Showing results for tags 'terms'.

-

Firstly a bit of background. I have a secured loan with blemain finance (we all make mistakes:-x) It was taken out in may 2007 and is for £10K also it is cca regulated. They have added over £4K in charges in just 2 years, I have requested the charges back and after lots of letters i have they're final bog of letter. so i am now debating whether to take then to court for unfair credit agreement or go to the fos, i have phoned the fos and they have taken details and sent me out the forms to carry on with my complaint,but as yet i have not sent them back.so i have all options open to me and some advice in which way to go would be appreciated. Also i have a suspended possession order after they went for repossession, now the thing is i think when they took me to court they first sent out a default notice, but i think that it is non compliant and would like a second opinion,and some advice on how to deal with a suspended position order that they got on the back of a dodgy default notice. my issues with the default notice are a]That they didn't give me 14 clear days to rectify. b] No specific date to remedy (they say 14 days from date of letter) c]The paragraph saying that if you dint understand this then seek advice from CAB is missing the following is word for word what it says on the default notice and the only date on the notice is at the top of the page. 1] To remedy the breach you must pay the total arrears of £xxx within days of the date of this letter. 2] If the action required by this notice is taken before the 14 days, no further action will be taken in respect of the breach. 3] if you don't take the action required by this notice before this date then the further action set out below may be taken against you. 4] FURTHER ACTION: on or after the date shown above we shall apply to the court for an order for possession and sale of the mortgaged property. so any advice on how to proceed with this would be greatly appreciated and thanks for looking. welshperson (from bridgend:-))

-

I ended up with 3 debts to Barclays bank - Premier Card / Overdraft and Select loan.I challenged Barclays on the way that they had been charging interest on my Overdraft and Select Loan. Very good news they did not challenge me back but simply sent me letters saying they would be writing them off. I have written to Robinson Way who now hold the Barclays Premier Card debt asking for my terms and conditions / interest rates/ how Barclaycard applied them to my account. Barclaycard have supplied a copy of the original agreement but have said " WE ARE UNABLE TO SUPPLY THE HISTORIC AND VARIED TERMS AND CONDITIONS " My question is whether they can refuse to supply these details ? Many thanks in advance for your kind help

- 11 replies

-

- barclaycard

- condtions

- (and 4 more)

-

Dear all, Exeter Road Car Park, Braunton, EX33 2JJ - Parking Charge Notice I have also been subject to this rather off-putting Parking Charge Notice in the same place; Following the thread above I have completed the questions from the link below: 1. Date of the infringement: - 05/10/18. 2. Date on the NTK [this must have been received within 14 days from the 'offence' date]: - 11/10/18. 3. Date received: - 12 or 13/10/18. 4. Does the NTK mention schedule 4 of The Protections of Freedoms Act 2012? [y/n?]: - Yes. 5. Is there any photographic evidence of the event?: - Yes. Two photos of car. Two of numberplate [both dark]. 6. Have you appealed? [y/n?] post up your appeal]: - Not yet, but I have drafted it and posted below. Have you had a response? [Y/N?] post it up: - N/A - not yet. 7. Who is the parking company?: - Premier Park Ltd 8. Where exactly [carpark name and town]: - Exeter Road Car Park, Braunton, EX33 2JJ Draft online Parking Charge Notice Appeal wording: "Dear Sir/Madam, Please be advised that in normal circumstances I am law and rule abiding, in any case. At the time in question this was no different, however, after recalling this journey to an area that I am not familiar with and which receives a significant amount of tourism traffic, I would state that the terms and conditions of the car park are not sufficient for the average visitor to use and create a valid contract. Specifically I am appealing against the availability of, and clearness of, the signage and how well lit the car park is to make this reasonably visible to any user in order to create an acceptable contract. At the time of the evening stated, and as can be evidenced from your own photographic evidence stated, it was almost pitch black dark if not for the light omitted from a vehicle itself. So much so that the vehicle make, model, colour or driver cannot be determined. If I recall correctly, at the given time of the evening, a bus also pulled into the bus lane outside the car park on Exeter Road, meaning that anyone would have to tightly pull in front of it to gain access to the car park, missing blocked entry signage and parking terms signage. The darkness of the evidence provided also does not display and make clear were my car was photographed and if it even entered the car park or remained stationary/unattended there for any period of time at all. Please can I appeal to good faith that if the displays were clear and visible I would have seen no option but to comply with the terms and conditions, but in this case, for multiple reasons, the terms were not clear enough for me to be made aware to do so at the time. There is also no evidence provided to the contrary that the car park is clearly displayed, including its terms, or sufficiently lit to substantiate the claim that any contravention was intentionally made at the time. If you do not agree that this penalty has been unfairly applied and reject my appeal, I will be left with no option but to further this appeal with IAS. I look forward to hearing from you Regards," --------------- Any help you could give here would be greatly appreciated?? and I hope that this helps others Thank you

-

Hi everyone I use a courier company, i will call "TPC", who in turn use DPD. I have to say on the whole the past few years has been event free but a few months ago we sent a 3D printer to someone to use and it was smashed up really badly. The recipient took photos and has emailed us stating the damage was beyond dropping in his view and we have loads of photos of the box damaged etc. I reported the issue immediately and TPC were originally very sympathetic etc. I have to say I was shocked at the damage, you would have had to try really hard to do what they did. As the client needed to get printing urgently, I resent a new identical printer out, only this time this one had a glass build plate, so about 30x20, super tough, heat resistant glass plate that the plastic is printed onto. This was in fact a bespoke upgrade I did to this one but the plastic plate was also sent. This printer was also sent insured fully. This 2nd delivery went horribly wrong yet again, with a tonne of damage done. We sent both printers in the original boxes, designed for transporting them. They are thick boxes, with the original polystyrene inserts. Loads of space etc. we also used an outer box with more packaging to be safe. The packaging has never been challenged, in fact DPD stated that it was fine. long story short. I know DPD have accepted both claims (although irrelevant as the contract was with the 3rd party we use, TPC). I am still waiting for any decision, I have emailed multiple times and so we logged a small claims track. Unfortunately the printers are no longer made, so I have asked for the replacement cost of the latest available model for both printers. The defence is that they will not pay as there was glass in the box (even though only the 2nd item had glass in it) There is no consideration about the first delivery that had no glass in it at all. I have sent the court questionnaire off, have stated I am willing to mediate and I am waiting. No solicitors seem to be involved at this point, certainly no legal sounding stuff has come back from the defendant at this point. Just want some help and advice really. I have basically lost a part of my little business due to these printers being damaged beyond repair. Questions: 1. I have no doubt that I will get the compensation for the 1st Printer as there was no glass and it was clearly in breach of the Sale of goods and services act 1982, (reasonable care and skill clause). however What about where there is a piece of glass in an item? I have never actually claimed for this extra add on, I feel that if they had delivered properly in the first place I would not have had to send the 2nd printer out and also the glass did not cause the damage, it was just "also" damaged, but again I am not claiming for this. 2. I would normally claim for the cost of the item if damaged. However in the case of the model being superseded and no longer being available. Is it OK to claim a little more for the latest available model? I have averaged the price from 5 retailers and would genuinely be buying these to simply replace my lost printers. In my defence it is a real pain in terms of retraining and new software to learn a new machine. Any help would be appreciated on the best course of action and of course I will post everything up here so others can learn from my mistakes and hopefully successes!! I am about to go through mediation, but can't find much on the process here. Has anyone gone through this process as a claimant and is there any advice anyone can give. I have been told by the CAB that it's a chance to "negotiate" but Ii'm not sure if negotiation is what I want to do, i'd really like the defendant to try and see the light. Also can the defendant deny wanting to use mediation? Any help appreciated.

-

Good day everyone! I would like some advice regarding changes with the redundancy payment as shown in the Staff Handbook. In the past, our Staff Handbook showed that in the case of redundancies, payment will be calculated on a months salary for each year of service. (Which I have retained a copy of) In the last few weeks, I have reviewed the staff handbook again and it now reads that redundancy payment will be calculated on the statuary minimum, being a weeks pay for every year of service. This has come to a surprise to me and a lot of the other staff I work with. We are all wondering if this change is legal and fair, as it was implemented without our acknowledgment. Brexit is not too far away and we all believe it will have a fundamental effect on the business we work in and therefore we believe redundancies are inevitable. Can someone please advise if we have a leg to stand on or do we just accept that we have to put up and shut up. All comments welcomed! Thanks for reading Mark

-

Hello, I have looked at various posts on here to obtain some guidance and have some questions! This is the situation: NatWest ignored my written correspondence, and served a Default Notice in December 2007 for a joint (with my wife) current account. They continued to ignore written correspondence, and issued a CCJ to my wife (without prior advice) in March 2008 and to me in May 2008. Their claim included the "standard" court interest under s.69 at 8% and charges for solicitor The overdraft was around £5200. Their claim was for approx £5200, plus interest and costs Of this approx £3,200 we found to be their unlawful charges and interest, so we counterclaimed for this, and both cases (mine and my wife's) are currently stayed pending the outcome of the test case. We have recently received a "Terminated Overdraft Notice" sent from Natwest "In compliance with the Consumer Credit Act 1974 because you have failed to make required payments" in which they indicate added interest (without a rate quoted) which provides a balance of over £5,800. I have continually kept the bank informed of my financial status, and I have even had a third party agent write to the bank prior to their issuing of the Default, all of which were ignored. I am making regular payments in line with the amounts agreed with the third party agent. My questions are: 1. Is it relevant for me to obtain a copy of my original Credit Agreement? 2. Can the bank keep adding interest, even after the issuing of a CCJ? 3. Should I respond to this notice in any way? More info can be provided! Thanks in hope someone can help us! Tedney Hello, Any chance of some help please?

- 296 replies

-

- overdrafts

- statements

-

(and 1 more)

Tagged with:

-

Hi Thanks in advance. I am looking for some help on my current situation at work. I have worked there for more than two years and have not been subject to disciplinary procedures. Last week I handed in my notice. The primary reason I did this was due to leave request being declined. In my letter i stated i would work my notice but would not be working the specific dates i requested. Later on my line manager informed me that i would be leaving the same day and to prepare a handover which i did. This was seven days ago. Since then i have not received any information regarding the terms of my departure. Two days ago i contacted my line manager's manager to discuss the situation. He told me he was busy but would contact me today. He didn't contact me so again i followed up with him. He advised that he was very busy as i had caused a serious issue. He said he would email this week. I responded to ask him to confirm whether i was on garden leave to which he replied he couldnt. I then asked whether i had been sacked on the spot to which he replied that he would email me this week. I would just like some opinion on whether i should be on garden leave? If they decline to place me on garden leave and say i have been sacked on the spot for gross misconduct, how should i proceed? Thanks a lot

-

Booked a 'camping' break for two nights 13th to 15th Feb, this was booked on the 16th Jan. However, the better half no longer wishes to go, mainly due to the weather/temperature, but primarily because she isn't feeling great, and would prefer to simply go out for the day on Valentines day. I rang Away Resorts who deal with the bookings, and was told that if I cancelled then they don't have to refund the cost (£70) because their T&C's say so..... https://www.awayresorts.co.uk/terms-and-conditions/ Seventy quid is a lot of money for us, just to simply throw away into someone elses profit pocket...... I am aware of potentially having to go the visa debit chargeback route, but I'm also aware they will more than likely claw it back, just out of spite? I'll be writing to them to air my disgust and disappointment with them, but can anyone think of a better angle of attack here?? TIA..Boo

- 3 replies

-

- balls

- cancellation

-

(and 3 more)

Tagged with:

-

My bank has just sent me an email with upcoming changes to my (and your account) which causes me great concern and wonder if other people have had the same. Basically it says: there will be no payments in/out of my account over the weekend. What really concerns me is they warn of a new financial system where TPP (third party providors) will offer to manage my bank account, they could ask for (that means WILL ask for) my banking login and password details. Of course the bank says, if I do this then it's nothing to do with them if my bank account goes to zero. I would think that new service will trigger a zillion crooks into action - beware! The email says this scheme is forced upon them by the EU (I thought we opted OUT!!) and it gets worse... Changes to Payment Regulations Thanks EU

-

Hello All I am currently involved in a legal dispute with UKAR regarding a property mortgaged with MX. In order to defend the case, I need an original copy of their Terms and conditions 2004 booklet. I have several "Manipulated" copies that have been sent to be by UKAR however, each copy varies in detail. If anyone has a copy I could borrow/purchase it would be very much appreciated. Thanks

-

Hi Just received the attached today 12th July. I was back in the car 4 minutes before the parking expired I was unaware that there were cameras up and was loitering near the exit waiting for the family to catch up. I thought as I was in the car out of the space that there wouldn't be a problem as I wasn't aware as I say there were cameras on the entrance/exit. I presume i'll have to pay this now, i'll need to pay in installments as my only source of income is my ESA so can't afford even the £60 discounted figure. There is signage up in the car park but I didn't see mention of anything to do with ANPR cameras anywhere, as it was a pub car park with a ticket machine I assumed it'd just be the pub enforcing it. Any suggestions gratefully received, thanks

- 38 replies

-

Am I correct that the prescribed terms for a fixed sum variable rate consumer credit act agreement is: a amount of credit b interest rate c amount of payment Credit £25,000 Interest £9.319,57 applied at 4.5% above banks base rate 5% payments £408.68 x 84 Theres no total amount payable as this could alter due to an interest change throughout the time of the agreement. However, the amount of credit plus the interest applied to the credit do NOT equal the initial monthly payment? £25,000 plus £9.319.57 = £34,319.57 divide by 84 payments = £408.56 This payment appears to be 12 pence less than the payment stated on the agreement. Anyone clued up on this? Paul

- 40 replies

-

- agreements

- fixed

-

(and 5 more)

Tagged with:

-

I paid them for a couple months via Monthly Standing Orders which i set up, this was after the Debt Management Company I used folded, I then stopped paying all of them recently ... I have just received a true copy of my original CCA from Halifax, back dating to 2001, so will now need to sort a repayment offer with them They are the only 1 from 5 to provide thus far, so tbh i still had a great result This is very true, i assumed info from a company like StepChange would be best i would get, not a mention or suggestion of doing CCA's came from them Sometimes their hands are tied to give certain aspects of advice and as I say CAG was a blessing in disguise when i read what people were saying about making CCA requests I have just received a true copy of my original CCA from Halifax, back dating to 2001, so will now need to sort a repayment offer with them, they are the only 1 from 5 to provide thus far, so tbh i have still had a great result ! Better late than never, very true

-

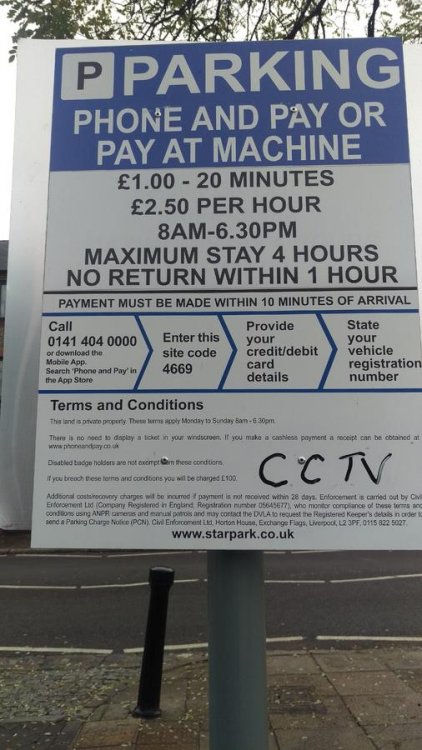

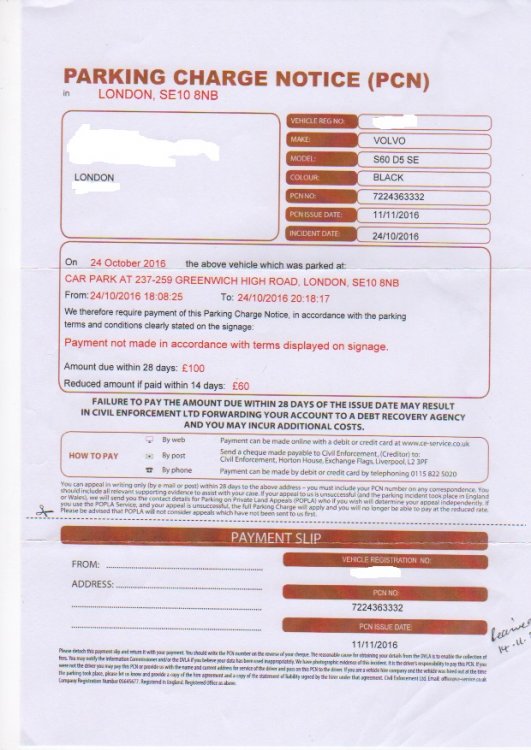

You've helped me once before (post4830039) with a 'parking charge notice'. I don't think I actually need help this time, but wanted to post on this site for general awareness in case there's a pattern in how this firm operates. I parked in a car park where controls are effective 08:00-18:30. The PCN shows I entered the car park at 18:08:25. I purchased a ticket (which I still have) at 18:12, paying £2 for 20 minutes as I didn't have anything smaller. The ticket I purchased shows the expiry time as 18:32 (ie, 2 minutes after parking controls ceased to be effective). Today I received a PCN from CEL citing 'Payment not made in accordance with the terms displayed on the signage'. I've gone back and checked the sign and I can't see any term that I failed to comply with: - I paid the fee - the ticket was purchased within 10 minutes of entering the car park - I didn't exceed the maximum stay Although I said I don't think I need help on this, any offered would be appreciated especially if you spot something I've missed. Otherwise I will email CEL advising the above facts and that if they don't withdraw the charge they must stipulate exactly which term or terms they believe I contravened, with the effective date of the charge being the date they reply. Incidentally, I only received notification of the supposed offence 3 weeks later and it's pure luck that I still have the ticket. What does anyone do in the situation where no parking notice was issued at the time and the ticket has been discarded? It seems pretty outrageous to me that these parking cowboys have the law on their side in cases like this...

- 9 replies

-

- accordance

- civil

-

(and 6 more)

Tagged with:

-

Hi I am sure plenty of members are aware of Labours National Executive Committees (NEC)decision to bar all members who joined in the last 6 months (100,000 people approximately) from voting in the new leadership race? That is unless you pay a £25.00 membership fee within the next two days? The questions I would like to pose are, a)Is it illegal to, retrospectively, change the constitution/rules to deny the’ new’ labour party members a chance to vote? b) How much would it cost to mount a legal challenge against their decision? c) Would the new Labour party members be willing to pay an extra couple of quid to finance the challenge ?( here is my £2) d) Would anyone from CAG be able to assist in setting up a secure holding account etc etc if required? Now whether it’s Mark Twain, “If voting made any difference they wouldn't let us do it.” Or Ken Livingston’s twist on it (I think?) “If voting made any difference they would ban it.” Both quotes and the labour parties NEC decision give me grave concern in this world of “open and transparent democracy”. Regards Biff

- 13 replies

-

- acceptable

- against

-

(and 8 more)

Tagged with:

-

Hi, Hopefully you can help or give advice on what to do regards talkmobile and their total lack of understanding regards the issue I have at the moment. I have chatted online to them and was told they had escalated the matter and I should expect a call with 48 hours. After 2 weeks of no reply I rang them, The gentleman on the phone was firm and I was not put onto his supervisor/manager to discuss the matter. They stated they do not offer an sort of payment plan and the sum needed paying straight away or the phone will be cut off, it has already been cut off for sending texts or ringing people, although texts phone calls are still coming through o my phone for the time being. Here is the issue I have. My 16 year old son has issues with gambling, He maxed my credit card 6 months back to the tune of £800, which I couldn’t claim back as I had left my card for him to have easy access to. I would have paid anyway as I feel I am my son’s dad so have a duty to pay off any debts as he is still a Minor and worried he may get done for fraud if I make a complaint??. After this I have blocked all sites on my router and made sure he has zero data on his pay monthly sim (I spoke to the lady when setting it up and she put a note on his record to allow 0 data on his 3G phone) My son rarely goes out and when he does he goes to his friend’s house who also has the same issues as my son regards betting and having spoken to their parents they also have full blockage on adult related sites, and his phone is very old so has no option to connect to the internet. My phone was coming up for an upgrade and I chose talkmobile as they had a Sony Aqua for £12.50 per month which I felt was a very good deal. However my son used my phone to access gambling sites via my 4g and paid for these gambiling sites via my phone, I hadn’t a clue you could do this so did some talking with talkmobile and it was with is a company called Boku who deal with gambling sites along with other sites which are much more legitimate. My main issue is he raked up £400 and the only reason I knew is when outgoing calls were blocked. I told the webchat team that when I signed up I had a £50 maximum limit (this is in their terms and conditions) so how could charges go all the way up to £400 and I not be informed of an issue on my account, I asked for a breakdown and all charges were to Boku. As I said at the start, it is my son that has caused these charges so it only feels right I pay for his errors, I have made sure my son has paid for his stupidity and had both his mobile phone and laptop removed indefinitely at least until this matter is resolved. I asked talktalk for a payment plan and they refused outright and demanded full payment, I will not be able to pay £400 in one go, so I checked all their terms and conditions and these two stood out the most which may help my case?? Their Age restricted content states that :- Your Talkmobile phone is automatically set to block access to all age restricted content. Age restricted content is anything that has been classified as 18+ by the British Board of Film Classification (BBFC), or any 18+ sites that might contain any of the following: • Adult humour • Pornography • Alcohol/tobacco • Gambling • Violence/hate/racism • Weapons • Cult/occult • Illegal drugs • Personals/dating • Chat/instant messaging We block this content in accordance with the OFCOM code of practise and UK and EU regulation in order to protect underage and vulnerable people from potentially harmful content. The content block means that you can protect anyone under the age of 18 from seeing any potential adult content. This could be useful if you have children who have Talkmobile phones, or if anyone underage has access to your phone. I checked the age restriction policy and pornographic sites were blocked but no gambling sites at all were blocked. Is this a breach of their terms and conditions?? They also have an allowance limit in their terms and conditions which state :- The allowance limit is designed to protect your account from someone using your phone fraudulently. Once you hit £50 of billed usage we'll restrict your services. This means you won't be able to use your phone but you'll be able to receive inbound calls and texts. To remove this restriction you need to make a payment to bring you below the £50 allowance limit. Then you can carry on using your phone as usual. Is this another breach of their terms and conditions?? as they allowed my account to go all the way up to £400 until they cut me allowing to make calls or send texts, thus making me aware and getting into contact with talkmobile, at no time did I receive any correspondence from talkmobile. As I stated at the beginning I feel I should pay for my sons issues with gambling as he is a minor and I have a duty or care (I am in contact with a charity who have said they will may with his issues) the issue is talkmobiles refusal to even get in a discussion regards a payment plan which has really annoyed me mainly due to ineptitude on their part and my fault for leaving my phone lying around so my son had easy access to it. but with the age restriction block on I felt it would be fine. I know this is long winded but I have no clue of the law and was wondering if it was worth writing to their complaints department to hopefully resolve the matter and sort a payment plan out?? Also is there a template letter at all that covers things like this? Thanks for your help and if you have read all of this you will need a cup of tea lol. Thanks in advance for any advice. Kirk

- 3 replies

-

- adhered

- conditions

-

(and 3 more)

Tagged with:

-

Which? don’t think that you should have to read endless pages of baffling legal jargon just to make sure there are no unwelcome surprises in a contract. Earlier this year Which? launched a campaign to simplify terms and conditions. The Government has now announced that it has started a review of complicated terms and conditions, including a call for evidence. The Government hopes to reduce the risk of ‘nasty surprises’ hidden in opaque or lengthy T&Cs. This could involve fining businesses that don’t comply with consumer protection rules. http://press.which.co.uk/whichstatements/which-response-to-bis-announcement-on-tcs/ The Government is seeking views from the public, consumer representatives, businesses, trade bodies and regulators on how terms and conditions (T&Cs) can be made more user-friendly and on proposals to introduce fines for unfair terms. https://www.gov.uk/government/consultations/improving-terms-and-conditions Consutation closes on 25th April

- 5 replies

-

- conditions

- consultation

-

(and 2 more)

Tagged with:

-

So this is a long story but a couple of months ago I had some signal issues at work with Vodafone (I know they are only contracted to provide signal to home) so I asked to see if I could cancel the contract (they put the price up past the RPI so I knew I could) and they asked if they gave me two months free would I consider staying. My signal issues wasn't a massive inconvenience at work, since you know, I was at work but still slightly annoying - as the deal was good with the two months free I advised that I would. The 1st month came along and vodafone sent me a bill, I advised them that I was supposed to have the two months free, they apologised, waived the first month and advised I would get the second month free. The second month came along and I got charged (a albeit lower amount due to how they structured the billing) I then asked them to refund that amount and as of yet they haven't. I read that in contract law if a term is broken the contract can be repudiated by the losing party - does this apply to small claims court / is that the best case to do it. I realise that it seems like muchado about nothing but I wanted to cancel initially and have lost all faith in vodafone now, moreover they have had over 8 weeks to put this right and have not as of yet.

-

HI All I signed up to a boot camp, stayed for over a year then went through the cancellation process, which stated notify in writing and send back wrist band. No notification of a fee extra. I advised them due to health that i was cancelling, would send back the wrist bank, and i have just paid a full month so that was ok. They sent me a note back say they cannot accept my email as cancellation i would have to go online to their form and fill it in. Ok so got on there and filled in the form, then saw it wanted me to accept new terms and conditions on cancellation! No chance, so i got back to them said im not agreeing to new terms etc etc. they tried to threaten me with third party etc but i told them getting someone to change terms on cancellation so you can then get payments including and amin fee is unlawful. Can any of my CAG friends help with confirming the law on terms and condition changes, i believed we should have been notified and acceptance given. and that coercing people to sign on cancellation is unlawful. But need the correct legal bits thanks in advance

-

While browsing through the current UJ pages of advertised jobs I came across a local job advertised by 'UK Recruitment' I never apply for jobs via the UJ site itself since the jobs are invariably advertised by other employment agencies that I use. On this occasion I clicked on the 'Apply' button to check on the what method of applying was required and found that in order to apply I would have to register with UK Recruitment. In order to register successfully I would have to agree to their terms and conditions which were listed as: By clicking submit, you accept our Terms & Conditions Match my skills and distribute my CV to your partner job boards via Freemycv.com and you agree to their terms and conditions In addition to all other job websites, I also agree to have my details registered on TotalJobs. The TotalJobs Group Privacy Policy I agree to have my details registered on Jobsite UK (Worldwide) Ltd Privacy Policy and Terms and Conditions apply. I agree to; Share my CV and details with Glassdoor. Create a Glassdoor account and Job Alerts. Agree to Glassdoor’s Terms of Use, Privacy Policy and Emails. The Universal Jobmatch Terms & Conditions for Employers, Advertisers and Recruiters states the following in clause 9: 9.1 You agree that jobs you advertise on this site will: 9.1.4 be available to jobseekers on an open and fair basis; My question is; would any reasonable person regard the conditions set by UK Recruitment for applying for this job as open and fair? My curiosity having been aroused I checked further the UK Recruitment terms and conditions to see if they complied with UJ terms and conditions and found quite a few that do not comply. Causes for concern do not end there. On further investigation I found that: UK Recruitment is part of Improbable Technologies Ltd, a privately owned company developing innovative solutions for the worldwide recruitment industry. UK Recruitment offers a low cost, high impact recruitment solution to our clients and has grown significantly in recent months. Improbable Technologies Ltd, founded in Glasgow in 2015. Registered company address: 272 Bath Street, Glasgow, G2 4JR. Company No. SC516353 Turns out there is only one officer of this company with one share and it has only been in existence since September 2015. Looked up 272 Bath Street, Glasgow and found the name 'Blue Square' above the door. After further investigation of 'Blue Square' on Google it turns out to be company dealing in virtual office or telephone answering products. The advertising promotes it as: "If you are looking for a Glasgow virtual office or telephone answering product, a good starting place is to have a look at our virtual office packages page. We also provide a registered office address service for Limited companies and LLPs. Our services can be purchased online, however, if you would like to sign up by telephone or talk to one of our team, please call 0141 353 9300." My next question is; what is a virtual office? It also transpires that this officer was one of two directors of another sort of employment agency called The Local Agency Ltd, also based in Glasgow. This company operated from April 2011 to Dec 2012 when it was struck off the Register of Companies. I can't ascertain whether or not foul play was involved but, according to HMRC website, in the period 2011/12 struck off companies cost a loss to the Revenue of £16 Billion. My final question for now; who do I notify of my concerns/suspicions that would be able to take the matter further?

-

I have had an ongoing claim with Jet2 for compensation following a fight delay in Feb 2011. There are six family members in the group, my wife and I, and four children under 16. I am the lead passenger and paid for the flights and the booking was made using my Jet2 account. It was a technical fault and they have been using the “unexpected circumstances” excuse since 2011, and most recently said they were waiting the outcome of their appeal to the Supreme Court which they said would affect the outcome of my claim. When the Supreme Court refused permission for them to appeal, I wrote again asking for the full amount plus interest. They have now asked me to submit a separate claim for each individual or they won’t consider them. This is the first time since I first claimed in 2011 that they have made such a request. After my initial claim, they made a partial pay-out for our allocated seats booking-fee, all on the same claim. So they have the all the passenger details and they have even partially paid out on the claim. I am inclined just to go straight to the County Court now because they are obviously just time-wasting. In my most recent letter, I said that if they did not inform me within 14 days of how and when they are going to compensate me, I would pursue the matter in the court. Am I now justified in taking them to court? Is it reasonable of me to expect a reply in two weeks after an almost four year on-going case ? Their normal reply time is six to eight weeks. If I don’t submit the claims again individually, would they be able to use that as reason for not paying if I go to County Court? Many Thanks

-

I am appealing for advice in this case in which Barclays has failed over a 2 year period to put right errors on my mortgage account and now refuses to abide by the binding settlement terms. To confuse matters, the Ombudsman provided misleading information which led to me agreeing the terms and the complaint being closed while the issues are unresolved. Ombudsman has now washed its hands of the case and told me I need to sue Barclays. The Financial Services and Markets Act 2000 (FSMA 2000) makes an Ombudsman’s decision legally enforceable in court, but I can find no solicitor to take on my case on a no-win-no-fee basis and I am not in a position to incur legal fees. It is an obvious winner with loads of political mileage for any law firm. I assume I need to sue once for the statement which they were supposed to provide under the settlement terms and then again later for my losses- which I can only work out once I see the statement. The complaint relates to Barclays’ failure to credit my account with several thousand pounds of overpayments, even claiming the balance had INCREASED after said overpayments. This was my 3rd consecutive complaint regarding Barclays’ mismanagement of the same account. Under the settlement terms finalised 2 June 15 by the Financial Services Ombudsman, Barclays was to provide “a full breakdown of my (mortgage) account from June 13, showing when each overpayment was applied and a clear and accurate explanation for any amendments made to the account”. Barclays has failed to provide the above documentation, but not before lying to the Ombudsman claiming it had! A misleading letter from the Ombudsman claimed the account was now in order (Dec 14) and I thus agreed the settlement terms, which included a nominal payment (which the bank has made). However, the documentation that Barclays was to provide is obviously central to the complaint, particularly since I now have documentary evidence proving the anomalies on the account have NOT been corrected by Barclays. This may be why the bank now refuses to provide the documentation. This documentation was only made available to me by the Ombudsman AFTER I had agreed the settlement terms, believing the account to be correct, and AFTER Barclays had failed to comply. The Ombudsman provided me with documentation the bank provided to it during the course of the investigation, including a calculation (not a statement) which states “this calculation has been provided to assist with the resolution of the complaint”. This documentation does not tally with an independent audit of the account I was obliged to fund. The document makes it clear NO remedial action has been taken, ie it contains a heading “steps required to rectify the account” as opposed to “steps taken to rectify the account”. Nevertheless the Ombudsman told me in writing the account had been corrected! The document is virtually impossible for a layperson to understand and abruptly ends March 14, giving no clues to the current balance and states “the balances shown on this calculator do not represent the actual balance on the account”, so the information is of little use, hence the instruction from the Ombudsman that Barclays provide me with “a full breakdown of the account from June 13, showing when each overpayment was applied and a clear and accurate explanation for any amendments made to the account”. So I have no idea how much interest I have been and continue to be overcharged by the bank on the incorrect balance I was a diligent overpayer until Barclays mismanaged the account. Based on my previous pattern of overpayments, I have been prevented from overpaying at least 10k to date. I have written to John McFarlane CEO asking him to ensure his staff provide the documentation as per the binding settlement terms, to clearly show how much interest I have been overcharged, what steps have been taken to correct the account, and what the correct current balance is, however, it is highly unlikely I will receive a response based on the bank’s attitude thus far. The FCA said they could not assist. I wrote my MP who says he has written to them but won’t show me a copy of the letter. I made a formal complaint about the Ombudsman, but that won’t rectify the account issues. I contacted BBC watchdog and various consumer columns and got no reply. I guess no one dares take on the establishment. I have posted on Barclays FB page and would now like to post the above letter online as widely as possible – any ideas as to where and how would be appreciated. Also any advice on where to find a law firm to represent me on a no win no fee basis would be appreciated.

- 31 replies

-

Hi I purchased a washing machine in Dec 2012 and paid for a premier insurance so if my washing machine could not be fixed in 7 days I'd get a new one. On the 10th July I called as my machine was not emptying or spinning. It came up with an error18 which meant a blockage somewhere in the machine. I had to wait 4 days for an engineer. He came, replaced a part and left. My machine worked for 2 loads then the same error appeared the next day. I called and they couldn't get an engineer for another 5 days. They said if it needed a part then they'd order one. I mentioned my policy was a 7 day but they said it was 21. As I had the paperwork it clearly stated 7. In Dec 2014 as I had a few products insured they suggested i go on a multi care policy as it would save money. All the advisor done was put me on a multi care policy. He explained nothing about anything changing such as the terms and conditions. I know I'm also to blame as they sent through the new policy and I didn't read the terms and conditions as I wasn't aware they'd change. Now they say it's tough. It's my fault I didn't them. I recorded the call when I changed to the new policy and he mentions nothing. I thought they have to at least mention the change to make sure it was suitable to me but they say it's not there responsibility it down to me. I have 3 children and a disabled husband and can't be without a machine which is why I purchased a fix or replace in 7 day policy. I have little faith in the engineers they employ. As the machine suggested a blockage he done nothing to locate it just sorted the spinning problem.

- 1 reply

-

- advised

- conditions

-

(and 2 more)

Tagged with:

-

Or as they advised.... "changes to our small print". Have just received a letter from Npower advising they have made changes to their terms and conditions. Which apparently came into effect on 22 June 2015. Should they not have advised their customers that they WERE making changes before hand ?

- 4 replies

-

- changes

- conditions

-

(and 2 more)

Tagged with:

-

I've an ongoing saga with CABOT regarding an OPUS card which they say was my CITI card. Shouldn't I have had some notification of some sort from CITI when this change occurred? I've been waiting years for a CCA for my CITI card, but none has been forthcoming.

- 18 replies

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.