SleeplessInDebt

Registered UsersChange your profile picture

-

Posts

17 -

Joined

-

Last visited

Content Type

Profiles

Forums

Post article

CAGMag

Blogs

Keywords

Everything posted by SleeplessInDebt

-

Natwest PPI Claim Back

SleeplessInDebt replied to SleeplessInDebt's topic in Payment Protection Insurance (PPI)

I have sent a letter to RBS,saying they did not comply with my SAR and I will wait another two weeks for the documents. NatWest has now sent me a cheque for £10 back saying they have given me all the info I need to claim back PPI and they have satisfied my request. I could scream. -

Natwest PPI Claim Back

SleeplessInDebt replied to SleeplessInDebt's topic in Payment Protection Insurance (PPI)

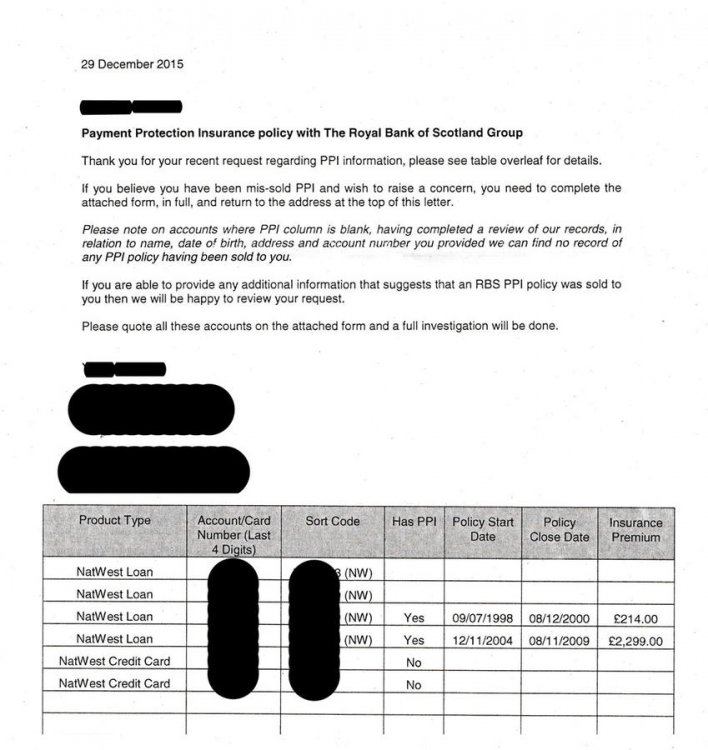

I have sent SAR letter to Natwest on the 18/11/2015. They have responded with the letter asking for my reasons, otherwise they may not be able to satisfy my request. I have emailed them back, that I wish to reclaim mis-sold PPI. I have then received a letter on 29th Dec, which I don't quite understand, with a form to fill, which is asking for information that I would have if they honoured SAR. I am not sure what to do next. They keep asking me to phone them, unfortunately I had another surgery on my cervical spine, and my vocal cords don't work. Any help much appreciated. -

Natwest PPI Claim Back

SleeplessInDebt replied to SleeplessInDebt's topic in Payment Protection Insurance (PPI)

Thanks. I will do that today. -

Natwest PPI Claim Back

SleeplessInDebt replied to SleeplessInDebt's topic in Payment Protection Insurance (PPI)

Hi, I hope you can help me reclaim PPI from NatWest bank. I am unsure how to begin, and was advised not to use any companies advertising to do it for you. I have fallen ill in 2004, and defaulted on my loan repayments in 2006. NatWest never paid the insurance. I forget their reason for it. I have had several loans with them that have always been extended, and topped up over the years , and I was always told, to be approved for the top up, I have to have PPI. I do not have any paperwork anymore, apart from one loan agreement. I was wondering whether I can still claim PPI that far back, and how do I obtain all my loan agreements. I have a short window in which to attempt to do this, as my health is failing again, and I am scheduled for surgery. Recovery time is about a year long, so it will probably be too late to claim then. Thank You -

Hi! I was just wondering whether I can still claim for mis-sold PPI from NatWest. I have had a loan with NatWest that has been extended several times over the years. In 2004 I had a stroke and I am since disabled on benefits. In 2005 I defaulted on NatWest loan repayments after running out of my savings. Many Thanks

-

Can Capital One demand my bank statement?

SleeplessInDebt replied to SleeplessInDebt's topic in Debt Collection Agencies

I received a letter from Frederickson saying that they are no longer acting in relation to the matter and are unable to provide the documents I requested. They also say I must request them direct from their client the Capital One. Does that mean Capital One still has my account and the £4 are still going to them, or should I stop paying until I know who has my account. It's all very confusing. One good thing; the telephone calls have stopped. -

Can Capital One demand my bank statement?

SleeplessInDebt replied to SleeplessInDebt's topic in Debt Collection Agencies

Thanks -

Can Capital One demand my bank statement?

SleeplessInDebt replied to SleeplessInDebt's topic in Debt Collection Agencies

Should I stop paying £4 to Capital One or can I change to £1? -

Can Capital One demand my bank statement?

SleeplessInDebt replied to SleeplessInDebt's topic in Debt Collection Agencies

Have received a letter from Fredrickson today, demanding immediate payment in full as instructed by Capital One. -

Can Capital One demand my bank statement?

SleeplessInDebt replied to SleeplessInDebt's topic in Debt Collection Agencies

@coledog; many thanks, am printing it all out, ready to send off on Monday. I have had two phone calls from Fredrickson so far today but they are recorded? That really stinks, can't even tell them to stop phoning. Whatever next! -

Can Capital One demand my bank statement?

SleeplessInDebt replied to SleeplessInDebt's topic in Debt Collection Agencies

Thanks for all your help guys. Since I didn't hear anymore from Capital One, I just kept the £4 repayments and did not send them any bank statements. However, last week I received a letter saying that my account is now in default and they now have the right to demand the payment in full. The next day I started to receive phone calls from Fredrickson every day or even twice a day. They ask for my personal information but when I ask to know who they are and why they are calling me, they say that they cannot disclose that information. They sound quite a nasty bunch. I suspect Capital One has passed my account onto them. I told them I will only respond in writing but the phone calls persist. I find them very difficult to deal with. I can't disconnect the phone since I have severe spinal cord compression and it wouldn't be very safe for me. I will sent CCA this Monday and see. Just want to say that since I found this site they do not scare me anymore and the information and support you guys offer is worth gold. Thank you. -

Can Capital One demand my bank statement?

SleeplessInDebt replied to SleeplessInDebt's topic in Debt Collection Agencies

I am just worried they may take me to court as I am not up to it, health wise. It’s a credit card debt of about £6000. I am making a payment of £4/mth since state benefits are my only income. I have nothing to hide and all the information I send them is correct but I feel very uneasy them having copies of my benefits now. I had their credit card for some years before my life was turned upside down in 2004 and I ended up on benefits with a debt which seemed to have grown out of all proportions. Should I just ignore their last letter and hope they don’t take it any further? Many Thanks -

Can Capital One demand my bank statement?

SleeplessInDebt posted a topic in Debt Collection Agencies

I have been sending my income and expenditure to Capital One for the past three years now, but on the last update they wanted proof of my benefits which I have sent. They are now requesting a copy of my "Bank Statement" and I wonder whether I need to do as they ask to avoid them getting a court order. I don't know what to do next. Any advice much appreciated. -

*** THE FORUM NEEDS HELP - Please read ***

SleeplessInDebt replied to alfwithhair's topic in Debt Collection Agencies

2£ done, would love to donate more, as I think you people are great. Good luck -

Fight back nasty DCA - help please

SleeplessInDebt replied to SleeplessInDebt's topic in Debt Collection Agencies

Yes rory32 I think I will eventually have to, although I would prefer to avoid it for a couple of reasons. My health being one and there is also a very good chance I may loose the place I rent now. So my aim is just to get people off my back till I am better, but thanks for your comments. -

Fight back nasty DCA - help please

SleeplessInDebt replied to SleeplessInDebt's topic in Debt Collection Agencies

Thanks NailPost You are right, I will change that to 1£ lol. I have sent CCA a while ago and have received relevant paperwork from NatWest. I would like to dispute the amount as the interest rate kept going up all the time and there are a lot of charges, but I may do that when my health is a bit better. For now I would just like them off my back, at least for a while. -

Hi all! I am heavily in debt and since my stroke have been juggling a number of DCA’s and creditors. I have only found this site a while ago and it has proved invaluable. I do not deal with any of them over the phone any longer thanks to this site. One of my debts is a NatWest credit card which has been passed on to Wescot and they seem to be in a league of their own when it comes to bullying tactics The latest letter is from their solicitors threatening legal action. I am now thinking of standing up to them, as all my offers of small repayments whilst I am off sick have been refused. I am just wondering whether sending that letter could stand against me in court should they realise their threats. Dear Sir! Thank you for your recent letter indicating you will be commencing legal proceedings against me. Due to a stroke, my financial situation is indeed very dire and bankruptcy would only come as a welcome relief. Ironically, I can not afford court fees to petition myself. You also indicate in your letter that Wescot is willing to consider realistic options for repayment. Since my income consists solely of benefits, and I do not own any property, or other assets of any value to realise, there is no such thing as a realistic repayment amount at present. Any token offer I have made so far has been very unprofessionally ridiculed by your people at Wescot, in tandem with threats and bulling tactics and since any stress could have detrimental effect on my health, I had no choice but to seize all communications with them. However, since, I doubt very much that you will cover my court fees purely as an act of generosity, I once again offer a token payment of £2 until my return to work. Should you be willing to accept this offer, please could you forward the necessary details so that a standing order can be setup. Any comment would be greatly appreciated. Thanks

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

- Create New...