Penfolds

Registered UsersChange your profile picture

-

Posts

64 -

Joined

-

Last visited

Reputation

1 NeutralRecent Profile Visitors

The recent visitors block is disabled and is not being shown to other users.

-

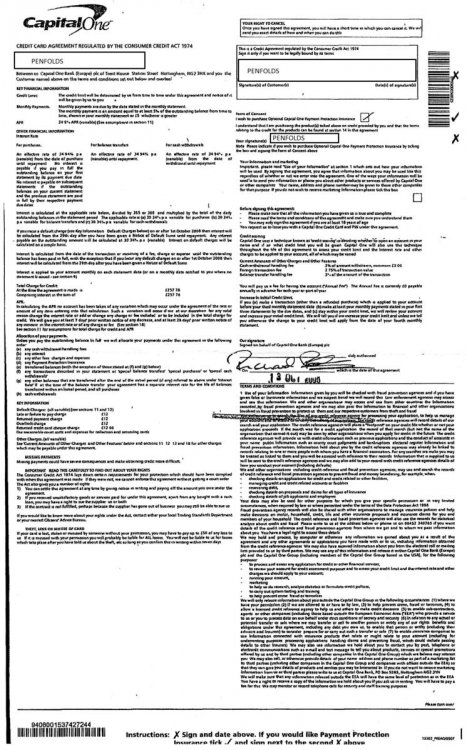

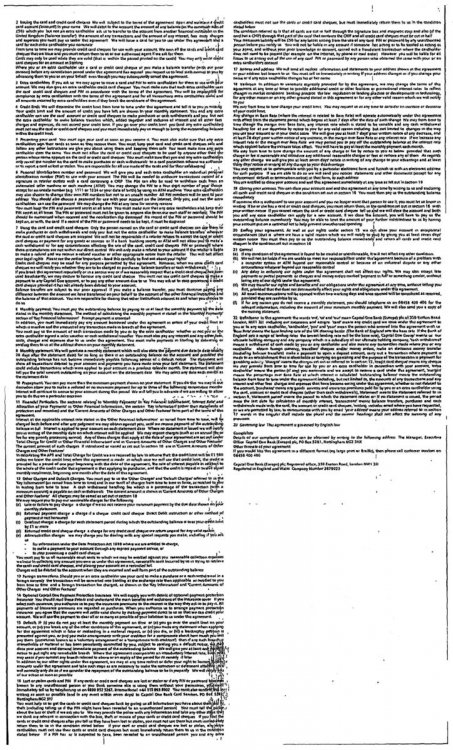

Evening All, Thanks again DX. Date of issue 22 NOV 2016 What is the claim for – 1. The claimants claim is for the sum of £700 being monies due from the defendant and Capital One (Europe) plc. (xxxxxxxxxxxxxxxx) and assigned to the claimant on 30/11/2012, notice of which has been provided to the defendant. 2. The defendant has failed to make payment in accordance with the terms of the agreement and a default notice has been served pursuant to the Consumer Credit Act 1974. 3. The claimant claims the sum of £700.00. C has compiled, as far as is necessary, with the pre-action conduct practice direction. What is the value of the claim? £700 Is the claim for a current account (Overdraft) or credit/loan account or mobile phone account? Credit Card When did you enter into the original agreement before or after 2007? OCT 2008 Has the claim been issued by the original creditor or was the account assigned and it is the Debt purchaser who has issued the claim. Debt purchaser. Were you aware the account had been assigned – did you receive a Notice of Assignment? Do not recall. Did you receive a Default Notice from the original creditor? Do not recall. Have you been receiving statutory notices headed “Notice of Default sums” – at least once a year ? No. What was the date of your last payment? JAN 2012. Was there a dispute with the original creditor that remains unresolved? No. Did you communicate any financial problems to the original creditor and make any attempt to enter into a debt management plan? No. --------------------------------------------------------------------------------------- Defence 1. The Defendant contends that the particulars of claim are vague and generic in nature. The Defendant accordingly sets out its case below and relies on CPR r 16.5 (3) in relation to any particular allegation to which a specific response has not been made. 2. Paragraph 1 is noted. I have in the past had an agreement with Capital One (Europe) plc, but do not recognise this specific account number or recollect any outstanding debt and have therefore requested clarification by way of a CPR 31.14 and a Section 78 request. I am unaware of any legal assignment or Notice of Assignment pursuant to the Law and Property Act 1925 Section 136(1). 3. Paragraph 2 is denied. I have not been served with a Default Notice pursuant to the Consumer Credit Act 1974. 4. On receipt of the claim form, the Defendant sent a request to the Claimant by way of a Section 78 pursuant to the Consumer Credit Act 1974, for a copy of the agreement. To date, nothing has been received. 5. A further request was sent via CPR 31.14 to the Claimants solicitor, requesting disclosure of documents on which the Claimant is basing their claim. To date nothing has been received. 6. It is therefore denied with regards to Defendant owing any monies to the Claimant; the Claimant has failed to provide any evidence of a Credit Agreement / Assignment / Balance / Breach requested by CPR31.14, and remains in default of my Section 78 request, therefore the Claimant is put to strict proof to; a) Show how the Defendant has entered into an agreement and; b) Show how the Defendant had reached the amount claimed for and; c) Show the nature of the breach and evidence by way of a Default Notice pursuant to Section 78 of Consumer Credit Act 1974. d) Show how the Claimant has the legal right, either under statue or equity to issue a claim. 7. As per Civil Procedure 16.5 it is expected that the Claimants prove the allegation that the money is owed. 8. On the alternative, as the Claimant is an assignee of a debt, it is denied that the Claimant has the right to lay a claim due to contraventions of Section 136 of the Law of Property Act and Section 82A of the Consumer Credit Act 1974. 9. By reasons of the facts and mattes set out above, it is denied that the Claimant is entitled to the relief claimed, or any relief. Penfolds

-

Hi All, I have recently defended a claim by Shoosmiths on behalf of Capquest for a Cpaital One credit card taken out in Oct 2008, the last payment made was in Jan 2012. The claim was stayed at the end of Jan 2017 after filing a defence. Before filing the defence Capquest was sent a CCA request, a copy was also sent to Shoosmiths with a CPR31.14 request, which Shoosmiths remain in breach of. However today Capquest has sent a response to the CCA request (attached). They have also sent somebody elses application for a Barclays Sky Card which includes their name, address, DOB, household income, home, mobile and work telephone numbers and applicants signature. Any advice greatly appreciated, please advise if defence or CPR 31.14 request needs uploading. Thanks Penfolds

-

Hey Caggers, This morning 3am i received a email alert from equifax to say there had been another change to my credit file... They have now removed all data relating to this. I did not even make contact with them, one would assume ELS are are watching. Now this makes it interesting that they are trashing my credit file and they knew of it, for them to have stopped, means they or some one told them to remove it? surely this makes them look guilty of something or misconduct? Penfolds

-

Hey Caggers, Im back and so are these low life ****..... after agreeing with them the following Further to our recent exchange of correspondence we have taken our client’s further instruction. They have confirmed that they will agree to settle this matter on an amicable basis as we have discussed. For the avoidance of any doubt the terms are: · Our client agrees to discontinue their claim on the basis that both sides bear their own costs to date and you agree not to pursue any counter claim. Effectively this matter is closed. · Our client will close their file and following settlement they have also instructed us to close our file. · Following closure no further assignment, sale or collection activity will take place. · No further action (court or otherwise) will be taken against you in respect of this matter. · No court (or other) action to be taken by you against our client in respect of this matter. · Our client has agreed to arrange for the removal of any entry recorded with the Credit Reference Agencies relating to this matter. · A payment of £500.00 will be remitted to you (enclosed). · We will send a Notice of Discontinuance, copy enclosed, to the court to draw this matter to a close on the basis that both sides bear their own costs. We trust that this matter has now been brought to a conclusion and will close our file. After getting my cheque 3 weeks later they removed all entry with credit reference agencies, however on 17/11/11 they have put a new entry saying the account was settled in OCT 08 with no payment details... thus surely having a negative effect on my credit file? So which way do i go now, ask them nicely to remove it or a more heavier approach, is it time for there cheque book to come out again?

-

Ok sent my request for copy of NoD by the 24th June 2011, heres there reply Dear Sir, Thank you for your earlier email. Just to confirm we have now received our client's cheque and the letter to you enclosing a copy of the Notice of Discontinuance together with our client's cheque is in tonight's post. We also confirm that the Notice of Discontinuance has also been sent to Danger Mouse's county court. -- Regards ELS & Cole Solicitors ________________END_____________ I will scan all latest correspondence including notice of discontinuation to photobucket when hard copies are received. Thanks for the title change Slick, and your contribution to this thread you too have been a great help. It was never about receiving £500 from them, I was hesitant to send another FF and just accept there offer to discontinue, but I was frustrated at the lack of threads about Tessera Portfolio Management Ltd (Im sure there is more of them out there some where). I wanted to make an example of them for others to follow and maybe have this thread changed to a sticky? I have just made a donation to http://www.consumeractiongroup.co.uk and i have just booked my holiday. Thank you Tessera Portfolio I must admit all this has not been easy, but i would encourage any one in the same position to fight back, and not ignore that claim form. You will find everything you need here on this website, and if you cant find it - just ask, if you dont understand it - just ask. I originally wanted to deal with this in 2009, before any court action, and created another account then to seek help but was to embarrassed to plead my story - dont be, many people here have been there previously, and visitors here are here for some similar reason. I wish those 4000 guests online right now would join and blab away. Kind regards to all. Penfolds £6,075.05 Debt Extinguished, £500 Compensation Paid, CRF Restored.

-

Hey Gunit, Well done, i too have just had my court case discontinued from them find my thread here http://www.consumeractiongroup.co.uk/forum/showthread.php?304547-***WON***-Court-case-dropped-and-compensation-paid*** Your the top hit on google when googling there name through forums, i think my thread may be of use to others fighting back against them. Penfolds

-

Hey Caggers, I got a response from Tessera's Sols ELS...................... Dear Sir, Re: Tessera Portfolio Management Limited-v-Mr Penfold Case Number: XXXXXXX Without prejudice save as to costs Further to our recent exchange of correspondence we have taken our client’s further instruction. They have confirmed that they will agree to settle this matter on an amicable basis as we have discussed. For the avoidance of any doubt the terms are: · Our client agrees to discontinue their claim on the basis that both sides bear their own costs to date and you agree not to pursue any counter claim. Effectively this matter is closed. · Our client will close their file and following settlement they have also instructed us to close our file. · Following closure no further assignment, sale or collection activity will take place. · No further action (court or otherwise) will be taken against you in respect of this matter. · No court (or other) action to be taken by you against our client in respect of this matter. · Our client has agreed to arrange for the removal of any entry recorded with the Credit Reference Agencies relating to this matter. · A payment of £500.00 will be remitted to you (enclosed). · We will send a Notice of Discontinuance, copy enclosed, to the court to draw this matter to a close on the basis that both sides bear their own costs. We trust that this matter has now been brought to a conclusion and will close our file. Yours faithfully ELS & Cole Solicitors ___________________END_________________ Also attached is the Notice Of Discontinuance, although it is unsigned.....I am about to go into further correspondence with them to request a signed copy is sent to me before the 24th June 2011 (AQ filing Date), so i can hand deliver to the court myself. Is there anything else i should be doing? Caggers, again i cant thank all of you enough for the help and support you guys have gave me, you are a great inspiration to myself and others..... Thank you! I will make a donation to http://www.consumeractiongroup.co.uk this evening to support this great site. I will regularly pop in to see if i could ever try and help others as you guys have, I too are fed up with big bully companies that try and push the regular Joe to far. Penfold

-

Hey eventually knocked this up after being bad killing zombies on ps3 all night its 6am...........(whip) without prejudice save as to costs Offer of settlement. Dear Sir, Offer in full and final settlement of all matters between myself Mr. Penfolds and Tessera Portfolio Management Ltd. I am prepared to permit your client to withdraw proceedings against me without opposal, application for costs or counterclaim subject to each and every one of conditions below being met by yourselves. 1) The alleged debt is extinguished permanently by your client. 2) No further court action be taken by your client against myself. 3) The account will never be sold, assigned or permitted to suffer any form of collection activity by any party including your client and/or any unspecified 3rd party. 4) All adverse references to this account be removed permanently from any credit reporting facility. 5) All personal data relating to me under the control of your client be destroyed except such as specifically prevented by statute. 6) A payment of £500 be made to me by your client to cover my costs incurred. The above to be agreed in writing and signed by an officer of your client of sufficient stature to become legally binding prior to any settlement action being taken. If your client is churlish enough to proceed with the action in what by the value of the claim is likely to be a costs bearing Court then it shall be stoutly defended. As previously stated I am quite content to see the entire farce played out before a judge, of course this will occur after i have filed a part 20 counterclaim for the illegal default. However as a gesture of goodwill I will agree to not enter any counterclaim against your client on acceptance of the above offer. I estimate my costs at present to be in the region of £800 however as a gesture of goodwill I am prepared to cap my costs at £500. I have already wasted dozens of hours of my time investigating and defending this speculative and vexatious claim. Letters have been drafted for the OFT, The FOS and The ICO, your client may well be paying £500+ to enjoy the experience of having the illegal default and unlawful application of interest investigated by these regulatory bodies. However as a final gesture of goodwill these will be destroyed on acceptance of the above offer. I feel that it is in the best interests of both parties if this matter can be resolved without the need to waste the courts resources and applying for my costs and counterclaim through the courts. I hope we can come to a mutually agreeable settlement by the end of today, I am willing to swiftly respond to your response and work with you resolving this matter. Yours faithfully Penfolds Any thing need changing or adding i plan to fire this off to them ASAP- Im trying to get out of the country any day, ( i want to be on a beach by the end of the week), lets see if Tessera will pay for it

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.