asterion

Registered UsersChange your profile picture

-

Posts

32 -

Joined

-

Last visited

-

CP Plus Charge Notice at MOTO services

asterion replied to asterion's topic in Private Land Parking Enforcement

Thank you guys. This is incredibly helpful. Would you email or reply by recorded delivery?- 6 replies

-

- charge notice

- cpplus

-

(and 1 more)

Tagged with:

-

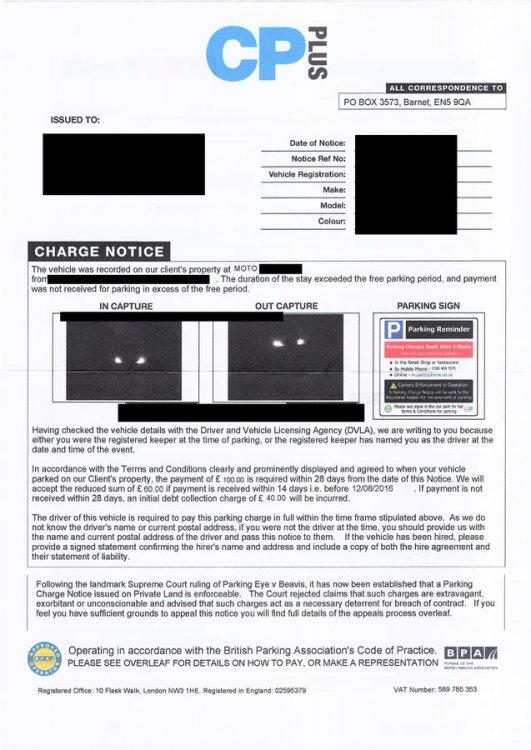

Hi guys, I just received the letter below regarding parking on 22 July. What is the best way to handle it? This one: Dear Sir Ref ***** I am challenging this Parking Charge Notice I was not the driver of the vehicle and your Notice to Keeper fails to follow the statutory wording of the Protection of Freedoms Act Para 9 to pursue me as keeper. I also refer you to Para 4(5) of the Act that under no circumstances do I have any liability for your "£40 initial charge" or any other charges. Yours Faithfully or this one http://forums.moneysavingexpert.com/showthread.php?t=5026700 http://cars.aol.co.uk/2014/08/06/aol-cars-investigation-uncovers-service-station-parking-loophole/?ncid=webmail8 Thanks in advance!

- 6 replies

-

- charge notice

- cpplus

-

(and 1 more)

Tagged with:

-

How do I go around removing these if they are incorrect? I have already complained to the CRA and they got a response saying the markers were correct. Essentially, I had a 30-day SIM only contract with Orange, I gave them the required notice, paid the last bill and cancelled the DD. During the phone conversation, I was asked if I wanted to keep the number as PAYG. I agreed to this and was told I would get sent a fresh SIM in the post. This never happened and I was not that bothered about keeping the old number, I ignored it. On receiving a "why have you stopped paying" letter, I rang them and was told that as I had not transferred out the number to the PAYG SIM card they had sent me, they had not cancelled my account!

-

StepChange (CCCS) – Interest Charges – Help

asterion replied to mrblueskies's topic in Debt management and Debt self-help

Natwest never stopped the interest charges when asked by CCCS. I ended up threatening to take them to court using the "you must treat your customers fairly" clause from the Banking Code. At the end, they stopped and even credited my account with over £1500 in interest charges from the default date. CCCS gave me some advice but it was me and only me who did the hard work. -

After a year of messing me about and thousand and one stays, they have decided to drop the claim without a tomlin order, as they could not agree to remove the default. Pathetic way of wasting the taxpayers money....

-

hi bazaar, Last year I threatened to take them to the Financial Ombudsman as they seem to keep on adding charges and interest to the account. My reasoning being that they had failed to help me when I did need it, making my DMP reduced payments worthless as the charges and interest being added monthly were nearly as high as my repayment. After giving them a final deadline, I received a proper response from the bank not the solicitors, agreeing to refund any charges and interest from the date I notified I had started a DMP with the CCCS, but that they would not review any previous charges from before the DMP started (in all honesty, I had not asked for this anyway). I also got confirmation on paper that they would no longer add any charges or interest to the account but informing me that the repayment was not high enough (essentially a hint that they would have a go at court). By my own calculations, the figure on the claim form was probably not too far off (not 100% sure, as no statements for two and a half years) but they have not updated it for sure to deduct the last 5 or 6 monthly DMP payments. About point two, re-reading the first point of their schedule it does read "the defendants pay the claimant the sum of £xxxx in full and final settlement of the claim". About point three, they have never agreed to work with the CCCS but have been accepting payments since the plan started. About point four, I reckon they are using the same set template they use for settling unfair fees repayments, when they want to avoid publicity, etc. About point five, how far should I go? I am tempted to ask for any defaults and negative information to be removed from any credit report, as they would be in breach of their own confidentiality clause and they have not me presented yet with any default or presentation notice?

-

Hi manchestman I wrote them a letter explaining that given that this was a small claim track they would not be able to claim costs, as they already knew. Most importantly, I reiterated that they would end up worse off, as any judge would probably ask for any repayments to be made pro-rata out of what I now pay to the CCCS (essentially they would be getting less than half what they get now). At first they sent me a letter asking me for an I&E update using their own form, which I declined as it was way too intrusive, clearly targeted at valuing my assets, likely with eyes on a charging order. I told them I would not fill in such a form and reminded them that the CCCS did my I&E review. Their reply was to ask for the CCCS I&E form once again, which they got late last year. I kind of sat on this for a few days to see how they reacted. Today, rather than their previous "send us the I&E and then we'll see", I got a proper written response, advising me that natwest has "taken a commercial view and is prepared to accept my current monthly repayments". Now for the tricky bit, they want me to sign a Tomlin Order. Overall, I am happy to do so, as I get them off my back and would not end up with a CCJ. However, they have still not produced any of the documents mentioned on the claim form, including the default and termination notices (they will probably have them and I have much to risk by calling their bluff if they don't). My main issues are the following: The claim sum is about £500 higher than my estimates. It is hard to say, as they stopped sending me statements a long while back. Would you ask for this to be put right? For a start, they have not been discounting the existing monthly payments since they started court action. The schedule of the order mentions that "the monthly instalments shall be reviewed after a period of twelve months, with the first review to take place in May 2011 (surely 2012?) and each and every twelve months thereafter, until such time as the settlement amount is paid in full". My biggest concern is that I would rather they abide by the CCCS reviews, as if they decide that I can pay more, it would need to come out from somebody else's repayment. Can I ask them to agree to accept my existing DMP review terms? The schedule also mentions that in default of the payments they would be entitled to enter judgement after 14 days notice. As my payments are managed by the CCCS, I am concerned that if anything happens, even as simple as they not updating the new account details, they would try to void the agreement. They also want to make the terms of the order confidential. How can I even agree to this if the CCCS is managing my DMP? Surely I need to let them know? Is there anything else I should ask to be added to the Tomlin Order schedule to cover my back? ie so they cannot add on any interest, costs, etc Any advice is always welcome. Many thanks

-

Also, if I agree to the Small Claims track, I was under the impression that no costs could be added. Is this correct?

-

Thanks a lot. I don't know what to do. I would rather they just stick to their allocated share of my DMP. I am now due with the CCCS for a review, which I have been holding back because of them. Not knowing what to do is killing me. Manchestman, what was the part you asked me to ignore, was it the Draft Order for Directions? I had put something together but it is just a reshuffle of my defence. If they were to present the documents at the last moment, I am sure if it would stand any ground. My biggest concern re Time Orders is the up-front fee and that they may still not work. I need to do some more research. In the meantime, how wise would it be to include the attached DOD? IN THE XXXXXXXXXXXXCOUNTY COURT Claim No XXXXXXXXXXXXCOUNTY Between XXXXXXXXXXXXCOUNTY and XXXXXXXXXXXXCOUNTY On XX XXX 2011 and XX XXX 2011 I requested the disclosure of information pursuant to the Civil Procedure Rules, which is vital to this case from the claimant. The information requested amounted to copies of the documents referred to in the particulars of claim, including any default or termination notices. To date the claimant has ignored my request under the CPR and I have not received any such documentation requested. As a result it has proven difficult to compose a comprehensive defence without disclosure of the information requested, especially given that I am Litigant in Person. I respectfully ask the court to use its case management powers to order the claimant to disclose the information requested as it is vital to allow me the opportunity to defend this action properly and would be unjust and totally unfair to allow this action to continue without allowing me the opportunity to view the documents which form the basis of this claim. The claimant shall within 14 days of service of this order file and serve the following: 1. Copy of the contractual terms and conditions that formed the original contract. Further, that any general conditions incorporated in the contract should also be attached; 2. Copies of all statements of the account upon which his claim relates, from the date the agreement relied upon was concluded between the two parties to the date of termination thereof; 3. Copies of all Statutory Notices served upon the Defendant pursuant to said act and said regulations that have been issued prior to commencement of these proceedings, originals of said notices to be produced at the Trial or final hearing; 4. Copy of documentary evidence that substantiates Proof of service of all Statutory Notices served upon the Defendant, including Termination and Default; 5. A schedule setting out each charge repayment of which is sought, showing the date, amount, and reason given (if any) for that charge being made; 6. Copy of any other document(s) relied upon in support of his claim. In Default of this order or any part thereof, the claimant’s claim be struck out without any further order or notice. The defendant shall within 14 days thereafter file and serve the following: His sufficiently particularized amended response/defence to the statement(s) and document(s) supplied by the claimant, to include any defence set off or counterclaim, in the form of his signed Statement of Truth and copies of any documents he intends to rely upon in these proceedings. Costs be awarded to the Defendant for time spent preparing and filing/serving his response to the claim

-

bump

-

Hi guys, I received a response from incasso regarding my reminder, completely disregarding my request and saying they would not agree to an extension. No need to say they have not sent me any of the documents I asked for. Do I need to inform the court? If so, how? Now I need to complete the allocation questionnaire and have various doubts: Do I agree to mediation service? Do I agree to small claim track or should I point out I am still waiting to receive the documents I requested when the case was trackless (well, still is) Under other information, should I point out that incasso completely ignored my release request? Woulod you also mention they are refusing to accept my DMP despite being my smallest creditor? Thanks

-

Thank you. I have now done so. By the way, I did not realise there was a line limit. I almost left three paragraphs out!

-

Bump

-

Not really sure if this is the best way to do it. Please read on. I need any advice I can get: 1. IN THE NORTHAMPTON COUNTY COURT Claim No xxxxxxxxxx Between NATIONAL WESTMINSTER BANK PLC and xxxxxxxxxxx Defence 1. I Xxxxxxxx of xxxxxxx am the defendant in this action and make the following statement as my defence to the claim made by National Westminster Bank PLC. 2. Except where otherwise mentioned in this defence, I neither admit nor deny any allegation made in the claimants Particulars of Claim and put the claimant to strict proof thereof. 3. I am embarrassed at pleading to the particulars as they fail to comply with the Civil procedure rules, in particular part 16 and practice direction 16, in particular paragraph 7.3 as the claimant has failed to supply a copy of the written document which forms the basis of this claim. 4. The claimant has failed to set out how the figures which they claim are calculated nor do they set out the nature and scope of any charges contained within the figure claimed 5. The claimant has failed to also attach a copy of the default notice which they claim has been served 6. The courts powers of enforcement in cases relating to Credit Agreements under the Consumer Credit Act 1974 are subject to certain qualifications being met with regards to the form and content of the documentation, in particular the Default notice. Therefore these Documents must be produced before the court and must comply with the relevant sections of the consumer credit act and the regulations made under the act, I will address these requirements later in this defence 7. Consequently due to the claimants failure to supply the documents required under the civil procedure rules and the fact that the claimant has failed to sufficiently particularized the claim I deny all allegations in the particulars of claim that I am indebted to the claimant in any way and put the claimant to strict proof thereof 8. I will now look at the important issues relating to this case which must be brought to the courts attention Pre-action protocols 9. The claimant National Westminster Bank PLC has failed to follow the pre-action protocols insofar as they did not attempt to enter into any negotiations to try and resolve the issues. The claimant repeatedly rejected any reduced payment offers as part of a Debt Management Plan managed by the Consumer Credit Counselling Service (CCCS) in an unreasonable manner. Despite the fact that the claimant was already receiving the biggest share of the DMP payments allocated by the CCCS. The Request for Disclosure 10. Further to the case, on 14 February 2011 I requested the disclosure of information pursuant to the Civil Procedure Rules, which is vital to this case from the claimant. The information requested amounted to copies of the documents referred to in the particulars of claim, including any default or termination notices. 11. To Date the claimant has ignored my request under the CPR and I have not received any such documentation requested. As a result it has proven difficult to compose this defence without disclosure of the information requested, especially given that I am Litigant in Person 12. The claimant is therefore put to strict proof that a document which is legible and Compliant with the Consumer Credit Act and subsequent Regulations made under the Act exists The Default Notice 13. Notwithstanding the matters pleaded above, the claimant must under section 87(1) Consumer Credit Act 1974 serve a default notice before they can demand payment under a regulated credit agreement 14. It is neither admitted nor denied that any Default Notice in the prescribed format was ever received and the Defendant puts the Claimant to strict proof that said document in the prescribed format was delivered to the defendant 15. Notwithstanding point 14, I put the claimant to strict proof that any default notice sent to me was valid. I note that to be valid, a default notice needs to be accurate in terms of both the scope and nature of breach and include an accurate figure required to remedy any such breach. The prescribed format for such document is laid down in Consumer Credit (Enforcement, Default and Termination Notices) Regulations 1983 (SI 1983/1561) and Amendment regulations the Consumer Credit (Enforcement, Default and Termination Notices) (Amendment) Regulations 2004 (SI 2004/3237) 16. Failure of a default notice to be accurate not only invalidates the default notice (Woodchester Lease Management Services Ltd v Swain and Co - [2001] GCCR 2255) but is a unlawful rescission of contract which would not only prevent the court enforcing any alleged debt, but give me a counter claim for damages Kpohraror v Woolwich Building Society [1996] 4 All ER 119 Conclusion 17. I respectfully ask the court to use its case management powers to order the claimant to disclose the information requested within this defence document as it is vital to allow me the opportunity to defend this action properly and would be unjust and totally unfair to allow this action to continue without allowing me the opportunity to view the documents which form the basis of this claim 18. I further ask the court consider striking out the claimants’ case as it fails to comply with part 16 and practice direction 16 insofar that no documents have been supplied and fails to show any consideration to the overriding objective to allow the court to deal with this case justly 19. Alternatively, I respectfully request a stay in proceedings until such time as the claimant complies with the requests outlined above or until the court orders its compliance with the same. I will then be in a position to file a fully particularised defence and counterclaim and will seek the courts permission to amend my statement of case accordingly. Statement of Truth I Xxxxxxxx believe the above statement to be true and factual.

-

I am really stressed right now, I have to admit. I am meant to submit an embarassed defenced by tomorrow and have no idea how to do it. I am sorry for asking for help again. As I expected, I have not got a response to my last letter yet.

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.