Showing results for tags 'capital'.

-

Hello everyone, Could certainly do with some advice if at all possible. around 5 years ago during the 'credit crunch' a company I was sub contracting to went belly up leaving me out of pocket in the short term and out of work in the long term. Up until this life was good and like so many others had various credit arrangements. However this all became unmanageable almost over night. We are now improving our situation and have payment plans in place with around 6 different creditors all of which we have stuck to and maintained payments. However Capital One was always a bit of a problem, always insisting on more than we could afford, up to 3 or 4 phone calls a day and just generally badgering the life out of us. It got to the point where I adopted the [removed] attitude to them and left them to whistle. We even changed our home phone number to stop the nuisance calls from them. Over time the letter thinned out to almost stopping. Then the letters came from different Debt recovery companies acting on their behalf. Maybe a bit foolish of me but I just ignored them hoping they would just go away. Best part is, they did. Different companies would write and as I thought, tried their luck. The thing is, none of them pushed it. I'm now at the stage where rightly or wrongly I'm beginning to think I'm going to get away with this........... Then a couple of weeks ago we got a letter acting on behalf of Lowell Porfolio 1 from a company by the name of BW Legal. Now we had heard from these people before when they threatened bankruptcy against us but like all the rest they just seemed to give up and go away. out of the blue last week we had another letter from them stating that they had commenced court action against us. No final warning of letter of intended action. Just a letter to say they had initiated court hearings via moneyclaim online. Now I know that this is a mess of my own making and that I should have worked a little harder at coming to an arrangement with one of their Pit Bulls but the fact of the matter is I didnt so here I am facing litigation. What I would like some advice about if possible though is how to defend the claim against me as I feel I am being shafted by these people to the tune of over £1500. The last statement I had from Capital 1 was for around £3400 owing but these sharks are taking me to court for almost £5200. I know that I am going to have to pay what I owe and I fully accept that but I can help feeling like someone is taking advantage of this situation to make a tidy sum at our expense. I have acknowledged the court summons to gain a little breathing space albeit 14 days but can I ask for a breakdown of the total sum for which I'm being sued? The summons states that I am being sued for the following. Amount Claimed £4909.75 Court Fee £185.00 Solicitors Cost's £80.00 Total Amount £5174.75 Now I am certain that a fair amount of the original amount they are claiming for contains plenty of charges for missed payments etc and it appears that I am being charged interest on these charges as well. Can I contest this, is it legal? I am happy to put my hand up, admit liability to the original debt and make an offer to pay but I'm not sure how to contest the way in which the debt has been ramped up especially as Lowell's have bought the debt and it looks like they are trying to charge interest on the amount from way back when it was still in Capital 1's hands. Sorry for droning on, any help greatly appreciated and if I have missed something out or anyone needs more info please don't hesitate to ask. Cheers, Chris

-

Hi.. .have received a reply from Barclaycard, they have sent a copy of Barclaycard conditions Leaflet, NO signature in fact NOTHING. their letter states sorry for delay, and goes on "The information we must provide to you under the terms of Section78 is prescribed by the Consumer Credit Act 1974 and by the Consumer Credit (Cancellation Notice and Copies of Documents) Regulations 1983. .This completes our obligation to you under section 78 of the CSA 1974. As I see it they have not complied with my original request for a signed copy of the original agreement ,I have also written to them stating they are in default.. ..what do you make of the letter. ..what is the next step please... ...Firstship

- 98 replies

-

- asset

- barclaycard

-

(and 3 more)

Tagged with:

-

dx....10+ years with Stepchange I wanted to clear my debts but over the last few years I have only paid them £5 for each creditor ,they are unhappy that I can no longer pay anything and are taking for ever to approach creditors so I will do it myself.Will raise a new CCA request, so if I do not pay them what action can they take FS

- 11 replies

-

- asset

- barclaycard

-

(and 3 more)

Tagged with:

-

Hi All I was issued with a claim on 9th January which I acknowledged through MCOL, i need to file a defence soon and needed some advice, am I correct in saying that my defence is due by the 11th Feb? The following are the POCs: date of issue - 9th January POC 1.By an agreement between CAPITAL ONE BANK (EUROPE) PLC & the defendant on or around 05/11/2012 ('the agreement') CAPITAL ONE BANK (EUROPE) PLC agreed to issue the defendant with a credit card. 2.The defendant failed to make the minimum payments due & the Agreement was terminated. The Agreement was assigned to the claimant. 3.THE CLAIMANT THEREFORE CLAIMS 5xx.xx The total amount including court fees etc is £6xx.xx Am I correct in sending a CCA request to the Claimant as I have no documents from them? The answers to the questions you require are as follows: Have you received prior notice of a claim being issued pursuant to paragraph 3 of the PAPDC (Pre Action Protocol) ? Not to my memory What is the value of the claim? £5xx.xx Is the claim for - a Bank Account (Overdraft) or credit card or loan or catalogue or mobile phone account? Credit Card When did you enter into the original agreement before or after 2007? After 2007 (2012 according to POCs) Has the claim been issued by the original creditor or was the account assigned and it is the Debt purchaser who has issued the claim. Assigned to Cabot Financial (UK) Ltd Were you aware the account had been assigned – did you receive a Notice of Assignment? Not to memory Did you receive a Default Notice from the original creditor? Not to my memory Have you been receiving statutory notices headed “Notice of Default sums” – at least once a year ? No Why did you cease payments? probably 2013 but cant be sure as this was long ago What was the date of your last payment? Not sure Was there a dispute with the original creditor that remains unresolved? No Did you communicate any financial problems to the original creditor and make any attempt to enter into a debt management plan? No Roland60

-

My partner finally decided to claim her Capital One credit card PPI. The card was issued in 2003 which was more or less when PPI was introduced I believe with a avg credit amount of £500. About 2 weeks ago she made a claim using the Capital one/resolver online application. The original card application was completed on the phone and her complaint was it was not fully explained to her what PPI was and why she should be accepting. Within a week she received a reply stating she was not eligible for a PPI reclaim due to the following reason: aged 16-64 Employed and paying class 1 NAT INS Living in UK Based on the above we are confident the PPI was not mis-sold !!! They confirm it was sold on a telephone application which they do not have the recording ! How is this confirming that it was not mis-sold ? They have however agreed to just over £1200 as a result of redress scheme which was introduced in 2014 re a high commission rate which is unfair to the consumer under the CCA 1974. Not sure how to work out the PPI as not much statements are available. Given the above info, what would be the best course of action? Thanks in advance

-

Hi, i took out an mbna card in around 2002 (unsure of exact year) i was made redundant and ran up debts, on returning to employment i started to pay them off for many years, however the interest rates kept going up and eventually (aug 2012) i just stopped paying completely, initially i intended to enter into a debt arrangement scheme but mental health issues and anxiety/stress meant i just started to ignore it! I have ignored this situation for almost 5 years Recently found out that after 5 years its unenforceable. ive been praying that it would get to that point to relieve this stress Balance is sitting at around £8.5k I have always had PPI on this card I phoned broadies on receipt of the letter to request a CCA which they said they'd send. I have not received anything, does anyone have any advice, ive no idea what to do next? im scared they dont send any on for because it was done via phone, should i email them? just checked and my first month of not paying was august 2012, last recorded payment was july 2012

-

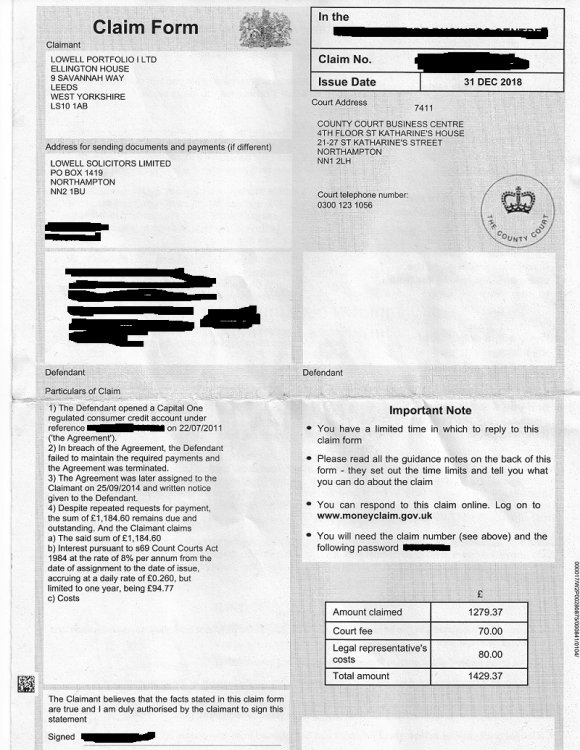

Hi I received County court claim back on Friday 4th January despite it states issue date 31 December 2018 it did not arrive in post until then but no matter what I assume date on paper work stands. I then received 15th January a warning from Lowell that they had sent it to court and I should receive something soon their letter was dated 7th January so that came very late. Okay I will get to the facts really hoping for your urgent help and assistance in this as I have suffered with sickness this month and also at same time struggled as had to keep work balance. I don’t want to use any excuses other then It was easier for me to hide this away and just wish for better things. But I did submit my AOS and full defence within the 2 weeks on Sunday 13th January and was received and noted by court on Monday 14th January. I did receive the proper letter regarding Lowell would submit to court and I had the 30 days before end of November 2018 so they followed rules for that. To try put facts about my debt down short basically was a credit card I took out with Capital One back in 2011. To be fair I am not 100% sure when my last payment was and if its statue barred. It was at a lower limit then years later was setup to £1000 limit. I fell into a dispute regarding some £12 charges etc and also had contact through phone and emails I then stopped payments and kept going up. I did not get proper response on my emails etc I was even trying to settle a solution. My fault for ignoring further letters with request for payments and debt was sold to solicitor Lowells in 2014. To cut to the chase I need to submit my defence tonight as I understand and I have not got CCA and CPR (31.14) letters sent off despite I have made them ready. Can I still get these sent off tomorrow morning with Royal mail 1st class recorded delivery and then attach £1 postal order for each? Also because of my dispute with Capital One I really wish to claim back all charges and the 8% interest etc but how do I deal with this now? Can I sent letter to them or does that has to go to Lowell? Hope for your assistance guys I would be so grateful. I have attached Claim Form and also I have done a draft Defence for me to submit tonight hope it looks okay? here is my defence draft Defence 1. The Defendant contends that the particulars of claim are vague and generic in nature. The Defendant accordingly sets out its case below and relies on CPR r 16.5 (3) in relation to any particular allegation to which a specific response has not been made. 2. Paragraph 1 is noted. I have had an agreement in the past with Capital One but any alleged balance is and remains in dispute for charges/services. 3. Paragraph 2 is denied I am unaware of any legal assignment or Notice of Assignment allegedly served over 1 year ago. 4. It is therefore denied with regards to the Defendant owing any monies to the Claimant, the Claimant has failed to provide any evidence of agreement/assignment/balance/breach requested by CPR 31. 14, therefore the Claimant is put to strict proof to: (a) show how the Defendant has entered into an agreement with the Claimant; and (b) show how the Defendant has reached the amount claimed for; and © show how the Claimant has the legal right, either under statute or equity to issue a claim; 5.As per Civil Procedure icon Rule 16.5(4), it is expected that the Claimant prove the allegation that the money is owed. 6. On the alternative, if the Claimant is an assignee of a debt, it is denied that the Claimant has the right to lay a claim due to contraventions of Section 136 of the Law of Property Act and Section 82A of the consumer credit icon Act 1974. 7. By reasons of the facts and matters set out above, it is denied that the Claimant is entitled to the relief claimed or any relief. Signed I am the Defendant - I believe that the facts stated in this form are true xxxxxxxxxx 27/01/2019 Defendant's date of birth x/x/19xx Address to which notices about this claim can be sent to you xxxxxxxxxxxx

- 26 replies

-

- capital

- county court

-

(and 1 more)

Tagged with:

-

Hi Fellas, Can anyone give me a link to the "Get lost, prove it" letter? Had a letter threatening court action, and while I have seen the last few off once papers arrived, I thought it best to try and get ahead of this one for her. Thanks

-

started a new thread as advised. my wife started to get letters about debts from lowells. all have had cca requests sent on 4th july this year, but they have all been acknowledged and all the accounts are on hold except capital one. the paperwork they have sent suggests the debt isnt as old as we thought. i have attached all the letters in pdf format. capitalone.pdf

-

Lowell Solicitors sent me a letter in December 2018 saying on 08/08/16 a CCJ was entered against you and you were ordered by the court to pay £50 per month. I haven't paid anything on it. It says they are considering options to enforce the CCJ as its in arrears. The amount of the CCJ is £499.13 It also says to avoid the possibility of enforcement action we need to agree a payment plan with you. This CCJ was issued years ago to an old address, i now know it's my responsibility to inform them of my new address and my circumstances at the time would not allow me to do that but i was just hoping for some advice. It was originally a Capital one credit card. Thanks

- 12 replies

-

Hi, A while ago, for various reasons (including being a doormat and allowing someone to leech off me) I got into credit card debt. Paying it back has been a nightmare. I live frugally and pay as much above the minimum payments as I can afford. The balances are going down, but slowly. It's been stressful and I hate thinking about my debt. My brother has been pushing me to make PPI claims for ages now. (The two worst credit cards are ones I've had for years, and at the time I got each one, the PPI box was pre-ticked and I was told when I phoned to activate each card that it was compulsory). I didn't claim as it seemed like stress and hassle and I figured I wouldn't get anything anyway. My brother has been really pushy, and last week pulled up the Resolver website and pushed me into claiming. So I did. One of those claims was with Capital One. When I made the claims, there were separate forms for Plevin claims and traditional claims. My brother told me to make standard/traditional claims, and said Plevin should be a last resort if the standard claims were rejected. So in both cases, I didn't claim under Plevin. Capital One have responded already, saying they are writing to me, they hope I am satisfied with the outcome etc. I checked my Capital One account this morning, and there are several debits and credits, each with the word "Plevin" in the description. Adding them up, apparently I am getting a cheque for nearly £2500. I was happy about this - I can make huge overpayments on these two cards, plus keep a little back to tide myself over this month. (Living frugally due to debt feels mentally exhausting, I was depressed about being the shabby aunt who only buys cheap presents and gives handmade gifts, so for once I went a little over budget on Xmas gifts for my nieces and nephews.) I told my brother and he's outraged on my behalf. He says he's annoyed that they've responded as if I'd made a Plevin claim, when I didn't. He says the fact they've coughed up so fast means they know I am entitled to more under a standard claim, and they are just trying to appease me and weasel out of paying the full amount I'm owed. Is he right? I'd assumed that they would have looked at my claim and decided I'm owed nothing, but have then looked at my claim again under the Plevin ruling and paid up there. My brother is convinced this is a "lowball offer" to make me go away, in the hope they won't have to pay out what he says I'm "really owed". Should I accept the Plevin payment and just drop the original claim? Or should I push back? My brother says a standard claim could end up theoretically leaving me with enough money to pay off a big chunk of my debt. He's convinced I'm due more. I have no idea what to do, and no idea how I should proceed. There are template letters for claiming and appealing claims, but not for "well, you've paid me under Plevin but that's not what I claimed for, so please look at my standard claim". Any advice would be much appreciated, as I'm really not sure what I should do. It seems daft to send them this cheque back and potentially end up with nothing, but my brother is convinced I'm owed more, due to being told PPI was a compulsory charge. He thinks Capital One know this and are just trying to appease me. I'm just confused... Many thanks for any advice anyone can offer.

-

Hello,this is my first post and I am seekng advice. I received a letter of claim from Restons. Following on from the advice given to others in the same circumstances as me, I sent a CCA request to Cabot and downloaded the PAP reply form, from here and filled it in. I followed the instructions on post 6 on the PAP thread. Well hubby did as I couldn't get to type in pdf format. I have receved a reply from Restons but don't understand why they are askng me to explain on a separate piece of paper. I thought I had? restons reply 13 04.pdf

-

Received letter from Capital One in April 18 RE:A credit card debt. We are writing to inform you we have instruced Fredrickson to act on our behalf to arrange payment of your capital one account, blah blah blah. I DONT HAVE A CAPITAL ONE ACCOUNT. Checked credit file with call credit and already listed on my report as sustained arrears. Steady flow of letters coming from Fredrickson now one stating on 5/6/18 "as there is a default on your credit file this may affect future credit". Checked credit files this morning no default as of yet. Sent SAR to Capital One and received reply back stating "The information you have requested has not been enclosed as we cannot locate a capital one account in your name using the details above". So they have added an account to my credit file in arrears Have sent me letters stating they have passed it onto Fredrickson Received steady flow of letters from Fredrickson But they state they dont have any record of me ?????? As stated above i do not have or had any dealings with Capital One . Whats the next course of action please ?

-

looking for help and guidance re a Capital contribution order for Legal Aid being collected by Rossendales. In 2011 a friend and his partner were arrested for fraud both were co-defendants and both pleaded guilty at first hearing. As part of the criminal proceedings in October 2011, a restraining order was issued from Taunton Crown Court, freezing the assets and including the house. After conviction in April 2017, a Confiscation order was made under the Proceeds of crime act and the house was sold to pay. POCA was for £27k for party A and 260k for party B. on 28th August 2018 Party A received a letter from Rossendales stating a capital contribution order. It has stated the amount is £53697.11 and given 28 days to pay. This is broken own as Final defence costs of £57172.11 and disposable capital of £209185.44. they have stated that his is the equity in the house minus £30k. However, from the Criminal Defence Service (contribution orders) Regulations 2009 reg 17 where an individual is restrained from dealing with a capital resource, the assessing authority shall disregard that resource, and as property was sold under a confiscation order, the monies being paid directly to the court to clear the POCA and the balance then returned. under reg 26 of the CDSR there is no liability Rossendales were informed of this by letter dated 4th September, a reponse was received dated 13th Sept stating they were not made aware of the restraining order and confiscation order, proof of such must be given and then a review will be undertaken. A copy of the letter was also sent to the Legal Aid Agency, to which a similar response was received. The relevant documents have been requested from the CPS and they have acknowledged and will send them next week. today a letter has been received from Rossendale with a heading NOTICE OF INTENTION TO ENFORCE CONTRIBUTIONS ORDER this states that if payment is not made in 7 days they WILL make an application to the court to take enforcement action. Can anyone advise re this last letter, please? My understanding is that as the amount in dispute then proceedings should be frozen until it is resolved. As it stands, by calculations the Contribution order will be assessed as below the £30k and therefore struck. the timings given appear unreasonable, to say the least, and Biffin Ltd v HMRC appears to give guidance on the matter. Any other advice would be much appreciated. sorry if ive done this wrong, but the rest of the documents ross1.pdf 2018_09_28 23_57 Office Lens.pdf own reply1.pdf ross2.pdf ross3.pdf rossnip1.pdf rossreply1.pdf rossreply2.pdf

- 3 replies

-

- capital

- contribution

-

(and 1 more)

Tagged with:

-

Me again, So out of the blue SLL Capital have put a default on my credit file for a Mr Lender Loan from 2016 that i never repaid. Can they do that? The Mr Lender loan isn't on my credit file before this I will of course do a irresponsible lending complaint to Mr Lender, is it worth sending a prove it that i owe this debt to SLL Capital?

-

Hi..... Just a quick question. I have just been going through some old bank statements trying to find an old Humber Finance payments as I'm sure I had a loan with them. I have instead come across Associates Capital loan payments....from 2002. Am I to understand that CITI financial is Associates Capital? I have already claimed back PPI from CITI from loans in 2007 but i don't know if the loan from 2002 was part of my claim. Any ideas please. Thanks.

- 35 replies

-

- associates

- capital

-

(and 1 more)

Tagged with:

-

Hi Just received my credit file and after getting into a bad financial situation I have a total of 19 defaults on my credit file!, 11 are due to drop of this year and 3 next year the rest are around 2022, for the latter do you think my credit file will improve If I pay them of so they are marked as satisfied? or should I just wait, none of them are chasing me for payment at the minute Just edited to add one is for a mobile phone debt that I was paying for 2 years at £35 per month, it says I owe £550.00 now

- 61 replies

-

- capital

- county court

-

(and 13 more)

Tagged with:

-

Morning all. I have an outsanding credit card with Capital One ( well pre 2007). Been paying nominal amount for 10 years with payplan The debt is still with Capital One - not sold off to any DCA whatsoever. Is there anyway to check the default date on it ? Both on Clearscore and and Experian I have clean CRF. All defaults well and truly dropped off. The reason I am asking , is that I am currently in process of CCA'ing everyone. Capital One is the only debt NOT sold on to fleecers. But cannot remember / have not got any paperwork with a default notice. Pretty sure it was defaulted say 8 years ago - just want to make sure 100% - I now have clean CRF and dont want it damaged for another six years - if and when I stop paying them. This is the only card I have NOT CCA'd at this present time , on this basis. Any help much appreciated. Thanks again.

-

Hi all I made a mistake and tried a ppi agent to deal with Cap1. they paid them and the agent deducted their commission and sent me the balance together with Cap1 letter calculations. Cap1 determined that since i was aware of PPI in 2005 when i cancelled the ppi then i was not entitled to receive interest since it was over 5 years ago. I wrote back asking them to pay the interest since i cancelled the ppi because i could not afford it... NOT THAT PPI HAD BEEN MISSOLD... DIDNT AWARE OF THAT UNTIL MY CLAIM WAS SUBMITTED. They will not budge their offer was final. Questions: do I have a reasonable case for interest? should I lodge complaint with FOS or go to court?? thanks

-

https://www.consumeractiongroup.co.uk/forum/showthread.php?421236-Rossendales-DCA-chasing-old-legal-aid-debt-**WON!!-revolked-cancelled** HELP PLEASE, Thanks for sharing your experience of dealing with Rossendale and Legal aid right through the end. It gives me HOPE about my same problem i'm experiencing at present. In my case, it is now been over 6 years since the end of my case when i was convicted of a crime in end of 2011. i received a surprise out of the blue capital contribution order of over 40k to be paid within 28 days. letter with legal aid heading on the left side and rossendales on the right head, signed at the end 'for and behalf of head of crime case management.......plus a separate letter from rossendales. legal aid was granted after assessing income etc at the time and i did not contribute anything. i was never made aware and had no knowledge of the amount granted or provided with the cost of fees from solicitors firm -if i knew the fees was going to be sky high i would have never got representation. i was unaware of any conditions to pay at a later date i understood it was a grant, not a repayable loan. my question is under the section 9 of statute barred limitation act 1980-after 6 years since the legal aid application, can legal aid agency enforce this debt on me? please help.......

-

Hi all Was wondering if any of you have had any dealings with Frederickson and Capital One? My dh offered an 80% full and final settlement figure to Frederickson for Cap 1 debt and it was accepted. Before he could pay he received a letter from Capital One saying that the debt had now been returned to them?? Any ideas as to what he should do?

-

Hi All if any one can help , i am looking to claim credit card charges ,late payment and over limit fee . SAR done to capital one and received every thing account was opened in 2005 january . charges in total is £200 interest rate was 34.9% i have done the spread at the interest rate of 34.9% so total amount is coming nearly £9000. should i charge 34.9% or lower ? I have been to court few times on hearing with lowell and won (its was mobile phone contracts) this claim is for my survival and i am willing to go to hearing (if its comes to that point ) but first time taking someone to court if any one can guide me with my claim . My reason for same interest as on card is that go for higher amount and then settle for bit lower reasonable amount any chance of success at that rate? thanks in advance

-

Hello All, I'm not sure where to ask this question so move it if it's in the wrong place. I have a defaulted account with Capital One (last payment 1/10/10) it has now been bough by Cabot and the have re defaulted it from 1/11/15. Is the correct and ok to do? I know Cabot are diddley so want to be sure? Surely if it was already default, they can't re default it?? Thank you for your help

- 20 replies

-

Hi everyone, Please can anyone advise how I might make contact with this firm (which I think has been "taken over") and claim for mis-sold PPI, as I took out a £14,000 loan from them a good few years back and was told I had to pay for PPI or the loan would not be granted (they said they wanted to be sure they would be repaid, whatever happened to me and/or my circumstances). Also, I was self-employed so probably couldn't have claimed, anyway. But I have no paperwork, anymore. Thank you. Jib

- 14 replies

-

- associate

- associates

- (and 7 more)

-

Hi, Just looking for some advice as am fretting hugely and feeling a bit confused by the rules. To explain as simply as I can... I am currently in receipt of high rate DLA and income related ESA in the support group. I was awarded both of these at reassessment without any difficulty and wasn't even called to a medical for my ESA. I have been on these benefits for a long time and have also been on housing benefit for about two years since I moved into my own flat. I suffer from mental health difficulties including a long term eating disorder and type 1 diabetes which means my physical health is also very poor. I struggle with extreme spending which has been the case for some time. I have mental health issues and I particularly struggle during the evening times when feeling low. I tend to click click click on websites and buy things I do not need, sometimes parcels arrive and I am not even sure of what on earth I have ordered. By extension my eating disorder is anorexia with binge/purging subtype and the amount I spend on food is disgusting, which has been the case for the past 15 years. In October last year I was seriously sexually assaulted and a week later my dad died. This sent me into a spiral of even worse mental health and excessive spending. I try to return things but don't always manage to, and you obviously cannot return food. But I also have a pile of clothes that I've never even worn. I took out a DRO in 2009 because I had racked up so much debt on credit and store cards. This honestly saved me for 6 years as I could not obtain credit, but after it was lifted I managed about a year until I started applying for high interest credit cards and now have a stack of them which I have been trying to keep up with the minimum payments for. A month ago I took out a loan from natwest to try and consolidate these debts a bit and reduce my overdraft which was costing me around £80-90 a month in interest fees. My brother and I are waiting for an inheritance from my father. There was no will and no need for probate as my father rented, so my brother has had to sort everything out. I am not quite sure how much we will have but it will certainly be above the 6k threshold. Currently it is sat in an account my brother opened but when everything is finalised he will transfer half of that money to me. I am so scared that the DWP are going to class my spending as deprivation of capital. I really, really want to pay off all my debts including my loan because the interest on everything is so high and having that debt looming over me is a major stress. But will they allow me to do this? I imagine the loan may be regarded with some scepticism as it was recently taken out, but I was literally desperate and in a situation where I was going to be unable to pay my rent (yes despite the HB payments), I am thinking of ways I can protect myself. I'd perhaps like to have my mother take care of a proportion of the money in a savings account that I cannot touch. If I blow through the inheritance with my recklessness then I will never forgive myself. The only thing I really want to do is go on holiday, health permitting. I have not been out of this country for about 10 years and feel a break would do me some good. But again, will the DWP permit this? Furthermore, what if I wanted to use some of the money to access some private healthcare; therapy or maybe even a short hospital stay to try and get a hold on my eating behaviours? Obviously this could help me towards better mental health and I'd like to think that some day I might be well enough to begin some part time work, which would ultimately be beneficial for both the governments purse as well as myself. The other thing I am worried about is the whole showing receipts and bank statements, the idea of which I find humiliating largely due to my food expenditure. I found this quite distressing during the DRO claim process. How much scrutiny do they place you under exactly? I know it is different for everyone but what is the most likely scenario I will face? I need to ring the DWP soon and I am so anxious about it. I hate making phone calls as it is and don't know where to start/how to explain. Any advice is much appreciated. Please don't think I want to defraud in any way, I just want to do the right thing. Thank you.

- 14 replies

-

- capital

- deprivation

-

(and 3 more)

Tagged with:

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.

.thumb.jpg.1b86f160057887670bb40461dba7eac1.jpg)