gonnabreaksoon

Registered UsersChange your profile picture

-

Posts

13 -

Joined

-

Last visited

Reputation

1 Neutral-

Welcome Fin. Loan rewritten, wrong car on agreement

gonnabreaksoon replied to gonnabreaksoon's topic in Welcome Finance

Again sorry for the delay, so many things are going on. Welcome have traced me to my new address and their agents sent a letter saying their client sees no reason why I shouldn't pay ( I have in the past mentioned to Welcome that the agreement is void). I've left it at that. I don't know what to do apart from tow the thing to their offices and leave it there with a note on it! -

Welcome Fin. Loan rewritten, wrong car on agreement

gonnabreaksoon replied to gonnabreaksoon's topic in Welcome Finance

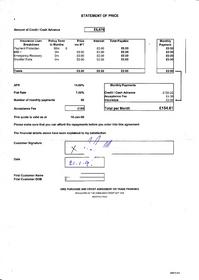

Hi folks, many thanks for your responses and sorry for the delay again. I have the original agreement and there is no PPI. It was rewritten Jan 2009 with the amount of credit being £6676. I think we have paid approx 1k of this -

Welcome Fin. Loan rewritten, wrong car on agreement

gonnabreaksoon replied to gonnabreaksoon's topic in Welcome Finance

Hey folks, sorry to bump my old thread but I need to get some clarity on this as I really don't know where to go from here! Since my last post I fell ill, pretty bad, long time in hospital. Now I'm recovered I still have this car, Sorned, outside my house (new address, Welcome don't know it). I did an HPI check on the reg and it states still in contract, money owed etc. What can I do? I can't scrap it or sell it and if I fix it and use it, what action will Welcome take when they discover it's being used and find my whereabouts? Or will they? Arrgh!! Thanks essexboy for your post, much appreciated. You say wrong car, no agreement - do you have any ideas where I might go from here? Hoping some of you lovely people can advise a stressed out fool! -

Welcome Fin. Loan rewritten, wrong car on agreement

gonnabreaksoon replied to gonnabreaksoon's topic in Welcome Finance

Hi, identifiable info removed. thanks -

Welcome Fin. Loan rewritten, wrong car on agreement

gonnabreaksoon replied to gonnabreaksoon's topic in Welcome Finance

there we go -

Welcome Fin. Loan rewritten, wrong car on agreement

gonnabreaksoon replied to gonnabreaksoon's topic in Welcome Finance

-

Welcome Fin. Loan rewritten, wrong car on agreement

gonnabreaksoon posted a topic in Welcome Finance

Hi everyone, I have a car on finance with Welcome Financial Services. Last year I fell into arrears when the fuel pump went (the car is a lemon unfortunately!). When we first signed the contract at Carcraft in Bristol the salesman stated that after 2 years with good payment history we could opt out. I attempted this last year after I got the fuel pump replaced but was told by Welcome that I would have to pay a termination charge etc etc - and it was around £1800. So! I had to have the loan rewritten. A guy came to my house and gave me a new credit agreement, needless to say heavily weighted in Welcomes favour. Later on when he had gone I noticed that the agreement is for a different car altogether and some of the boxes are filled with obviously dummy entries. So it's not a valid contract. My question is, bearing in mind now the head gasket has gone (it's a freelander and not much point fixing it) and there's £7000 left on it, I want out. Can I wriggle out of this any way? Let me know if you want scans. Cheers -

Thanks Happy Contrails, I subscribed with NACSA and am in the process of getting all the info I need before phoning them. Thanks also nightsurf, I have been paying what I can when I can (as little as it is!) - so hopefully that scrubs culpable neglect. I haven't had any response from Marstons since I emailed and posted copies of the HP agreements asking them to remove levy. My concern now is that, even though they would be acting illegally, will they just come and take the cars anyway and worry about the legalities later. That would screw me up completely as I use at least one of them regularly everyday for my business, plus all the tools in them etc. Would I be wise to not assume that they won't take them just because they're not supposed to?

-

Forgot to say.. Could the warrant he's talking about be a Warrant of Execution? What exactly is that? I know it applies to arrears up to £5000 and my arrears are £5600. What warrant could it be? Also, on the final warning before removal document he put through the door it states in print: "If you fail to make immediate payment we may re-attend your premises with a locksmith, remove goods in your absence (as instructed by the CSA and in accordance with the law) and sell these goods at public auction" Surely this is scare tactics and lies?? Besides nothing inside the house is listed on the walking possession

-

Hi Many thanks for your comments and invaluable advice and apologies for the delay in my reply (no broadband for a while! ) I had another visit from Marstons yesterday which works out to be 13 weeks and 5 days after the LO was issued. I was in, but hid in the kitchen! My mother in law who was here answered the door. The bailiff asked for me and my mother in law said I wasn't here, to which he then said he had a warrant to enter the property and told her exactly what it was all about. He then went to take details of my cars on the drive (both on HP not loans and are for my business - (I was making better money last year than now, customers have folded/stopped paying etc due to economic downturn!)). While he was doing this, my mother in law locked the door. His attitude changed and told her she made a big mistake doing that. He asked where my wife works, her number etc but info not given. He put a final warning before removal notice and a notice of ditress through the door and went on his way. The notice of distress listed my two cars as the inventory and in the walking possession agreement section where I am supposed to sign it, he entered "NOT PRESENT". Also, hand written on the final warning doc was "Re your email - Points A to F are of no relevance to bailiff action, please phone to pay or removal action is next." Removal obviously being the cars - both used for business, one frequently, the other occasionally. Also, Points A -G are detailed in my first post in this thread, he missed out G, so is he implying that they will negotiate instalments? I am going to email and post scans of the HP agreements for the cars today. Can they take them? Can he enforce anything since it's after 13 weeks? Should it now be back with the court? Any help would be much appreciated. Many thanks

-

Hi, I've a right old situation here. I have CSA arrears of c.£6,000, a Liability Order has been granted and I've got Marstons on my back. I had no notification that the bailiff would visit, but he did 2 weeks ago. I didn't let him in. He put a note through the door demanding full payment and that he would return in 5 days to remove my posessions. They haven't visited again since then, but I received a letter through the post today from them stating that they have authority from the court to remove my goods unless I pay in full - last chance, but no time limit. The arrears is partly based on interim assessments and my ex (who won't let me see my daughter) has been recently busted for benefit fraud. She thought I shopped her, but I didn't even know about it. The fact she thinks I told the authorities is why she won't let me see my daughter. Following this accusation I notified CSA by email and they wrote to me saying it makes no difference and they are taking me to court. Which they did, and were granted the LO. I didn't attend, I have been so depressed about all this and I guess that is my only excuse as to why I didn't. Shortly after I received the LO through the post I emailed the CSA again requesting a copy of my file - this was ignored and then the bailiffs instructed. My question is, if I persistently refuse the bailiffs entry into my house, will it return to the CSA and then to the court? If so, will I then have an opportunity to make a repayment offer to the court to pay the debt in affordable instalments? I understand Marstons won't look at affordable instalments? (I am just about to send my income and exp. details to the CSA - should I send to the bailiffs as well?). Or, will it just continue with the bailiffs and will they be able to force entry (or can they only force if they have walking posession)? I emailed this to Marstons earlier today: "I received your letter today offering me a final chance to pay the debt in full and I am contacting you to advise that a.) I cannot afford to pay the debt in full and if the full amount is demanded persistently then the situation will obviously worsen. B.) I requested a copy of my file from Plymouth CSA and they ignored it. Apparently it is my right to request this. C.) I informed them that my ex fraudulently claimed money from the government (I am expected to foot the bill when I’m not even allowed to see my daughter), noted but dismissed. D.) the amount is partly based on interim assessments which is unfair. E.) Yes I know, I had the chance to contest. But due to the depression the CSA caused to me and my family, I regrettably didn’t. F.) I own a guitar and a laptop (but the laptop is used for my business anyway). G.) I put it to you that I will make you an instalment arrangement offer. Please can you let me know if you will be prepared to consider this and in the meantime I will work out what I can afford. It is the only way I see the debt being paid." My heads all over the place! Not sure what I'm asking or what to do, but any help and advice would be much appreciated. Many thanks

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.