lew247

Registered UsersChange your profile picture

-

Posts

14 -

Joined

-

Last visited

Content Type

Profiles

Forums

Post article

CAGMag

Blogs

Keywords

Everything posted by lew247

-

Thank you all for your help and suggestions O2 have recalled the Lowell one and have agreed to remove the defaults and have reversed the debts so I now owe nothing It wasn't simple, it took loads of emails and researching various laws and finding out from them that the amount I owed was about 20p less than the defaults showed so they agreed to remove the defaults. I know it won't show properly on my credit record for a while but it will help a lot once it does show as they were the only problems on my record.

-

Blue Badge - lower rate mobility

lew247 replied to TickledPink's topic in Special needs, Disability etc

Yes you can but it depends on the council and the interview I have lower rate mobility and care (up for appeal in May) and I applied for a BB due to multiple problems stemming from a brain injury with operation in 2007 I was fully expecting to be turned down, but got a call 2 days after the interview/assessment and was told I was successful It was like winning the lottery Just be truthful when you go for the assessment is the best advice I can give -

Working days or normal days?

-

Thanks - just sent it off now

-

Thanks for that Fortunately I still have all the original agreements I have signed, and a copy of most letters sent to them and some of the ones they sent me IF I sent an SAR would that be better than sending a CCA? or do I send a CCA? OR do I do both? What I'd like is a copy of everything that they have on me, but I also want a copy of this mysterious loan agreement that I know I did not sign.

-

I have a loan from Welcome Finance, well I've had several since 2003 (Stupid I know but...) The one I have a problem with was taken out in 2005 and has the account number 1**9711 tota I have all the paperwork for this including the one with signatures. The problem I have is this I took this loan out to consolidate a previous loan as I was recommended to when I had problems at the time (ill health) Consolidation of previous loan £2K appx plus an extra bit to give us some cash plus the ppi Since I took the loan out, about a year after I was reading though the PPI documentation and it confirmed my suspicions that i raised when taking out the loan that it was useless as I had claimed previously (back problems) and it didnt cover me. I disputed this with them and argued and in the end I stopped paying in I think late 2006 and put the account in dispute in July 2007 Since then I have had various letters and some before but only recently realised all the letters had the wrong account number I claimed the PPI back a few weeks ago and I also saw my credit record, and the two don't tally at all. According to my credit records I now owe around £9K and it's been going up most months since I put it in dispute Yet the letter I got from Welcome bout the PPI refund say's I now ove just over £2K After the PPI refund they reckon I still own just over £2k which is possibly right and I will pay it if it is and I owe it BUT in the PPI calculation, they said there was no adjustment of the loan due to previous PPI I reckon there should have been as the main part of the loan £2K was to pay the previous loan off, which included PPI Am I right or wrong? Should my balance have kept increasing once I had put the loan in dispute? Is there anything I can do to get them to remove the default notice on my credit file seeing I put the loan in dispute and not them? Regarding the account number can someone please explain to me how they can reckon I owe £9K on an account that I know nothing about, the account number I have on my records (the paperwork I signed) has a different account number I emailed them to ask about this a few days ago and also asked them about the PPI rebate frmo the prevous loan and should this loan start amount not have been adjusted, also did I get a rebate for the medicare and life insurance and also queried the wrong records on my credit record. I got this responce

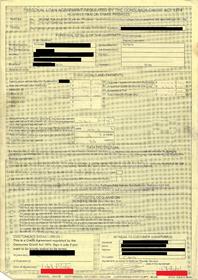

-

I posted this in a couple of forums but got no meaningful replies I have to decide what to do by tomorrow (Thursday) night as the 6yr period ends on the 11th March My first question is if I put in a claim (again) for a PPI refund will this restart the 6yr clock as I actually still owe them money There is a bit at the end of the long story (sorry for it being so long but with the brain injury I have to write things down,m then read it then change bits that i remember better or missed out until its correct) about how I spotted after finding the original agreements that the date I signed was a day before Welcome Signed, as in they got me to sign it one day and they signed the next. This is on at least 3 of the documents I have. Now the story and apologies It's long and I'm going to paste if from the other thread, and I already know I shouldnt have taken the loan and I should have ran a mile from Welcome Finance In 2003 I got a car through Welcome Finance, and later on got a loan 2004 I had deep vein thrombosis and was off work for months with this and back problems 2005 I cancelled the car policy and returned the car and also got another loan to "tide me over" Yes I know this was stupid. But the guy in the office was great, he said he'd cancel the existing loan and give me £1000 cash to keep me going till I got back on my feet I told him that I didnt want the insurance as it wouldnt pay out - it specifically says previous back problems make you ineligible, and I'd already claimed on the insurance so it was unlikely they'd pay out again He said that I have to have it or I can't have the loan and I can't remember what he told me to put down as my job but in reality I wasn't working at the time. We (my partner was working) managed to make the payments for a while but then things got real tough and this is where it gets hazy in 2007 I was in hospital for months with a brain injury so my memory is absolute rubbish at the moment, I'm still seeing neuro docs to try and get it sorted. Sometime between the start of 2007 and mid 2008 my computer died and I lost everything that i had sent to them calculations and so on and all that I have left is hard copies of what I believe is most of the info I sent to them and letters received from them (Welcome) I had told them that I was mis sold the PPI and so on but they refused to refund it to me, just cancelled it from the date I told them but they appear to have made no deductions to this I only found the paperwork last week and have been going through it and I have a statement that was sent in July 2006 which may or may not be the last time I sent them a payment, I honestly don't know- I know from the hard copies of paperwork I sent to them that I tried to make a payment on the telephone in late July/August 2006 and they refused to take it, and they had a cheque previously to that and it was never cashed. Looking at the figures they have charged me 2399.59 to settle the previous loan Should this amount not have been reduced because on the date it was settled the PPI should have been cancelled and a rebate applied including a refundment of interest not now owing? BEFORE the settlement figure was worked out? Maybe I'm wrong in that but the PPI should never have been on there so thats one thing I need sorted one loan the 1st one was in 2003 and it was the settlement for that which comprises the bulk of the 2nd loan the 2nd was was no the 11th March 2005 which is why I need to decide what to do soonish Now the agreement was signed in early March 2005 so what's my best option now? At the time of the statement I got it ends with -March 05 Interest posting £72.90, Penalty Fees £23.81 (no idea what they might be for) and Settlement £2399.59 Now Am I reading this right in that the £2399.59 is the figure I owe them (not allowing for PPI and so on)? DO I need to start a claim in the next few days regarding the PPI or is it best to leave "sleeping dogs alone"? I have had several letters from debt companies in the past few years whuich Ive ignored, The last one was from Mackenzie Hall for the sim of £4652.37 - no idea where that figure came from and Finally one from Welcome Finance (it has their green logo) but the address says Mackenzie Hall Collect. This states period of statement 20-02-09 to 20-02-11 Amount of Credit provided? I never got that amount of credit!! £4842.58 date of 1st movement - the date of the last welcome loan in 2005 20-02-2009 opening Balance £4652.37 Closing Balance £4652.37 Interest rate 36% 20-02-09 0.0% 16Dec10 - 20-02-11 Sent in the past few weeks which makes me wonder what on earth is going on now! I have Definatley sent a letter before action to Welcome in 2006 and 2007 Now finally I spotted this 02 March 2011 The FSCS has declared WFSL in default. This is because the firm is unable, or likely to be unable, to pay claims against it in relation to PPI. WFSL sold a substantial number of PPI policies to its customers, and a declaration of default opens the way for those customers, and any others who might have valid claims against the firm that are protected by the FSCS, to make a claim. The FSCS will now be responsible for PPI claims against WFSL. To assist in its handling of claims, the FSCS has arranged to use WFSL’s claims handling resources. However, the FSCS will remain responsible for all decisions on claims, which will be made in accordance with FSCS rules, and will closely oversee and monitor all steps in the handling of claims. This arrangement will enable claims to be processed more quickly and efficiently. What do I do? Anyone got any ideas/suggestions? As in do I claim back the unwanted PPI and then try and somehow to work out what I actually owe them or what do I do? Its 6 yrs since the start date of the contract in a few days On a normal day years ago it would have hurt my brain but now along with the brain damage it's totally screwing my head up I have NO idea what to do I'm still not working and I get no benefits as Unfortunately my partner works full time so I still have 0 Zero income. Sorry if this was too long and complex I actually have statements showing the total amounts owed and paid for the 1st loan and a car loan previous to that (PPI was claimed on both when I got sick which is why I knew the 2nd loan the PPI was invalid even before I signed the papers) I'm assuming I can't claim a refund of the PPI for the 1st loan as I actually claimed on it what I don't know though is should the PPi have been cancelled on the date the loan was settled and a refund applied in the calculation for the settlement figure, and how would I know if it actually was. The 2nd loan I have statements I found and I know what i paid, I know what date approximately I told them the account was in dispute (around the end of April 2006) and I have a statement from them dated after this date telling me the balance at that time was £3508 which obviously still includes all the PPI and interest I have to decide what to do soon as the 11th is coming fast, and I don't want to stir them up either I'm wondering do I do, leave them and hope it just gets time barred next year? I'm assuming its 6 years from the date of last contact agreeing I owed them money or how does it work? or do I make the claim properly for the PPI refund now and see what happens afterwards and once that's done get a proper statement? Should the interest have stopped accumulating from the time I told them it was in dispute or did it keep growing over the past few years? I've just I noticed the dates do not correspond on the contract I signed and also the Demands and needs statement It appears (I cannot remember due to the brain injury) but it appears that i signed the contract and documents on the 10th and WF signed them on the 11th This would prove that as I said I was made to sign otherwise I would not get the loan I thought at 1st it might be a smudge but the same contradiction is on all pages, the yellow and blue copies I have It seems they ticked all the boxes and I was just told to sign and for some reason they didn't sign and put the details in till the next day. They must have posted the copies out to me, I honestly cannot remember but I see no other way I would have signed one day and they signed the next. I have scanned the contract front [age (scrubbed of details) back page terms etc and the demands and needs statement They are enclosed and are: Contract front page http Contract back page (terms etc) Demands and needs statement If I contact them now does that restart the 6yr clock? If I claim back the PPI will this restart the clock again? Is it best to leave it and hope it goes away? I have no idea what to do right now, I am certain their figures do not add up properly. I really am stuck I don't know what to do now and my brain hurts just thinking about it.

-

Advice regarding Virgin Media requested please

lew247 replied to lew247's topic in Telecoms - mobile or fixed

Many thanks. I've seen several different addresses for Virgin Media, in Manchester and London, which should I send the request to, and which address to send queries regarding charges, and when it gets that far which do I send the letter before action to? as I know I wont be happy with the first reply. -

Hi all, not been on these forums for ages now, I have had Virgin Media since I moved to Manchester sometime in 2003. I was happy at first, had a few late payments due to bills not arriving in time to pay, went to E-billing when asked and then got no bills for 6 months or more, they called asking for full payment plus late payment charges, I cant remember how much I agreed to pay but they agreed a less amount than was owed. This was a good few years ago, since then I mainly have been on paper billing and at first had a direct debit set up and to me all seemed fine,. I then got really sick and several periods in hospital, so there wasn't going to be much money in the bank account I cancelled the direct debit, called Virgin Media and asked to be billed. They then for however long sent me out bills but each bill contained a late paytment charge plus non DD charge. From what I remember the late payment charge was on each bill as they never arrived in time to pay, and the next bill was being produced. I cant remember the exact details as I had brain surgery while in hospital and trying to remember things exactly with no reference is extremely hard. What I'd like to know is, can I ask for copies of ALL bills and payments, even those bills that were meant to be E-bills, Oh i remember now why some didnt get paid, for some reason their bills never arrived, even thoguh it was an NTL email address, they just never turned up even after complaining. Anyway I would like a copy of EVERY bill, and EACH payment including a full breakdown showing charges. I'd also like a copy of every letter and telephone call made to them.. I understand? there are two ways to get lists of charges bills etc, one costing £10 and one costing £1 I think the SAR is £10 while the other one is something to do with a DPA request I honestly cannot remember though Which is best, cheapest, quickets, will definately work to get the list of all bills, payments, and charges paid and owed? I'd also like to have the credit reference agencies updated when they remove these charges to NOT show that I owed them money at the time, or I was late paying when it was their fault it was late most months. Is this possible? Sorry for making this sound so complex, but its hard to write down exactly what I see in my mind these days, I start writing something then get distracted for a microsecond and lose where I was. Oh I forgot to say, when I started with Virgin, I had the full works, then eventually got rid of the tv and went to sky, and then got rid of the telephone and went to BT, and eventually got rid of the phone and moved to O2 boradband. So since the start of this year sometime I have had no Virgin services whatsoever. I didn't want to start any kind of claim while I still had their services as I imagined it might get nasty.

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.