todd390

Registered UsersChange your profile picture

-

Posts

125 -

Joined

-

Last visited

Content Type

Profiles

Forums

Post article

CAGMag

Blogs

Keywords

Everything posted by todd390

-

Smart insurance protecting damage to paintwork on car

todd390 replied to todd390's topic in Motor Insurance

Probably would but I've gone through the insurance now. Lesson learnt and I hate fireworks. -

Smart insurance protecting damage to paintwork on car

todd390 replied to todd390's topic in Motor Insurance

Homer 67, Thanks for the suggestion. I should have done that but alas LV have got the case in hand at the cost of my excess £600 on a £880 Comprehensive policy. Fingers have been burnt with that one. I learnt my lesson and a loss of 5 years no claims. Thanks Chris -

Smart insurance protecting damage to paintwork on car

todd390 replied to todd390's topic in Motor Insurance

Hammy 62, Thanks for your reply unfortunately I did not read the insurance renewal this time as usual. Getting my insurance at £880 Comprehensive was good with 9 years no claims. I learned my lesson with that for next year. I have always gone on line to get better quotes over the years, but this year I was foolish. I wont be next September. Using £600 excess also cost me 5 years no claims, £600 is most of the cost of my insurance - I won't be using LV again in a hurry. Thanks Chris -

Smart insurance protecting damage to paintwork on car

todd390 replied to todd390's topic in Motor Insurance

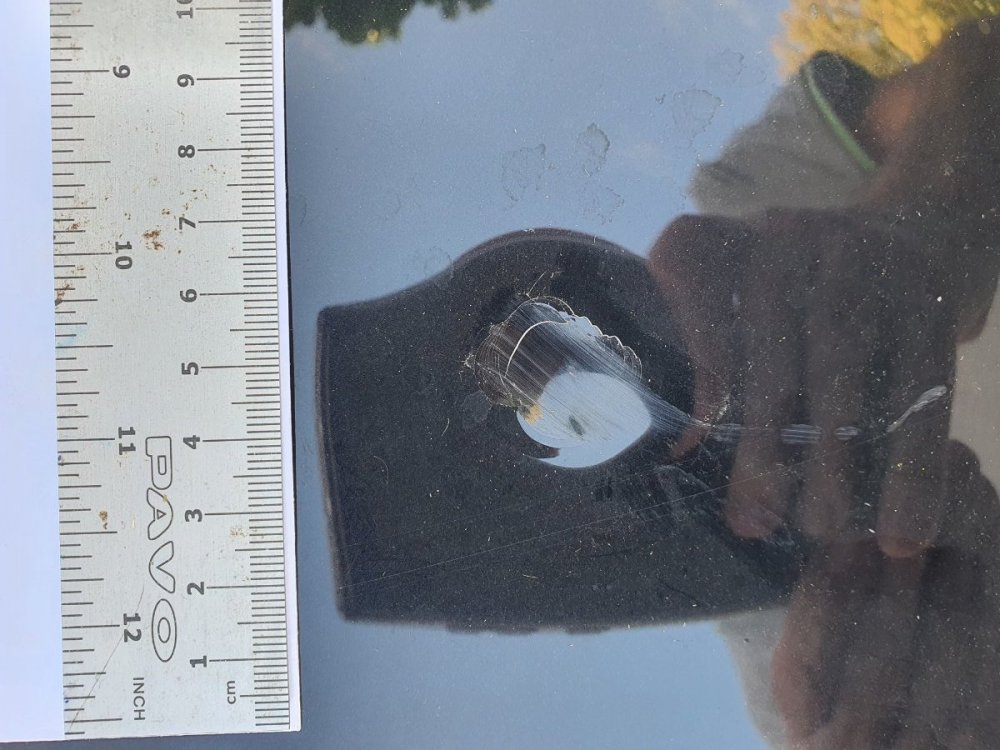

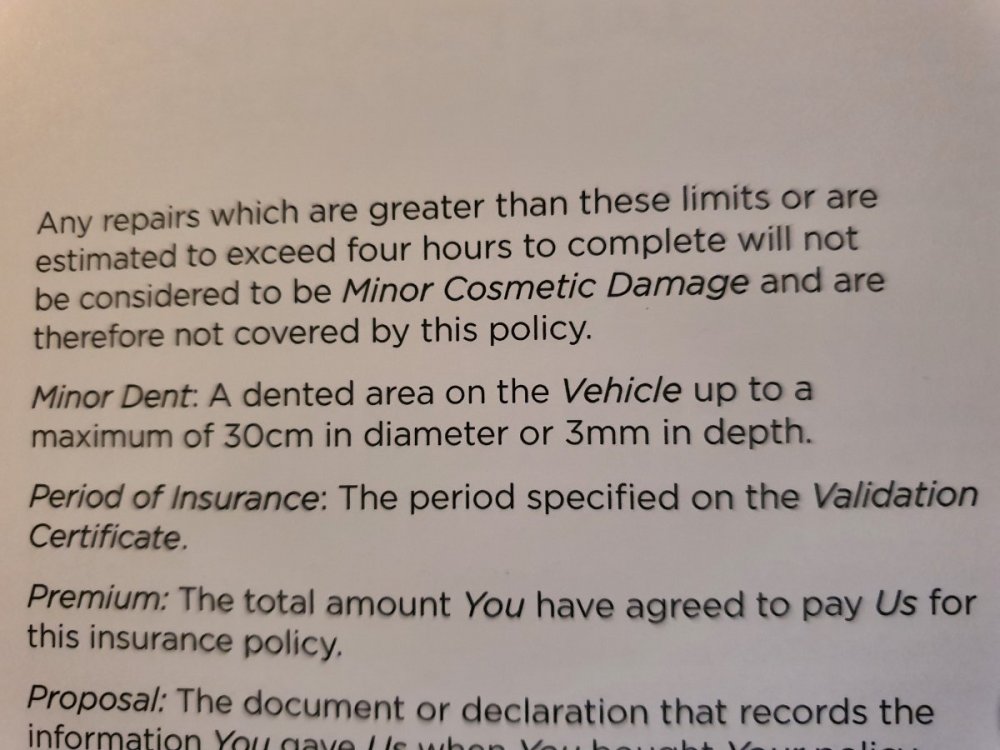

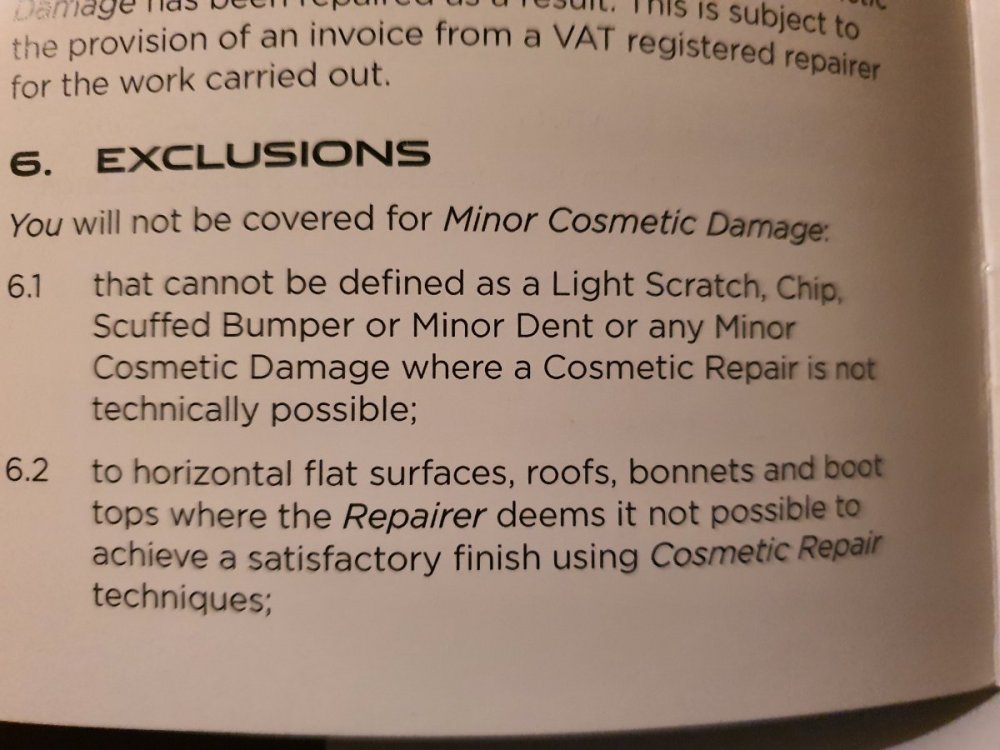

Firstly let me apologise for getting off on a bad foot, hopefully you will accept this. As you see in the exclusions it give a description of what is not covered. The booklet says a dent of 30 cm in diameter and 3 mm in depth, I also enclose a picture of the dent. Page 4 says Any repairs which are greater than these limits or are estimated to exceed four hours to complete will not be considered to be Minor Cosmetic Damage and are therefore not covered by this policy. Photos attached for you information. Best regards Chris -

Smart insurance protecting damage to paintwork on car

todd390 replied to todd390's topic in Motor Insurance

I wasn't using the 'having a full time job as a tool. Just basically saying I used a bit of time I had to seek information about a subject. I used the group a few years ago regarding bank charges, and I must say you were very helpful and I applaud you. -

Smart insurance protecting damage to paintwork on car

todd390 replied to todd390's topic in Motor Insurance

I didn't see any foul language in my reply. The type of person I am is decent. I got the impression from your first reply that you had suspected I was trying to use the group for poking fun at it by referring to my 7 minutes on line. I was then in the process of getting ready for work. I understand that people do go on group sites and waste time of other people. If I am still allowed by your group I will look the information up and post it. If not allowed then all I can say is thank you for your time and good luck in the future. Regards Todd390 -

Smart insurance protecting damage to paintwork on car

todd390 replied to todd390's topic in Motor Insurance

Like some people I haven't got all day to sit at a computer and develop conspiracy theories about people and acting like a prick I have a full time job to go to. I looked at the booklet after speaking to the insurance and there is a clause that includes the over 4 hours labour for repairs. I didn't imagine it. When I return home I will have a look again to make sure I am right. I shan't make any unwarranted attacks regarding your reply and the lack of brain cells that you posses. Thank you. Another 7 minutes used during a well deserved break as a key worker. -

I brought a new car in November 2018 and as we don't have PPI anymore the sales teams promote Smart Insurance for damage to paintwork and alloys. Sound good that if you have any damage they will sort it I know. That's not the case though. On November 5th this year my car was hit by a rocket firework while parked outside my house which is in a gated property. The firework left a small dent in the bonnet and scorch marks on the bonnet. I phone the smart insurance and sent them photographs of the damage on 6th November so they could assess the damage. I received an email saying they will contact me when they have an expert assess the damage. I had to phone back 6 days later 12th November and they informed me that the damage was not covered on the policy. The policy states that small dents are covered but if the repair would be over 4 hours then it would no be covered. After all this I decided to go through my insurance who have agreed to have the damage repaired but (my own fault for not reading) my excess is £600. Obviously I need the repair sorting as it makes the value of the car less if selling. I was wondering if I should write to the smart insurance and either get the policy cancelled as it seems to another way, like PPI, of getting money out of customers with no intention of actually providing any safeguard when a situation arises? I welcome positive thoughts and advice on this matter if anyone has any. If it is a futile action trying to recover my well earned £600 then so be it.

-

tsb DD Guarantee GB Energy/Co-Op Energy - Indemnity Claim ?

todd390 replied to the thinker's topic in Financial Legal Issues

If errors were made with payments from your account then why wont you tell the person on the phone the amounts? You say you told them errors were made that's all they need to know. Surely if you give the full story the person will be able to help. I bank with RBS and they are very good if I ask about or raise an issue. It appears to me that it is you with an attitude problem not the TSB. Now grow up and sort it by being civil to the people you talk to on the phone. Every little helps. TTFN. -

So basically they could refuse anyone insurance? Its a bit like my father told me years ago they are always only too willing to take your money off you but when it comes to paying out they dont want to part with the cash. Thanks for your reply.

-

A question for a friend who was a private cab driver with local firm. He had an accident 12 months ago when a motor cycle hit the side of his vehicle. No serious injuries to him of motor cyclist. Taxi driver received 3 points and £100 fine. That put 6 points on his license. He packed private hire in last week due to lack of earnings with company. He was offered a collar on hackney carriage, but insurance company refused to insure him as they say the accident cost them £22,000.00 3 points are due to come off his license in February. Question is "Are they within their rights to refuse insurance?" He hasn't lapsed on his payements as it was a company block payment. 6 points on a license isn't the crime of the century (3 for speeding). I have told him to complain in writing and tell them if it isn't resolved to his satisfaction write to the Insurance Ombudsman. Basically they are stopping him from working, are they allowed to treat anyone this way? After all why do we pay insurance?

-

Thanks for that I didn't know there was no time limit. I got involved with welcome accidentally, I brought a car and they financed it, the car was written-off in an accident and they re-financed a replacement. The replacement car was stolen and they didn't tell me that the shortfall (GAP) had paid out until 18 months later (they didn't mean to tell me then either). The insurance company refused to pay up at the time, so I was paying for a car I didn't have. So I refused to pay any more money to them. I refused to reply to any of their letters. They didn't threaten me with debt collectors or anything as they knew they where in the wrong. Evetually they contacted me and we came to an agreement which at the time meant I would have wrote off £1500.00 on their loan. I reckon I have paid that though in interest, they applied the PPI without me knowing (the crafty b******ds). After I took out a bank loan to pay them off thats when I discovered the PPI, and thats when I complained. At the time they would not entertain my complaint. My advice to anyone regarding Welcome - STAY WELL CLEAR.

-

With regard to Welcome's PPI offers, I think any offer at the moment is a step forward. If you dont really agree with the amount offered I am sure there is scope for arguing the amount and actually taking court action and maybe end up with more than the offer. However, will it cost more in court action? I am happy with the offer they made me, they did however, tell me that they could not include three policies they could not include as they where past the time limit. Fingers crossed when someone eventually takes them to court they may reconsider. One thing is for sure I will never ask Welcome for a loan ever again. I would rather ask my bank at least their customer focus is better than Welcome's, and their politness too.

-

I phoned Welcome and asked if they have received my agreement and they said "Yes", as I did send it by recorded delivery. They say it should be in my bank within ten working days. So just waiting now.

-

Dont give up keep on at them, get some advice legally though and make sure you stand firm. I know it can be frustrating but you have to keep up the fight. It proves they are wrong when they do a u-turn all of a sudden. They will pay the interest back, they have to. All this proves that they are acting illegally and mis-selling PPI. They are obviuosly on a commision to sell the product. When I stood firm and refused to pay another penny they combined my loan and told me they had written off so much due to my protest, they sold me short fall (gap) insurance and when my car was stolen never told me the insurance had paid the amount out-standing and I ended up paying for something I didn't have, the whole point of the insurance. When I discovered 18 months later they tried to cover it up. Then they added PPI without telling me. Sitting in their Liverpool office was like sitting in a police station being interrogated. I'll never forget that, they talked down to me and told me I was silly refusing to pay and it made sense to combine the loans. I know I probably repaid the outstanding amount in interest though, they are cowboys. I would be glad to see the collapse of their company, not before they pay me back though. PS Regarding last post I only noticed spelling mistakes after posting thats why its on twice.

-

Its been nearly two years since I paid Welcome off and I made a claim for repayment of PPI last year to no avail. Today (25/10/2010) I was gob smacked when a letter arrived over turning their decision and making a substantial offer and compensation for the refusal. I'm off to the post office to record my reply so as not to lose it in their internal web. Still I would never go to them for a loan ever again, just not worth the hassle.

-

Its been nearly two years since I paid Welcome off and I made a claim for repayment of PPI last year to no avail. Today (25/10/2010) I was gob smacked when a letter arrived over turning their decision and making a substantial off and compensation for the refusal. I'm off to the post office to record my reply so as not to lose it in their internal web. Still I would never go to them for a load ever again, just not worht the hassle.

-

Welcome Finance - This company needs to be banned.

todd390 replied to tightbum's topic in Welcome Finance

Offer to pay them a £1 a week. I'm lucky I paid them off but it took them 18 months to write to me to say the account was settled. I did get a letter telling me I owed more but sorted it. Now I am trying to get them to alter a comment on my credit report from 6 late payments to satisfied. They are by far the worst finance company in the world, run by idiots. -

Hi All, Good news I finally got one of their staff at the Liverpool branch to do their job. A nice lady spoke to me on the phone and assured me she would send me a letter of acknowledgement that I owe nothing and the account is paid up and they are satisfied with that. She told me she would post two letters to make sure I got at least one. I recieved a letter telling me it is settled. Thats all I ever wanted after twelve months. So I am happy and glad to be well rid of Welcome Finance. I now know at least one of their staff who is not bone idle and helpful. I congratulate her but if she has any sense she'll seek employment with someone worthwhile.

-

I recieved a letter from 1st credit saying I owe Money shop £150 for a cheque which was not honoured by my bank. i have asked them for details such as the account number and date of the cheque. The so called female telephonist was very snotty and abrupt on the phone. She insisted if it was prove that i we the debt they want paying straight waay. i told her if it was proved that it was my debt I would make an offer of payment, but they have got to prove the debt first. I am waiting, they threatened me with a bailiff too. Can't wait to see the outcome.

-

Hi salviablue, Thats how I got involved with Welcome by buying a Vauxhall Omega. And guess what? That was dodgy too. First week it was in the garage more than in use. The petrol i put in it was used by the so called mechanic doing test drives and telling me it was ok. I got advice of a friend and he told me what was up and I told the so called mechanic and they got the part. The brake pads where all down to the metal. I reported the fact to DVLA as i thought it was a dodgy MOT. Regarding Welcome they are worthless their staff dont do their job. I am in the process of writing to the FSA as Welcome ignore me. All in all they are arse holes.

-

Hi Jon Chris, No unfortunately I did not record them. But been in touch with their head office again I told them someone was not doing their job properly. They assured me they will send statements which will be zeroed meaning there is no money owing. I'm giving them 7 days if the letter doesn't arrive then I write to the FSA.

-

Well everyone Welcome certainly have done it this time. I received a letter from them yesterday informing me that I would have to pay £25 for missed payments. I phoned their head office and asked if the account was closed as I made a final settlement in April 2008. Surprise, surprise they told me it is still up and running and I owe £518.00. They transfered me to my local branch who assured me they would deal with the matter. I asked for a letter confirming the account was closed and they assured me they would send one. I asked why the letters they promised confirming this was not sent out when I closed the account after me requesting such letter on several occasions. They could not answer. I said I would consult a solicitor they asked why I was threatening them with such action. Instead I am writing to the FSA. They (Welcome) are absolutely crap (sorry for having to put that on here and hope I dont offend any decent people but it has to be said in a truthful manner.

-

My daughter opened an Additions account via the inernet and filled the forms out and lied about her age. She filled the form out as though she was 18 yet she was only 16 at the time. Nobody bothered to check to see if her decalation of age was true or not. She has allowed the account to fall into debt due to her not being employed and no income. She has informed them that she lied about her age and they have requested a copy of her birth certificate and she has been told that it will either result in the account being closed or taken to court. They are still adding interest and £12 per letter to the account. I know she has commited fraud with regard to her lies about her age, but how does she stand with regard to the situation in general?

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.