Anyoldname

Registered UsersChange your profile picture

-

Posts

14 -

Joined

-

Last visited

Reputation

1 NeutralRecent Profile Visitors

The recent visitors block is disabled and is not being shown to other users.

-

Yes. I've double checked the "debt" it is the same account number, card number, etc. I looked out my claims Summary Report, and my final report (9/5/2017), and something called the "List of Dividends Or Composition" and all the details are the same - account number, card number, etc. To be honest, I've no idea how check all that stuff. Not showing up on my credit report, and the only reason I know it's there is because I phoned my Mortgage lender, and they checked with the Land Registry. How do I find dates, etc? I've tried online, but it just says I have nothing against me. D.

-

K. To give a timeline, etc. Around 2012, I was in financial problems. I'd changed jobs and lost a lot of income. I considered an IVA, and approached a company. They told me I had to have a CCJ to do that (I'm not sure if this is legit or not) so I did. I can't remember, but I'm assuming it was MFS (Well, MBNA) that took me to court. As soon as I did that, my IVA guy signed me up... I'm not sure if it's relevant, but MBNA / MFS signed on for the IVA. I have the report here, account numbers tally, payments made to them, etc.. The initial amount was for around £7K. They have received the proportion (Dividend?) payments I made. I never missed a payment, and I was discharged on 9th May 2017. About a year ago, Restons started writing. I passed them onto my IVA guy, who said not to worry, they had no claim. Now this. BTW, there's no record on my credit file. I'm spoken to my mortgage people, and they've confirmed there is a charge. Forgot to say... Home is owned solely by me, the debt was solely by me. D.

-

Hi. The history behind this is: I signed into an IVA sometime back in 2012. All my debtors signed up, and I paid it on time, at the amounts prescribed by my IVA Consultant. I was discharged from the IVA on 9th of May 2017. I'm now get threatening letters from Restons, in the name of MFS Portfolio. They have a charge on my property, (and I've just checked that they have). The account they quote is the one I paid through my IVA, and appears in the "Creditors Claims Summary Report" so that shows they signed up to the IVA, and its T&Cs. There's records of payments made in the report from my IVA guy, etc., etc. Restons, are just not interested. They're passing me to "enforcement" and I can't find any phone numbers, etc., for MFS Portfolio. Any help here? D.

-

HRMC enforcement team at my door for self assessment from 2015

Anyoldname replied to Anyoldname's topic in HMRC

Hi. There's two separate sets of letters. One addressed to Me (Properly) and one to this other identity. Now, I don't want you to think it's as if they've sent letters to a Mr Smith, and another set to Mr Jones. While trying to stay relatively anonymous on here, They've sent one set of letters to Peter Smith, and another set to Paul Smith. And Peter is the one who has paid the debt, but they're chasing Paul. HMRC seem incapable of figuring out their mistake, and openly agree "Peter" has paid the debt, but they're still going to break "Paul's" door and impound "Everything he owns." I've also just gone through some of those letters, and all I can see for "Paul" is a claim for about £200 for National Insurance. I've not found anything at all that claims thousands...- 11 replies

-

- assessment

- door

-

(and 4 more)

Tagged with:

-

HRMC enforcement team at my door for self assessment from 2015

Anyoldname replied to Anyoldname's topic in HMRC

Yeah, I've asked that question, and they simply don't care. Again, going back to my "accountant" - I think it may be from a spelling mistake on the forms they registered with the HMRC in the first place. For some reason HMRC can't seem to get their head round the mistake, and don't care that my "correct" name has paid the debt through PAYE.- 11 replies

-

- assessment

- door

-

(and 4 more)

Tagged with:

-

HRMC enforcement team at my door for self assessment from 2015

Anyoldname replied to Anyoldname's topic in HMRC

None of those companies are involved. The letter pushed through my door is headed as: Debt Management Field Force. HMRC DMB 103 BX5 5AB- 11 replies

-

- assessment

- door

-

(and 4 more)

Tagged with:

-

HRMC enforcement team at my door for self assessment from 2015

Anyoldname replied to Anyoldname's topic in HMRC

Hi. The first point you made: When I spoke to "them" (I think it was the self assessment team,) they cancelled this "self assessment charge and all fees relating to those," for 2017-2018 and 2016-17. They said they can't cancel anything more than two years old. Having checked my records, I stopped being self employed in March 2015. I told my accountants, HMRC, etc. My accountant then received a letter from HMRC about a late return. I didn't get this letter, but the accountant forwarded it to me. It was dated Feb 2015. I subsequently got a letter from HMRC, stating I owed them money, and they said they would adjust my tax code accordingly with this new job. I paid this (And by HMRC's own records, I've been paying £1700 extra in tax per year for almost four years.) up until approximately the beginning of this year. (I still need to check my online payslips to find out exactly when my tax code changed). Second point: I'm waiting for the "new" accountant to get in touch (It's "technically" the same lot, just name changes, moves, closures, retirements, etc.) Third Point. I'll do a SAR now. Overall, I do not think I owe the HMRC any money at all. I WAS in debt to them, and without having accountants check etc., I agreed that I owed them for a late filing charge in 2015. I have subsequently paid £6,800 over 4 years. I think the underlying problem is names. I get one set of correspondence from my real name - which states I'm up to date, paid in full, etc., but this enforcement is not even in my name.- 11 replies

-

- assessment

- door

-

(and 4 more)

Tagged with:

-

HRMC enforcement team at my door for self assessment from 2015

Anyoldname replied to Anyoldname's topic in HMRC

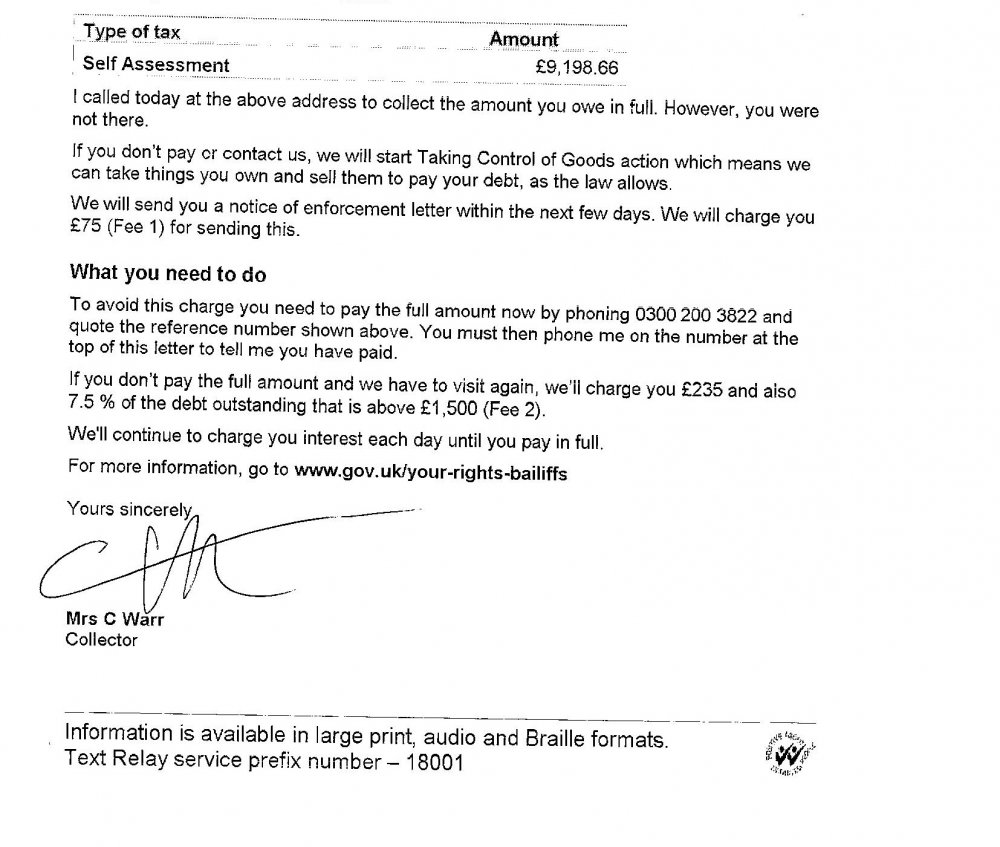

Hi. The letterhead says HMRC Debt Management Field Force. I've attached the letter to this post (I hope) The Tax people I called have cancelled the last two years, but refuse to delete the previous two. They also admit I've paid £1700 per year to the original debt (Even although the "original" debt was only £1654) They just seem to be making their own rules up as they go along... I'm still waiting for my accountant to get back to me. The complicating thing is (Hope you don't mind me using the company names): It used to be Taxassist (At Bridgwater) My accountant retired... The business was bought over by Tax-Shop They closed the Bridgwater office and moved elsewhere. All at exactly the time I was closing down my self employed status. Thanks.- 11 replies

-

- assessment

- door

-

(and 4 more)

Tagged with:

-

Hi. Right Kind of upsets, but here we go. I WAS self employed. Had an accountant, etc. I gave this up in March 2015. I told my accountant, etc., and they said they'd deal with it. I then took up full time employment with a company. HMRC sent me a letter to my name saying I owed them for tax and a late filing of returns. The bill was £1654.72. I agreed, and for the last four years or so, I'm been paying it through my PAYE. In about February this year, they said it was paid off, and my codes, etc., returned to normal. Today, an enforcement officer arrived, demanding £9,198.66, plus saying he was going to lump on £1735 more on if I didn't pay. An additional factor is that from March 2013-April 2018 I was in an IVA, which I paid every payment to, and was discharged in April of this year. Don't know if it's relevant or not... Now, as far as I can tell, the following has happened... My accountant didn't do the right paperwork in 2015. The HMRC have been sending "demands" or whatever you call it, to the wrong name and address. They admit I've paid (On average) £1700 per year to this debt for the last four years They don't care, they want money now... They don't care about the IVA, although they were invited to the meeting at the beginning. There is a clear discrepancy between my name and the one they're using for the enforcement. Any advice?

- 11 replies

-

- assessment

- door

-

(and 4 more)

Tagged with:

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.