Showing results for tags 'prac'.

-

Hi, I have a BW Legal court case going on at the moment. Today I received another county court claim from BW Legal for a different company. This is fraud too. Name of the Claimant ? PRAC Financial Ltd Date of issue – 29/09/17 What is the claim for – 1.The Claimant's claim is for the sum of £300 being monies due from the Defendant to the Claimant, under a loan agreement regulated by the consumer credit Act 1974 between the Defendant and Instant Cash Loans Limited t/a Payday UK under account reference xxxxxxx and assigned to the Claimant on 09/12/2016 notice of which has been given to the Defendant. 2. The Defendant has failed to maintain the contractual payment under the terms of the agreement and a default notice has been served and not complied with. 3. The claim also includes the statutory interest pursuant to section 69 of the County Courts Act 1984 at a rate of 8% per annum (a daily rate of £0.06p from the date of assignment of the agreement to 28/09/17 being an amount of £18). What is the value of the claim? £360 Is the claim for - a Bank Account (Overdraft) or credit card or loan or catalogue or mobile phone account? loan When did you enter into the original agreement before or after 2007? After Has the claim been issued by the original creditor or was the account assigned and it is the Debt purchaser who has issued the claim. debt collector Were you aware the account had been assigned – did you receive a Notice of Assignment? The account was opened at a different address to mine. I lived at this address about 20 years ago but have moved twice since then. I received a debt collector letter in 2013 for this and I wrote and said they have the wrong person but I did not hear a thing until March this year when I got a county court summons. Did you receive a Default Notice from the original creditor? No Have you been receiving statutory notices headed “Notice of Default sums” – at least once a year ? No Why did you cease payments? I have never made any payments What was the date of your last payment? None Was there a dispute with the original creditor that remains unresolved? Yes, there will be now. I did not know anything about this loan. Did you communicate any financial problems to the original creditor and make any attempt to enter into a debt management? No

-

Hi guys Any advice on how I can get rid of a CCJ issued by PRAC Financial? My credit report states that the default on my loan with Payday UK (whose debt Prac has acquired) is Satisfied as of Jan 2017. Another credit report says its closed. Unfortunately these clowns still want their pound of flesh. Ive received two letters. One from Northampton County Court about the CCJ and one from BW Legal saying I pay the amount of £1,029. I dont want to pay another £255 to set aside. I dont want to pay anything to remedy? What should I do? Maybe write to the court?

-

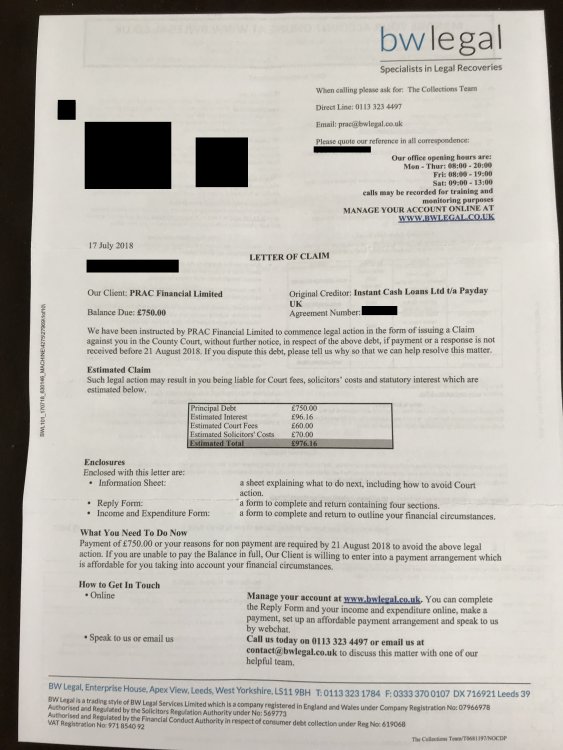

Greetings my fellow Acting Consumers Have just come back from holiday only to find this letter (attached). Went through all of it and started to panic a bit. Been reading CAG since morning and I'm not sure how to go about this letter. It's a Letter of Claim issued by BW Legal on behalf of PRAC for a PDL i took back in 2012. I know I'am suppose to action it but after spending all day reading I just don't know how to. (too much information). I do not have time to digest all that info as the deadline for response is 21/08 (tomorrow). I'm guessing if I fail to respond on time, the next letter will be a Court Claim? I had a look at my credit file and the Default date for this loan was 01/11/2012 I am literally months away being Statue Barred on this account Is there anything I can do NOW to get out of this mess. Possibly delay any proceedings for few months or Claim back from PDUK for irresponsible lending. I was in a big trouble back then when I took this loan, stuck in payday loan loop with multiple PDL's. Any help or advise would be much appreciated. Thank you

-

Hi, Seems like a lifetime ago now, but for many years I was a compulsive gambler. I funded this mainly through pay day loans and credit cards. RE:Payday loans I got into the trap of borrowing from one lender to pay the other, at the time I was either unemployed or low paid. In each case of borrowing, it was unlikely i was ever going to be able to pay the debt back - a simple credit check would have shown this and i had many defaults against me. After hitting rock bottom - fast forward 5 years i have turned my life around, paid back most of my debts and saved some money and have a decent paying job. The couple of PDL lenders who didn't push me hard for the money at the time i decided to not pay back - I had particular anger against their lending practices. However, one now is pushing hard for payment. Originally taken out with Payday UK, I believe they have sold the debt on to somebody called Prac who have hired BW Legal to reclaim the debt. I ignored their usual threats - but I went on holiday recently and on my return i got a letter from them saying if i don't respond by 1st of July they will take me to the county court. The heading of the letter was letter of claim. Now the deadline has gone. I am aware of the PDL guide here but i have a few questions as to what my options are. 1). Is it too late to take the action stated in the guide since the deadline for response has passed? 2) Is the letter of claim the real last action and last chance i have to respond before attending a court? or is this another threat? 3) Can i still make a claim for irresponsible lending given the fact that these debts were taken out before the changes were made by the FCA? and given the fact that i am in a position now to pay it back? Any help appreciated?

-

I took out a payday loan (not wise, i know!) with PAYDAY UK/MEM CONSUMER FINANCE LTD. I have not repaid the loan after coming into financial difficulties.The amount outstanding is £516.00 Apart from the original interest which was apllied to the borrowed amount, they haven't added on any extra charges or interest at present.The debt has now been passed to a DCA - EQUIBET. I am now in a position to pay back the debt in installments and asked PAYDAY UK for their bank details in which to start paying them.They refused to give me their details stating that they no longer have my details and that i must payback using Equibet.I informed them that i am recording on record that i am making an attempt to resolve the debt under OFT guidelines and that they were refusing to help me. I am cautious in paying equibet, as i dont want the debt to remain outstanding having paid it back using Equibet's bank details. On my credit file the debt shows as a 2 month late payment and registered with Payday uk. Would you pay money into the bank details of Equibet? thanks for all advice in advance

-

Hi I've been posting on a different site about this but help seems to have dried up. I'm keeping things vague as I don't want to tip their hand. Last year I complained about IL to PDUK. Extremely close to this time, probably passing in the post was a claim form from BW about a £100 loan outstanding from PDUK. I informed them it was in dispute, sent off the usual CCA request and CPR naming agreement, default notice and assignment. My defense stated the account was in dispute and that BW had not supplied docs or CCA. No response from BW. DQs were exchanged, I reminded them no docs had been sent. During this time PDUK took a very long time to turn down my complaint, I escalated it to FOS. Mediation comes and goes as no docs had been produced. BW finally supply reconstituted Agreement 3 months after CCA request. Still no Default or assignment. Hearing date set, BW pay court fee. Im now preparing witness statement, still awaiting FOS outcome they are waiting for docs from OC. Not sure how to proceed with witness statement. I know how to write it but am not sure what legal arguments I should flesh out. Anyone know mistakes BW may make and or arguments I can use on my WS? Also what mistakes may have been made on their reconstituted agreement?

- 36 replies

-

- county court

- hearing

-

(and 2 more)

Tagged with:

-

Hello All In 2012 I took out a payday loan with PaydayUK for the sum of £400. At the time of taking the loan out I was on a low income and I wasn’t able to pay my rent I took out the loan to cover rent costs - stupid idea I know but at the time I had no other way of getting the money I didn’t pay this loan back as I couldn’t afford too. I vaguely remember contacting them to advise them of this but they were really unhelpful and I just ended up not paying and I heard nothing for 5 years. In December 2016 I received a letter from PRAC/BW Legal saying they have purchased the debt - I ignored this and heard nothing further up until now . I have received 2 emails from them also - they were just copies of the letters I had received in the post The most recent letter (final request for payment)states that if I don’t contact them within 14 days, my account may considered for legal action and it states that the next letter I receive will be a letter of claim prior to the issuing of a county court claim BW claim I owe £420 and I think this is incorrect . I decided to check my credit reports and my bank account. On my credit report it states I borrowed £500 and I know for a fact I did not take that amount. I also checked my bank statements and it shows the payment of £400 which was paid in - and it also shows that they had taken a total Of £314 over various payments with my card from February to May 2012 as they had CPA - I remember at one point they completely cleared my account and they gave a me a measly refund of £34 - I remember calling them angrily as they’d completely emptied my account and stated that they would keep on taking money from my account so I think I may have cancelled my card. I have not made any other payments and I have not had any contact with payday uk or PRAC/BW Legal I’m assuming they are getting heavy handed as I’m pretty sure it’s getting close to the 6 Years (not sure how I would find out when the 6 years is up) Just wanted to know what action I should take? What is likelihood of them actually taking me to court Any advice will be greatly greatly appreciated Thank you in advance

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.