waroo

Registered UsersChange your profile picture

-

Posts

92 -

Joined

-

Last visited

-

Received Statutory Demand - some help needed

waroo replied to waroo's topic in Financial Legal Issues

Please could someone claify to me how much detail I should include on the form 6.5 witness statement. I have typed up 4 pages of detail which includes extracts re: default notices and CCA 1974, OFT guidelines etc. Do I just include a brief outline for my reasons to set aside on the form and attach an appedix explaining in more detail or just include the whole lot attached to to witness statement form? I have copy letters to attach which I assume I can refer to extrat A,B etc. Thanks -

Received Statutory Demand - some help needed

waroo replied to waroo's topic in Financial Legal Issues

THanks, I have just found it. -

Received Statutory Demand - some help needed

waroo replied to waroo's topic in Financial Legal Issues

http://www.consumeractiongroup.co.uk/forum/showthread.php?278958-Halifax-havn-t-fully-complied-with-cca-request-what-do-I-do-now Link to my earlier thread regarding CCA request for this account -

Hi, I received a SD on Saturday evening (12th) although the SD and accompanying letter were dated at the end of September. It was pushed through my letterbox having answered the door with my young children when it was dark and raining outside. I didn't confirm who I was and he didn't tell me what he wanted but said he was here on behalf of the solicitors on the letter. I said I wasn't willing to discuss anything on the doorstep and shut the door. He posted it 10 mins later. Back in September 2010 I had an issue with the original creditor over adding a late payment charge and over limit fee onto my account when my payment wasn't late & I wasn't over my limit. Despite making the minimum payment one month, there interest charges eventually pushed me just over my limit so that open the doors for them to add more charges. They then of course took my low lifetime balance transfer rate off me and my payments doubled so I couldn't afford to make payments. In Septmeber 2010 I sent a CCA request to which I recveived a response with a copy of an application form with my signature on it but date on both my signature and that of the creditors had been filled out by someone, not me. The year on both these had clearly been altered. I sent an 'account in dispute' letter but received a reply stating they basically has comlied so tough. I started a post on here about this so I won't repeat myself but will try to post up a link in a minute. Anyway, my issue is that in October 2010 I received a default notice which only gave me 14 days for the date on the letter to remedy so I believe this to be invalid. The amount of the arrrears is far higher than the amount showing as owed on the October statment (£400 more on DN). 2 days before the date to remedy the default was up I have a letter stating I had failed to comply and they had terminated the agreeent. I sent a letter acknowledging there letter. After the date of the termination letter I continued to receive several statements all adding more interst and charges and another default notice. My questions are: 1. Do I have grounds to have the SD set aside on the basis that I had put the account in dispute in 2010. 2. The original default notice being invalid 3. Termination of the account before the date to remedy the default had passed. 4. The SD refers to a default on a date several months after I had received the 1st 2 DN's. The one referred to in the SD I have never received anything. 5. Is the amount being claimed wrong because it continued to increase after the account was terminated (although if it was terminated too early then they lost all right to claim anything but the arrears didn't they?) I have been reading so much on here that I have lost my head a little as to what exactly I should be putting on my application to set aside. Any help would be greatfully received, thanks

-

Halifax havn't fully complied with cca request - what do I do now?

waroo replied to waroo's topic in Debt Collection Agencies

THanks for the reply, sorry to be a pain but how do I go about that - is there a letter template or is it a simple letter saying thankyou for the termination of the account I accept it. To put the account in dispute would that go in the same letter and what should I put. I want to make sure I get it right but don't want to give away any vital info to them that may go against me. Thanks -

Halifax havn't fully complied with cca request - what do I do now?

waroo replied to waroo's topic in Debt Collection Agencies

Just an update. Further to my post #45 - the second DN gave me until the 9th Nov to remedy, however, I have received a letter dated the 7th Nov stating I failed to pay up by the date in the DN so they have ended my agreement & it will now be passed to debt collectors, all this after I sent an account in dispute letter which they responded to as per my earlier post stating that it isn't in dispute as far as they're concerned. What now? Should I just wait & see? -

Halifax havn't fully complied with cca request - what do I do now?

waroo replied to waroo's topic in Debt Collection Agencies

Just a quick update on things - I received a reply from Halifax who have basically said they have complied with my resquest and fulfilled their obligations (details of acts & sections etc all included in their letter). Ended the letter saying the argreement is enforcable & will continue to treat it as such & for the avoidance of doubt the CCA 1974 does allow for collection activity even if an account is in dispute. On the same day I received the above letter I also received another default notice. The first one gave me to the 26th to make payment & the one I've just received was dated the 26th & gave me until the 9th Nov to make payment. Do they have to just give 14 days or do they still have to allow for service? Thanks -

Not sure if I've posted this in the right section (sorry). I justed wanted to ask if anyone had any thoughts on if the Halifax overdraft charges of £1 per day could possibly fall into the 'Unfair Relationship Test'. I don't really know much about this but have read up on the Nation Debt Line website about a Time Order & it mentioned something about the Unfair relationship test. Also, can an overdraft be eligible for a time order application. I have only just read up on this so sorry if it's a bit jumbled & vague. Also, does anyone know if the Halifax are allowed to take thier monthly bank charges if their wasn't enough money to cover them. They took their charges on Saturday (I thought they took them on the last day each month which was Sunday) but couldn't get to the bank in time once I realised as they close at 1pm on Sat, so have incurred two days at £5 per day as they are obviously closed on Sundays so had to wait until Monday. I'm pointlessly going to send a letter asking them to freeze the account & charges to allow me to repay. Anyone had an experiences themselves or any advice on my best way forward. Thank you

-

Halifax havn't fully complied with cca request - what do I do now?

waroo replied to waroo's topic in Debt Collection Agencies

Thank you very much for that! Much appreciated -

Halifax havn't fully complied with cca request - what do I do now?

waroo replied to waroo's topic in Debt Collection Agencies

Can anyone help with the end of my 'account in dispute' letter. I have copied this from the bottom of one I've found on this forum "Since the agreement is unenforceable it would be in everyone’s interest to consider the matter closed and to write the debt off. I suggest you give serious consideration to this as any attempt of litigation will be vigorously defended and I will counter claim for all quantifiable damages". I'm not sure if this is acceptable to put, is it? Basically my letter says the document they've sent doesn't contain any of the prescribed terms etc with details of the relevant sections and so on which I'm pretty happy with but I'm struggling to find an appropriate ending. I think I need some advice from anyone who's done this before as this bit is new to me. Thanks -

Halifax havn't fully complied with cca request - what do I do now?

waroo replied to waroo's topic in Debt Collection Agencies

Hi, The said branch would be my nearest one, there is nothing on the reverse. The cover letter states below: "...the prescribed terms of the agreement would have been validly incorporated into the agreement on the reverse of the enclosed sheet or a separate attached sheet. By providing the documents attached to this letter we have satisfied our obligation to provide a copy of the exectuted agreement..." The copy I've posted is all I've received. -

Halifax havn't fully complied with cca request - what do I do now?

waroo replied to waroo's topic in Debt Collection Agencies

I'm not sure. The date showing on the form is 3 weeks after I got back off honeymoon & it's a Thursday - I would have been at work 9am - 5pm out of town so no way could have been in branch that date & I'm pretty sure after 3 weeks off I wouldn't have had a holiday day & I'm do remember saving up my holidays so I could take 3 weeks off when I got married so I wouldn't have had any days left to take. -

Halifax havn't fully complied with cca request - what do I do now?

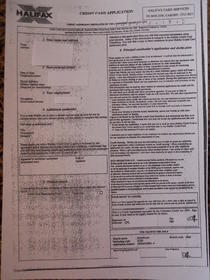

waroo replied to waroo's topic in Debt Collection Agencies

Hopefully this will work You can see where I've covered over personal info but I've left the year showing in the signature box so you can see how it's been altered -

Halifax havn't fully complied with cca request - what do I do now?

waroo replied to waroo's topic in Debt Collection Agencies

Just an update, things are getting a bit strange now. I today received a letter from Halifax enclosing a copy of the original signed application form! They go on to say the prescribed terms of the agreement would have been validly incorporated into the agreement on the reverse of the enclosed sheet or a separate attached sheet. By providing the documents attached to this letter we have satisfied our obligation to provide a copy of the exectuted agreement.... The photocopied sheet is headed Credit Card Application and contains my name, address, DOB, employment title & salary on one half & a cardholder declaration which includes a statement about I understand my application may not be accepted. I was under the impression that prescribed terms re interest, repayments etc had to be on the agreement. There is a signature box at the bottom with my current signature on it and a date which has had the year clearly altered (I can't make out what it originally said but has been altered to 04) The branch have then signed it and again altered the date to read year 04. My main concern is that the 16 digit number written on the top is not my card number or anywhere close. I did have an old card which was stopped and transferred in 2005 when my purse was stolen but it's not that number either. I'm going to take a photo & hopefully load it up on here if someone could be so kind as to take a look. Thanks -

Halifax havn't fully complied with cca request - what do I do now?

waroo replied to waroo's topic in Debt Collection Agencies

Yes, the one supposed to be the current one is identical, the one supposed to be the original is almost the same except there are fewer points in the whole thing and there is nothing on the first page with the amounts about total charge for credit being £xx etc.

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

- Create New...