springer007

Registered UsersChange your profile picture

-

Posts

8 -

Joined

-

Last visited

Reputation

1 Neutral-

Lowell - old J D Williams cat debt cra markers help

springer007 replied to springer007's topic in Mail order catalogues

-

Moneybarn default and what if anything I can do.

springer007 replied to springer007's topic in Moneybarn Issues

Oh well thanks anyway, Will just ignore them then if nothing I can do. -

Lowell - old J D Williams cat debt cra markers help

springer007 replied to springer007's topic in Mail order catalogues

Think it may have been June 16 ish I think. And its on Noodle too. -

Lowell - old J D Williams cat debt cra markers help

springer007 replied to springer007's topic in Mail order catalogues

-

Moneybarn default and what if anything I can do.

springer007 replied to springer007's topic in Moneybarn Issues

Well, they basically didn't give me a choice. It all happened within a month and I hadn't come across this forum until recently, Wish I had. -

Moneybarn default and what if anything I can do.

springer007 replied to springer007's topic in Moneybarn Issues

I didn't have a lot of choice, to be honest. Couldn't do a VT as I was barely a year into a 4-year agreement. So do I just let this thing sit there and not worry about them selling said debt on or do I engage with them to pay some of it back?? -

Hi, I had a van through Moneybarn which they repossessed in Aug 16 and sold it at a loss and now are wanting £6403 out of me. What options have I got to get them to play ball nicely? I know they had what I borrowed back plus about 2.5k in payments etc in my mind they had the initial loan back. There is a big fat default on my credit file that I would like sorted as trying to get car finance is an issue currently. thanks

-

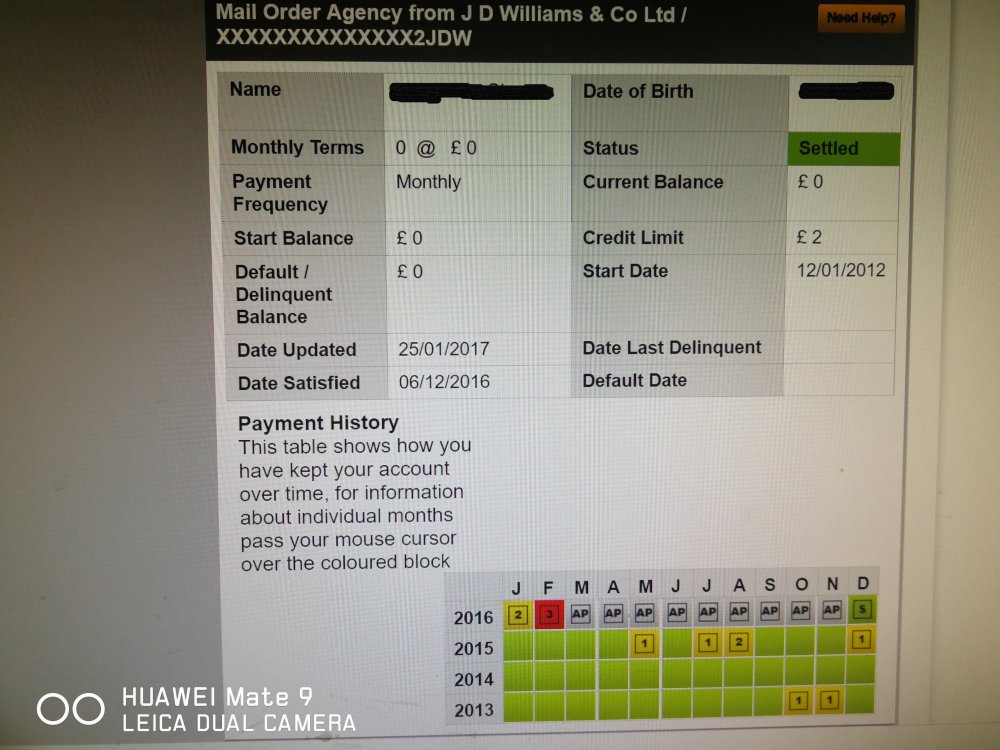

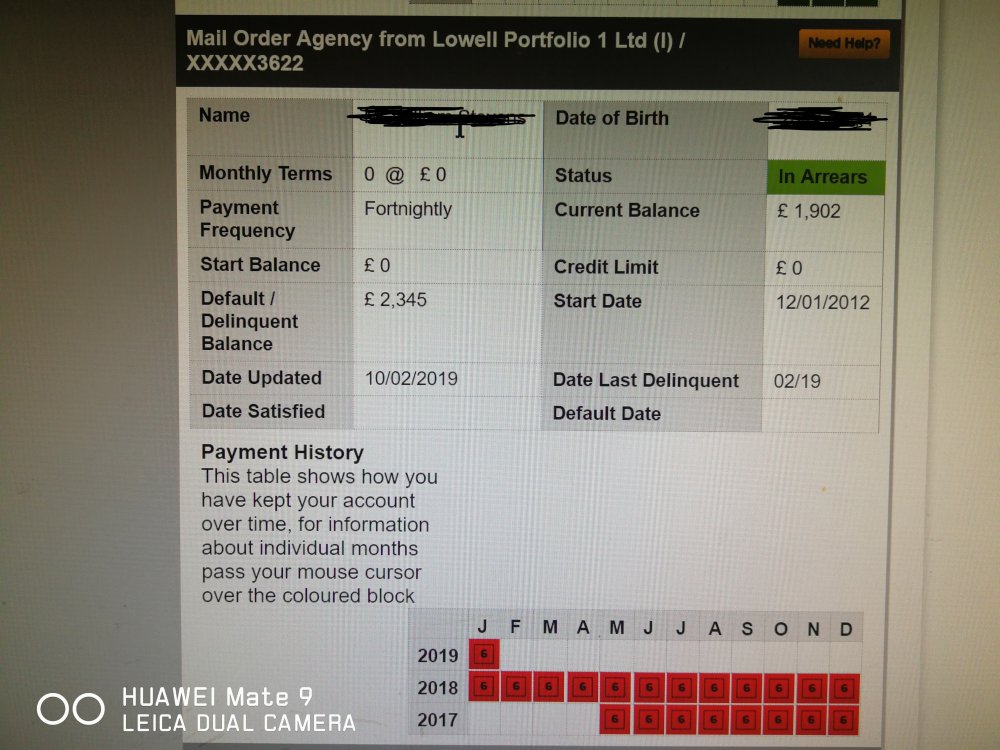

Hi, Newbie here, I have an account with Lowell which I have been paying and the account has been placed on my credit file with me making regular payments to it. It's a J D Williams account that Lowell had bought. My issue is whilst they are recording the fact the balance is going down each month the payment history is showing 6 payments late all the time. Should it actually be on my credit file at all and if it is then how do I get them to show that I am paying said debt off and get them to amend the payment history. Thanks for any wisdom.

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.