LordSuggs

Registered UserChange your profile picture

-

Posts

140 -

Joined

-

Last visited

Reputation

2 NeutralRecent Profile Visitors

-

Thanks that's really helpful - I can't locate the original paperwork, so may have to put. in an SAR on that. I'm prioritising the Sole Trader account and will clear that off before the end of the year. While waiting on the SAR I'm guessing I can't do anything with regards closing the Ltd.

-

Hi Bazza. I'm trying to track down original bank docs (can't see anything in online banking docs), but I think there was. It was the Barclays rep who said that if I progress through to Collections Department it will affect on my persona credit report. The accountant is more concerned with the Sole Trader account which is a lower amount

-

Hi all, I have 2 business accounts with Barclays - one as a sole trader which I started as and - one as a Limited Company, which I became a few years ago. Unfortunately Covid has hit my business model hard and I've made the decision to cease trading to focus on another project. The issue is that I have two overdrafts that need clearing - £1750 on Ltd and - £700 on ST both of which are accumulating bank charges. My accountant has advised I get a personal loan to pay off the debt before closing the Ltd. I've spoken to Barclays and they have said that is likely the best option as if it goes to Collections that will affect my credit. I'm wondering if anyone has any suggestions about the best option when it comes to clearing this amount - is a loan the best option or would a credit card be better? I think realistically I could clear off the balance within 3-6 months but thought I'd check here before sending out any applications.

-

PPI Egg Loan/Credit Card

LordSuggs replied to LordSuggs's topic in Payment Protection Insurance (PPI)

Excellent news - the Card PPI claim has been upheld. It's about £14 less than the claim I made and they've subtracted £794 for tax, but can't complain about £7022.41 So that's two successful claims, just awaiting their calculations on the first loan. Many thanks once again gentlemen - I'm so grateful for all your help. I set up a regular monthly donation to CAG last month but will make another one off donation once the cheque clears. -

PPI Egg Loan/Credit Card

LordSuggs replied to LordSuggs's topic in Payment Protection Insurance (PPI)

I've received a cheque from CS for the loan PPI - £2,238.72. Banked and will give a CAG donation once it clears. Thanks guys. Also received a reply to the Credit Card PPI that I had queried. 8 weeks since my letter and they have written that due to the high volume of complaints it's taking longer than expected to respond. They expect another 8 weeks to respond of close the complaint. -

PPI Egg Loan/Credit Card

LordSuggs replied to LordSuggs's topic in Payment Protection Insurance (PPI)

Ok, understood. Will draw a line under that one then. Just the credit card claim to hear back from... -

PPI Egg Loan/Credit Card

LordSuggs replied to LordSuggs's topic in Payment Protection Insurance (PPI)

I had to look through the whole bundle of SAR files several times before I spotted it. There's nothing in the comms log, but there is a 'Case Report' which is the date they're referring to. I'm still not 100% sure I received the letter - seems somewhat familiar but I can't say definitely. Do they need a copy of it for the proof you're suggesting, or is this sufficient for them? PPI Egg.pdf -

PPI Egg Loan/Credit Card

LordSuggs replied to LordSuggs's topic in Payment Protection Insurance (PPI)

Gotcha - appreciate the advice -

PPI Egg Loan/Credit Card

LordSuggs replied to LordSuggs's topic in Payment Protection Insurance (PPI)

Nope, I've been in the same property since 2003 - this loan was taken out 2005. I think I received this letter at the height of the Shoosmiths/Arrow DCA pressure and, being honest, just got worried about responding to it. Didn't realise there was a time limit on it. Doesn't that then affect all claims? Wasn't mentioned in the first loan reply. Ok I'll shoot off a letter to them about the first loan to ask for detailed calculations and double check on the SAR tomorrow to see if they have the letter in the comms log. Thanks dx -

PPI Egg Loan/Credit Card

LordSuggs replied to LordSuggs's topic in Payment Protection Insurance (PPI)

I do recall receiving a letter - not sure if it was 2012, but could have been. I can't remember seeing a copy of it in the SAR but I'll double check. Definitely don't recall reading there being a time limit mentioned - is this a valid reason to reject by them if so? -

PPI Egg Loan/Credit Card

LordSuggs replied to LordSuggs's topic in Payment Protection Insurance (PPI)

Second one has come through and it's along the same lines. This is for the refinanced loan that was recently DCd by Arrow Global: Claim PPI payments £2836.01 8% Interest £2865.40 Total £5,701.41 Offer PPI Payments £3,365.51 Interest of payments £485.94 8% Interest £748.61 Less redress £2,388.44 Less basic tax -£149.72 Total £2,238.72 Very helpful of them to suggest I contact Arrow Global and make a payment to them! Same tactic on this one - just ask for a breakdown of their calculations? PPI2.pdf -

PPI Egg Loan/Credit Card

LordSuggs replied to LordSuggs's topic in Payment Protection Insurance (PPI)

I think it was more I was unsure if I could cash the cheque while also disputing the total - sounds like if it's a F&FS and I cash, that's the claim finalised. Just wanted to check as I could have sworn I saw someone give advice on here the other way. -

PPI Egg Loan/Credit Card

LordSuggs replied to LordSuggs's topic in Payment Protection Insurance (PPI)

First reply back - complaint upheld but far lower than in my claim: Claim PPI payments £556.10 8% Interest £794.17 Offer PPI Payments £473.55 Interest of payments £40.21 8% Interest £262.27 Less any previous rebate paid -£330.20 Unsure why their 8% is so low in comparison to the spreadsheet's calculation They've also taken out 'rebate paid' which in their notes says it's a partial refund of the premium upon early termination of the policy - I paid this loan off early. Does this make sense? Lastly, they say that if I cash the cheque they're sending I agree this is full and final settlement and can't make any further claims on this case - is that true? I'm sure I read something else to the contrary here. PPI 1.pdf -

PPI Egg Loan/Credit Card

LordSuggs replied to LordSuggs's topic in Payment Protection Insurance (PPI)

Yeah, I did think it was a bit of a 'kitchen sink' reply. Ok, I've spoken to my previous employer and they've directed me to the sick/absence pay terms online - 52 weeks sick pay. I'll write up a reply to CS tonight and include a printout of this. Thanks. -

PPI Egg Loan/Credit Card

LordSuggs replied to LordSuggs's topic in Payment Protection Insurance (PPI)

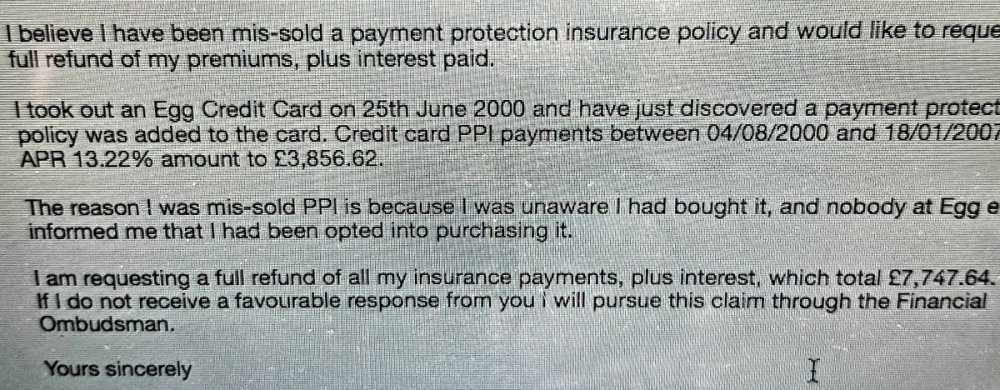

My letter to them was focussed purely on the fact that I didn't opt in to PPI for the card and was not told about it by Egg. I didn't outline all the bullets they've listed.

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

- Create New...