dunnie1

Registered UsersChange your profile picture

-

Posts

231 -

Joined

-

Last visited

Reputation

11 Good-

Egg loan/card PPI claim - now Canada SQ Ops

dunnie1 replied to dunnie1's topic in Payment Protection Insurance (PPI)

OK, fair enough. Thanks for advice - yeah, think how many people have just accepted the figures and allowed them to get away with 5% - all adds up.. -

Egg loan/card PPI claim - now Canada SQ Ops

dunnie1 replied to dunnie1's topic in Payment Protection Insurance (PPI)

Not sure why you'd want a pdf - the image I posted was not blurry, upside down, difficult to read etc and I've posted images of text before - I've also used text to pdf scanners and the quality is in fact worse than the image I posted... Anyway, the contents are discussed in my previous post so the image of the letter was a nice to have, not vital to understanding next steps -to which I wondered if you had any advice or if there are any templates which challenge an underpayment of contractual interest? Also, is it usual to have income tax applied and should I challenge that or claim back from IR? Thanks. -

Egg loan/card PPI claim - now Canada SQ Ops

dunnie1 replied to dunnie1's topic in Payment Protection Insurance (PPI)

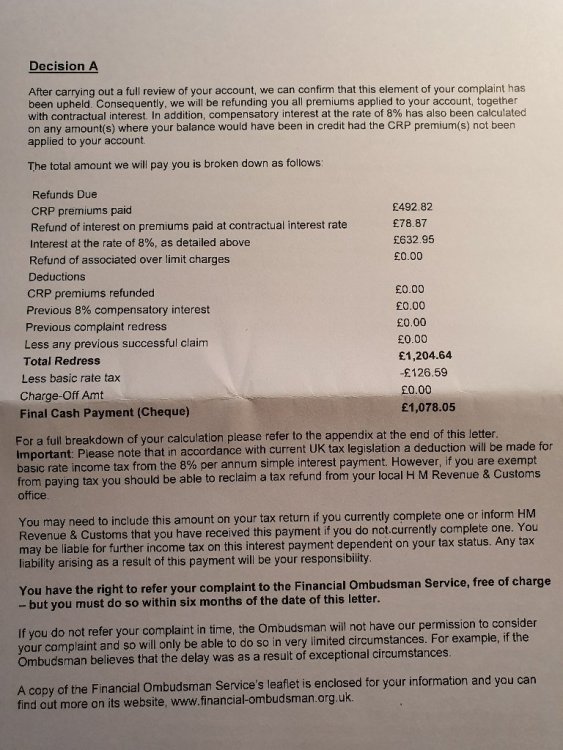

Ok, I have an update: Loan claim - still being processed due to backlog, with Canada Sq Op apologising and stating they need another 8 weeks Credit card claim - Complaint upheld and offered £1078.05 as F&F settlement - However - this is less than I asked for (my original details below) "Credit card PPI payments between 11/06/2002 and 01/11/2006 @ APR 13.9% amount to £714.14, and with statutory 8% interest applied this totals £1,444.08 as at 22/07/2019, with interest accruing daily." The shortfall is due to Canada Sq Ops using a contractual interest rate of 5.425% instead of 13.9% which I intend to challenge. Additionally, I have been charged basic rate tax which was unexpected - I understand I can claim this back from the Inland Revenue though, or is this another underhand tactic? Thanks, Dunnie1 -

Egg loan/card PPI claim - now Canada SQ Ops

dunnie1 replied to dunnie1's topic in Payment Protection Insurance (PPI)

ok thanks - any content advice? -

Egg loan/card PPI claim - now Canada SQ Ops

dunnie1 replied to dunnie1's topic in Payment Protection Insurance (PPI)

first draft Dear Sir/Madam, Ref: Credit Card: **************** Personal loans ****/****/****/**** I believe I have been mis-sold three payment protection policies and would like to request a full refund of my premiums, plus interest paid. Credit card PPI payments between 11/06/2002 and 01/11/2006 @ APR 13.9% amount to £714.14, and with statutory 8% interest applied this totals £1,444.08 as at 22/07/2019, with interest accruing daily. Personal loan PPI payments across the four loans (including one partial PPI rebate) total £231.89, with statutory 8% interest applied this totals £547.32 s at 22/07/2019, with interest accruing daily. The reason I was mis-sold PPI is because I was unaware I had bought it, and therefore the following applies: · I was not asked whether I had any other insurance which would cover the loan. · I was not told I could buy PPI elsewhere to cover the loan\credit card. · I paid upfront for the PPI but it was not explained that there were some PPI policies where you could pay monthly. · My PPI was an upfront premium and I repaid the loan early and received only a partial refund. I received no refund on the final loan that went into default. · The Terms & Conditions of the small print were not fully explained to me. · You are not allowed to make PPI a condition of taking out the loan unless you include the costs of PPI in the quoted interest rate, which you did not do. · In forcing me to buy this policy, you have also breached paragraph 8.6 of the Banking Code, to which you are a signatory · No refund was applied once the products went into default, nor was it explained to me that I having become unemployed, I was able to claim – I was instead subject to repeated calls asking for the money to be re-paid, and eventually the debts were sold to DCA’s – this significantly contributed to my financial distress and prolonged my struggle to re-gain credit-worthiness, my health (Chronic stress and anxiety) and ultimately gainful employment. Insurers are under an obligation to ensure that the policy they are selling is clearly included in T&C’s, and options for claiming against the policy are clearly articulated to the potential claimant. I am requesting a full refund of all my insurance payments, plus interest, which total £ 1991.40 (as @ 22/07/2019). If I do not receive a favourable response from you I will pursue this claim through the Financial Ombudsman. Yours sincerely, -

Egg loan/card PPI claim - now Canada SQ Ops

dunnie1 replied to dunnie1's topic in Payment Protection Insurance (PPI)

Great, I'll get on this asap -

Egg loan/card PPI claim - now Canada SQ Ops

dunnie1 replied to dunnie1's topic in Payment Protection Insurance (PPI)

So, next steps? FOS questionnaire isn't it? What do I include in this as I was never aware of having PPI, and was never offered the opportunity to claim when I went into default - this seesm worth including I would have thought. -

Egg loan/card PPI claim - now Canada SQ Ops

dunnie1 replied to dunnie1's topic in Payment Protection Insurance (PPI)

I default on the loan after the 7th payment and it eventually gets sold to a DCA, starting a downwards spiral towards bankruptcy (avoiding it ultimately) - Had I known I had PPI, I might have attempted to claim it.. that is the sum total of payments I made on loan 4 - I think that's why I was rolling the loan amounts over, sub-consciously I was trying to maximise the claim.. -

Egg loan/card PPI claim - now Canada SQ Ops

dunnie1 replied to dunnie1's topic in Payment Protection Insurance (PPI)

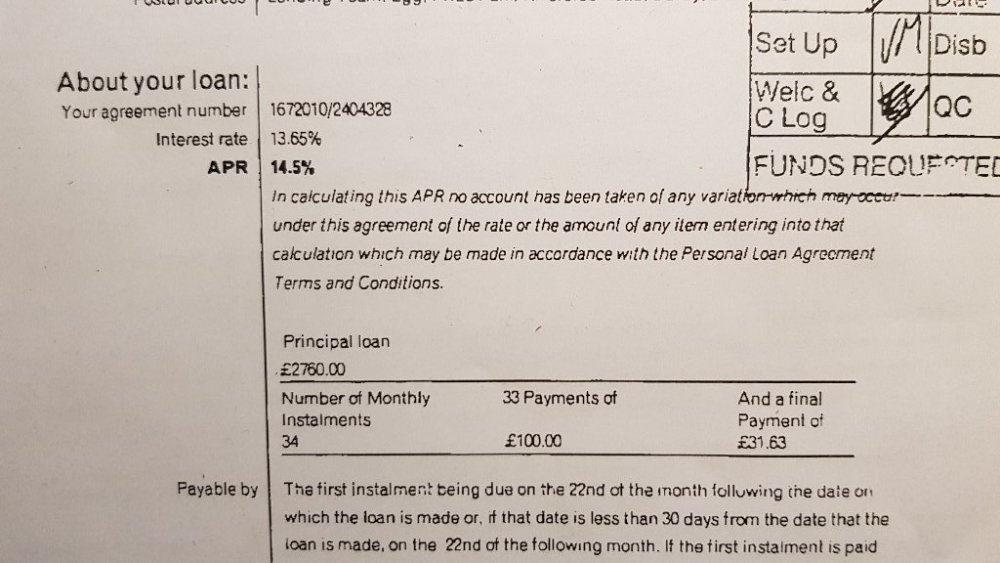

Its probably the PPI rebate of £97.56 making it seem lower than you'd expect maybe loan 1 - no ppi loan 2 - ppi loan 3 - no ppi, loan 4 - ppi so I would expect %age PPI to drop, as I had PPI rebate and had already repaid some of the PPI which rolled into a loan with no PPI, as per below. 4 monthly repayments made (on 22/12/2001, 22/01/2002, 22/02/2002, 22/03/2002) which equates to total PPI paid on this loan: 4 * £13.26 = £53.04 PPI carried over to loan 3 below = £440.50 (original PPI premium) - £53.04 (amount repaid) - £97.56 (PPI rebate) = £289.90 PPI proportion of loan 3 = £289.90 / £2,760.00 * 100 = 10.50% I've used mthly payment amounts (which includes APR) to derive the ppipcm, and opening balance of the loan the other side /. there is no information in my SAR to determine whether this includes front loaded interest (or any other type) or whether its all in the mthly payments. the subsequent opening balances upon re-finance would include it though I would have thought. So in summary I'm not sure what other figures I could have used. I'll post a screenshot of loan 3 shortly. -

Egg loan/card PPI claim - now Canada SQ Ops

dunnie1 replied to dunnie1's topic in Payment Protection Insurance (PPI)

Ok, I've got it now Loan 1 – 08/08/2000 No PPI Loan 2 – Refinance of Loan 1 – 13/11/2001 Borrowed £2,880.00 PPI premium for loan 2 £ 440.50 --------------------------------------------------------- Total Loan 2 Amount £3,320.50 PPI proportion of loan 2 = £440.50 / £3,320.50 * 100 = 13.27% Monthly repayment = £99.89 Therefore, PPI element of repayment = £99.89 * 13.27% = £13.26 4 monthly repayments made (on 22/12/2001, 22/01/2002, 22/02/2002, 22/03/2002) which equates to total PPI paid on this loan: 4 * £13.26 = £53.04 PPI carried over to loan 3 below = £440.50 (original PPI premium) - £53.04 (amount repaid) - £97.56 (PPI rebate) = £289.90 Loan 3 – Refinance of Loan 2 – 09/04/2002 Borrowed £2,470.10 PPI premium from loan 2 £ 289.90 --------------------------------------------------------- Total Loan 3 Amount £2,760.00 PPI proportion of loan 3 = £289.90 / £2,760.00 * 100 = 10.50% Monthly repayment = £100.00 Therefore, PPI element of repayment = £100.00 * 10.50% = £10.50 1 monthly repayment made (on 22/05/2002) which equates to total PPI paid on this loan: £10.50 PPI carried over to loan 4 below = £289.90 (PPI premium carried over from loan 2) - £10.50 (amount repaid) = £279.40 Loan 4 – Refinance of Loan 3 – 07/06/2002 Borrowed £4,720.60 PPI premium from loan 3 £ 279.40 PPI premium for loan 4 £ 223.15 --------------------------------------------------------- Total Loan 4 Amount £5,223.15 PPI proportion of loan 4 = (279.40 + £223.15) / £5,223.15 * 100 = 9.62% Monthly repayment = £250.00 Therefore, PPI element of repayment = £250.00 * 9.62% = £24.05 7 monthly repayments made (on 22/07/2002, 22/08/2002, 22/09/2002, 22/10/2002, 22/11/2002, 22/12/2002, 22/01/2003) which equates to total PPI paid on this loan: £168.35 Total PPI Paid Loan 2 £ 53.04 Loan 3 £ 10.50 Loan 4 £168.35 -------------------------------- Total PPI Paid £231.89 Date of Charge Description Amount of Charge Number of Days Elapsed Interest at 8% Simple 22/12/2001 PPI payment of loan 2 (Payment 1 of 4) £13.26 6415 £18.71 22/01/2002 PPI payment of loan 2 (Payment 2 of 4) £13.26 6384 £18.62 22/02/2002 PPI payment of loan 2 (Payment 3 of 4) £13.26 6353 £18.53 22/03/2002 PPI payment of loan 2 (Payment 4 of 4) £13.26 6325 £18.45 22/05/2002 PPI payment of loan 3 (Payment 1 of 1) £10.50 6264 £14.47 22/07/2002 PPI payment of loan 4 (Payment 1 of 7) £24.05 6203 £32.82 22/08/2002 PPI payment of loan 4 (Payment 2 of 7) £24.05 6172 £32.66 22/09/2002 PPI payment of loan 4 (Payment 3 of 7) £24.05 6141 £32.49 22/10/2002 PPI payment of loan 4 (Payment 4 of 7) £24.05 6111 £32.33 22/11/2002 PPI payment of loan 4 (Payment 5 of 7) £24.05 6080 £32.17 22/12/2002 PPI payment of loan 4 (Payment 6 of 7) £24.05 6050 £32.01 22/01/2003 PPI payment of loan 4 (Payment 7 of 7) £24.05 6019 £31.85 AWARD CALCULATION Monthly Payment of PPI £231.89 8% Simple Interest £315.12 Total £547.01 -

Egg loan/card PPI claim - now Canada SQ Ops

dunnie1 replied to dunnie1's topic in Payment Protection Insurance (PPI)

ok.. I need to remove the lump sum carry overs, what about the last one? (don't know if I settled, partially settled or full amount sold to DCA and then I settled or whether it was written off, one of the lat two probably) Loan 2 principal loan £2880.00 PP 440.50 as %age 15.29% as %age of mthly payment of £99.89=15.18 loan 3 is rebated so I just need to carry over PPI payments from loan 2 as a %age of the payments I'm making on loan 4 (plus loand 4 %age ppi) by my reckoning. I'll have another go tomorrow, too late this eve. -

Egg loan/card PPI claim - now Canada SQ Ops

dunnie1 replied to dunnie1's topic in Payment Protection Insurance (PPI)

So should I remove all lump sum rows or leave in the last one? This debt was eventually written off and sold to a DCA, and I can't remember whether it was finally written off or partially settled. -

Egg loan/card PPI claim - now Canada SQ Ops

dunnie1 replied to dunnie1's topic in Payment Protection Insurance (PPI)

Yes I am.. was starting to think I was double counting them somehow.. will do. StatIntSheet loan 12337314 v3 - Copy.xls -

Egg loan/card PPI claim - now Canada SQ Ops

dunnie1 replied to dunnie1's topic in Payment Protection Insurance (PPI)

thanks - don't rush on my account, heading out for evening in a bit (hope it is right, head hurt by the end of it!) -

Egg loan/card PPI claim - now Canada SQ Ops

dunnie1 replied to dunnie1's topic in Payment Protection Insurance (PPI)

Yes, hence the corrected post, 2nd part of previous post (annoyingly merged together for some reason)

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

- Create New...