Dannyde

Registered UsersChange your profile picture

-

Posts

25 -

Joined

-

Last visited

Reputation

1 Neutral-

Hi Guys, with all the latest goings on with Wonga I hoped I might be in line for some compensation as I received letters from 'Chainey, D’Amato & Shannon’ so I filled in the contact section on the website as per the email back in September. I hadn't heard anything by the end of November so I decided to give them a call to see if they would acknowledge that I had been affected by this, they said I was and that I would be receiving a letter in due course. While on the phone I asked if they could send me a statement on my account so I could see what I actually paid back on my £750 Loan, Here is the statement: Initial Loan Advance 30 September 2008 £750.00 Total Principal Amount: £750.00 Payment 03 November 2008 £256.18 Payment 04 November 2008 £100.00 Payment 12 March 2009 £100.00 Payment 17 April 2009 £100.00 Payment 21 September 2009 £50.00 Payment 21 September 2009 £50.00 Payment 25 September 2009 £50.00 Payment 17 October 2009 £50.00 Payment 05 December 2009 £50.00 Payment 08 January 2010 £50.00 Payment 05 February 2010 £50.00 Payment 05 March 2010 £50.00 Payment 01 April 2010 £50.00 Payment 06 April 2010 £50.00 Payment 07 May 2010 £50.00 Payment 05 July 2010 £50.00 Payment 06 August 2010 £100.00 Payment 03 September 2010 £50.00 Payment 08 October 2010 £50.00 Payment 05 November 2010 £50.00 Payment 01 February 2011 £110.47 Payment 07 March 2011 £110.47 Payment 17 March 2011 £220.94 Payment 23 March 2011 £770.65 Payment 05 March 2013 £24.00 Payment 25 March 2013 £4.74 Payment 24 June 2014 £12.39 Payment 05 March 2013 £24.00 Payment 05 March 2013 £24.00 Payment 05 March 2013 £24.00 Total Sum Paid £2,731.84 Total Principal Amount less Total Sum Paid -£1,981.84 Transfer Fee 30 September 2008 £3.00 Extension Fee 04 November 2008 £10.00 Default Fee 30 October 2008 £10.00 Default Fee 28 November 2008 £10.00 Default Fee 07 December 2008 £45.00 Interest 29 October 2008 £222.81 Interest 27 November 2008 £197.50 Interest 13 January 2009 £50.00 Interest 01 February 2009 £534.73 Interest 29 March 2009 £585.67 Interest 21 September 2009 £50.00 Refund 05 March 2013 £174.00 Interest adjustment 05 March 2013 £24.00 Interest adjustment 05 March 2013 £24.00 Interest adjustment 05 March 2013 £24.00 Interest adjustment 25 March 2013 £4.74 Total Outstanding -£12.39 As you can see it took a long time to pay this back and got a default on my Experian Credit file which wont come off until February 2015! I got an email in March 13 saying my account had been wrongly calculated and I had over paid £174.00 and this was refunded. Just really wanted opinion from you guys if I have a case for reclaiming some of this inflated interest and if I do, who do I go to? Thanks D

-

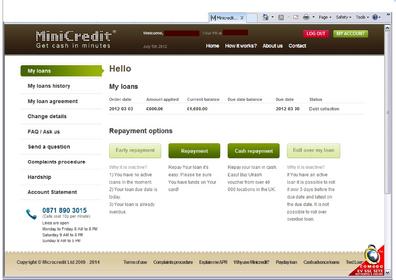

Mini Credit reply today by email: Dear .......................... Your account is overdue for 97 days. You have 23 days to continue making partly payments towards Your balance via Your Minicredit.co.uk online account and if You wish to avoid the Legal actions, within 23 days gather up funds as much as You can, give us a call and make us a settlement offer. If it is agreed, then the payment must be made immediately via same phone-call via debit card or Ukash voucher only. Kind regards MiniCredit.co.uk Client Support Team ..................................................................................................................... Thanks MC, very helpful, gather up as much as you can and we will then tell you that we won't accept it lol! Think i would rather go to county court as i'm sure the Judge would't tell me to "gather up as much as you can" to make a payment!

-

this was not intended to offened anyone it was only meant as a laugh in between being hounded by this company, I made no reference to your version of the meaning of cretin or about those with cerebal palsy, it would seem that you are trolling the boards looking for an argument? if you do not like what i have written - do not read my thread, if you have nothing worth while to add - please do not add to my thread. It strikes me that you calling me a cretin for making the comments makes you as Neanderthal as me? your attitude would be better suited on the MSE forum, you would fit in well with the judgmental lot on there.

-

I think this should be their new name, MiniCretin!! It pretty much sums them up: Cretin: A Person that is: brainless, stupid, child-like, and full of pointless information that makes no sense and appeals only to other cretins. (Taken from Urban Dictionay! Not meant to offend anyone just a bit of humor that keeps people going when they are low due to the treatment these companies give out)

-

Hi Guys, I am still battling on with MiniCretin and have sent them this hoping they may send the account to opos....Got the LAST LETTER BEFORE LEGAL ACTION on 03rd July, someone really needs to teach these lot how to write a letter as it is only 'partly' english!!! The current balance on my online account today stands at £1688.00 for a £600 Loan due on 31.03.2012! Dear MiniCretin, Thank you for your letter dated 28.06.2012, headed, LAST LETTER BEFORE LEGAL ACTION, the contents of which have been duly noted. I would like to draw your attention to the following: Despite all of my efforts, you have chosen to ignore my attempts to come to a payment arrangement. You have sent me several letters demanding payment in full which I have told you on several occasions that if I had the sum of money involved to settle this loan I would have settled the loan on the due date, I did not have the money and still do not have the money, you are adding charges to the account by the day as per your agreement so in short and simple terms I will never have the money to pay this debt in full as the outstanding balance continues to rise every day. You have not offered any form of 'payment options' as mentioned other than that I can make 'partly payments' which cost £5.50 each time one is made, I have made two payments of £80 (PLUS £5.50 FEE) to my account which you are not taking into account as you are saying that I have 'chosen to ignore your efforts'. I can not avoid legal action as you put it as I can not settle the account in full as I do not have the funds available. Your mention of my 'forthcoming CCJ' is of particular note; You as a company have to file a claim in the county court against me providing a breakdown of charges, at which point I get the chance to defend the claim. I will defend the claim and will attend court, I will show willing to pay the balance and the judge will decide which charges you have added are justified and what a reasonable amount is to pay you back that I can afford from my earnings as this type of debt is not classed as a "Priority Debt", once I have provided them with an income and expenditure form the will decide how much of the debt i have to pay and what payment I have to make. I would then have to BREAK this agreement and not pay you back for you to be able to send door step collectors/bailiffs to my home to recover the debt. At this point, you have not filed a claim and you have not received a judgement against me so please do not threaten me with mention of a 'forthcoming CCJ' which you as a company can not give me. I have repeatedly offered a payment of £80 per month to clear this debt for the original amount borrowed plus one months interest which equates to £762.00 I have paid £160.00 leaving a balance of £602.00. I am willing to pay this monthly by 7 instalments of £80 then a final instalment of £42 beginning on the 1st August 2012. I will pay this ONLY BY MEANS OF STANDING ORDER TO YOUR BANK ACCOUNT; you will need to reply with your bank details as I refuse to pay £5.50 per time to make a payment which would be free of charge using bank transfer facilities. If you are not willing to accept my offer of payment, please begin proceedings against me as at least that way I will be able to defend my self in court and will not have to continuously be harassed by your company for this debt as once (and if) judgement is granted I will only have to pay what I can afford and by accessible means, i.e. via a standing order. No Judge in the country would agree to the only payment method to be one that costs £5.50 each time, after all, once they have seen my I & E form you may only get £5 per month. I would like to come to agreement regarding this outstanding balance and request the you reply with the information i have requested, how ever, any reply and previous replies/letter from you company may me used as evidence in court should your company try to get judgement granted against me. Also please note that any telephone calls received will and have been recorded. ...............................................................................................................

-

Hi Sillygirl, I have told them so many times now that I simply dont have the money to pay them and have offered £80 per month if they agree to freeze the interest and stop adding made up charges, they just keep replying with " "All the overdue charges and interest will be added until full repayment"ive already changed my account, they have details of my Natwest Basic one which the card has just expired for so they wont get a bean out of there as i dont keep any money in it and Natwest are tighter than 2 coats of paint so they wont pay anything lol.I offered them the origional loan amount plus a months interest last month when I got a bonus from work but they refused to accept this as full and final so i told them to go forth........ I havesince used that money for other debts so they can have that now, they are the last ones on my list now.

-

Minicredits latest email - They refuse to accept a payment plan or freeze interest: The total outstanding balance GBP1317.00 from the date of issuing until today consists of the following: 1. Loan principal GBP600.00 2. Interest in total GBP372.00 (1% of the Principal per day) (62 days) 3. Overdue penalty GBP25 (was added on the 1st day overdue) 4. Overdue penalty GBP55 (was added on the 3rd day overdue) 5. Debit Attempt fees in total GBP165.00 (every unsuccessful attempt to receive the repayment costs up to GBP3) (55 tries of my card where i do not keep any money) 6. Debt Recovery fee GBP100 (was added on the 30th day overdue) The Loan Agreement states that Interest on any sum in arrears will be charged at the contractual rate, both before and after judgment, until payment. An also that the Customer has to cover the costs and expenses we incur (including any legal costs on a full indemnity basis) in tracing the Customer, or enforcing, or attempting to enforce, our rights under this Agreement. Microcredit Ltd considers that all the overdue charges and interest have been rightfully added to the outstanding balance according to the Loan Agreement You accepted. We are willing to consider the possibility of a settlement figure if it is reasonable and paid in full. Please contact our Customer Support on the number 08718903015 when You have funds available to offer as full and final settlement. If the settlement is agreed, the payment has to be made with a debit card immediately.

-

Hi Guys, I have recieved this letter today - warning me of the DOOR STEP COLLLECTORS Basically it says that they have added £100 to my debt for the doorstep collectors. What happens next? I made a "partly" payment of £80 + £5.50 transmission fee on Friday to show willing but these clowns charge £5.50 per "partly" payment and even charge a fortune to phone them, 10p per minute!! Surly they should have a local rate number? Help would be appriciated please!

-

Hi Guys, had various loans from Minicredit and had a £600 loan and was due to repay on 30.03.2012. As per many on this forum I have come to the point where i can't keep rolling over and paying extortionate charges so changed my DC and did not pay them. I've had the usual emails, calls texts etc but have ingnored all unitl I emailed them for a breakdown of charges last week to plan what i was going to do this payday. So they now want: The total outstanding balance GBP1061.00 from the date of issuing (3rd of March 2012) until today the 19th of April 2012 consists of the following: 1. Loan principal GBP600.00 2. Interest in total GBP282.00 (1% of the Principal per day) 3. Overdue penalty GBP25 (was added on the 1st day overdue) 4. Overdue penalty GBP55 (was added on the 3rd day overdue) 5. Debit Attempt fees in total GBP99.00 (every unsuccessful attempt to receive the repayment costs up to GBP3) The origional amount inc interest was due on 30.03.2012 was £762.00 and I am willing to pay the £762.00 to clear the account - am i doing the right thing by offering them this and do you guys think they will accept? or should i just make "partly payments" to them for the next few months then offer them a full and final when i have some more funds? Any help would be great.

-

Lending stream whats the deal with these

Dannyde replied to paxon's topic in Payday Express/Wage advance/Cashtillpayday

I have just had my reply from mucky hall to the email i sent them regarding LS using my debit card as if they were my wife to get back £900 so far for a £500 loan. they still want another £397. I pointed out: The Office of Fair Trade have already warned at least two Payday Loan Companies who have used these unreasonable practices that they are not allowed to perform such acts in the retrieval of missed loan payments. From the OFT website: only take money from the borrower's account on the date or dates set out in the loan agreement, unless otherwise agreed with the borrower in advance not change the repayment amount unless this has been specifically agreed with the borrower in advance only take money from an account specifically given to th loan company for the repayment of that loan. Failure to comply with requirements can lead to a fine of up to £50,000 per breach, or action to revoke a company's credit licence This is their reply: Please see section 2 “YOUR OBLIGATIONS” particularly 2.1.9, 2.1.10 and 2.1.11. These outline the authorisation for debit card payments and also the process when a debit card payment is declined. With this in mind I must advise that Lending Stream were within their rights to debit your account as per these terms and conditions. from my loan agreement: 2.1.9. You authorise us to debit the amounts payable by you on each Payment Date and any other fees that you may incur under this Loan Agreement to the debit card nominated by you in your loan application ("Your Debit Card"); 2.1.10. If a debit is returned unpaid or dishonoured for any reason when it is first presented by us for payment, we may re-present the debit for payment on Your Debit Card until we receive the Total Amount Payable under this Loan Agreement. Unless we agree otherwise, if you do not pay the Total Amount Payable in accordance with this Loan Agreement, you may incur default charges and other charges as specified in the loan particulars of this Loan Agreement. You agree that we may also collect any such charges by way of a debit to Your Debit Card. The authority given by you to debit Your Debit Card for the purposes of this Loan Agreement is to remain in full force and effect until your obligations to us under this Agreement are fully satisfied. 2.1.11. In addition to our rights under condition 2.1.10, if a debit to Your Debit Card is returned unpaid or dishonoured for any reason, you authorise us to debit, without any further notice to you, any such payments in accordance with the Direct Debit Authority given by you in the course of your loan application. The authority given by you under the Direct Debit Authority for the purposes of this Loan Agreement is to remain in full force and effect until your obligations to us under this Loan Agreement are fully satisfied. so they are continuing with thier recovery action and say i need to pay. Is this legal? Any helpwould be apprieicated

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.