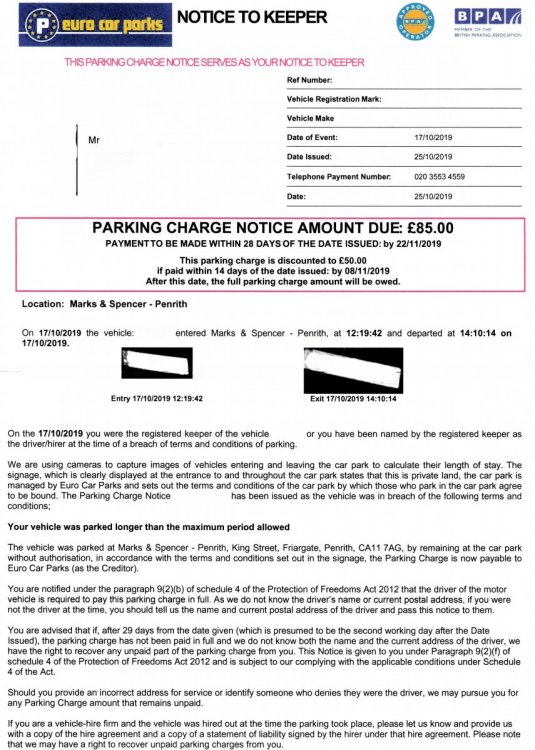

Thanks, everyone, for the prompt responses and advice. Just to clarify -- and many thanks to Mrs O'Frog for posting the advisory link -- the correspondence received from Euro Car Parks is NOT in the guise of a "penalty charge notice". Rather, it is headed: NOTICE TO KEEPER and, further down the page, features a large oblong panel whose boundary is delineated in red ink. Within that panel appears this text: PARKING CHARGE NOTICE AMOUNT DUE: £85.00 Beneath that is the text quoted in my OP incorporating the unsubstantiated accusation that I broke the Terms & Conditions of parking there (but without going into detail as to what those T&Cs actually were.) As lookinforinfo has so accurately discerned, the car park notice which both my wife and myself read and took note of allowed up to 2 hours free parking if you were an M&S customer, which we collectively were. We parked up at 12.19pm and left around 10 minutes short of 2 hours later. I agree with lookinforinfo that the amoeba responsible for trying to make a living out of this kind of 'enforcement' activity are as likely to be incapable of adding up as they are of punctuation, and so I can foresee that the Parking Charge notice was issued in error. Equally though, I can also see how profitable it must be for any unscrupulous business in this sector to deliberately withhold important facts in pro forma monetary demands for breaching signage T&Cs, gambling that as the target might be too far from the specified location and unable to readily return to it, they will therefore pay up. I don't believe the correspondence I've received is entirely unique to me, rather that it is a sample of the stuff winged out by Euro Car Parks to all alleged offenders, the staff responsible for the letter's despatch not having much sense of geography either, but just hoping that there's a lot of miles between the alleged offender's address and the address of the car park where the alleged parking breach occurred so that they won't be able to go back and check what the T&Cs are. I'm not going to undertake at an early date a 40-mile round trip to re-check the signage, particularly as both myself and my wife are entirely clear in our recollection of what it actually said, as is our memory of how we legislated for that in terms of our less-than-2-hours-parking-duration. When we do return, we will -- as lookinforinfo recommends -- seek out the store manager; and be interested to learn (if the information is available) if any /how many other M&S customers have been in touch with the store about the same issue. I don't know why, but my hackles are a bit high at the moment, the nagging thought that there's more to this than just an innocent mistake by an incompetent organisation. I think I'll run a quick google search into local newspapers of recent date, see if anyone else has had a punitive experience at that location -- and, perhaps, paid up: some folks in this part of the world do still write a Letter to The Editor when "outraged" about traffic wardens, parking tickets, and what they describe as "parking fines". Pending that, it seems to me that responding promptly via the so-called Euro Car Parks appeal process to say I don't have any idea what they're talking about or claiming for because of the regrettable absence of relevant fact is the best course to follow -- doing so as much for the record as anything else, seeing as how this outfit would never have bothered me had it not been for a government agency selling my name and address data to it, a point I shall be making to the DVLA in due course. There. Thanks everyone. Looks like I've now just made the decision for myself. -

To be blunt, OP, one approach to this horrendous problem of yours is staring you in the face: Helen McCardle. She is the reporter bylined in the Evening Times report (above). The problem faced by many victims of criminal behaviour is that they can't get newspaper publicity of their plight because media works on the basis that if a story is already running, then it's an established fact and can be capitalised upon in future. |If it isn't already running, then maybe it's not a story at all. Remember: the definition of "news" is that which the Editor of one paper thinks the Editor of another paper is going to publish next day. Victims of fraud etc can't 'break through' a newspaper's reluctance to publicise their situation, and are thus so often left with the desperate hope that the unimpressive showbiz offering 'Watchdog' from the BBC is the answer to their ills. It isn't. Watchdog is a national publicity platform and isn't in the habit of going national with the tale of a single individual's experience. Nor does it employ an investigative team to go out and dig up the facts on a case to see if others, elsewhere, have been affected. It waits and waits and waits and maybe one day gets around to actually screening an item that's been under consideration for many a month, though not necessarily to any individual's particular benefit.. Although you don't realise it, you have already got yourself into a strong position thanks to the good luck of the reportage of the Traffic Commissioners. You're attached to a "running story" now . . . one that has broken out through no efforts of your own, and which should be regarded as a horse upon which you should ride forthwith and, hopefully, steer. Don't let it gallop out of sight. You even have the name of a regional newspaper journalist to contact, one already flly acquainted with much of the background and highly likely to be well disposed towards you.. It's also a fact of life that police-follow-Press as much as Press follow what the police are doing. Let the journalists ask the police what they're doing in regard to the investigation and prosecution of this man -- though of course, you're going to have to use your own imagination and resources to locate the items you believe to be "lost", and retrieve them as fast as possible. Do not leave them (assuming they are still there, and haven't already been disposed of) in the hands of that company and its proprietor. Newspaper reports are here today, fish 'n chip wrappings tomorrow. Hopefully there's still time for you to capitalise on the recent media interest in this man and his business by contacting that named journalist as soon as possible. Good luck!

-

I have, over the years, sympathised with many motorists caught up in the great bounty hunt of private parking penalties. But it never occurred to me that I'd be one of them: so much for naivety /optimism. A couple of weeks ago, my wife and I went shopping at a Marks & Spencers store some 20 miles away from us. It had a small car park within which customer parking was free for a prescribed period of time. We read the notice in the car park and are convinced we abided by its T&Cs. Wd did not, however, take a photograph of the signage. Today, a preposterous letter has arrived from that pillar of probity, Justice and goodwill to all, Euro Car Parks, saying parking charge notice amount due: £85.00, payment to be made by 22/11/2019. (There's the usual oh-so generous "discount" for paying early: £35 knocked off the bill.) The barely literate accusatory section of the so-called 'Notice' reads as follows: "We are using cameras to capture images of vehicles entering and leaving the car park to calculate their length of stay. The signage, which is clearly displayed at the entrance and throughout the car park, states that this is private land, (sic) the car park is managed by Euro Car Parks and sets out the terms and conditions of the car park by which those who park in the car park agree to be bound. This Parking Charge notice x123456789yz has been issued as the vehicle was in breach of the following terms and conditions: your vehicle was parked longer than the maximum period allowed The vehicle was parked at Marks & Spencer, (location and postcode), by remaining at the car park without authorisation, in accordance with the terms and conditions set out in the signage, the Parking Charge is now payable to Euro Car parks (as the Creditor). Obviously, I'm not going to pay this bunch of illiterates £85, £50, or anything like it. But I find it hugely irritating that it has sent me a demand for money without any substantiation of claim (other than a couple of fuzzy photographs of my vehicle's number plate). My first thought was that it was laziness /incompetence / stupidity that brought about the omission, whereas I'm now of the opinion that the omission of the actual T&Cs which I'm alleged to have so expensively breached is an act of deliberate withholding, the company's hope being that I will actually live too far from the location to be able to revisit it and check out the signage for myself. Must be a nice little earner, if you're Euro Car Parks, and you can extract sums of money from gullible vulnerable people to whom you have deliberately denied actual evidence of claim, i.e., the specific wording of the T&Cs allegedly breached. Just to clarify: the "Notice" says we parked from 12.19.42 to 14.10.14 on the day/date in question, that duration being longer than the maximum time allowed. I'm not disputing the timing.As can be seen, the duration is less than 2 hours, and as both my wife and I remember from our viewing of the signage, up to 2 hours free parking was granted to Marks & Spencer's customers. (And yes, we have our credit car records as proof of being exactly that). We might, next week, tootle off out into the country again and pop into the store's car park just to refresh our memory. For now though, I'm not about to engage in Proustian discussion with Eurocarparks, but instead appeal the notice on the basis that the claim lacks substantiation. The fact that Eurocar parks thinks it can get away with behaving like this (thank Gawd we don't live 200 miles from the car park in question) is something I might subsequently wish to take up with the DVLA, seeing as how it is as much a profiteer in the civil parking charge recovery racket as any. However, given the fact that the letter-of-claim is unsubstantiated in its most crucial aspect, I'm tempted to file a succinct online appeal pointing out that the company's conduct is unreasonable and unprofessional, and that absent proof of claim, I am not prepared to consider the matter further. (There are 28 days to appeal via eurocarparks.com online form). Question: what would you do? IGNORE . . . Or APPEAL??

-

'Keep' well away.

-

Have you been able to get any further in regard to your £36.75p rebate? Top Cashback has given you the runaround, in much the same way it appears to so often treat its users with contempt. This £multi-million company is, in fact, regulated by the Financial Conduct Authority and appears on the FCA's Financial Services Register as an "Appointed Representative", this being the formal term for its regulatory status as "a firm or individual that can act on behalf of another firm (its principal) that is authorised in the UK or regulated in another EEAA country. The principal is responsible for the appointed representative's activities." [my emphasis] Where you are concerned, you were sold a regulated financial product (home insurance) by a business regulated by the FAC, the essence of sale being that a portion of the money you paid would be rebated to you. As you received no such rebate, you were mis-sold. The mis-selling of any financial product in the UK is taken seriously by the regulatory authorities, as demonstrated by the punitive costs incurred by the banking sector in regard to mis-sold PPI. Though Top Cashback is currently not subject to much greater regulatory oversight -- it certainly should be -- it is, in this instance, unable to avoid the perhaps inconvenient reality that it was, in your case, the Appointed Representative of Nationwide. Please disregard then, any carefully constructed gibberish from Top Cashback and instead file a written complaint with the insurer in its capacity as principal. Your complaint should state the time/date of purchase of the insurance, and the date(s) and content of any subsequent online contact with Top Cashback. Be aware that your complaint must be fact-based. It would not be enough to say that you bought the policy on the basis of the promise extended at that time (by the principal) on its Appointed Representative's (Top Cashback) website. If you have no such proof -- ideally, screenshots of the transaction as it progressed, and at least one screenshot showing Top Cashback's confirmation of your visit -- then your complaint stands almost no chance of being accepted. If, however, you know you can provide supporting evidence of your complaint -- and this is what we're talking about here: your correspondence with Nationwide MUST be headed: "COMPLAINT: Mis-selling of a financial product" -- then you will be seeking from them the sum of £36.75p + a £60 compensatory payment in regard to the stress and inconvenience caused to you. Because you are invoking a complaint in regard to the mis-selling of a financial product, an 8-week period now kicks in, during which time Nationwide must, by Law, accept or reject it or make you a compromise offer (for example, the £36.75p, but not the £60 compensation.) You should know, however, that due to the nature of the complaint, you are entirely at liberty to accept the £36.75p whilst at the same time continuing on with your request for £60 compensation. If after those 8 weeks have expired and you are still not happy with the outcome, you can lodge your complaint with the Financial Ombudsman Service. If the FOS decides that your complaint merits further investigation, it will contact Nationwide and require it to pay over a sum amounting to several £100s, this being the non-returnable fee that has to be paid to finance the FOS's inquiries. For obvious reasons then, businesses mindful of their own bottom line are mindful of the money to be saved by settling a complaint before it reaches the FOS. So. There's the answer. Complain, with supporting evidence, to the principal (Nationwide) about the mis-selling of its financial product (home insurance policy) and seek payment of the outstanding rebate and compensation, allow a maximum of 8 weeks to elapse and then if the matter isn't settled, file your complaint with the Financial Ombudsman Service. As to Top Cashback, don't believe anything that any of its representatives write or say. Keeping well clear of it. * Apologies for not spotting this post of yours until just now, when I was browsing the forum for something different.

-

Yes, I'd noticed last year, or perhaps even earlier, a solicitor of the same name as the esteemed Mr Crossley on the books at Rodney Warren's south coast law firm: http://www.rodneywarren.co.uk/our-legal-team/ and thought that the description of their Mr Crossley, as well as the photograph of their Mr Crossley: http://www.rodneywarren.co.uk/our-legal-team/andrew-crossley/ was uncannily reminiscent of the pathetic wreck of a shyster said by his peers to have brought the entire legal profession into disrepute. Given so great an insult to the standing and repute of lawyers everywhere, it was quite clear to me that no law firm with any respect for itself or its clients would ever consider having such a (literally) disreputable character on its books. I concluded, therefore, that the formerly bankrupt Andrew Crossley who specialised in civil litigation designed to intimidate and harass for financial gain is absolutely not the same Andrew Crossley who specialises in Civil Ligation and only has the best interests of his clients, and the larger public, at heart. It's all pure coincidence.

-

Thanks, blackknight. It's not an issue about the warranty though, but about the point you made: the 'extra level of comfort' for a PCP customer. In this instance, I'm assuming that ownership of the car has passed from the factory gate to the finance company (which is more than likely independent of the manufacturer though trades under the manufacturer's name.) What my relative does NOT want to have to contend with is a faulty vehicle that, though covered by manufacturer warranty, is then off the road for varying periods to be repaired. He's paying a monthly amount for a vehicle to be in his keeping, not a garage's. It's that point which I'm trying to clarify: if in the event that things do go pear-shaped, just what pressure can he exert to ensure he does not have loss of usage / enjoyment etc as a result? Already he's worrying about whether or not the vehicle will be all right. It's not a level of anxiety I'd be prepared to tolerate -- a £25,000 car that's 10 months old and, literally, you don't know if it's going to break down within the next few weeks?? I agree wholeheartedly with you about the Internet complaints though. They can be misread as to how representative they are. That said, there are also God knows how many who don't post on a forum and aren't members of one -- which includes my 75-year-old relative. . .

-

A family member decided 10 months ago to replace his ageing car with a factory-ordered brand new one. He opted for a PCP deal having first undertaken extensive homework about total interest payable and likely future value etc. Of all the options open to him, the PCP deal together with further incentives he negotiated with the supplying dealership most suited his circumstances. Until recently, he had no cause for complaint. But then the symptoms of one or two faults (or a single inter-related fault) affecting engine and auto transmission became evident. The car has been into the supplying dealership which immediately sought the manufacturer's involvement. Some preliminary work was then undertaken according to the manufacturer's guidance, pending further work which will be carried out two months' hence at its first service. The car, which has one 9,000 miles from new, is said to be perfectly usable until the time of that service and that in any event, anything and everything is covered under the manufacturer's warranty. Fair enough. Except: delving into the Internet to research his car's emergent problems, he has discovered dozens (literally) of posts on motoring forums going back over several years, all of them complaining about the same problem(s) and about the hoops it was necessary to go through to get them fixed. In some cases, the manufacturer replaced the engine and transmission under warranty -- though only at the end of protracted arguments where some consumers were concerned. Also in some cases, the vehicle was off the road for up to a month while those repairs were completed. What isn't clear from any of those Internet posts is whether or not the posters had financed the purchase of the car outright from their own funds; whether it was with a bank loan; whether it was hire purchase; or whether it was a PCP. That actually strikes me as being of crucial importance. Currently, my relative's car is still showing symptoms of inherent faults, albeit those symptoms are now less noticeable than originally. He is resigned to living with them and to abide by the dealership's / manufacturer's guidance. However, he is worrying about what might happen if it turns out that the vehicle becomes unusable due to failure, or if he is ultimately told that it will be out of his possession for a lengthy period due to the possible scale of repairs required. The word 'possession' prompted me to post this query on here, because it seems to me that he doesn't 'possess' the vehicle in a strictly legal sense (i.e., of ownership), rather that he and the manufacturer entered into a contract -- brokered by the supplying dealership -- via which he pays a monthly premium to the manufacturer's finance company and the manufacturer in turn supplies a car fit for purpose and usage. Am I right in thinking that in the event of -- and I must stress: 'in the event of' -- the situation becoming worse and the vehicle failing to perform / being unavailable to him for short periods or an extended period, the essence of the issue here is as more about breach of contract than anything else? Advice appreciated; though things seem to be under control at the moment, it's surely as well to be fore-armed by being forewarned of a consumer's position when it comes to the PCP of a new car and what happens if that car develops problems early in its life. Thanks.

-

Banned by Amazon for returning faulty goods

Flyyyte replied to Michael Browne's topic in Online Stores

The Grauniad article makes it abundantly clear that the customer registered an Amazon account 14 years ago and has returned 37 items in the past two years. The article also states that the customer has purchased 343 items, though perhaps due to lousy subbing, it isn't clear if that total accrued in the past two years or over the full 14. But that's by-the-by. The key stats are 37 returns in 24 months. Wow. That's some going. I've been a registered Amazon customer since 2002. I have no idea how many items I've purchased in that time -- many, many hundreds -- but I do know I've had legitimate cause to return four. 4 returns in 168 months. I've also been a registered eBayer since 2001, buying and selling hundreds of items in those 15 years. In that time I've found it necessary to give just one neg and to return just three items. I don't count myself as being extraordinarily lucky with my purchases. Rather, I reckon I'm just an average Amazon customer / eBay member. Where the allegedly vexatious Amazon customer is concerned, this individual is either the unluckiest individual there's ever been, or her / his transactional expectations have been consistently unreal. If I was running a pub and the same customer kept coming in to order a beer, taste it, and then rejecting it because it wasn't any good, I'd ban that individual from ever entering my premises again: I'm running a pub, not a product research laboratory set up for the benefit of someone on a free ride. Where eBay is concerned, those who sell on it can be as good, bad or ugly as those who sell on Amazon -- or on any street market, anywhere, seeing as how the latter are the real-world forerunner of both. Nowadays I actually use eBay more than Amazon, because unless I'm after the back-up to be derived from a purchase that's direct from Amazon or Fulfilled by Amazon then it's plain daft to fall for Amazon's £20 order minimum when an easy cross-check of the item on side by side browser pages will show that the same Amazon seller is also on eBay, selling the same item most usually (a) for less and, even more significantly (b) post free. One of the things most noticeable, back in the days of eBay's help-each-other forums -- killed off by eBay on the obvious though unstated grounds that it exists to take commission, not criticism -- was the sheer number of buyers who really shouldn't be let out on their own: failure to read a listing; failure to research a seller's ID history, location, and feedback record; failure to take even the most elementary self-protection. There's no reason to think that type of buyer has vanished. What surprises me about this thread is that some posters seem to regard buying from an Amazon seller as the same as buying from Amazon. Of course it isn't. Rather, it's the exact same as buying from an eBay seller, the only difference being that you can't, ever, buy anything from eBay anyway; you can only buy on eBay. As for Amazon's banned customer, his Amazon vouchers are void because his customer account is void. He may well have a legitimate argument in regard to that aspect but as the Grauniad article fails to state the amount involved here -- a fiver? Or £50? -- then who knows the scale of loss? It's up to him to take action for recovery. Whether or not he goes through 37 different law firms over the next 24 months will, of course, be his decision . -

Honeybee: Sincere thanks again for the LiP information. I've now browsed this site and noted a number of helpful references. I've copied / pasted text into Word docs where appropriate as well as screencaptured other items. Finally, I've followed various links to other reference resources including Law articles, Form N260, and the Bar Council Guide to self representation. I tend to work quickly so am hoping I've not missed too much on this initial LiP foray; I'll have more time tonight to re-read in more detail. The sheer volume of helpful information here continues to astonish and I've been happy to make a small donation just now, a fraction of the amount any Law firm would've required. I've also -- now that I've read Form N260 -- made an exact note of research time spent here, that is, the period from the time of my last post to the time of this. Armed, now, with knowledge I clearly lacked hitherto, I shall put further thoughts of civil action on hold, and wait to see what emerges in the course of the handling of my formal complaint. Once again: my sincere thanks to you, Good Sister and BazzaS.

- 15 replies

-

- customer service

- debt collection agency

- (and 4 more)

-

Hello Honeybee. Apologies for this unintentionally belated reply but I've only just caught up with your post. You most certainly are not off-track -- so many thanks indeed for bringing this LiP facility to my attention. I've never heard of it, iyiyiyiyi. I've some spare time this morning so am off to plunder this wonderful CAG website for more info. Once again: BIG thanks!

- 15 replies

-

- customer service

- debt collection agency

- (and 4 more)

-

I wasn't implying that you said that at all. I was merely theorising on a payments-of-worth calculus. What I'm actually trying to figure out is how a civil court, or even a utility company, might compute this. In employment, then an equivalent to the individual's paid hourly rate? Wow. I should be a corporate counsel then. Not employed? Therefore, no hourly rate for assessment purposes? Oh. We all know that utilities hide behind the mask of "goodwill" payments when goodwill has never entered into it. We're all, also, well aware of derisory payments, £50 here or £75 there. Go-away money. Courts? I presume there's some sort of yardstick. But I've no idea. Perhaps it's about time some Consumer Messed About Hourly Rate was legislated.

- 15 replies

-

- customer service

- debt collection agency

- (and 4 more)

-

Hello BazzaS: thanks for that info, it helps in trying to sort out a possible (and tenable) claim. And thanks especially for pointing out the error there: sheesh, the math really was wrong! I should, of course, have been working on the basis of a 37.5 hour working week, not a, er, 37.5 hour working day. I think I'll go apply now for a job with Scottish Power's billing department. A 37.5 hour working week equals a 7.5 hour working day, so at £12.82p an hour that's £96.15p per working day. In my case, then, that would be £288.45. Which (to me) seems nothing like enough. Though considerably more reasonable than that earlier £1,442. Eeek. Anyway. If one can't bill a company for the time they would have / might have paid an employee but whose work one has had to undertake oneself, then I guess the idea is a non-starter anyway. Might be better to have a look at the UK average wage and go from there. It would also be equitable, because if an argument is to be advanced that only a customer in employment can be compensated according to the hourly rate appropriate to her or his current employment, then the time of every customer who is not in employment, or who has retired, is counted as nothing. That signals to any utililty company (or any other company, come to that) that easy pickings are to be made from elderly consumers because they can't hit back because they're. . . worthless. I quite like the concept of mitigating my losses though. Most solicitors I know -- not paralegals, nor juniors -- charge between £85 and £140 per hour. So if an argument was -- theoretically -- to be advanced that 3 days of an individual's time had had to be given over to an issue such as this, whereas a lawyer could've dealt with it in half the time -- then 22.5 hours I've spent (which now need revising upwards) would equal 11 hours of a solicitor's time at £100 per hour. Call it £1,000. Ah well. Interesting to play around with figures, but really, this post was mainly to say thanks for clarifying things and for pointing out the fallibility of my math. Seems best now for me to set aside the issue of compensation until such time as all my hours are totted up at completion of the Formal Complaint letter to SP. Onwards & upwards -- or at least, sideways.

- 15 replies

-

- customer service

- debt collection agency

- (and 4 more)

-

Sincere thanks, GS. At a time like this when, despite best efforts, one's thoughts are somewhat scattered, your post provides clarity and enables focus. Doesn't get any better than that. I'll sit down tomorrow and draft a letter of Formal Complaint which I'll send to Scottish Power's complaints-handling address. I'll structure it according to the points you've highlighted. It is unlikely to have the appearance of amicability because I can not, in all good conscience, pretend that I am not outraged at this company's behaviour towards me. It will not, however, be hysterical: words have been my business for many a long year, and I'm well aware of the standard required for writing-for-the-record. I'll update here in due course, hoping that the recording (on here) of this episode may be of some help to others in future. Meantime: sincere thanks again.

- 15 replies

-

- customer service

- debt collection agency

- (and 4 more)

-

Many thanks Good Sister for responding so quickly and constructively; thanks, too, to the site team's citizenB: I have to confess to an initial reluctance to even raising my query, seeing as how folks must surely get fed up of hearing yet *another* complaint about a UK utility company. And yet, in a way, that's the real indictment: the treatment of honest, decent and responsible consumers by corporate giants who couldn't care less how heavily and how wrongly they tread. My situation at the moment is that I've no idea what a Judge would consider to be a "reasonable" claim against SP or not. There would, I assume, need to be specific grounds: no good me ranting on about distress and dismay etc if SP is going to honey-voice its way out of things and (for example) respond that though I may have grounds for being annoyed, I have no actual legal grounds for compensation. It is my (hazy) understanding that Direct Debit agreements with a utility provider are outwith the Consumer Credit Act (though why I should even have to spend the time, trying to find that out, escapes me: I'm not a lawyer nor have I any aspiration to be.) I see from citizenB's link that "mismanagement of my account" may, possibly, provide some basis for civil action but if at the end of the day we're talking about some kind of industry voluntary code, then I can't see how a default in respect of that which is voluntary can be said to mean the same as a breach of some legislative act or order. Then there's the amount. I have spent so many, many hours dealing with this, trying to get Scottish Power to LISTEN, and then as a concomitant trying to understand which regulators do what and how and for whom and on what basis. None of that should ever have been necessary, yet to be unprepared is to be vulnerable, and to be vulnerable is -- or so it seems to me -- to be the last thing any consumer should be when a company with as appalling a public record as Scottish Power's comes a-hunting for money. By way of trying to devise some theoretical sum, I reckoned that as I'm the one who has had to do so much work in regard to this mis-billing because Scottish Power has not, and will not, then I'll base it on an estimated £25k a year paid to an SP customer services manager (it may be more, it may be less) equalling £480 a week for a 37.5 hour week equalling an hourly rate of £12.82p. By my calculation, in terms of time spent not merely in dealing with SP but in trying to protect myself against its serial misconduct -- including now having to pester people on here for help -- the time is now 3 full working days, equal to 112.5 hours and therefore, £12.82 x 112.5, total: £1,442.25. And the total is growing -- ironic, really, seeing as the amount at issue (that is, the difference between that which SP is doing its darndest to make me pay and the sum that the facts show I should be paying may not be more than £50.) That difference, however, is of fundamental importance, because it relates to the consumption of gas which Scottish Power hasn't provided. . . but Sainsbury's Energy / British Gas so very clearly has (and been paid for it.) I'm now poised to write a formal letter of complaint to Scottish Power. All previous complaints, in my emails, were effectively ignored / dismissed. As soon as I realised Scottish Power, with its FINAL DEMAND, seemed about to pressure me into paying it monies to which it has no lawful claim, I kept everything in writing. For the record. And advised SP I was doing so. They'd had one telephone call from me. There would be no more. The paper trail, then, is complete. Because of all this entirely unnecessary wasting of my time, I've had to learn that OFGEM won't deal with a consumer directly -- OK, fair enough -- but will only act in light of anything flagged up by some Energy Ombudsman service or other . . . if said Ombudsman service can even be bothered to do so. To even initiate such a process though, I must first make a formal written complaint (in my case, about both mis-billing and appalling CS behaviour) so that SP can have a period of time in which to resolve matters -- as if it hasn't had enough time already. I do wish to place that formal complaint on record though, not least because I intend to seek the assistance of my local constituency Member of Parliament. Question then (I guess: sorry for being so. . . scattered at the moment!) do I now register my formal complaint with Scottish Power and allow 8 weeks (I think?) to elapse OR: do I now write to SP saying I'm about to institute civil action and not bother filing a formal complaint OR: do I threaten civil action -- but not yet initiate it -- in a formal complaint? I cannot stress too much here that it is not the amount that troubles me. It is the oppressive weight of a giant company (and a foreign-owned one at that) which all too clearly thinks it can do anything, say anything, and get away with anything, regardless of whatever censuring it may previously have received from the regulator and regardless of whether or not it has just been acclaimed -- if that's the right word -- the worst major company in Britain for its handling of customers. Again: sincere thanks to Good Sister and to citizenB; in a better regulated market than the one we seem to have here in the UK, none of this would be necessary. And Scottish Power wouldn't even have a licence any longer to even operate. (And in addition to my thanks, my apologies, too, for any inconvenience my posts here may inadvertently cause.)

- 15 replies

-

- customer service

- debt collection agency

- (and 4 more)

-

I hadn't actually thought such might be possible until seeing bankfodder's thread: http://www.consumeractiongroup.co.uk/forum/showthread.php?444374-ScottishPower-%96-do-you-want-to-sue-ScottishPower-in-England-%96-Contact-details but am now interested in doing just that. Cut a lonng story short: I am sick, weary and tired of having to do Scottish Power's work for it in terms of (a) accurate billing and (b) best practice customer service, neither of which seem to me to be concepts that this company even faintly understands. Six months ago it issued me with a final bill on my departure to Sainsburys Energy. (Had I realised at the time that Sainsbury's Energy is just a trading name of British Gas, I'd never have gone to it -- but that's another story.) British Gas / Sainsbury's Energy made a complete shambles of this routine switch and not only "lost" the gas meter reading I provided to it but then went on to give Scottish Power a meter reading entirely of its own invention. Scottish Power, therefore, sent me a Final Bill which bore no relation to my usage. As this wasn't SP's fault, I immediately telephoned -- BAD mistake, but at that stage it had my sympathies -- and spoke to an SP rep who brought my account details up on screen and within mere seconds said they had a logarithm (or 'formula'? Can't remember which: both words may've been used) that they ran to check a disputed bill. It was obvious from that, or so I was assured, that the meter reading they'd received from BGSE was wrong. I now provided the meter reading given to BGSE some six weeks earlier and was told the following: 'We will take this up with your new supplier as it's clear that a mistake has been made. Until we have sorted out the facts of the matter, the bill we have issued to you is suspended. This means you do not have to pay anything and you do not have to do anything until we contact you again with a revised bill.' (Note: rightly or wrongly, I don't trust any UK utility company to look after me or my money. Shortly before the switch to my new supplier occurred, I therefore cancelled my monthly Direct Debit payment to Scottish Power on the basis that I'd rather pay it what I owed than have it taking my money and, in the event of a billing dispute, being obstructive about paying any of it back.) Meantime, my supply continued from BGSE. I also received an apology from it for the mess it had made of my switch. As I'd been told not to do anything until hearing back from SP, I left it at that. It wasn't until August that SP got in touch again. I received by surface mail and by email a letter headed FINAL DEMAND requiring that I immediately pay an amount owing from March. The amount was higher than the original, "suspended" bill. No accompanying documentation was provided by way of explanation of how this FINAL DEMAND had been calculated. No explanation was offered as to how I was in receipt of a 'demand' that was 'final' when no other 'demands' had ever preceded it. Thus began a protracted to-ing and fro-ing of email correspondence which achieved nothing other than the waste of many hours of my time. SP's emails were, to my mind, a disgrace, each one beginning with a scripted 'apology' as cosmetic as it was meaningless, and concluding with an invitation for me to go online if I still had a problem because SP was sure I could find "answers" there. I repeatedly provided SP with all the information it needed to act reasonably and responsibly and, at one stage, even seemed to be making progress: one reply I received said that in light of the information I had (repeatedly) provided, the matter was being passed to SP's billing department to investigate with a view to issuing a revised bill if such was appropriate. But I never heard any more about that. Instead, another threatening email arrived -- the usual stuff, about jeopardising my credit record, this despite the fact that I had (repeatedly) said that I was furious about being treated in such intimidatory fashion. This last email was now either a downright lie or an act of blazing incompetence but whichever, it was clearly calculated to make me pay up whether I owed SP the amount stated or not: for the first time, the word "agreed" was incorporated into the text, as in "I can confirm that I have looked into your bill based on the agreed meter readings". Obviously, if the darn things had ever at any time been agreed, then there'd have been no need for me to expend so much effort, disputing the position. It seemed to me I had exhausted whatever level of collective ability -- if any -- might exist in SP Customer Service and so I asked for the matter to be elevated to a managerial level. I also made that request in writing, wasting yet more time reprising the facts. It wasn't merely that I was furious about being patronised / dismissed / misled / and (to my mind) lied to by this company, rather that I had provided SP with inarguable proof of its mis-billing and yet it was giving every appearance of seeking to wilfully ignore that and harass, and threaten, until it had, in so many words, extorted from me monies to which it had no right to claim. If that was how Scottish Power thought it could treat me, then God only knew what it thought it could get away with where a customer, for whatever reason, was less able to challenge its steamroller tactics. SP has sent me no further emails. Instead, I have received an unsigned letter from Pastdue Credit Solutions in which it is claimed that I owe its client a sum of money that is now even higher than the earlier amount owing that was in itself higher than the original bill which an SP representative assured me was "obviously wrong". I have written back to PastDue saying I don't recognise the amount it is saying I must pay immediately and as no supporting documentation was supplied in respect of that claim, would PastDue now kindly correct that omission within the next 7 days. Where we go from here, I'm not sure. A sum in excess of £200 is in dispute. The documented grounds for my challenging SP would instantly demolish its claim in any civil court. I don't, therefore, know if SP would even dare risk going to court -- but am worried (and no consumer should ever have to be "worried" by behaviour as repellent as this) that it might try to sidestep that process and mess up my credit history instead. More than that though: as I said at the start of this post, I am sick, weary and tired of being compelled -- because it is just that: compulsion -- to do Scottish Power's work for it. I have had to repeatedly demonstrate to Customer Service staff how they should be dealing with a genuinely distressed customer; I have had to repeatedly demonstrate how to even calculate a bill. All the hours invested in such labour have been wasted. But why should I be the one who is penalised for the indifference, the incompetence, and the sheer intimidation that is so evident here? I've no idea of what, let's say, a CS manager gets at Scottish Power but if it's £25k a year then I can't see why I shouldn't be on that same hourly-equivalent rate seeing as I've been required to do that same job . So-oo . .. Back to Bankfodder's original thread. I would really, really like to sue this company for compensation in regard to my time wasted / distress caused etc etc, using as a yardstick of claim the equivalent cost of 15 hours' CS Management pay. I haven't done the math because I've only just thought of it but that's by the by. The main question here is: Has any ordinary consumer ever attempted to sue a UK utility company and if so, on what basis / for what amount / and was her / his action successful? I'm guessing that at some point along the line, SP is going to have to roll over and may even offer to make a "goodwill" payment or "goodwill" gesture, coupled with an apology about how a technical hitch occurred or a misunderstanding arose or SP has been dealing with system problems which it has now overcome and really honestly genuinely we're very very sorry, never happen again, blah-blah-blah. But that "goodwill" will be as counterfeit as any and all of its apologies. That "goodwill" will make it appear it has never done anything wrong, and that it is a utility company fit and proper to hold a UK operating licence. Well: I don't want to allow it to skip away into the convenient obfuscation of "goodwill". I want Scottish Power punished. And I want Scottish Power's money in my pocket -- not my money in its.

- 15 replies

-

- customer service

- debt collection agency

- (and 4 more)

-

Sincere thanks, Conniff -- much appreciated! All best: Flyyyte.

- 3 replies

-

- appreciated

- monies

-

(and 3 more)

Tagged with:

-

Help appreciated from wiser heads on here than mine will ever be . . . At the beginning of last month, June 2015, a friend of mine purchased a 37-month-old Ford Focus 1.6 diesel from one of the Northeast branches of the Evans Halshaw group. He px'd his existing car and paid a cash difference of several £000s. The Focus being a month out of manufacturer's warranty wasn't particularly troubling as the car came with a full service history and Evans Halshaw's 3-month parts and labour guarantee. At completion of the transaction, my friend drove his newly acquired Focus the 60-odd miles to his home. Next morning, he drove the car a short distance for an equally short time before it broke down. He contacted the dealership and it arranged to come and take the Focus away for repair. The car was collected next day. No word was heard from the dealership in the following week and it was only when my friend telephoned to find out how the repair was going that he was told 'we haven't had time to look at your car yet.' So much for week 1. The week after that -- 2 weeks after the transaction -- he was told the fault was a fuel filter which had now been fixed. His car was ready for him to collect. He pointed out that he had no car to go the 60 miles to the dealership so asked for his car to be returned to him. The dealership was manifestly reluctant to do so but three days later, brought the car back. Next morning, my friend drove the Focus for a short time and over a short distance and it broke down again. The car was taken back by Evans Halshaw to be repaired again. My friend was told that a part was awaited. It's now 3 weeks after the date of transaction. My friend told Evans Halshaw it was his belief that he had been sold a product not fit for purpose and should have his money back. He had given the dealership the opportunity to fix the car but it had failed to do so. He was incurring extra costs and going to no little effort and inconvenience as a result. Evans Halshaw told him it wouldn't take long to fix the Focus and they would provide him with a loan car for a few days. This turned out to be a 3-cylinder Vauxhall Corsa, significantly smaller than his own former vehicle as well as the vehicle he had purchased but was unable to use. With the Focus still unrepaired by Evans Halshaw, my friend complained to the dealership last week -- that is, 4 weeks after the date of transaction --about its refusal to refund his money and its failure to repair his car. He pointed out that he has a longstanding booking of a fortnight's family holiday in Cornwall, commencing next week. The Corsa is entirely unable to accommodate himself, his family and his luggage and seems hopelessly underpowered for a round trip of 600 miles or more. Today, Tuesday July 7 2015 is now 5 weeks from the date of the purchase transaction. The Ford Focus is still not repaired. Evans Halshaw is making great play of the fact that it isn't actually charging my friend a penny for the work (work that failed in the first place; work that hasn't even been done since then.) It is steadfastly refusing to refund his money, that is, to restore him to the financial state he was in prior to purchasing the car. Evans Halshaw continues to be unable to repair the car, saying it is *still* waiting for a part to come in. It seems markedly disinclined to even discuss the issue of the 3-cylinder Corsa loan car. Question 1: what rights under consumer protection legislation might my friend specifically exercise by way of bringing pressure to bear on this dealership to give him his money back / return him to the financial state he was in prior to the transaction? (NOTE: the dealership claims it sold his PX the day after the transaction. Presumably, it went into the trade. It seems highly likely to have been retailed out in so short a time.) Question 2: what complaint process should my friend be following here? He has lost all faith in this dealership so should he be taking it up at a higher corporate level at Evans Halshaw?(Not sure where to start with that one though.) Question 3: is there a 'professional body' to whom he can file a complaint about what has happened / is happening here? In summary: it is now 5 weeks since the transaction occurred and he does not have the car he purchased, does not want the loan car the dealership persuaded him into accepting, and having given the dealership every opportunity to repair what is, after all, just a Ford motor car, not some exotic beastie for which spare parts are hard to get, believes he is entitled to say that the car he was sold was not fit for purpose then, is self-evidently not fit for purpose even now, and he should have his money back. Now. Any thoughts? Thanks.

- 3 replies

-

- appreciated

- monies

-

(and 3 more)

Tagged with:

-

£100 fee for posting bad hotel review

Flyyyte replied to Michael Browne's topic in Holiday & Airline companies

The hotel is now for sale. At £375,000. http://www.rightmove.co.uk/commercial-property-for-sale/property-48891254.html Turnover is £160k per annum. Profits aren't known. But it's not impossible that £100,000 in turnover contribution has been made from, er, "fines" . . . -

Luvvly thought, SG. But before Crossley did something like that, he'd be well advised to contact a solicitor who knows something about copyright and rights holders. I'm not sure if he's ever come across anyone with that kind of expertise but it ought to be easy enough to discover if a guitar that looks like a £ sign is a breach of someone else's rights. One can't be careful enough nowadays and it'd be a shame if Crossley suddenly received a letter out of the blue threatening him with Court action unless he paid up immediately. But then, he could always come here to CAG for advice as to the direction he should follow in this matter and many of us would be willing to tell him just where to go.

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.