mkb

Registered UsersChange your profile picture

-

Posts

1,084 -

Joined

-

Last visited

-

Days Won

2

Content Type

Profiles

Forums

Post article

CAGMag

Blogs

Keywords

Everything posted by mkb

-

Thanks again, DX CCA & CPR requests posted today. Told him to get proof of posting & send first class. Will do MCOL when he comes back. If I'm honest, he probably wouldn't have the fight for an irresponsible lending case. I mentioned a DRO to him & he seemed quite interested in that - it would take the pressure off him but I made sure he knows he has to deal with this first.

-

He's gone back home to get his wife up & dressed but he remembers making the £2 payments by standing order years ago. He has absolutely no recollection of any 39p payments ! He won't phone from his house because he doesn't want his wife getting stressed but he'll be able to phone when he comes back round to me. He's going to ask his bank for copies of his bank statements for the period 2012 - 2015 so he'll be able to confirm/deny with evidence.

-

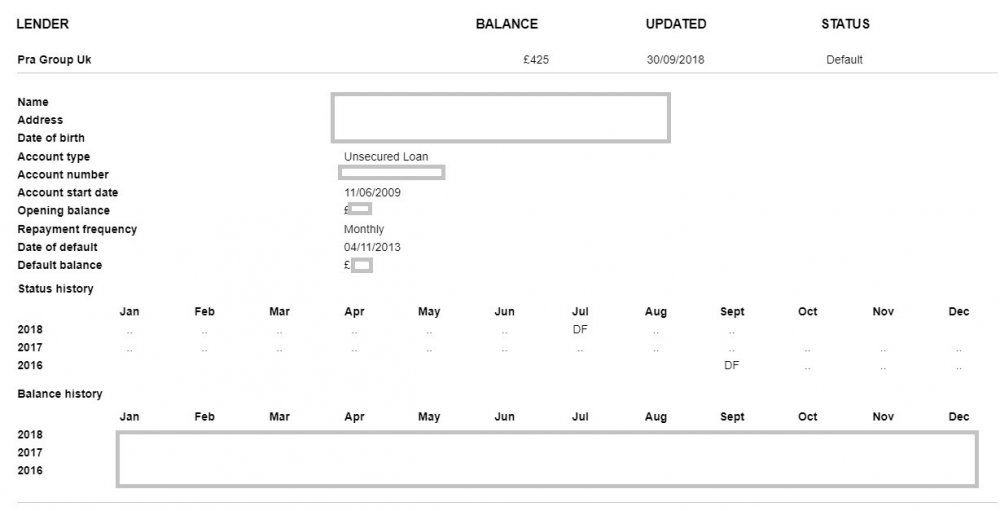

Credit file shows nothing other than below Interesting to see two Defaults were recorded yet no letters of Default have been received. He rang PRA to ask for last payment date. They said there was a payment on 12/06/2014 for 39 pence but that there had also been payments of £2 also in 2014. He got them to email me a copy of the payment schedule from 2011 showing erratic payments of sums he has no recollection of making. He acknowledges he was trying to make payment but categorically denies making payments of 39p a month at any time. I guess since he admits to making the £2 payments, there's no denying the debt nor is it SB. He asked for the initial loan balance but nobody appears to have that information. I'm stuck for ideas now so please, any and all help is welcome Ultimately if he has to accept a CCJ, it'll be another £5pm on account of his limited income.

-

I'll tell him to ring Prov in the morning. He doesn't have any paperwork earlier than 2017 - he says he binned most of the letters. He feels fairly sure he hasn't paid anything since giving up work in 2010 but can't prove it. I'll get him to check his credit file when he gets round here in the morning. Hopefully it's SB & all this can then go away.

-

Thanks DX Been reading the SB defence letter to DCAs. Should he use the same letter to the OC via the N1 ? Is there anything else he needs to do in the meantime other than to ask for CCA & CPR 31.14 ?

-

Just been on the phone to him & he doesn't think he's paid anything toward this debt since 2010 so it seems to me that they are out of time & the debt should be SB. Since a SAR would take him over the 33 day limit, what can he do ?

-

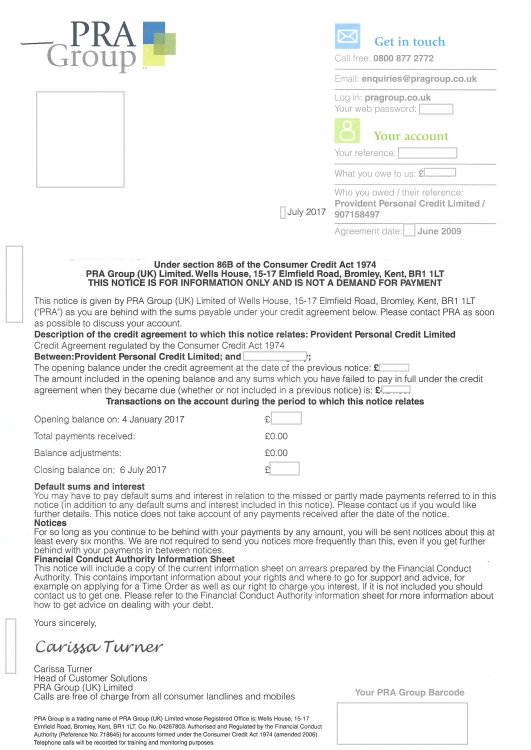

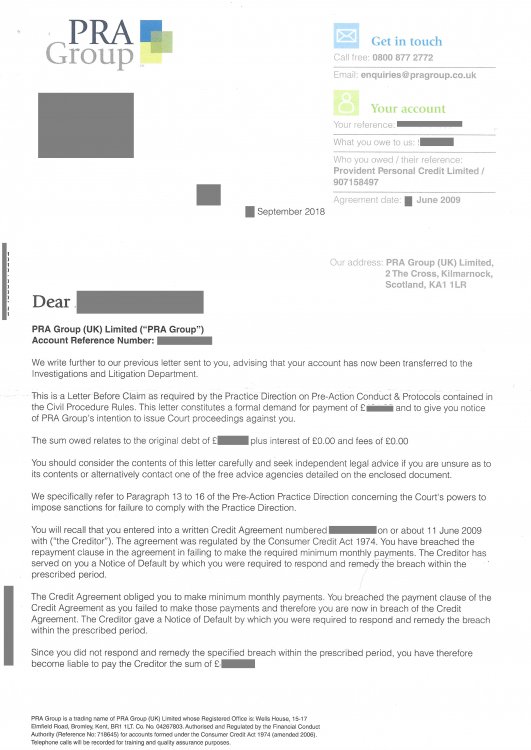

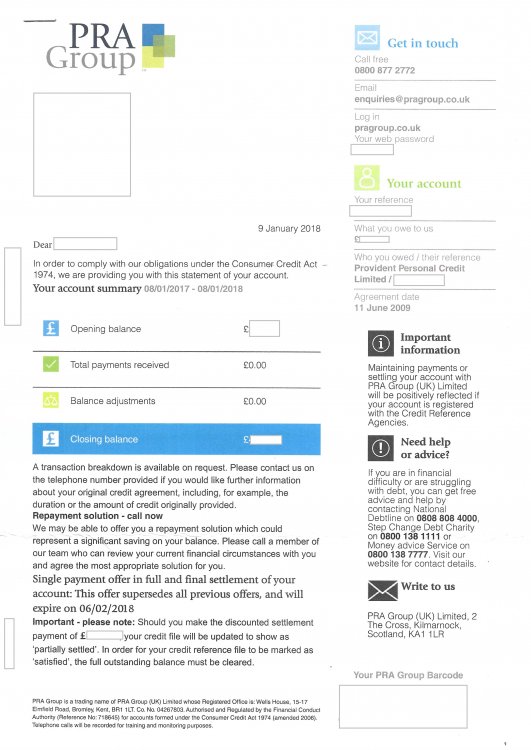

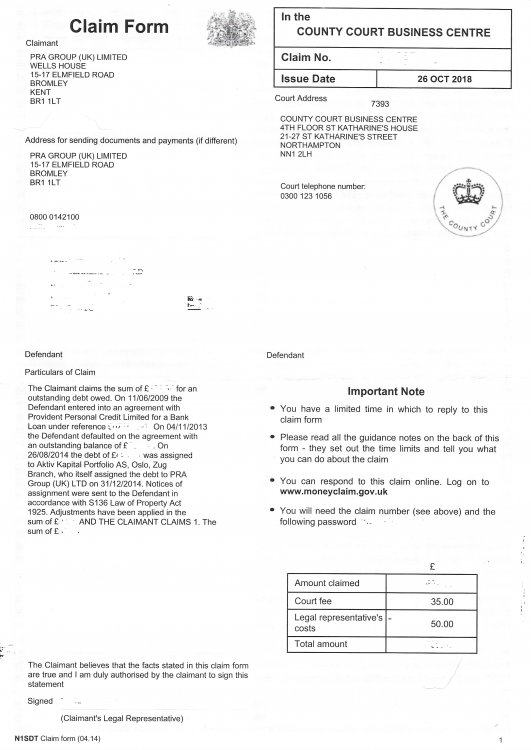

Name of the Claimant ?PRA Group (UK) Limited Date of issue – top right hand corner of the claim form – this in order to establish the time line you need to adhere to. 26/10/2018 Date of issue XX + 19 days ( 5 day for service + 14 days to acknowledge) = XX + 14 days to submit defence = XX (33 days in total) - 28/11/2018 ^^^^^ NOTE : WHEN CALCULATING THE TIMELINE - PLEASE REMEMBER THAT THE DATE ON THE CLAIMFORM IS ONE IN THE COUNT [example: Issue date 01.03.2014 + 19 days (5 days for service + 14 days to acknowledge) = 19.03.2014 + 14 days to submit defence = 02.04.2014] = 33 days in total Particulars of Claim What is the claim for – the reason they have issued the claim? Please type out their particulars of claim in full (verbatim) less any identifiable data and round the amounts up/down. The Claimant claims the sum of £425 for an outstanding debt owed. On 11/06/09 the Defendant entered into an agreement with Provident Personal Credit Limited for a Bank Loan under reference *********. On 4/11/2013 the Defendant defaulted on the agreement with an outstanding balance of £430. On 26/08/2014 the debt of £420 was assigned to Aktiv Kapital Portfolio AS, Oslo, Zug Branch, who itself assigned the debt to PRA Group (UK) LTD on 31/12/2014. Notices of assignment were sent to the Defendant in accordance with S136 Law of Property Act 1925. Adjustments have been made in the sum of £0.40 AND THE CLAIMANT CLAIMS 1. The sum of £425 Have you received prior notice of a claim being issued pursuant to paragraph 3 of the PAPDC (Pre Action Protocol) ? 2 identical letters were sent claiming to be "Letter before Claim as required by the Practice Direction on Pre-Action Conduct & Protocols contained in the Civil Procedure Rules" The first of these letters was dated March 2018 & the second in September 2018. What is the total value of the claim? £510, incl court fees & legal fees Is the claim for - a Bank Account (Overdraft) or credit card or loan or catalogue or mobile phone account? Doorstep loan - not a Bank Loan as claimed in the POC When did you enter into the original agreement before or after April 2007 ? 2009 Is the debt showing on your credit reference files (Experian/Equifax /Etc...) ? Yes Has the claim been issued by the original creditor or was the account assigned and it is the Debt purchaser who has issued the claim. Original creditor Were you aware the account had been assigned – did you receive a Notice of Assignment? No memory of such but as sent back to OC, prob not applicable Did you receive a Default Notice from the original creditor? No letters marked Default Have you been receiving statutory notices headed “Notice of Default sums” – at least once a year ? No Why did you cease payments? Had to give up work to become full time carer for disabled wife. What was the date of your last payment? Not sure Was there a dispute with the original creditor that remains unresolved? No but seeing as OC has already obtained CCJ's for 2 other loan a/c's, it seems particularly odd that they have come for such a small amount & after such a long time. Did you communicate any financial problems to the original creditor and make any attempt to enter into a debt management planicon? No What you need to do now. Answer the questions above If you have not already done so – send a CCA Request to the claimant for a copy of your agreement Posted 30/10/18 ======================================================= Hi, a dear friend has asked me to help him as he got court papers this morning & he's in a panic. He doesn't have access to computer or scanner so everything will be uploaded/discussed via myself. Since 2017, the only paperwork received has been: 1. Account summary, dated January 2018 and letter marked "not a demand for payment" 2. LBC dated March 2018 incl account summary 3. Letter marked "Not a demand for payment" incl letter offering to accept reduced sum in full payment 3. LBC again dated September 2018 incl account summary 4. N1 claim There is no paperwork saved before Jan 2017 so a CPR 31.14 request for the original agreement, assignment & reassignment letters as well as the default notice will be posted tomorrow. His only income is Income Support and Carer's allowance & he already has 3 CCJ's of which 2 are to PRA re Provident which they secured in Feb 2017. He pays each of them at £5 per month. In view of the fact that their paperwork doesn't appear to be in order, I wondered if he had a chance of successfully defending the claim. Your opinions would be helpful. I have uploaded all the documentation. Interestingly, every piece of paperwork has his correct address on it apart from the September LBC & the actual N1 claim ! Ok, so it's only the last letter of the postcode they got wrong but it strikes me as odd that it's been right up until now - my cynicism alarm bells rang when I noticed it, lol

-

Well quite but it proves how they need checking on & how knowing one's rights under the law, aided by the knowledgeable folks at CAG, is enormously helpful in putting the case to them

- 9 replies

-

- bankruptcy

- dated

-

(and 1 more)

Tagged with:

-

- 9 replies

-

- bankruptcy

- dated

-

(and 1 more)

Tagged with:

-

LOL, postie's just delivered & there's a letter from Prov ! It's just a letter setting out how their complaints process works but at least it confirms my letter has been received. Will update thread as & when my complaint gets dealt with in case it helps anybody else in a similar situation.

- 9 replies

-

- bankruptcy

- dated

-

(and 1 more)

Tagged with:

-

Thanks dx but if I have no proof of delivery, surely Prov will keep on doing nothing but supplying Experian with incorrect information. Are you saying just wait the 28 days then slam a complaint into the ICO, citing s7 Interpretation Act ?

- 9 replies

-

- bankruptcy

- dated

-

(and 1 more)

Tagged with:

-

Hi I feel as if I should know how to do this by myself but age is catching up with me & the brain's not as sharp as it once was so any help will be greatly appreciated. I went bankrupt in 2010 & was discharged in 2011. When checking my credit file with Equifax - all ok but Experian have a default with Provident marked against me, dated 2011 ! Prov were definitely included in the BR & I know they are wrong to have marked the default after the date of the BR so I wrote to them demanding they rectify the information they provide to Experian, posted recorded delivery & good old RM didn't get a signature to show whether it had been delivered ! What do I do now ? Do I send the same letter, this time by Special Delivery ? Do I do nothing & wait for 28 days then if no response from Prov, complain to the ICO stating s7 Interpretation Act ? Do I send the same letter, this time by Special Delivery but pointing out the 28 days started from the date of the original letter ? As I said, any help will be greatly appreciated. After 6 years of waiting, it's a pain in the proverbial not to have a shiny clean credit file

- 9 replies

-

- bankruptcy

- dated

-

(and 1 more)

Tagged with:

-

citizenB

mkb replied to BankFodder's topic in Consumer Forums website - Post Your Questions & Suggestions about this site

Seen the news & wanted to say thanks for the help you offered when my financial life was in a mess. The advice & suggestions of CB (as well as Ellen & AndyOrch) have helped me enormously & I know for sure I'm not alone in that. CAG is losing a gem but all the best for the future CB -

Risking your home for the sake of £1800 is madness. Arrange an affordable payment plan with the water company, set up a standing order to pay it on time each month & move on with your life.

- 197 replies

-

- 6years

- attachment

- (and 19 more)

-

Have you applied for DLA ? If not, it sounds as though you should. You have met the qualifying period so if I were you, I'd get the form in & start the ball rolling. The extra money each month makes a huge difference.

-

I read it as the OP has been asking for a letter but think a request from the employer would have a different, and better, effect - sorry if I'm wrong but that's how I read it.

-

I have absolutely no complaints about the NHS & the way it has met the needs of my family. I have a degenerative, disabling disorder of my spine. To get a diagnosis I had consultations with my GP who referred me to the hospital. An orthopaedic surgeon ordered MRI scans, x-rays & courses of physio. He then referred me to a rheumatologist who prescribed me appropriate medication & instruction to my GP to continue/amend medication as my condition dictated. I also have emphysema & again my GP referred me to a consultant in respiratory disease. He ordered lung function tests, spirometry & x-rays in order to ensure I was on the appropriate medication. Over time my inhalers were no longer maintaining good airways so the respiratory consultant referred me to the Royal Brompton Hospital in London, a specialist hospital where lots of research is done as well as experimental treatments. On my first visit there I had CT scan of my lung & tests to establish the exact condition of my lungs. The CT revealed a couple of nodules on both lungs so he ordered a PET-CT scan as well as repeating the CT. These scans showed an active tumour in one lung & another in the other lung that didn't uptake any of the radioactive sugar so is present but not doing anything - yet. I was given the choice of having the tumour removed by way of lobectomy but declined this. I was not forced to comply with what the doctors wanted to do. It was my choice to wait & see and the medics accepted that & agreed to monitor me. I have had 4 monthly checks since then & the tumour has grown on each occasion so we are now actively exploring the possibility of cyber knife treatment or failing that, palliative radiotherapy as & when the appropriate time arrives. Throughout this whole saga, my GP has been brilliant & always there if needed - our surgery runs a same-day surgery or a telephone consultation if it's just advice needed. Every hospital appointment has taken place on the day it was arranged for both for my spinal problem as well as my cancer. I can arrange to read my GP notes by following the data protection procedures & I requested that letters from the hospitals are copied to me also. The NHS is a brilliant establishment. Sure it has it's problems - what organisationn of that size wouldn't have - but it's always there for us when we need it & without it many millions of us would be in a much worse state than we are. I cannot begin to imagine what this would have cost me if the NHS had not been free to users. I would be unable to get insurance owing to my existing disabilities & even if I could, what cost would that come to given the cancer diagnosis/treatment. The number of bankruptcies in the US or people going without treatment because they don't have insurance is frightening. Constantly knocking it & the people that work in it simply serves to demoralise them & does nothing to improve things.

-

Can't your employers write to the Consultant for his opinion ? I think that's usually how these things work (well, it was when I needed to get expert opinion on my medical problems but practices may have changed since)

-

Some, like his Barclaycard, were signed up for online so will have electronic sig, others haven't produced a CCA at all. Those with no CCA are not being paid at all & the enforceable ones are being paid at an agreed rate, well below the due sum but each one is registered as in default.

-

-

Debt Managers Ltd.

-

My OH has checked his credit file & found that an unpaid debt to a catalogue company for £270 has been registered as a default on 01/02/14 despite having not made payment at all since 2009. Balance history Hide details Jan Feb Mar Apr May Jun Jul Aug Sept Oct Nov Dec 2014 270 270 2013 270 270 270 270 270 270 270 270 270 270 270 270 2012 270 270 270 270 270 270 270 270 270 270 270 270 2011 270 270 270 270 270 270 270 270 270 270 270 270 2010 270 270 270 270 270 270 270 270 270 270 270 270 2009 270 270 270 270 Hide previous years He doesn't deny he owes the money but when asked to prove that he signed the agreement, none was forthcoming & the company ceased chasing payment. Clearly it has been sold on to a DCA but no contact has been made yet this default has now shown. Should he: a) ignore the date of default ? b) question the default & if so, with whom ? c) will it matter what the date is since, if I've got this right, it should drop off his file after 6 years since last payment activity on the account ? He has other debts that he's made arrangements for so already has a trashed credit file but wants to at least have the trash being correctly applied ! All help appreciated AARGHHH !!! On reviewing the file, I note that it is only the updated date that has registered as 2014 - the actual default is 2009 !

-

PRS landlord to evict tenants on housing benefit.

mkb replied to citizenB's topic in Benefits and HMRC

Ok evidence. I said: Benefit cap maximum of £500 - easily found on govt website but the Turn2Us (a recognised national charity) website explains what's covered & what isn't. Here's Shelter's take on it to show that Turn2Us are relaying facts, not political spin: Labour Market Surveys are released every month. There you can download the Claimant Count statistics dating back to 1986. Walk down any high street or shopping centre & ask the TV retailers. Even second hand places like Cash Converters rarely stock them. No verifiable evidence that Brighthouse, Provident etc are frequented by those on benefits but ask yourself if those that aren't struggling on minimal income would shop in those stores or pay the extortionate interest rates to get a loan if they were able to access mainstream funding. Not sure what other evidence would be required in order to convince people that life on benefits is not a breeze - sometimes people believe just what they want to, in spite of the facts

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.

.thumb.jpg.9f1078d75b01658796e5b3b8634f3636.jpg)