skylinegtr

Registered UsersChange your profile picture

-

Posts

10 -

Joined

-

Last visited

Reputation

1 NeutralRecent Profile Visitors

The recent visitors block is disabled and is not being shown to other users.

-

UPDATE.... I have received a final letter from QQ regarding their decision..... We would like to take this opportunity to respond to your complaint dated 02/06/2019. Please accept this as our Final Response Letter.We are sorry to learn that you are dissatisfied with the lending decisions made and services provided by CashEuroNet UK LLC (CEU). CEU offers products under brand names QuickQuid (QQ), Pounds to Pocket (P2P) and OnStride (OS) and as such we will review your complaint as it relates to all our brands. We take all complaints very seriously and would like to thank you for bringing this matter to our attention.Your ComplaintWe understand that you are dissatisfied about: Irresponsible LendingComplaint Investigation and FindingsWe have now had the opportunity to investigate your complaint and are able to provide you with our findings in this final responseResponsible LendingProportionality of ChecksWhen you first borrowed from CashEuroNet UK LLC we were regulated by the Office of Fair Trading (“OFT”). However, in April 2014 regulation of consumer credit became the responsibility of the Financial Conduct Authority (“FCA”).Both the OFT and FCA required us to conduct proportionate checks to ensure any borrowing would be affordable and sustainable.Our checks were not expected to be exhaustive and we were entitled to use our judgement when determining the types of checks we would conduct to assess affordability. When reviewing your complaint, we have assessed our lending against either OFT or FCA regulations, depending on whether you borrowed from us before or after FCA regulations were implemented.We have assessed loans funded before FCA regulations were implemented using the “other credit commitment” (OCC) value taken from your credit report at the time of funding and used a reliable average for all remaining expenses. In assessing loans funded after FCA regulations were implemented, we used validated expenses figures. We arrived at those figures by validating your declared expenses for various categories from your loan application against credit reference agency and Office of National Statistics data.AffordabilityIn assessing whether your loan(s) were affordable, we evaluated whether your total repayment across the loan term was sufficiently less than your total estimated disposable income across the loan term, after taking into account your expenses. Your expenses were gathered and determined as explained above. We further assessed affordability by viewing your account history for hardship. If we concluded that any of your prior loans were in hardship status, we evaluated whether any subsequent loans were issued without an adequate gap in time in between.DependencyIn assessing whether you exhibited dependency upon short term loans, we closely reviewed whether you took out multiple loans in short succession and whether there were negative changes in your individual circumstances such as a decrease in income and/or an increase in “other credit commitments” between said loans. We further analysed dependency by examining whether you had any loan(s) with numerous extensions or rollovers and if so, whether any subsequent loan was funded in close proximity thereafter.CreditworthinessIn assessing whether you exhibited sufficient creditworthiness at the time of funding your loan(s), we carefully analysed whether any loan was funded in close proximity to a prior loan that was in arrears for a significant duration before it was paid off.Your Loan Investigation Summary<<See table 1 in Annex>>*Please note that for any loans funded prior to FCA regulation, the “Loan Term EDI” column will state N/A for the reasons explained above.ConclusionCashEuroNet UK LLC Complaint Upheld/ Not Upheld: Not UpheldBased on our investigation methodology laid out above and your individual circumstances, we have come to the above decision on your irresponsible lending complaint.Please see the table below for the reasons for our decision.<<See table 2 in Annex>>Please see below the summary of our offer.<<See table 3 in Annex>>This offer represents the interests and fees you have paid us on loans we have upheld, plus 8% simple annual interest on those interests and fees, minus 20% tax withholding (on the 8% simple interest) to be remitted directly to HMRC on your behalf. If you have any outstanding balance with us at this time, we will first apply the redress towards the balance and any remaining redress will be paid to you as a cash refund● Interest and fees eligible for refund: £ 0● plus 8% statutory interest £ 0● less 20% withholding £ 0● Total Owed to you £ 0--------------------------------------------------------------------● Total Waiver Amount: £ 0--------------------------------------------------------------------● Total Outstanding balance after the redress: £ 416.5You have the right to refer your complaint to the Financial Ombudsman Service, free of charge - but you must do so within six months of the date of this letter.If you do not refer your complaint in time, the Ombudsman will not have our permission to consider your complaint and so will only be able to do so in very limited circumstances. For example, if the Ombudsman believes that the delay was as a result of exceptional circumstances.’ I assume they’re trying to throw me off by doing this. Ombudsman is the next stop? Any advise/tips before referring my complaint to the Ombudsman?

-

Thank you for the replies. I really appreciate the help! I did a quick write up based on the advise made, and was going to send this (by letter)... "I am under no legal obligation to supply you with any of the following you have requested. However, QQ should already have this information providing you did the appropriate checks as part of the under writing process. If necessary I can provide information to the FOS if they request these details. I will be opening a complaint with the FOS regardless unless the situation is resolved to my satisfaction when 8 weeks have elapsed from my initial letter." Is this strong enough to send, anything that needs to be rectified or altered? Thanks!

-

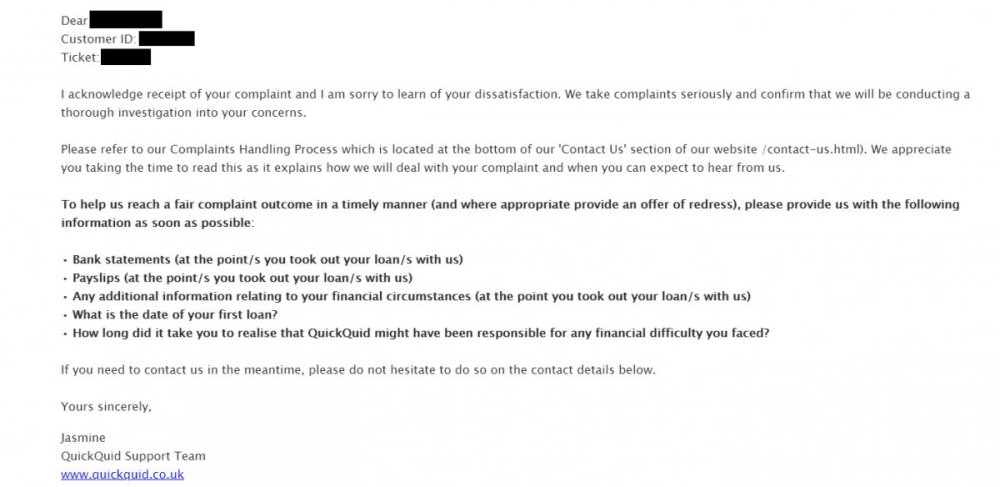

Hi all, I have finally received a response from quickquid regarding this matter (see below). Now do I follow their request regarding bank statements, payslips and other information required to back up my claim? I should be able to get a bank statement for the time I took out the loan and proof of other pay day loans I had at the time... Any advice will be much appreciated.

-

I have been digging up emails and letters to fully understand the matter of the loan/loans I took out around this period. I can confirm I was in arrears with Wonga shortly before and current whilst taking out this loan with QQ, however before this QQ loan I did take out one or two loans previously with them which I did pay on time (which would of been around the same time i took out the wonga loans too) This QQ loan I defaulted on was a 3 month payment plan loan. I did contact them to tell them I was in financial difficulty when the account went into arrears, in which they emailed me a Financial Statement Request in which I can't find any emails I sent back to resolve or fill out their forms. They then 3 months later emailed me this... "As we have advised you previously in the Notice of Default, you have failed to make payments required under your Loan Agreement with QuickQuid or to contact us to take corrective action. Loan #: ****** Funding Date: ******* Loan Amount: ****** Due Date: ******* Finance Charges: ****** Late Fees: ***** Discounts & Credits: ***** Total Payments Received: £0.00 Amount Outstanding: ******* As a result, we have SOLD your debt to a third-party collection agency. This agency owns ALL legal rights to the amount owed. All inquiries regarding this debt should be directed to the agency listed below. If you would like to make a payment, please contact the debt collection agency: arvato Financial Solutions 0844 894 0634 @red-castle." Do I still have a case for irresponsible lending before proceeding with sending my letter to QQ?

-

Hi, thank you for the response, I'll link you into the guide you have attached. Is this definitely the best route to take to resolve this? Also what do you mean run on each? Arvato Financial Solutions is currently the only one listed on my report... Can anyone elaborate on why it says the account is settled or partial settled? I've just logged into QQ where it says the account is £416.50 in arrears still. Makes no sense to me Thanks again!

-

Hi, back in 2014 I took a short term loan out with QuickQuid of £250 where I couldn't afford to pay back. It fell into a repayment schedule in that year where I still wasn't able to repay the amount back which then fell into arrears £416.50. Moving forward I received a letter from Redcastle around 2015 stating that they have taken on the debt of £416.50. In response I contacted QuickQuid via email to resolve the outstanding amount in full IF they removed the two defaults placed by QQ and redcastle themselves, in which they refused to do. Fast forward to now, I cannot see QQ on my Equifax credit report or redcastle, but a company called Arvato Financial Solutions with the same outstanding amount £416. The last updated status says its 'settled' in 2015 yet I haven't made any form of payments? It also mentions its a partial settlement? I did also have a couple of wonga loans I defaulted on that were cleared and removed from my file due to the terrible assessment checks back in 2014 etc. I'd like to get this QQ removed as its denting my chances of getting a mortgage massively, or any credit for that matter. Is there anyway I can get this debt wrote off due to possibly irresponsible lending or anything? I've attached the following credit file... Thanks,

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.