hannanshah

Registered UsersChange your profile picture

-

Posts

154 -

Joined

-

Last visited

Reputation

1 Neutral-

This topic was closed on 10 March 2019. If you have a problem which is similar to the issues raised in this topic, then please start a new thread and you will get help and support there. If you would like to post up some information which is relevant to this particular topic then please flag the issue up to the site team and the thread will be reopened. - Consumer Action Group

-

This topic was closed on 09 March 2019. If you have a problem which is similar to the issues raised in this topic, then please start a new thread and you will get help and support there. If you would like to post up some information which is relevant to this particular topic then please flag the issue up to the site team and the thread will be reopened. - Consumer Action Group

-

This topic was closed on 03/07/19. If you have a problem which is similar to the issues raised in this topic, then please start a new thread and you will get help and support there. If you would like to post up some information which is relevant to this particular topic then please flag the issue up to the site team and the thread will be reopened. - Consumer Action Group

-

This topic was closed on 03/06/19. If you have a problem which is similar to the issues raised in this topic, then please start a new thread and you will get help and support there. If you would like to post up some information which is relevant to this particular topic then please flag the issue up to the site team and the thread will be reopened. - Consumer Action Group

-

Good news. After ignoring several letters from Reston's asking us to accept a settlement of the case at a lower figure we've just received a letter stating that their client is withdrawing their claim. Result! Thank you everyone for your help with this.

- 69 replies

-

- cabot

- county court

-

(and 3 more)

Tagged with:

-

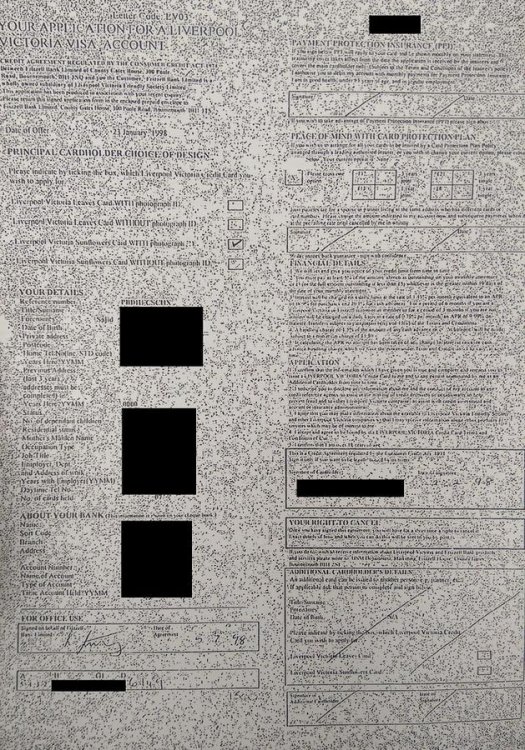

Cabot / Reston have finally replied. Reston have asked us to explore the possibility of making a settlement without further litigation. A Cabot letter includes some Liverpool Victoria statements and an apparent copy of an agreement. The statements have a different card number (ending 3466) which is completely to the two numbers on the claim from Cabot. The agreement is a poor copy which is unreadable mostly dating to being signed in 1998 and appears to show my father's signature. However, if I look at the bottom left corner there appears to be a card number written there beginning 5432 (as the LV cards do) but the rest of the number is again completely different. I have attached a scan of this below: My father has had various credit cards over the years so this to me doesn't prove at all that this is one of the 2 credit card accounts referred to in the claim. There is another unsigned agreement for a different card number and some T&Cs on separate pages although these are in better condition (so I suspect not taken form the original agreement!) I have typed out both letters in full below. As a reminder the case refers to 2 alleged debts of around £3k each, one is for an account beginning 5432 XXXX XXXX 3463 The other is 5432 XXXX XXXX 1557 Reston's letter refers only to the 2nd account although the court claim covers both. How do you propose I respond to Cabot? Make the point that the agreement isn't clear and we won't settle? Make a without prejudice offer to settle for £1? ================ Cabot's letter 1 November 2016 Re: Liverpool Victoria - 5432XXXXXXXX3463 Thanks you for your letter received in our office on 27 OCtober 2015. My name is Kathy Cakebread, I am the Consultant that has further investigated your concerns and I hope to help you now by providing a resolution to this matter. Information under Consumer Credit Act 1974 Please find enclosed all of the relevant information following your request for information under section [77-78] of the Consumer Credit Act 1974. Whilst I appreciate the copy of the agreement is not the best copy your name and address as clearly visible. The terms and conditions are shown on the associated documentation. What happens next? We consider the agreement is now enforceable and therefore we are entitled to obtain a County Court Judgment against you. However, we would prefer that you work with us to set up a repayment plan to settle your outstanding balance. The status of your account The outstanding balance is currently £XXXXX. Please make contact with our Customer Operations Department on 08000 328 0708 as soon as possible to discuss the options available in order to make payment or settle this account. If you have any queries, please do not hesitate to contact me. Your sincerely Kathy Cakebread Customer Support Consultant ============== Reston's letter WITHOUT PREJUDICE SAVE AS TO COSTS Dear Sir Re: Cabot Financial (UK) Ltd v Yourself Account number: 5431xxxxxxxx1557 Original creditor and product type: Liverpool Victoria - Credit Card We have been instructed to write to you regarding the above matter. We note from reviewing your account that you have not withdrawn your Defence, nor has a payment arrangement been agreed. Having said that, please be advised that we are still awaiting documentation from our Client. Due to the time that has elapsed since proceedings were issued, our Client has asked us to remind you of the details regarding the outstanding debt. The current outstanding balance is £6,XXX.XX which relate to a Liverpool Victoria - Credit Card facility with account number 5432xxxxxxxx1557. Our client's records indicate that the account was opened on or about Wednesday, September 19, 2001. In line with the Terms and Conditions which governed the account, the original creditor had a contractual right of assignment. In other words, the original creditors was entitled to transfer their rights and benefits under the account to a third party and that right was exercised on Wednesday, July 9, 2008. Our Client has asked us to explore the possibility of a settlement being achieved without the need for this litigation to continue and is therefore willing to enter into a payment arrangement that is affordable and sustainable for you. We kindly ask that you complete and return the attached financial statement within the next 30 days, confirming what your offer of payment is. If you wish to settle the matter by way of a lump sum payment our Client may be able to offer you a discounted settlement figure. Please contact ourselves on the above telephone number if you wish to discuss settlement of your account or have any other queries relating to your account. Your faithfully Miss D Armstrong, Trainee Solicitor

- 69 replies

-

- cabot

- county court

-

(and 3 more)

Tagged with:

-

Update: We entered our defence on 30 Oct 2015. There has been no progress on the case since and it still says defence entered. In November Reston had asked for some additional information on our original requests which we have provided. Their last letter was a December response from Reston saying that they have noted our evidence on the s77/78 requests and are 'currently awaiting documentation previously requested from our Client and will be in contact upon receipt of such documents.' Do we have to wait for Reston to take the next step or can we do something to get the case thrown out?

- 69 replies

-

- cabot

- county court

-

(and 3 more)

Tagged with:

-

Yes sent recorded and we have proof of delivery. Should I sent just copies of our requests or the Cabot responses too?

- 69 replies

-

- cabot

- county court

-

(and 3 more)

Tagged with:

-

My father just received the following response from Reston solicitors following the filing of his defence. Should we respond to them with the requested information or ignore it? -------------------- Dear Sir We write further to the Defence you recently filed. We note you dispute liability and effectively put the Claimant to strict proof of the Claim. Within your Defence you make reference to having made two separate requests under Section 78 of the Consumer Credit Act 1974 and allege that these requests have not been responded to. Please therefore kindly provide evidence of the requests you made and that the relevant statutory fee has been paid. Upon receipt of such evidence, we will investigate further with our Client. We look forward to hearing from you within the next 28 days. Yours faithfully, Miss L Tipping, Chartered Legal Executive

- 69 replies

-

- cabot

- county court

-

(and 3 more)

Tagged with:

-

We had a quote for some wedding decor at a wedding by an events organiser. A formal quote of £2,000 was agreed and this was emailed to us. We agreed to this and sent a £300 non-refundable deposit by bank transfer. The organiser then decided to raise the agreed price to £3,000. We then requested that we weren't going ahead any more as the agreement had been broken. Initially the contact agreed to refund the deposit but is now refusing. We have made alternative arrangements and our argument is simple. She broke the original agreement by demanding a higher price after we had paid the deposit. She then agreed to refund the deposit. The agreement had ended. She is now saying that the agreement is still in place and she can either deliver what we want for £2,000 or not go ahead but the deposit is non-refundable. We say that the deposit is only non-refundable if we had broken the agreement. We are not using her as we have made alternative arrangements. All of these discussions are on text messages. I now want to send a formal letter before court action demanding that the deposit is refunded as our agreement ended when she raised the price after we paid it and later agreed to refund the deposit. One thing I'm not sure about is who I would claim against in the small claims court if it went that far. The events organisation isn't a company. Can we still issue the claim against the organisation or will I have to sue the individual we are dealing with (the payment was made to an account in her name)? If we have to target the individual can we use the business address as we obviously don't know her personal address?

-

Thanks for all the help. I really appreciate it. I have now submitted the defence on MCOL.

- 69 replies

-

- cabot

- county court

-

(and 3 more)

Tagged with:

-

Updated below with the statement and some minor other tweaks. Will submit this if no further comments from anyone. Particulars Of Claim 1.The Claimant claims payment of the overdue balances (set out below) which the Defendant(s) have failed to pay as required under contracts with the following particulars acc no xxxxxxxxxxxxxxxxxx and acc no xxxxxxxxxxxxxx between the Defendant(s) and Liverpool Victoria dated on or about Sep 19 2001 and Feb 06 1998 respectively. 2.The contracts were assigned to the Claimant on Jul 09 2008 and Jul 09 2008 respectively. PARTICULARS - a/c no xxxxxxxxxxxxxxxxxxxxx a/c no xxxxxxxxxxxxxxxxxxxxx DATE ITEM VALUE 09/09/2015 Default Balance 3251.99 09/09/2015 Default Balance 3066.10 Post Refrl Cr NIL TOTAL 6328.09 The Defendant contends that the particulars of claim are vague and generic in nature. The Defendant accordingly sets out its case below and relies on Civil Procedure Rule 16.5 (3) in relation to any particular allegation to which a specific response has not been made. The claim is denied with regards to two amounts due under two agreements. The Claimant/Solicitor has been unable to disclose any agreement or statements on which its claim relies upon. I am unaware of any legal assignment the claimant refers to within its particulars and deny the notice was served pursuant to the Law of Property Act 1925. On receipt of this claim I requested information pertaining to this claim by way of a CPR 31.14 on 10 October. To date I have yet to receive a compliant response. The claimant's Solicitor, responded to this request on 26 October but didn't provide the documents requested. I have requested information pertaining to this claim from the Claimant by way of separate Section 78 requests under the Consumer Credit Act 1974. To date I have yet to receive a response complying with my requests. The first requests were sent on 28 May 2010. The Claimant acknowledged that they were unable to provide the documents and were requesting relevant documents from the original lender. I have sent second s78 requests on 25 October 2015. I have not received a response to these. Therefore with the courts permission the Claimant is put to strict proof to: (a)Show and disclose how the Defendant has entered into agreements; and (b) Show and disclose how the Claimant has reached the amounts claimed for; © Show how the Claimant has the legal right, either under statute or equity to issue a claim; As per Civil Procedure Rule 16.5, it is expected that the Claimant prove the allegation that the money is owed. On the alternative, if the Claimant is an assignee of a debt, it is denied that the Claimant has the right to lay a claim due to contraventions of Section 136 of the Law of Property Act and Section 82A of the consumer credit Act 1974. By reason of the facts and matters set out above, it is denied that the Claimant is entitled to the relief claimed or any relief.

- 69 replies

-

- cabot

- county court

-

(and 3 more)

Tagged with:

-

For reference, here is the CPR request we sent: ================================= Edit...please do not post our Templates on the open forum...they are for members use only. Andyorch

- 69 replies

-

- cabot

- county court

-

(and 3 more)

Tagged with:

-

Here's my defence before I submit it at 4pm. I would welcome any comments. I have also attached what we received in response to the CPR 31.14 request. ================================== The Defendant contends that the particulars of claim are vague and generic in nature. The Defendant accordingly sets out its case below and relies on Civil Procedure Rule 16.5 (3) in relation to any particular allegation to which a specific response has not been made. The claim is denied with regards to two amounts due under two agreements. The Claimant/Solicitor has been unable to disclose any agreement or statements on which its claim relies upon. I am unaware of any legal assignment the claimant refers to within its particulars and deny the notice was served pursuant to the Law of Property Act 1925. On receipt of this claim I requested information pertaining to this claim from Reston Solicitors by way of a CPR 31.14 on 10 October. To date I have yet to receive a compliant response. The claimants Solicitor, Reston Solicitors, responded to this request on 26 October but didn't provide the documents requested. I have requested information pertaining to this claim from Cabot Financial (UK) Limited by way of separate Section 78 requests under the Consumer Credit Act 1974. The first requests were sent* on 28 May 2010. They acknowledged they were requesting relevant documents from the original lender. To date I have yet to receive a response complying with my requests. I have sent second s78 requests on 25 October 2015. I have not received a response to these. Therefore with the courts permission the Claimant is put to strict proof to: (a)Show and disclose how the Defendant has entered into agreements; and (b) Show and disclose how the Claimant has reached the amounts claimed for; © Show how the Claimant has the legal right, either under statute or equity to issue a claim; As per Civil Procedure Rule 16.5, it is expected that the Claimant prove the allegation that the money is owed. On the alternative, if the Claimant is an assignee of a debt, it is denied that the Claimant has the right to lay a claim due to contraventions of Section 136 of the Law of Property Act and Section 82A of the consumer credit Act 1974.Statement of Truth The Defendant believes that the facts stated in this Defence are true.

- 69 replies

-

- cabot

- county court

-

(and 3 more)

Tagged with:

-

How long do I have to submit my defence? The issue date of the claim was 30 Sept. Does that mean I have till Monday 2 November (33 days from claim date) or should I submit by tomorrow Friday 30 October 4pm?

- 69 replies

-

- cabot

- county court

-

(and 3 more)

Tagged with:

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.