Showing results for tags 'some'.

-

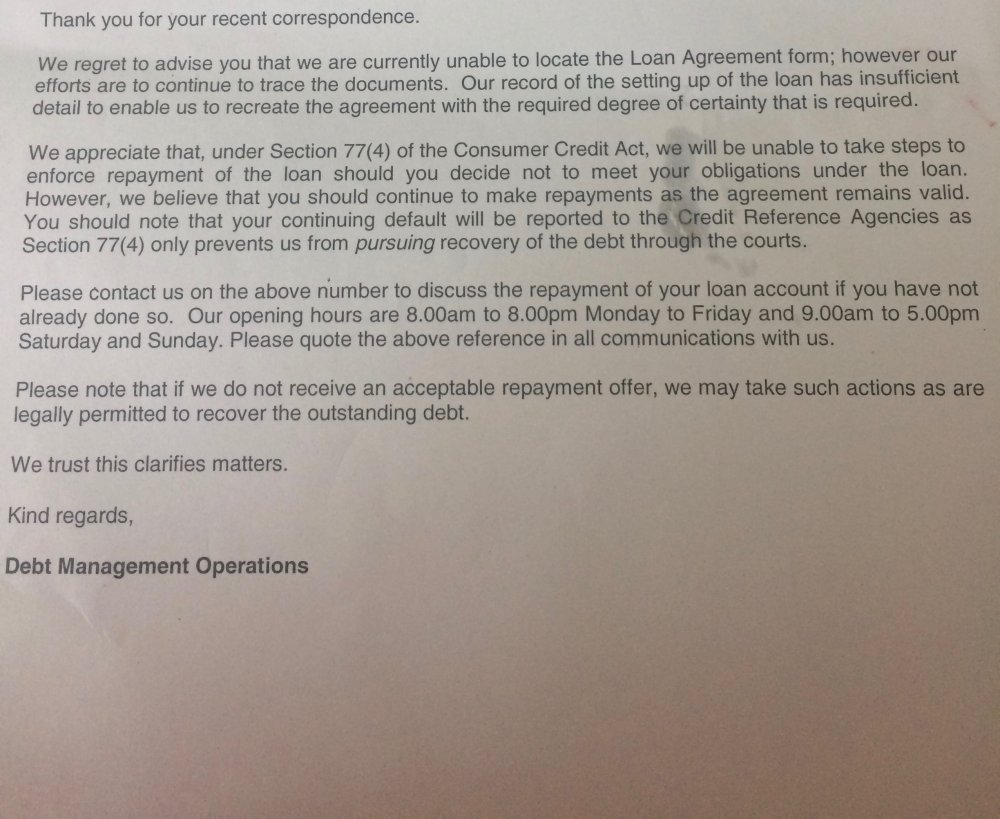

Good Afternoon. I was wondering if someone can help me with some questions regarding an old debt I have. About 5 years ago, my mother became terminally ill, I was in full time work and had to reduce my hours to help her as she refused to go into care. At the time I was paying for a Loan from NatWest. I knew I was going to start to struggle paying the loan amount so I went into the bank to ask for help. 3 times I went in asked, each time they either tried to replace it with a bigger loan over longer or just said no. On the 3rd time I spoke to the General Manager who said to stop paying the loan and we will be in touch to arrange a lower payment. I was unaware what this actually meant but did it. 5 Years on I have a default and debt owing to NatWest, However they have got Westcot to manage the Debt which I pay a token payment of £1 a month. Recently a friend told me about the original terms and conditions tactic. I wrote to Westcot asking which they told me they only manage the debt I then wrote to NatWest who have replied saying they cannot find them or have enough data and that the debt is not enforceable however because I'm in default this only stops them not pursing in court. The letter says please continue to pay because it they don't they will use what ever means by the law to get the debt back. They also say the Debt is still Valid and please contact them to arrange payment if I haven't already done so. My question is what do I do now? My Default will drop off soon and I don't want to cause a issue which could stop that happening. This is the only debt I have and its effects my credit score. What should I do? Any help with be greatly received. I have attached the letter.

-

Hi I would like some advice please. I owed the freeholders of my lease some service charges that were a total of 436.62. In mid Aug I telephoned them and they demanded I pay in full immediately. I tried to discuss with them some payment plan but they would not accept anything just a demand to pay it all or they will instruct their solicitors. I paid 250.00 by direct debit at the end of Aug. 10 days later in early Sept I receive a letter demanding 436.62 be paid. I called them and told them that their figures were wrong Both they and the freeholders had to check their accounts, they demand I pay the remaining balance of 186.62 or they will ask for interest per day and take me to court. I then receive a credit note in mid Sept for 124.00 balancing for the year. this meant I owed 62.62 in sept In addition around the early part of Sept they sent me another service invoice in advance for 105.00 for sept 29 to Dec 24th. now I ow 167.62 I was unwell for the later part of Sept and early Oct. and under the doctor. I didn't pay it with my Sept salary. I am 1700 overdrawn and living in debt that leaves me with no income for food. I am having bowls of cereal for meals. This is just to give you a snap shot Well I was paying the money at the end of this month Oct and paid it under duress today on my account again when I don't get paid till Friday this week The reason is this Saturday I get a money claims letter. They are asking me to pay interest back to March and costs of the court application at 35.00 and for writing a solicitors letter at 50.00 all this on top of their costs. I want to ask you this A. I did not receive any demand letter from the freeholders, only the solicitor in early Sept when their figures and understanding of what I paid was wrong. The company have not liaised with me, only sending me a statement in mid Oct, they have also allocated money I paid of 250.00 on what invoices they wanted leaving the furthest one back as the ones that still need paying for which I believe is so they can gain more interest, but it stands to reason that the money was for the earliest invoices. I don't believe they have given me any chance to negotiate, they write from a solicitor after a payment was made and they are not willing to have any arrangement. The recent invoice in advance and 62.00 was the only thing outstanding and that was only given in Sept. Are there any way behaving correctly I feel like I am being intimidated, I have had a good 6 years with this freeholder and have never missed payments until this year I dont know what to do. I was frightened into this payment but I knew I had to pay it this month anyway. Will I have to pay the court, letter they wrote me when I had paid most of the bills that was wrong and court costs. I can't afford them . I did try to speak to the accounts dept but the person was either not at her desk or I was working, I can't use my phone at work unlike some because I am on a ward and breaks are not heard of where I am it's so busy. Where I say 10 days later I recieve a letter, this was from the freeholders solicitors. Just to clarify now that I have paid the 167.62. Do I contest the charges on the money claims form for the 50.00 they are asking for the solicitors letter that came after payment, the first mention of it was on the money claim form, the interest they are seeking and the court costs of 35.00. I really don't have any money at all. Phew sorry for lengthy text. Thank you Caron

-

I had been given a PCN by Park Watch / Defence Systems in June for wheels over the line in a parking bay - £50 going to £100 if appeal fails. I appealed to POPLA, it was rejected so £100 charge stood. I paid £100 in october but they referred my case to Debt Recovery plus because they said the payment was late. The charge is now £160!! Even though I've paid £100...don't understand. I've emailed them and spoken to them and they're just bullying me and threatenign court action. I can't sleep with worry but I've paid £100 after being threatened and now they want more!! Surely this is not right in the eyes of the law??? I've seen some other threads about court summons and wondered the outcomes.

-

Hi all, 1) With my last claim for JSA you didn'tt have to allow the DWP access to a UJM account. Is this still the case? 2) Does UC also replace HB? 3) Overall is the net money lower with UC (I'm guessing so). Thanks all, JB

-

I have a flat and owe ground rent and insurance charge the total outstanding was £597. Then the debt was passed on to PDC I offered them £60 per month but they refused it. The next thing I received from PDC is a court summons and the claim has escalated to £1882.59 within this amount is a PDC fee for £250 and another to PDC for £840. The balance is made up of Solicitor's fee £80 Court fee £115. Can someone please explain how can PDC charge £1090 which is almost double the original debt. Thank you all

- 11 replies

-

- collection

- property

-

(and 1 more)

Tagged with:

-

hi everyone, im hoping some-one can help me out with this my brother passed away 18months ago and i was executor of his will. i did my duties as such but other than those in his will am i obligated disclosing info about him to anyone not on the will i.e other familly members just crawling out of the woodwork? many thanks in advance

-

I have never been down this road before, i need some advise I have been signed off work from June unfit for work. I have a long term condition that will never get any better only worse. Today I saw my gp who has written another unfit for work note. Everything has been crossed off and in the comments he has written... Will never be fit to return to current work and I think she should therefore be 'retired'. This will be the case for 3 months from 26/8/2018 to 25/11/2018. Goes on to say will not need to assess your fitness for work again at the end of this period. Sorry for the long explanation but it has confused me some what. Thank you in advance

-

Hi all, To make this as brief as possible, I had a second charge on my property with Nemo personal finance. In 2007 the property was repossessed due to a lot of bad luck and the original lender sold the property over £50,000 less than market value just to cover their own expenses (G E Money) which left nothing to pay off the second charge. I have been battling this loan on and off ever since and during this time Nemo took me to court and won because I never defended the claim and this was due to the fact \I knew nothing about it. I agreed a miminal payment to them which I paid monthly about 2/3 years ago I wrote to them sending them £10 PO asking for a SAR. They never produced it so after a while I stopped paying and things went quiet of a year. Now they are back on my case threatening with a attachment to earnings, High court Writ and Baliffs etc. I am not sure how I should proceed with this and would really appreciate some help. I id speak to one of their customer service reps when I got the first contact letter and explained that I stopped paying because they did not comply with my request and he said he would look into it and get back to me but he hasnt and I ave just had a letter threatening allsorts to collect. When I first loss my house I did do a lot of research on this with regard to the PPI and secret commissions which there undoubtedly was but never saw it through due to personal circumstances.

- 23 replies

-

Hi. Just needing some guidence on CRS on behalf of the Harlands gym. Cancelled the gym membership after 6 months i personally thought id taken it out for a 3 months time scale as i was told its for how long you want it too be not like other gyms!!! I was wanting a gym based more on classes as i got married in Aug 17. Cancelled with the bank as i was having personal issues it wasnt until i had to look at my bank account realised i was still paying for the gym as i thought id got it for the 3 months sounds a lame excuse i know have been told i owe them 342.00. Well ok then the contract i signed was for 12 months and i have paid 6 months at 29.00 a month i worked it out for about 174 .00 but they have put costs etc on. Having rang and explained they have been really rude and condescending. They have apparently sent me letters and also monthly statements of what i have paid to my address i can honestly say i have never received CRS says i need to have a word with Royal Mail as obviously i am not getting my post through their service. I receive my bank statements and overseas parcels so really not sure why i havent revieved their letters. I am more than willing to fight this im worried the affect it will have on my credit rating as im looking at changing my mortgage i dont want this to have an impact while im still trying resolve this. At the moment they are just rude people who speak to me like im a low life. Feeling worried and scratching my head whats the best course of action as obviously i signed up for the 12 months which is now my words against theirs but no way am i paying 340 odd pound.

- 26 replies

-

- cancellation

- crs

-

(and 3 more)

Tagged with:

-

Hello, I had taken a number of payday loans in the past, in particular the period of 2014-2015. Most of them are settled or just ignored, but there are a couple that keeps getting chased. One is for Cheque Centre which has been bought up by Lantern (Formerly motormile) and the other is The MoneyShop who I'm now getting chased by BWLEgal on behalf of PRAC Financial Limited. Now, so far I've just ignored them, get standard threat emails etc. Heard nothing regarding the moneyshop one for months until now. However, is it worth making a complaint and the proceeding to FOS for ireesponsible lending when in particular Cheque Center no longer exist? Would that get me anywhere, and who would I complain to, Lantern? As for The Moneyshop one, should I complain directly to them or Prac Limited? I've read the guide so I'm prepared to take them to FOS (I had many many payday loans at the same time, and Cheque center was in particular bad where I was offered £1000 every month with £300 interest, and I used them for rollover several months in a row..)

-

Hi, I have accumulated some relatively large charges from HSBC Business over the last few years, mainly for unauthorised overdrafts. Is it possible to have any of these refunded? I am in quite a bit of financial difficulty at the minute. I dont have any lending on this business account. I would also like to keep the account open, so dont want to do anything to harm that if possible. Thanks for reading! Jamie

-

Hi, Since September last year, I have been pursing claims against a total of 17 Payday Loan providers whom I had taken various loans from during the period 2010 to 2014. Of the 17 providers, 6 have settled directly with me and I have currently have 9 claims lodged with the FOS. The FOS have stated that they are currently trying to decide whether they are able to consider loans taken out more than 6 years before the start of an irresponsible lending claim, and cannot provide any timescales for the resolution of the issue. Does anyone have any guidance on a likely timescale for this to be resolved as I cannot find any further information?

- 7 replies

-

- claims

- irresponsible

-

(and 2 more)

Tagged with:

-

Hi All, I'm a newbie to the site and I hope i'm in the correct forum. I would be very grateful for any advice or guidance from those of you with experience of similar issues. We took a loan with Welcome Finance in 2007 secured against our home for £17,000. Over the years they have changed companies and are now known as Prime Credit. We have taken steps to sell our home and have accepted an offer. It is only now that we are in a position where we are looking for a new mortgage that we have realised the secured loan will create difficulties. We have paid £234 per month for almost 10 years totalling around £28K. When we finish the loan with Prime Credit in another 5 years we will have paid in excess of £40k Can anyone offer some advice on the best way to approach this with the Loan Company please. We have just realised that if we have to settle the loan first we will not have the deposit needed to move house. We have been improving our credit scores over the past few years and are bordering on achieving Good. Would it be advisable to apply for an unsecured loan to pay this off or would this also affect our mortgage application. We are so confused about the best way to deal with this Many thanks in advance for any help you may be able to give.

-

Sent my appeal off with some brief details of why i was appealing , Had a Letter from DWP confirming that they received my appeal, and about how much ESA i will get until it's heard, But so far over 1mth since requesting the full written statement of the Atos wca Form IB /ESA85, But so far i have not been sent it, The person that i recently spoke with from DWP ,Confirmed that they could see that i had previously requested it, but could not understand why i had not yet received it, What can be done to force them to supply this info,(assuming it actually exists) ?

- 389 replies

-

- abolition

- account

-

(and 80 more)

Tagged with:

- abolition

- account

- against

- answer

- appeal

- appeals

- asked

- atos

- been

- call

- center

- chda

- claimants

- cofirmation

- complete

- current

- diaries

- discriminate

- dla

- does

- doom

- duplicate

- dwp

- esa

- esa50

- ever

- evidence

- fast

- few

- gave

- has

- hasn

- hmtcs

- hold

- ineptness

- information

- issue

- jsa

- know

- legistlation

- mandatory

- maximus

- med

- mislaeding

- pip

- plan

- points

- possibilty

- programe

- questions

- recent

- recieved

- reconsideration

- record

- regarding

- regs

- report

- request

- results

- rules

- say

- scale

- scored

- sending

- some

- sor

- stictched

- stopped

- template

- them

- thinking

- tracked

- transferring

- tribunal

- tribunals

- tribuneral

- virtual

- visit

- wca

- wrag

- written

- zero

-

Hi, My partner has got herself into 9k's worth of debt with a credit card company. She kept it secret for years and has been paying £300-£350 minimum amount per month, but the interest keeps coming and she's missed payments because of other debts and outgoings. We don't have any joint savings to throw at it, I'm disabled and not working and we have a child of 4. She works full time. I'm not sure what further details are required, so please let me know and I'll add them. I would really appreciate some guidance as to what our options are. My first thought was to get a consolidation loan to bring down the payments to manageable levels, but I doubt she'd be able to get a loan because of the missed payments. CC firm don't seem interested in helping and the interest is mounting up. She hasn't spent anything on the card for many months since she first defaulted. Thank you. P.S. apologies if this is in the wrong section.

-

I received a letter from PRA Group recently which states:- Dear Mr XXXXXXXXXX PRA Group (UK) Limited ("PRA GROUP") Account Reference Number: XXXXXXXXXX We write further to the above and to inform you that your account has now been transferred to the Investigations and Litigation Department. This is a letter before claim as required by the Practice Direction on Pre-Action Protocols, to give you notice of PRA Group's intention to issue court proceedings against you. You should consider the contents of this letter carefully and seek legal advice or alternatively contact one of the free agencies detailed on the enclosed document. We specifically refer to paragraph 4 of the Practice Direction and set out in that paragraph are the courts powers to impose sanctions for failure to comply with the Practice Direction. You will recall that you entered a written agreement numbered XXXXXXXXXX on or around xx/xx/1998 with MBNA Europe Bank ("the Creditor"). The agreement was regulated by the Consumer Credit Act 1974. The agreement obliged you to make payments, however, in breach of the agreement you failed to make those payments and are now in breach of the agreement. By a notice of default the Creditor required you to remedy the breach within the prescribed period and gave notice that, in default of so doing, you would be liable to pay the monies due and owing. However, you did not remedy the specified breach within the prescribed period and you then became liable to pay the Creditor the sum of £xxxx By an assignment in writing dated xx/xx/2014, the Creditor assigned the debt to PRA Group. Then by notice in writing the Creditor and PRA Group wrote to you to notify you of the assignment. PRA Group has made further written and oral requests for payment of the sums but you have not paid the sum due and owing. If after considering this letter you take the view that you do not owe £xxxx then we look forward to receiving your reasons why you take that view plus supporting documentation. We do not presently envisage that expert evidence will be needed in this claim. This letter should be treated as an invitation to refer this dispute to medeation or some other form of alternative dispute resolution (ADR). In addition this letter triggers certain time limits that effect you:- 1. You are expected to acknowledge and answer this latter before claim by xx/12/2016. 2. You are expected to respond to the invitation to refer this matter to ADR by xx/12/2016. We look forward to receiving your letter in reply, responding to the claims made against you and / or setting out your proposals for settlement / payment. We are prepared to discuss repayment options if this assists you. If we do not hear from you within the above time limits then court proceedings will be issued against you which may increase your liability for interest and costs. If you have any difficulty in complying with the above limits please explain the problem to us as soon as possible and we will consider a reasonable request for extension. Yours sincerely Litigation manager PRA Group (UK) Limited Tonight I have done a CCA request to them which will be sent tomorrow. Is there anything else I need to do or just wait for there reply? Thanks in advance

-

I was really worried, I get caught for shoplifting at tkmaxxx. I have given my address, name, phone number and signed the banning form with exclusion list of stores for 12 months and a letter with RLP that I need to wait to pay them a lost cost of Tkmaxx which they have gotten all the goods back worth 60 Pounds. What will happen if I pay them? Will there be any further problems in the future? I am really ashamed of myself It happened because i'm not myself that day and suffering from depression from most of everything in my life. I really need some advice and help. Thank you

-

Hi, hopefully im in the right place im after a little advice without anybody judging me as finding it hard enough already Age -22 (now) Ive had a problem gambling addiction and have manged to cause myself around 10k+ of debt Without the Loans and the credit cards ive been in a vicious circe with payday loans Such as MyJar-2 Loans wonga-11 Loans Piggybank-8 Loans Sunny- 9 Loans Basicly taking one loan out to pay the other ect been going on for around 2 years now and wouldnt like to know how many loans ive received off the above 3. now ive heard stories unsure if there correct people are recieving refunds due to irrisponsible lending (does this class as that or not) Im not clued up with any of it so as much help as possible please. Many thanks

-

Hello All, I used moneybarn to purchase a car for 7k, over 39 months equaling 10.5k all together. I am paying £280 a month, I currently have one month arrears from about 3 months ago that im paying back in a payment plan of an additional £50 per month. Around £200 left in that arrears, my payment is due again tomorrow however and I am struggling to afford it. I am not 1/3 through my agreement, however I am wanting to VT my car and only be liable for the 50% which will be roughly 5.3k and ive paid around 2.3k minus arrears, so il be about negative 3000. If I send a VT notice today, will this work? Also regarding the remaining 3k will I be able to make a payment plan for this? I currently use a debt management plan so could I add this to that? Or are they going to hound me to go to court and all sorts of silly things? Please help?

-

This is also in our Media holiday and travel forum. From the BBC. Jeremy Clarkson will have to take a break from work for "quite some time" after contracting pneumonia, the TV presenter has said in a statement. The Grand Tour presenter was admitted to hospital on Friday after falling ill while on a family holiday in Majorca. http://www.bbc.com/news/uk-40846356

-

In the last few years I have been a huge idiot and coupled with my mental health deteriorating I have had fallen into some issues with my debts. I am trying to be more positive and to get myself out of this hole and others so I want to start tackling this head on. Very £1000 Lending Stream £450 (Received start of CCJ proceedings this morning) Wonga £600 Quickquid £400 Capital One £1000 Aqua £2000 Vanquis £1000 Credit Union £1000 I had gotten to the point where I had to take out payday loans to pay the payday loans I had just paid and it just all came crumbling down. My quality of life took a negative turn as I was paying so much interest and barely making the minimum on my other bills. I have a family so this compounded the issue and it just broke me down so I just ignored it all and managed to get some help for my health. I haven't really done anything with these debts for the 12 months and some have been passed onto DCA. I don't have any savings I can pour into this so it is going to be a grind, but I will do whatever I can to get out. Can anyone help?

-

approx.: 10 months ago we had a leak in bathroom. called Royal sun alliance Insurance to make a claim. claim exceeded a fixed amount of money Royal sun alliance handed over to Cunningham Lindsey as their loss adjusters. 10 months have passed and still no works completed. I have attached a letter that I intend to send this week to loss adjusters. we want to know if we are entitled to compensation due to all the stress & inconvenience we have had to endure, such as doctors & hospital appointments. Cunningham Lindsey letter of complaint - Copy.pdf

- 3 replies

-

- adjuster

- appreciate

- (and 4 more)

-

Hi I got caught taking some items from primark (I know, sad)! They took me in to a room and took down my details from my Spanish ID and I gave them my real address to send the fine they told me the RLP will send in a couple of weeks or so. I'm over 18 so they didn't ask for my parents details. They made a copy of my Spanish ID and didn't call the police. The total amount was £35. I swear I learned the lesson but I'm really worried if I'm going to have any criminal record in the UK or it's going to be a problem if at some point I want to apply for a mortgage? Also the security guy told me the fine will be £130 but I read on this website that it's £180. Also read that I don't have to pay, just ignore it. The security guy told me if I don't pay it this would be taken to the court and I would have a real problem. Is that real? They have my real address so it's easy the RLP can ask for it and send the police to my address or something? I'm really worried and i'm overthinking the worst! I would really appreciate if you can give me some advise. Many thanks in advance.

-

Is it legal, for council run car parks, to lease some of their bays? I have been using a particular car park; 30 years plus. It has six levels. First level has a row of bays painted pink [nice] for 'Handicapped' & 'Parents with children.' All the other bays are painted blue. Rightly or, wrongly, this colour has been considered for the use of all others It is a pay & display. It was busy. I drove up to the fifth level. All the bays were blue. It was 80 per cent full. Saw a bay and reversed in. Bought a ticket - onto windscreen. When I returned, there was a PCN on the window for not displaying a ticket. Found the parking office and entered. Within were 3 parking attendants munching happily. I was angry. A Team leader joined me. Went up to my car. Pointed out my ticket. He then alleged that I had placed it there after I had received the PCN. Got more angry. He said it had been issued by the Team Manager and he would have taken photos. He began to raise him on the radio. Whilst he was doing that, I spotted a 12" by 12" plaque saying one was not allowed to be parked in these bays - even if 'one' had a ticket. [Leased out to : Clinical Commissioning Group [CCG] {NHS} My research reveals they receive from the government i.e. 'us' two thirds of a 73 billion pound budget. Nice, again. Bear in mind - not even the Team Leader knew any of this. Also, other than the plaques being small, their positioning is suspect: The first one was blocked by my near side exterior mirror. The second, on the rear wall, was invisible to me as it was lower than my rear view mirror, and finally, the third one was out of sight as it was on the other side of the car parked next to mine. Of course, I am challenging the PCN. [inadequate signage] Has what has occurred - legal??

-

Hello. Had a whirlpool washing machine off brighthouse which I have been paying for 3 years with insurance cover and only have 2 weeks left to pay. The washing machine bearings have gone and brighthouse sent a guy to fix it and he said they will right it off and left a form. I contacted brighthouse and the lady said because it is 3 years old she is having trouble replacing it and would I like a new one with a reduce price which I refused. Now the lady is saying if it is replaced it will be one that is 3 years old. I am a bit confused on their website it states if they cant fix the item they will replace with new. She also said because our washer is now 3 years old that it is not worth anything and the price for it now is zero and she doesnt think she can find a like for like. I need to phone them back tomorrow so any advice would be great thankyou.

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.