Showing results for tags 'unlawful'.

-

Today I received a large pile of documents from Prestige Finance, with whom I have a second mortgage. I have identified 10 unlawful charges of £35 each. But this account was previously held by lenders GE Money. Either they went into administration and "became" Prestige Finance, or GE Money simply sold my account to Prestige Finance. I have identified seven unlawful "administration charges" of £40 each while the account was with GE Money, before I found my account being handled by Prestige Finance. So my question is in two parts. 1. Am I entitled to recover the £280 unlawfully charged to me by GE Money before Prestige Finance aquired the account (and if so, who do I get the money from? Prestige? Or GE, who may no longer exist?) I had always assumed that if a going concern such as a lender was aquired by another going concern then the buyer going concern would also be buying the seller's liabilities as well as its assets (in which case Prestige would be liable to refund me the money that GE had stolen from me). But I may be wrong in this case. 2. How do I get my money back from Prestige Finance? Do I just ask for it back or do I need to take them to court? Can I charge interest at the statutory 8% and how can I calculate that? Can I add on anything else such as the time it has cost me and also the stress? Thanks in advance.

-

Hi there CAG Community! So relieved there is hope out there - CAG!! In a nutshell, I have lived in Abu Dhabi, UAE, for many, many years.. I had a credit card and a loan, of those in the know, is a must if you are in need of renting any property as x2 payments up-front are needed..Anyways, long story short, I have always paid my loans/CC's on time, every time. In Dec 2017, I was unfairly dismissed, (part of the emiritization restructuring) and was given 3-hours notice to leave. Contravened Labor Law, thus was unlawful (which didn't make a difference) desperately tried to fight for my End of Service benefits, notice monies etc... which all went down the 'inshallah' road. Time and money ran out, I have had to leave Abu Dhabi as could no longer stay live there with my wife/kids as had no income.. Had to return to the UK in Feb 2018. Thus defaulting on monthly payments. Total debt; in the region of AED123k, approx £22k excluding the ungoverned interest rates Right, to the point; I have received an email from a collections agency couple days ago. The email is as follows: Dear xxxxx, First Abu Dhabi Bank (PJSC), Unique Identification Number xxxxxx We have been instructed by First Abu Dhabi Bank (PJSC) (the merger of First Gulf Bank and National Bank of Abu Dhabi) in the Middle East to deal with a number of liabilities owed by individuals resident here in the UK. All of our work in this respect is regulated by the Financial Conduct Authority in the UK (under FCA licence number 737367). A liability in your name features on a portfolio which we have been instructed to manage. We have been provided with this email address for you, so our intention is for all communications to be directed to this address. That said, we know and are sensitive to the fact that debt is a serious and very worrying issue for many people - so we do not want to increase that burden by communicating with you through inconvenient channels. Accordingly, if you do not want to be contacted via this email address, please let us have an alternative means of communication, within the next 7 days; either a telephone number, another email address or a residential postal address. If you do not take up this opportunity to direct us down a particular communication path (or paths) then we will assume that the continued use of this email address for communication is acceptable to you going forward. Please telephone us on 01494 911099 within the next 7 days. Our operators are here to help you Monday to Friday between 9am and 5.30pm. Please quote the above Unique Identification Number when you call. Please note that there is free debt advice available for anybody in the UK who needs it. This resource is available from the following organisations, amongst others: citizensadvise and moneyadviceservice

- 34 replies

-

- chased

- dissmissal

-

(and 3 more)

Tagged with:

-

I would like some advice on behalf of a relative please. She has been diagnosed with early onset Alzheimers / dementia. She has been co-operating fully with her employer (a large retailer), for example going to an occupational health appointment. The assessing "doctor" didn't have her notes beforehand, was really abrupt, derogatory and not listening to half of her answers / information. His report said she is a danger to herself and others, which we all strongly disagree with. (It is possibly due to her disclosing that she must be reassessed for her driving and may have her license taken away, but to my knowledge there is nothing she has done at work that proves her a danger at all.) We were hoping for some kind of medical retirement (she's in her mid fifties) or some kind of dismissal on capability grounds which would attract some sort of payout. They now claim they cannot provide a job for her and have "offered" her two options: 1. Move to another store for just 2 hours per day. Why they "can't give her a job" but then can give her a job only in another store for a few hours sounds very odd to me. Also a totally pointless exercise that nobody would take. 2. Dismissal - no compensation. I believe she would be classed as having a disability under the Equality Act and this seems like they would be breaking the law. I feel that dismissal may be disability discrimination. They do not seem to have made any attempt whatsoever to provide reasonable adjustments. I can think of a couple of things that they could have tried. In the meeting they started to bring up incidents from a year ago, such as she swore, a customer overhead and complained. That has *nothing* to do with her condition. They mentioned she forgot to put on safety equipment / misplaced her locker keys / forgot to clock in - all things I could see possible reasonable adjustments for (for instance, a "buddy" to help her remember things). It seems very unfair after 25+ years of service, with an excellent record, they can just dismiss her with no consequences. The union are involved and unhappy (but my experience is unions are pretty toothless) and she is going to speak to Alzheimers Scotland, but any advice would be appreciated.

-

Hello all, An acquaintance of mine got a parking ticket some time ago. The ticket and all correspondence went to her Grandmother’s address as she had previously lived there before being rehoused by the Council. The ticket remained unpaid and was escalated and the amounts increased. She lodged an appeal and a rejection dated 1st March was send to her stating that her appeal had been received out of time. The letter further stated that she would have 14 days to further appeal if she was not satisfied with the outcome. The letter arrived either Saturday 3rd or Monday 5th and waited in the house unopened by the Grandmother until today 6th March. I happened to be working with a family member (the girls Auntie and the householder’s daughter) when we got the message that Marstons HCE had knocked on the door and been let in! I at once went with the Auntie to the house which is a well-to-do four bedroom property to find a single and very unpleasant HCE from Marstons. The hall had some items in it that the guy had taken out of the dining room and living room, notably a TV, a nice small draw set and some pictures (prints I think rather than originals and not of significant value). I pointed out to the guy that these items were not the property of the Grand daughter who no longer lived there. He said we would need to prove that. I know for a fact the daughter lives elsewhere as I have known the family for over three years. I asked to see the paperwork related to the search and he said he did not have any as it was all on a tablet computer. He refused to let me see it as he said (probably correctly) that under data protection rules he could not show it to third parties. I do not know if he showed it to the grandmother (presumably under DPR he should not have!!) or if she comprehended what it was. By this time a Community Police support Officer had arrived (we had called the police) and she stated she was there to stop a breach of the peace and not to take sides which I expected and accepted and is I think the proper police stance. I pointed out to the officer that no printed paperwork had been produced or was in evidence, that the guy was not apparently making a list of items for removal and that he had been told by three different people that the granddaughter did not live there and as he had already stomped all over the house it was self-evident she did not live there. It was further evident that the items being taken were the property of the householder, they were not taken from any of the bedrooms that might conceivably be occupied by a granddaughter but from the living room and dining room. At that point the support officer called for backup and in short order two uniformed constables arrived. The police I think found themselves in a quandary as the HCE was adamant that it was up to the householder to prove the items did not belong to the granddaughter not the other way around but I thought this was an abuse of the situation as, to repeat my phrase from above, it was self-evident that the items were that of the householder. One o the police officers was shown the tablet computer and confirmed that a warrant (or writ or whatever the document is) was there for the collection of the fine or removal of goods) though I never saw it myself. The situation came to an end when the Granddaughter was got on the phone and asked her grandmother to pay the fine of which about half could be raised. The HE was unrelentingly hostile and rude. He did not like the situation reversing as one moment he was in a large house by himself towering over a small woman in her seventies and then next he was confronted by myself, a daughter and three uniformed officers. When we told him we would peacefully obstruct him from removing any goods (by standing in front of the doors) he threatened to "remove us" to use his terminology. The woman was left (temporarily) out of pocket some hundreds of pounds and left shaking and her house was in some disorder. My questions here are as follows 1. If this is at appeal should HCE action be suspended? 2. Once the letter is issued rejecting the appeal should HCE action be allowed to continue during the 14 days the Rejection letter allows for a further appeal. 3. Is it reasonable for HCE to arrive six days after the DATE of the Rejection letter, it can hardly have had time to be opened and read, never mind acted upon? 4. Should the HCE not have paper copies of any authority he has to gain entry and seize goods? 5. If he has been told by two other parties as well as the householder that the Grand Daughter did not live there and the items he was attempting to seize were not those of the granddaughter should that not be enough proof? 6. The lady was elderly and had a blood pressure condition. No attempt was made to determine if she was vulnerable and as such refer the Warrant back to the creditor/issuer to see if they wished to continue enforcement, is there a case against HCE for this omission? I hope fellow CAGers will understand that we are all very angry. I beleive that whatevere the merits of the fine and it's collection that the grandmother and her house have been violated. Any ideas who we need to go after? Do we have a case of any sort against Marstons? Do we have a case of any sort against the Council? Can we develop a case against the individual HCE for his behaviour or his firm? As of now the case is over as the outstanding amount has been collected by aggression and dirty tricks and despite the appeal process not being exhausted. Any responses gratefully received.

- 17 replies

-

- attempt

- deceiptful

- (and 4 more)

-

In May 2015, I filed a Consumer Credit Act ("CCA") claim with my then bank ("CCC") for faulty goods that I had purchased for which they were jointly and severally liable. They ignored that claim but after I obtained a successful Ombudsman's decision they finally agreed to process it. In June 2017, while the CCA claim remained in progress, the bank sold the outstanding credit card balance (of exactly the sum of the faulty goods) to a Debt Collection Agency ("DCA"). The DCA immediately filed a default on my credit file against my old address for the alleged debt. In September 2017, I moved home. I also served a letter before action on the bank in respect of the still unresolved CCA claim. That letter stated my new home address, as would be stated in all subsequent litigation. The bank ignored the letter before action and a county court claim was duly filed. Meanwhile, the bank would appear to have passed my new address to the DCA, who in turn have now removed the purported June 2017 default and replaced it with a September 2017 default. As you might imagine, a default which is now less than 6 months old is causing me serious financial prejudice. Is it lawful for a DCA to register a default for one month before then removing it and replacing it with a more recent purported default for a new address? Surely a "default" can only happen once? Is it possible to enforce the reinstatement of the original June default until the litigation is determined?

- 11 replies

-

- dca

- debt collection agency

-

(and 1 more)

Tagged with:

-

Hi all firstly apologies if this is in the wrong section just wasnt sure where to put it. Long story short, i lived in a property a few years ago and moved out due to the poor state of the property (environmental health were investigating) i informed United Utilities about moving out and the reasons and gave them a new address. I received bills for a full year which i questioned as due to the problems we only had the keys for 3 months but rarely stayed there due to the issues in the property. This was ongoing for a while as i could not get an answer of what i owed because i agreed i owed them something but not over £400 they were asking for. Debt recovery companies got in touch and i kept in contact with them and United Utilities regarding the amount all was explained to the Debt companies who said we will investigate and get back to you. This never happened I recently applied to rejoin a job and got told i could not until the CCJ on my file was rectified. This was a shock to me as i knew nothing about it, after investigating it was for UU for the amount on that house. I contacted them a number of times which got me no where. After this being ongoing for a while i have had enough of the stress and the embarrassment as i would of got in the police if it wasnt for this and ive not been able to get a new house or new family car which was needed not long ago. Despite having the proof of income that i can afford it i was declined. After all this as a last resort i emailed the chief executive with all the evidence i have and said this needs sorting. Since then i have been told the CCJ paperwork has been sent to have it set aside but this could take 4 to 6 weeks. Now i am waiting for this to happen and ive been told i should be entitled to compensation because of everything thats gone on. In regards to the paperwork they have admitted they have sent all paperwork to the property in question not the new address i gave them. With them getting the CCJ removed that to me is admitting liability for this and they are in the wrong. Ive been getting legal advice where possible and they have said about compensation. Has anyone won with a compensation claim for anything similar? Many Thanks

-

Good news. Swift have been ordered to pay back all charges plus interest in a county court judgment. The judge ruled that their standard terms between 2002 to 2009 were unfair. Regards

-

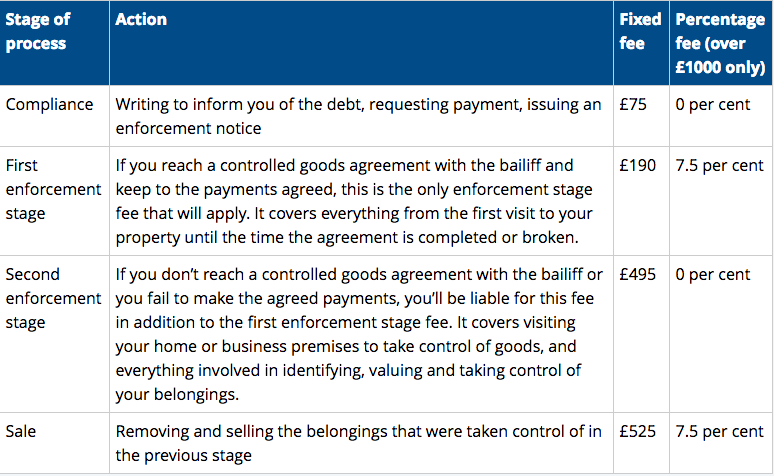

Hi all, I would really appreciate some advice. My business partner and I run a small business, and cashflow is very delicate. Some time ago we got in some money trouble and an invoice was sold to a debt recovery company. We managed to pay it off (or so we thought), but unfortunately my business partner is a bit scatternbrained with numbers, and paid the incorrect amount. The total outstanding debt was £5,723.96. My business partner sent them a transfer of £5,700, accidentally leaving off the £23.96. My business partner had some fees he wanted to dispute - The debt recovery company then sent a follow up email saying all prior fees are legitimate, and that "I have checked your account and can see we are still awaiting a payment of £23.96. I am assured this will be paid in due course, and this case can then be closed.". My business partner forgot to respond to the email (stupid, I know), and three weeks later (yesterday) they send a hired thug to our place of business, while customers were there, demanding the £23.96 plus a £1111.87 enforcement charge. He said that unless we paid that to him on the spot, he would confiscate goods that he valued to the sum of £8000. The £5,723.96 sum had a high court writ, which comes with a cap on fees of this nature that can be charged, as illustrated by the table below: The bailiff claimed to be able to charge for both stage two and three whether or not he actually had to carry out stage three. I pointed out that I was perfectly willing to pay the debt and the enforcement fee on the spot, which meant that he did not have the right to charge a "sale" enforcement fee, but he refused to drop it, saying I either pay exactly what he is demanding, or he starts ripping equipment out of the walls there and then. I had no choice but to pay the entire sum, and did so. There is no doubt in my mind that this is illegal and extortion, and in fact the bailiff himself used the very word "extortionate" when explaining the situation he was putting us in. My question to you is which regulatory body can I bring this to the attention of, are there any court cases setting a precedent in these situations, and are there guidelines that prevent bailiffs from charging huge bills for debts as low as £23? Even the £495 bill is entirely unfair, and clearly taking advantage of an admin error made by a small business. The law was not written to allow them to do this, and it puts our business at risk. Any advice on putting this right would be massively appreciated. Thanks a lot.

-

Hi everyone, This is not for me. Someone has had money illegally deducted from his wages (he gets far more than minimum wage) He intends taking his employer to the Tribunal. I believe he would be entitled to the deduction if he wins and Litigant in Person’s research cost. My question is, will he be entitled to compensation eg injury to feelings? Thanks and regards

-

Summary: If you have had a similar experience with Anglian Home Improvements please contact me directly. I am taking them to court and want to get as many witness statements as possible. Detail: Anglain canvassed our area offering free no obligation quotes 50% off. We got a quote for doing our house. We were conned into signing a purchase order which they now want us to pay. We were specifically told the following lies by their representative: We handed over £50 to “guarantee the price of the quote”. This was actually a deposit. We foolishly signed a purchase order. However, we did not know it was a purchase order, in fact were told it “was just a template for measuring the windows”. We were told “we could choose to go through with the purchase at any time for the next 12 months or not if we chose otherwise”. When the representative left our home we had no idea we had committed ourselves to any expenditure. This is of course in the small print of the purchase order (which we were told was not a purchase order). We are now way past the cooling off period and Anglian are demanding we pay the full value to get the windows installed, or 80% and get nothing. This way of getting business is clearly negligent misrepresentation, and I would argue fraudulent misrepresention. If you have been told similar lies by Anglian (even if you never went through with the purchase) I would love to hear from you to help build my case (or indeed strengthen yours if you are going through something similar). I would also be very interested in hearing any success stories from challenging similar contracts. Thanks in advance

-

Good afternoon Everyone, Hopefully someone could help/advise me with a problem I am having with my former employer. I recently resigned from a part-time job working for a well-known Housing Association as they weren't paying me in full for the hours I worked (among other dubious issues). My job started 20th January 2016 and I worked exactly half of my monthly contracted hours between my start date and 31st January 2016 - over four days/shifts. I therefore expected to be paid precisely half my contracted salary (salaried, not paid hourly, unless claiming overtime, which was calculated using an hourly rate). Using the assumption that I would receive half my monthly salary, I was underpaid for January in February's pay. Then, in March, they deducted even more money and claimed that they had overpaid me for January, when I believe the opposite was the case. After numerous emails and telephone calls, staff from payroll claimed that they had initially calculated my hours (15/week) over a 5 day period (3 hours/day), which is what was paid in February's wage. They then said that they had recalculated my hours over a seven day period (2.15 hours/day) hence the deduction in March's pay. However, I actually worked 2 x 7.5 hour shifts = 30 hours - contracted to work 60 hours/month – I have copies of the email from payroll outlining how they calculated January’s wage, copies of my signing-in sheets, copies of overtime sheets showing my working patterns and rotas before I left. As is stands, I have been paid approximately £4.25/hour for the hours I worked in January. After two months of trying to get them to pay me correctly (and among other issues, such as lone working without backup with potentially violent clients) I resigned. Before resigning, I also raised a Formal Grievance and received no response. I am going through the Early Conciliation process with ACAS, but I'm scared of the potential costs and/or risks (i.e. potentially paying their legal costs, they have a huge legal department!) involved taking it all the way to an Employment Tribunal. The Housing Association suggested that I accept two-thirds of what they owe, but I requested to be paid in full. The ACAS conciliator didn't seem too pleased that I didn't accept the offer, which worries me. Someone has also suggested that instead of taking them to a Tribunal that I could take them to Small Claims court instead. I suppose my queries are these: 1) Does it sound like an ‘unlawful deduction of wages’? 2) Does it look like I have a good case for an Employment Tribunal? 3) Would it be better taking them to Small Claims to lower my risks/be more feasible than going through an Employment Tribunal? Could someone be kind enough to impart their knowledge of such matters please, I would be greatly thankful. I hope I've provided enough information, if not please let me know (and apologies if I've gone on too much!). Very best wishes, Ammy

-

Hi, I received a PCN the other day for failing to pay the London Congestion Charge in time (within 24 hours). I decided to look into the legality of the whole scheme and have come to the conclusion (1) that the PCN issued to me is void (of no legal effect) and (2) that elements of the scheme are unlawful and, in fact, void. This means that many, if not all, congestion charge fines will have to be refunded. My logic is as follows, but I will be grateful for comments (I might have got it wrong): 1. With regard to the PCN itself, the Road User Charging (Enforcement and Adjudication) (London) Regulations 2001, 'Penalty charge notices', 12(3)(h) states that a PCN must state 'the effect of regulation 16'. Regulation 16 covers adjudication by an adjudicator. The PCN issued to me does not state the effect of regulation 16, as required by law, and it us therefore void. In other words, in law the document sent to me is not a PCN at all (it can't be because it doesn't fulfil the requirements for a valid PCN as stated in the regulations). If other PCNs are the same (do not explain the effect of regulation 16) then any fines paid on the basis of them were paid on the basis of an unlawful demand (being the PCN in question). ================================================== 2. With regard to the legality of the overall scheme, parliament is presumed to legislate in accordance with the principle of legality. In short, this means that, while Parliament can remove a fundamental legal right, it is presumed not to intend to do so unless it says so in a statute (Act of Parliament) in express terms (clear words) which allow no other interpretation. Of course, while Parliament can expressly remove a fundamental legal right in such a way (by express words), it is certain that no other body can do so (by means of secondary legislation for example) without the express authority of Parliament (and, even then, I doubt that the courts would allow such a delegation of power). This has been stated by courts at the highest level. For example, Lord Steyn in Secretary of State for the Home Department, Ex Parte Pierson, R. v. [1997] UKHL 37 said: 'For at least a century it has been "thought to be in the highest degree improbable that Parliament would depart from the general system of law without expressing its intention with irresistible clearness . . .": see the 4th ed. of Maxwell on the Interpretation of Statutes, (1905) at 121, and the 12th ed. of the same book, (1969), at 116. The idea is even older. In 1855 Sir John Romilly observed that ". . . the general words of the Act are not to be so construed as to alter the previous policy of the law, unless no sense or meaning can be applied to those words consistently with the intention of preserving the existing policy untouched . . .": Minet v. Leman (1855) 20 Beav. 269, at 278. This observation has been applied in decisions of high authority: National Assistance Board v. Wilkinson [1952] 2 All E.R. 255, at 259, per Lord Goddard, C.J.; Mixnam's Properties Ltd. v. Chertsey U.D.C. [1963] 2 All E.R. 787, at 798, per Diplock L.J. In his Introduction to the Study of the Law of the Constitution; 10th ed., London, (1968), Dicey explained the context in which Parliament legislates as follows (at 414): "By every path we come round to the same conclusion, that Parliamentary sovereignty has favoured the rule of law, and that the supremacy of the law of the land both calls forth the exertion of Parliamentary sovereignty, and leads to its being exercised in a spirit of legality."' just about the most fundamental of all legal rights is a person's right not to be punished for a crime/offence that he did not commit (Can you see where I am heading with this one?). Of course, Parliament, being supreme, can pass a law which punishes a person for a crime/offence that he did not commit, BUT IT CAN ONLY DO SO BY EXPRESS WORDS IN A STATUTE WORDS WHICH ALLOW NO OTHER INTERPRETATION. Apologies, for the use of capitals. PCNs are issued to the registered keeper of the vehicle on the basis that the registered keeper is liable in law to pay it (with certain exceptions) and, in most cases, the registered keeper will be the person who was driving the relevant vehicle at the relevant time. But does the law make the registered keeper liable, in accordance with the principle of legality explained above, if he was not driving the relevant vehicle at the relevant time - and, in fact, may not have given his permission for the car to be driven in the congestion charge zone? To comply with the principle of legality in such a case, the relevant Act of Parliament MUST make the registered keeper liable WITH NO POSSIBILITY THAT ANY OTHER PERSON (THE ACTUAL OFFENDER) COULD BE HELD LIABLE. This is because, as quoted above, if an altenative interpretation of the words in the statute in accordance with the principle of legality is possible, then that alternative interpretation MUST be adopted. In the context of the congestion charge, therefore, it is clear that, where the registered keeper was not actually driving the relevant vehicle at the relevant time (or is otherwise repsonsible), the registered keeper can only be made liable if the words of the relevant Act of Parliament make him liable TO THE EXCLUSION OF ANYONE ELSE. In other words, the registered keeper can only be made liable where he is the only person who can be made liable (under the Act of Parliament). Does the Act of Parliament actually do this (make the registered keeper liable to the exclusion of anyone else)? No, s.163(2) Transport Act 2000 states: '(2) Charges imposed in respect of any motor vehicle by a charging scheme under this Part shall be paid — (a) by the registered keeper of the motor vehicle, or (b) in circumstances specified in regulations made by the appropriate national authority, by such person as is so specified.' Now this is quite clear. s.163 allows some person other than the registered keeper to be held liable for a charge. It follows that where the registered keeper did not commit the 'offence' (and it is an offence, since it incurs a penalty), he cannot be held liable (in accordance with the principle of legality as explained above) because it is possible to hold someone else liable (the person who committed the offence) and so this must be done. In short, the registered keeper cannot he held liable for an offence he did not commit because the Act does not expressly say he must be. ================================================== 3. Further, it appears to me the requirement to pay the charge within 24 hours is also unlawful. The Greater London Authority Act 1999, Schedule 23 (Scheme to conform with Mayor’s transport strategy), Section 5 states: 'A charging scheme must [note use of the word 'must] be in conformity with the Mayor’s transport strategy.' The Mayor’s Transport Strategy states (p. 37) that the strategy includes an objective to 'enhance the quality of life for all [note the use of the word 'all] Londoners', including 'improving journey experience' and 'improving road user satisfaction (drivers, pedestrians, cyclists)'. So the question is whether the requirement to pay the charge within 24 hours complies with these objectives. Does imposing a 24-hour time limit improve the 'journey experience' and the 'road user satisfaction' of ALL Londoners, including those who incur the penalty charge because they failed to pay the congestion charge within 24 hours? If not then the requirement fails to conform with the Mayor's transport strategy and so is unlawful under Sch. 23. Furthermore, the question has to be asked whether such a short time limit is either necessary or just. If the 24-hour time limit is not necessary for the purpose of collecting the original charge (as opposed to a penalty) then the requirement is merely an exercise in extortion. Can it be part of the Mayor's transport strategy to extort money from Londoners - and how does such extortion improve the 'journey experience' and the 'road user satisfaction' of ALL Londoners? Such an exercise in extrortion must, in any event, be ultra vires; that is, the Mayor has no legal power to extort money from people - it is beyond his lawful authority.

- 19 replies

-

- charge

- congestion

-

(and 2 more)

Tagged with:

-

In 2015 there was a important and high profile Judicial Review regarding the serious matter of summons costs in relation to a Liability Order for council tax arrears. The case was that of the Reverend Paul Nicholson v Tottenham Magistrates and the London Borough of Haringey. In short, the court rules that Tottenham Magistrate's should not have allowed London Borough of Haringey to claim summons costs of £125 for each Liability Order given that the court did not have sufficient information before them to reach a proper judicial determination as to whether or not the costs claimed represented costs reasonably incurred by the Council in obtaining the liability order; The court found that Tottenham Magistrates Court erred in law by failing to make further inquiries into how the £125 was calculated. Accordingly, J Andrews ruled that the costs claimed were unlawful. Just before Christmas a further judgment was released in the case of another Judicial Review on an identical basis but this involving Highbury Corner Magistrates Court and London Borough of Camden. a copy of the Judgment is below: http://www.bailii.org/ew/cases/EWHC/Admin/2015/3788.html

-

FAO Brigadier or Ell_enn I have received a letter stating that SPML/Acenden is going for eviction due to my not being able to make the proper level of payments on my mortgage and arrears. I spoke with them today and explained that I am going to send them a letter with my proposals. The person I spoke with told me that at the moment they have not got an eviction date yet. I very briefly explained that I was out of work fro January and that since the beginning of April I have managed to make some payments and that I am now on pension credits and am also expecting housing benefit which will go directly to them. They have told me that to stop the eviction they HAVE to have an income and expenditure (do they? am I obliged to give them this?). I have made three payments over the last three weeks of £600 and expect to be able to pay another 300 to 600 before the end of June. But I will only tell them what I can realistically manage to pay which will probably be the mortgage plus (I think) about £90 per month but i do expect to make more payments than that. the other thing they told me was that I HAD to pay the full amount of £4800 +- which I do not have and as such they are charging me the lovely sum of £70 management fee per month for the privilege of not paying the acceptable level of payments. I am at the point where I expect to go to court (second time ...last one was in Nov 2010) so will probably be back to the point where I should have been by then. (hope this bit makes sense). My main questions are; do I HAVE to supply an income and expenditure, and if I manage to bring the arrears back to where they should have been can they still go for re-possession? Kindest regards George Jasperpad

-

A very interesting article from the Local Government Lawyer journal regarding a custodial sentence for 'wilful refusal' or 'culpable neglect' in paying council tax: http://localgovernmentlawyer.co.uk/index.php?option=com_content&view=article&id=23236%3Aimprisonment-for-council-tax-default&catid=56&Itemid=24#_ftnref

- 144 replies

-

- imprisonment

- tax

-

(and 1 more)

Tagged with:

-

Hi Guys, I have had ongoing correspondence with opos regarding a loan I took out with MiniCredit almost 2 years ago. After repeated requests for them to provide me with a completed breakdown of the claimed debt including charges/fees/interests I have finally received the below. They are attempting to claim £1,187.50 on an original loan of £150! Would appreciate any advice on how to respond. I am sure the Debt recovery fee and attempt fees are unenforceable. Here is the requested statement : Loan reference: Date issued: 01/09/2012 Due date: 25/09/2012 Loan principal £150.00 Interest £217.50 Overdue charges £80.00 Debt Recovery fee £100.00 Attempt fees (£5 per attempt) £640.00 Total balance £1,187.50 Payments received 31.10.2012 £100.00 05.11.2012 £100.00 Sincerely, Derek Thanks in advance guys.

-

Hi I am just about ready to send my N1 form. Have completed POC but I am wondering whether I should include anything from the FOS technical notes: "This will involve the business removing the PPI premiums, any interest that was charged on the premiums and any charges (and interest on those charges) that would not have applied if the PPI had not been added to the account." Any thoughts? suvin

-

Sorry for the long story, but if I had read this before joining I would have saved myself a ton of time and stress. LA Fitness (Guildford) is blatantly in breach of contract and my partner and I are currently in dispute with them. We recently moved to Guildford and were looking for a gym within a quick drive of our home that offered fitness classes. I don't use the floor machines or weights, just take classes.. I've been a member of at least 15 gyms in my life and usually attend classes 4-6 days/week. I know what I want and know exactly what to ask. I found that there were few options in my area, but LA Fitness was not too far so we went in to discuss membership. A manager/sales rep walked us around the gym and showed us the facilities. We weren't too impressed (not that clean or nice and an enormous pothole on the drive), but the fact that they had a variety of classes and were the only place easily accessible to us piqued our interest. We had a long discussion, explaining to our rep that we were there solely for classes (and only Yoga, Pilates, or Group Strength Training) and that we would only be attending in the evenings as drop-ins because of our work schedules. We said we did not use the machines, just classes and maybe the sauna. She said that would be no problem and gave us a class schedule, which showed classes we wanted, and explained we could either book online up to 10 days in advance or drop in, in the evenings as we wanted. We asked and she clearly stated that the were "NOT BUSY" and that we would have no problem getting into classes. This was stated multiple times and another manager even chimed in that they are really slow because there is no road signage. As we were heading out of town for Christmas/New Years, we couldn't begin using the membership for a few weeks so we asked to use the free 3 day membership advertised to try it out then we could join when we return. The rep/manager discouraged this stating that the membership price was at its lowest and would go up in the New Year. She even suggested we join that day and pay a fee to freeze the membership so we could lock in this special price, as that would be cheaper than waiting. We felt pressured and left to think about it. We were called a few days later and told that they would reduce the sign up fee so we could make sure we get this special price. We went in and signed up based on this information. We didn't want to pay more! Cut to.... We return from holiday and I log into the website to see what classes I could attend that evening. First thing I see is that the pricing did not go up at all and all new members actually received a free month. We had OVERPAID. At this point in time the price has even gotten lower and they are now contract-free. This wasn't the worst of it. EVERY SINGLE CLASS was booked. NOT ONE was available that evening or even for the NEXT 10 DAYS. There were maybe 1 or 2 slots for water aerobics in the middle of the day a few days away but nothing in the evening and nothing that I told the rep/manager that I wanted to take. The booking system only showed for 10 days out and they were 100% booked solid. I wasn't interested in booking anyway, but checked the next morning and it was the same situation, 100% booked. I called the Guildford location and explained the situation. The woman was completely bored with my plight and said that I could use the machines and that the classes were really busy. I explained that I was sold a membership based on the fact that there would be CLASSES for drop-ins, and I didn't use machines. She repeated herself and when found that I wasn't appeased she then gave me a number to call to cancel. I called and spoke with the rudest human in England. He said the same, that I could use machines and that I hadn't given him a good reason to cancel. I explained clearly that I was sold a membership based on the fact that I could take classes as a drop-in in the evening. His suggestion was to wake up at 6:00am to sign up for classes 10 days out and hopefully I would be able to make it. This was unacceptable obviously and I hung up frustrated. My partner went into the location and spoke with managers three times, including the same one who sold us the membership, and each time they told us we could cancel if we called the number, but when we called they would refuse citing "this isn't a good reason to cancel" and "classes are a luxury, not a right" and "classes are a bonus, not part of the membership". This was NOT what they had said when we joined and if they had, we obviously never would have signed on the dotted line. They never denied saying what they said about availability, but would not let us cancel. At one point they admitted that people were complaining and reduced the sign-ups to 3 days out, but this changed nothing. I tried wait-list because I felt I had no other options, but I never made it or it was so last minute I couldn't go. We never stepped foot in the gym to workout. We had paid 66 for the first month and cancelled our direct debit before they could charge more. They began to send us bills with extra fees and threatening us with collection agencies. We never stopped calling and emailing to explain our situation and they continuously refused and threatened us with bills. Finally, I did some research online and came across Citizens Advice. I explained what happened and they gave us great advice. Their words: "UK civil law defines a representation as 'a statement of fact, made during pre-contractual negotiations; as an inducement to enter into a contract'. As such, if a purchaser discovers that such a statement of fact is false, they could claim the seller has misrepresented the product and hold the seller in breach of contract. This could allow the purchaser to seek damages or rescission (be placed back into their pre-contractual status) or an indemnity for any expenses." They notified the proper authorities on our behalf (updating the info as we went along) then outlined our rights. As LA Fitness promised services that they could/would not provide, causing us to enter into a financial agreement that we otherwise would not, they were in breach of contract and the Consumer Protection against Unlawful Trading Regulations, 2008 (Section 5). They advised us that since we should try to resolve this with the company before proceeding with the courts, which we had done many times in person, via phone, and via email. They gave us a list of templates to use to send a certified letter, which we did, clearly what the situation (again) and requesting rescission of the contract and a refund of the monies paid, giving them 30 days to reply. They never replied by post, but they offered (via email) once to cancel as long as we paid the 3 months that had passed, which we refused. Then they offered to cancel and erase all outstanding monies owed, but refused to refund what we had paid. Again we refused. We shouldn't pay a pence to this company for services that they could not provide. Again, we've NEVER been able to use the gym for the purpose we joined! At the advice of Citizens Advice We have now filed a claim through the HM Courts. They charged us 25, but this will be paid back to us if we win. I fully expect to as they are clearly in breach and both my partner and I are happy to swear under oath what truthfully occurred. They have never denied stating these things and I would think that this employee wouldn't perjure themselves for the sake of this awful company. Hopefully justice will be served!!

-

I am in the early stages of reclaiming fees for arrears,management fees etc so on this front would appreciate a helping hand as this progresses but the other question I ask as I have seen reference to it in other posts is that we took out a self cert mortgage with SPML (now managed through Acenden) in 2006 where the broker who organised got paid a total of £10k for his trouble !!! What can I do about this too with regards to mis selling? From early enquiries they are no longer trading Thanks

- 5 replies

-

- arrears

- reclaiming

-

(and 1 more)

Tagged with:

-

Hi, I am new on this site. My problem is with CRS debit collection services. I cancelled my membership in golds gym on the last month of the contract. But they passed the £40 debit to CRS and they added £123 for recovery costs. And same thing for my wife. So it's £123 each of us. Could you give me any advice please? Do they have a right to do things like that? We don't mind to pay £40 each to the gym, but extra charges of £123 each is a bit too much. We would appreciate any advice.

-

Hi As stated in the header- I had a CCJ taken out against me while owed PPI on that account. The bank contacted me to say I was owed PPI a month after the PPI claim was invited so it was almost certainly in their system while the CCJ was taken out by their solicitors. Would this affect the legality/Validity of the CCJ. Thanks

-

Hi, I would be grateful if someone can give me a better insight into this matter. I will try to simplify it.although its a little complex: I have a Full merits hearing set for next Thursday. The respondent's team tried to strike out both my claims: Unfair Dismissal- due to lack of continuous service I only received a contract in May 2012, although I have written evidence that I was to receive a 'salary' from April 1st..and my April pay is not a round figure..suggesting deductions were made. I had prior to that, been working full time, self-employed. Unlawful Deduction of Wages-due to the claim being Out of Time My claim relates to a proportion of commission that was not paid. My argument is that the contract did not set a deadline for payment..and even after part of it was paid, the MD at least promised to look into it. I made the claim within 3 month of my final salary payment. Last week, they turned up to the Preliminary Hearing late and unprepared, so the judge decided to proceed to a full hearing which would deal with the preliminary issues as well. I have irrefutable written evidence that my commission claim is justified. (due to a last minute witness whose participation in effect forced disclosure). The other side have offered to settle on a figure based on this commission..but not the Unfair Dismissal.. My original ET1 claim and subsequent settlement proposal amounts to about 1/5 of the total schedule of loss...so I think its pretty fair. The original bundle included meeting notes that had been altered by the Respondent... Upon hearing that the original note-maker (currently still working for the Respondent) may be appearing as a summonsed witness, they resubmitted the notes in their correct version...both sets are in the bundle:further indisputable evidence of dishonesty... The danger is, that I may not win on the preliminary issues, despite the evidence confirming my claims are justified.. If the preliminary issues are borderline, would the actual facts regarding the veracity of the claim and the dishonesty of the Respondent have an impact on the panel ruling in my favour (on the preliminary issues)? The commission issue is a formality if the Judge rules that it was In Time. Unfair Dismissal is more complicated: Despite being Head and the most experienced member of my Academic department, I apparently came bottom of a dubious test, that the Respondent designed himself, meaning that I was chosen for redundancy despite being willing to take a teaching role at the same pay rate as my staff. The test showed that other staff had 0% lateness and 0% sickness and also scored me lower on teaching skills, despite no actual observations having been done. I did question the scoring, but never got a clear response. The Respondent has included many documents in the bundle to try to discredit me. Some of the allegations are fair, others are not. Can I perhaps use those allegations in my favour to suggest (as I believe) that I was made redundant because of these issues? I have other evidence to back up my credibility including an excellent reference from my current and previous employer..and an award won by the dept I managed... Many thanks!

- 37 replies

-

- deduction

- employment

-

(and 4 more)

Tagged with:

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.

3053548.thumb.jpg.6ea05a752ac6bbf38ae4e7be9676053a.jpg)