shiblets

Registered UsersChange your profile picture

-

Posts

43 -

Joined

-

Last visited

Reputation

1 Neutral-

Hi Dx100uk I have done a sar on Barclays and natwest. I am unsure what I am meant to do with all the information sent to me really. Neither sent me the original default notices that they have listed as part of the letters sent but not the letter itself. Regarding pra they are saying in the letter they are acting on behalf of their client and the account with Barclays. I will upload the letter from them if it helps. I am unsure where I can go with this now, after sar and cca I was hoping to either find out if they are unenforceable or have some power to negotiate reduced f&f and as they have kit provided proof of default notice which is now on my credit files I could negotiate that off too. Please any advice what my next step should be?

-

Hi Lookinforinfo, Thank you for your kind advice, the CCA is for a bank overdraft, I am now reading around further about this and it seems that banks do not have to comply with a CCA request if it is related to an overdraft. Whilst Natwest have not written to inform me of this, i am in a similar situation with Barclays they have had PRA group who are their DCA and who i had sent the CCA request to with a letter stating the above fact. I am now in a dilema how to handle this. I am writing with a letter to Allied and NAtwest as suggested however any ideas from anyone on how i could deal with this if it is an overdraft?

-

Hi All, I had another post on here where i had started my CCA requests for several debts, one of which was Natwest. The result has been interesting: 1: Natwest have sent across paperwork, a list of what letters were sent out to me and dates but no actual letters! There was a direct email address for the case worker who was dealing with my CCA request, i emailed stating that there was no hard copy of the 'default' notice stated in the paper work simply a date and that i require a copy of the original default notice letter, as my SARS request stated i require ALL documents sent or relating to me. I had a reply saying they did not hold this information on the system so she cannot provide me with proof of a default letter. Now my question is how can i chase this up and get my default removed as they do not have evidence that they sent me the notice yet continue to put a default on my credit file. 2: Natwest had orginally had Robinsonsway to chase me for my debt, whilst i sent a SARS to natwest i had sent a CCA request to robinsons way, now they sent quite few letters stating that the account is on hold while they request this information as it has not been provided yet. I have now received a letter from NAtwest stating the following " Our collection agents have been unable to come to a suitable arrangemnt with you, t herefore your account details have been passed to Allied International to act as our new collection agent. Any queries about your account should now be addressed to this collection agent until further notice. Allied International will be in contact with you during the next 14 days to discuss yoru repayment options, should you wish to contact them directly their contact details are 0141 228 3008 Regards Debt Management Operations. My question do i now have to go through the entire process again and send a CCA to this new DCA? if that is the case could natwest simply do this over and over again with a new DCA every few months? Is there a way i can put an end to this, clearly natwest couldnt provide robinsons way with the correct paperwork. Thanks!

-

Hi DX yes the transactions and agreement remains the same, I sent a SARS to Citi with no acknowledgement or reply yet, my concern is with their letter i have also posted, they state they will not hold the account and that sending across a SARS to Citi has in short nothing to do with them, they also state the agreement is true and enforceable. Unsure what my response or next step should be really

-

Hi Dx, I have uploaded a word document but i cannot convert it to a PDF as my computer wont allow it, i hope this is ok. The contract they have sent looks like the original one i had signed so I am kind of leaning to accepting that this one is legit? return.pdf

-

Any advice is really appreciated!! I am thinking of accepting their CCA and setting up a payment plans again and then offer a full and final settlement? HI All, A quick update and hopefully someone can shed some light on whether I have lost this case and continue making payment or if i should take things forward to the FOC? If so i have no clue what the next steps would be. if you look at the posts before this, i had sent a CCA Request and based on advice i sent another letter stating that the t&c sent were not compliant and informed them that I am waiting on the original lender Citi financial to get back to about the charges, they replied today with a final letter stating that I am wrong and they will not put the account on hold/dispute. If i choose to I can complain to the FOS. I have uploaded all the letters they have sent please take a look and let me know what the next step should be. Am quite lost now as to what to do. transaction statement attached here

-

Hi Everyone, i have requested a SAR on Natwest Bank and also Barclays, so far Natwest have replied back with their first letter. The objective of my SARS is to attain my old statement, fees, transactions and charges to claim back on and also for PPI. I know I have had a lot of bank charges as I used my Natwest account when i was a student and really bad with my money! I have attached the letter which Natwest have sent back, i was hoping someone could shed some light on what I could reply via email with? They have mentioned statements now can i say I just want ALL the information and statements available or I remember reading somewhere to specifically state i want all bank charges and fees? I typed up the below to send them, unsure if it is any good? Thank you for your letter of acknowledgment to my SARS request. As my letter states, I require ALL relevant documentation linked to my name, therefore I would like all statements including bank charges and fees to be provided to me, from the date my account was opened till it was closed. If you are concerned about the environment I will consider having it emailed over to me from an official source along with a written letter confirming what has been or will be provided via email to me, this is to ensure its authenticity, it is also proof for me should matters escalate due to any data violations and unlawful SARS violations. I should be informed of any documentation that cannot be provided to me via writing or email correspondence.

-

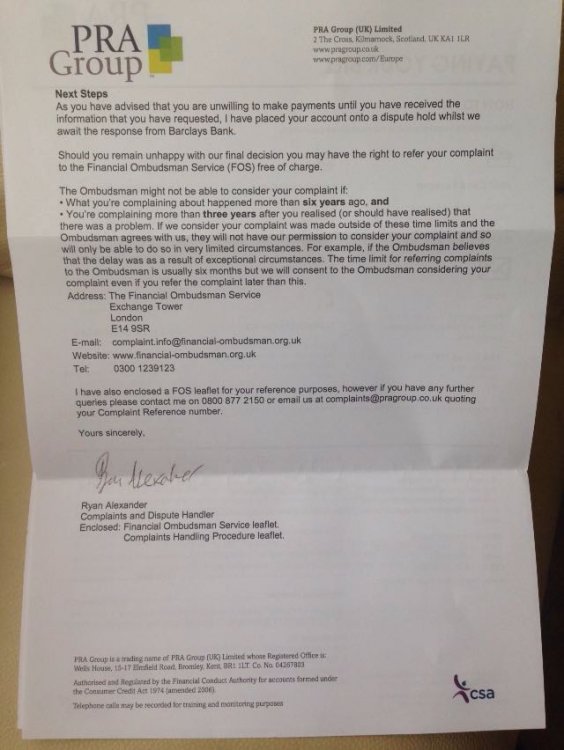

Hi Everyone, Just a quick update on one of the accounts I have been discussing and getting help for here! I sent PRA Group (for Barclay account) they sent me a letter confirming receipt and that they will get in touch, I stopped payments once I received acknowledgement, they sent a letter for a broken agreement. In reply i sent a reply letter stating that the account was in dispute and unenforceable as it had been over 6 weeks and I had not received the relevant documents. They have sent me a letter which I am uploading, is this a general letter - so far in my opinion it seems as though they will now stop chasing until they can find the correct paper work or from this point onwards if it is 6 years of me not paying the amount will be Statute barred? Just wanted to keep all of those interested and all those who have graciously helped me so far up to date. Please see upload of the letter and if there are any helpful tips or opinions on this they will be received with appreciation!

-

dx you truly are an amazing adviser! thank you for your time on this matter. I feel there is a clear pathway to take this down now. I will give this a go and of course come back to this thread with any update or outcome

-

Hi dx, I had taken an initial loan out with citi financial and then increased the amount I borrowed at a later date to pay off money I owed to family, and some credit cards. I believe you are correct it was sold to Idem in 2013. If I was to try and reclaim back the admin fee charges how would this process work? My account went from Citi Financial to Ardent then to Idem. I don't believe I had any letters from Citi but I think I had a letter from Idem when they took on the account unfortunately in my recent move I lost a lot of the paper work. If I was to try and reclaim the admin to be removed from the balance sheet how would I go about doing this? In a different thread i was advised that I am being a willing cash cow and as a suggestion some said perhaps stop payments until things are clearer and sorted, I only stopped the payment once I received a reply from my CCA.

-

So just to confirm what they have sent over is non compliant? Best thing to do is not send out any letters and NOT set up payments again?

-

Hi CitizenB, Thank you for your insight, Regarding the Admin fees, I believe they may have been for late payments or when they had to send a letter out to me , I can't really remember what they are for to be honest. I thought the list of payment breakdown was a statement of the account, as I am unsure what else a statement of account would be? THey haven't said they will claim against me i voluntarily sent a CCA request to see whether IDem have the right documents and agreements for me to be paying them after they took it over from Citi Financial. The ultimate goal was to find out if it is enforceable or not to negotiate a reduced settlement fee. Right now I have stopped payments. I am unsure whether to send out another letter stating that they have not complied and sent across the correct documentation or whether to offer a F&F settlement. What would a Copy of or truthful reconstruction of the agreement be? the original agreement with all all the pages and not just a photo copy of the last signed page?

-

Hi dx, I have created a multipage word doc with all the same letters provided but all the figures have been left in place. I am unsure at this stage what these documents reflect, enforceable or unenforceable. Hopefully you can shed a bit more light, someone else here believes these docs are not sufficient just after another opinion. I have deleted all the previous uploads to help save on confusion. Thank you for your help. docs1.pdf

-

Thank you for your kind help converting it into a PDF and also removing several info bits that I had missed out! I can upload it again with the figures once again it won't be in a pdf format but I will leave the figures in tact.

-

Hi DX100uk, I have tried to do what you have asked, but unfortunately my computer doesn't save anything as a PDF doc, I will continue to try doing the multipage thing but so far it has not been working. Is there any other format I can provide for you all to see it? I have tried to upload a multipage word doc but it is still saved as word. attachment.pdf

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.